Intro — Ivalue Infosolutions IPO

The Ivalue Infosolutions IPO is one of the most anticipated technology offerings of 2025, aiming to raise ₹560.29 crore through a pure offer for sale. Scheduled to open for subscription on September 18, 2025, and close on September 22, 2025, the issue is set to grab investor attention with its strong positioning in the digital transformation and cybersecurity space.

Priced in the range of ₹284–₹299 per share, the IPO offers a minimum lot size of 50 shares, translating to a retail entry point of ₹14,950. Unlike fresh issues, this IPO will not bring new capital to the company, as it is a 100% Offer for Sale (OFS) — meaning the proceeds will go directly to the selling shareholders.

Backed by promoters Sunil Kumar Pillai, Krishna Raj Sharma, and Srinivasan Sriram, the company enjoys a strong reputation as a trusted digital solutions provider with global reach. With operations spanning India, Southeast Asia, and the SAARC region, Ivalue IPO is being closely tracked by institutional as well as retail investors looking to ride India’s enterprise technology growth story.

As we dive deeper, let’s break down the IPO structure, timelines, and financial metrics to help you decide whether this issue deserves a spot in your portfolio.

Ivalue Infosolutions IPO Details

Ivalue Infosolutions IPO Snapshot

| Particulars | Details |

|---|---|

| IPO Date | September 18, 2025 to September 22, 2025 |

| Listing Date | September 25, 2025 (Tentative) |

| Face Value | ₹2 per share |

| Price Band | ₹284 – ₹299 per share |

| Lot Size | 50 Shares |

| Sale Type | 100% Offer For Sale |

| Total Issue Size | 1,87,38,958 shares (₹560.29 Cr) |

| Issue Type | Book Building IPO |

| Listing At | BSE, NSE |

| Pre-Issue Shareholding | 5,35,39,880 shares |

| Post-Issue Shareholding | 5,35,39,880 shares |

💡 Quick Take: Since this IPO is a pure OFS, no new shares are being issued — so the company won’t directly receive funds.

Ivalue Infosolutions IPO Timeline (Tentative)

| Event | Date |

|---|---|

| IPO Open Date | Thu, Sep 18, 2025 |

| IPO Close Date | Mon, Sep 22, 2025 |

| Allotment Finalization | Tue, Sep 23, 2025 |

| Refunds Initiation | Wed, Sep 24, 2025 |

| Credit of Shares to Demat | Wed, Sep 24, 2025 |

| Listing Date | Thu, Sep 25, 2025 |

| Cut-off Time for UPI Mandate Confirmation | 5 PM, Mon, Sep 22, 2025 |

Objects of the Issue

Since this IPO is entirely an Offer for Sale (OFS), the company will not receive any proceeds.

The objective is to provide an exit opportunity to the existing shareholders and promoters.

About Ivalue Infosolutions Ltd.

Ivalue Infosolutions Ltd. is a leading enterprise technology solutions specialist based in India, with a sharp focus on securing and managing digital applications and data. Over the past 16 years, the company has evolved into one of the fastest-growing technology services and solutions integrators in India (Source: F&S Report).

The company plays a vital role in the technology solutions ecosystem by bridging the gap between:

- OEMs (Original Equipment Manufacturers) → who design and produce technology solutions,

- System Integrators → who engage with enterprises to deliver customized technology stacks, and

- Enterprise Customers → large organizations undergoing digital transformation.

By working closely with these stakeholders, Ivalue Infosolutions curates multi-OEM solutions that ensure performance, availability, scalability, and security of enterprise IT environments. This approach makes the company an enabler of seamless digital transformation across industries.

Core Focus Areas

The company specializes in two major enterprise assets: Data and Applications. Its portfolio of offerings covers:

- Cybersecurity Solutions

- Information Lifecycle Management (ILM)

- Data Center Infrastructure

- Application Lifecycle Management (ALM)

- Hybrid Cloud Solutions

- Managed IT & Support Services

These services help enterprises navigate the complex multi-OEM environment, ensuring interoperability, reliability, and long-term scalability.

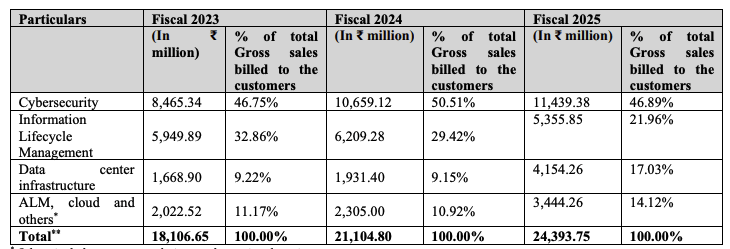

Revenue Contribution by Verticals (₹ in Million)

💡 Key Insight: Cybersecurity remains the backbone of Ivalue Infosolutions, contributing nearly 47–51% of revenues, while Data Center Infrastructure is showing strong growth momentum.

Business Growth & Partnerships

- OEM Network Growth → Expanded from 93 OEMs in FY23 to 109 OEMs in FY25.

- System Integrators → Partnered with 804 integrators in FY25, up from 567 in FY23.

- Enterprise Customers → Served 2,877 customers in FY25, compared to 1,804 in FY23.

The company also leverages a Customer Lifecycle Adoption (CLCA) model to ensure right-time adoption of OEM solutions by enterprises.

Global Footprint

- India → Presence in 8 locations, including headquarters in Bangalore.

- International → Active in Singapore, UAE, Bangladesh, Sri Lanka, Cambodia, Kenya, and extending services to Bhutan & Nepal.

- By FY25, the company worked with 57 OEMs, 133 System Integrators, and served 322 enterprise customers outside India.

Ivalue Infosolutions IPO Financials

Ivalue Infosolutions Ltd. has delivered a strong and consistent financial track record, with clear evidence of profitable growth and operational efficiency. Between FY24 and FY25, the company’s revenue rose 19%, while profit after tax (PAT) surged 21%, showcasing the strength of its digital transformation–focused business model.

The market capitalization of the Ivalue Infosolutions IPO is pegged at ₹1,600.84 crore, reflecting investor confidence in the company’s ability to scale in the technology solutions sector.

Financial Performance (₹ in Crore)

| Particulars | FY23 | FY24 | FY25 |

|---|---|---|---|

| Assets | 1,080.19 | 1,004.25 | 1,162.67 |

| Total Income | 805.79 | 795.18 | 942.35 |

| EBITDA | 88.82 | 111.06 | 129.13 |

| Profit After Tax (PAT) | 59.92 | 70.57 | 85.30 |

| Net Worth | 251.61 | 322.61 | 414.79 |

| Reserves & Surplus | 294.24 | 364.77 | 452.36 |

| Total Borrowing | 50.48 | 45.19 | 42.45 |

💡 Insight: Despite maintaining modest borrowing, Ivalue Infosolutions continues to expand its net worth and reserves, underscoring financial prudence.

Key Performance Indicators (KPI)

| KPI | FY23 | FY24 | FY25 |

|---|---|---|---|

| ROE | 29.15% | 21.13% | 20.49% |

| ROCE | 37.39% | 28.98% | 27.98% |

| RoNW | 29.15% | 22.02% | 20.49% |

| PAT Margin | 7.44% | 8.87% | 9.05% |

| EBITDA Margin (vs Revenue) | 11.15% | 14.23% | 13.99% |

| Gross Margin (vs Revenue) | 22.61% | 28.13% | 26.36% |

| Debt Service Coverage Ratio | 7.62x | 5.75x | 6.55x |

Observation: Margins and returns remain robust, though a slight moderation in ROE/ROCE indicates reinvestment for long-term growth.

Growth Trajectory

- Gross Sales Billed to Customers → Rose from ₹1,810.66 Cr in FY23 to ₹2,439.37 Cr in FY25, a 16.07% CAGR.

- Gross Profit → Climbed from ₹180.19 Cr in FY23 to ₹243.17 Cr in FY25, at a 16.17% CAGR.

- Profit After Tax → Grew from ₹59.92 Cr in FY23 to ₹85.30 Cr in FY25, translating to a 19.32% CAGR.

With its profitable growth, diversified revenue streams, and strong balance sheet, Ivalue Infosolutions IPO looks well-positioned for both short-term listing gains and long-term compounding potential. But Let’s check Valuation first.

Ivalue Infosolutions IPO Valuation & Peer Comparison

Valuation plays a key role in deciding whether an investor should subscribe to a new issue. Based on the financial metrics and peer analysis, Ivalue Infosolutions IPO is positioned attractively in the technology services and solutions segment.

Valuation Snapshot

| Metric | Pre-IPO | Post-IPO |

|---|---|---|

| EPS (₹) | 15.93 | 15.93 |

| P/E (x) | 18.77 | 18.77 |

| Price to Book Value | 4.96 | 4.96 |

Observation: With a P/E multiple of ~18.8x, Ivalue Infosolutions IPO falls in a fair valuation zone. It is priced slightly higher than traditional IT resellers but justified due to its strong digital transformation play, higher margins, and leadership in cybersecurity and data infrastructure.

Peer Comparison

| Company Name | EPS (Basic) | EPS (Diluted) | NAV per share (₹) | P/E (x) | RoNW (%) | Financial Statements |

|---|---|---|---|---|---|---|

| Ivalue Infosolutions Ltd. | 15.98 | 15.98 | 75.77 | 18.77 | 20.63% | Consolidated |

| Multi Chem Ltd. | 23.31 | 23.31 | 117.22 | 10.15 | 19.98% | Standalone |

💡 Insight:

- Multi Chem Ltd. trades at a lower P/E of 10.15x, but lacks the same scale in cybersecurity and cloud solutions.

- Ivalue IPO is commanding a premium due to its consistent 19% revenue CAGR, higher RoNW (20.63%), and strong OEM partnerships.

- The valuation premium is also supported by its enterprise-focused business model and proven ability to scale internationally.

Overall, while Ivalue Infosolutions IPO may look slightly more expensive than traditional peers, its asset-light, high-growth, and tech-driven model makes the pricing justified, especially for investors with a long-term horizon.

Strengths & Risks of Ivalue Infosolutions IPO

Every IPO comes with its set of positives and concerns. A balanced view of both is essential before taking an investment call on the Ivalue Infosolutions IPO.

| Strengths | Risks |

|---|---|

| Strong OEM Partnerships: Ivalue works with 50+ global technology OEMs across cybersecurity, networking, and cloud, ensuring steady revenue visibility. | High Dependency on OEMs: Any loss of key OEM partnerships could directly impact revenue growth and margins. |

| Robust Financial Performance: Consistent CAGR of ~19% in revenues with RoNW of over 20% reflects efficient capital usage. | Intense Competition: The IT solutions and cybersecurity distribution space has stiff competition from large global and domestic players. |

| Asset-Light, Scalable Model: The company focuses on distribution and value-added services without heavy capex, allowing faster scalability. | Working Capital Intensive: Receivables management and credit terms with clients may pressure short-term cash flows. |

| Strong Demand Drivers: Rising cybersecurity spend, cloud adoption, and digital transformation initiatives in India boost growth prospects. | Technology Risk: Rapid tech shifts may make certain solutions obsolete if Ivalue fails to adapt swiftly. |

| IPO Proceeds Utilization: Funds are earmarked for working capital, expansion, and strengthening digital infrastructure, supporting long-term growth. | Global Macros: Dependence on IT and digital spending cycles means global slowdowns can affect business momentum. |

💡 Investor View:

- The Ivalue Infosolutions IPO is backed by strong fundamentals and demand tailwinds.

- While risks like OEM dependency and working capital needs exist, the strengths outweigh them, making Ivalue IPO an attractive opportunity for investors seeking exposure to the cybersecurity and cloud growth story.

Ivalue Infosolutions IPO GMP

Currently, the Ivalue Infosolutions IPO GMP (Grey Market Premium) has not started yet. Investors are closely watching the grey market for early signals on demand and listing expectations.

Ivalue Infosolutions IPO Day-wise GMP Trend

| GMP Date | IPO Price | GMP | Estimated Listing Price | Estimated Profit* |

|---|---|---|---|---|

| 16-09-2025 | ₹299.00 | ₹0 (No Change) | ₹299 (0.00%) | ₹0 |

*Estimated profit is based on current GMP trends and may vary on listing day.

At present, the Ivalue IPO has no grey market activity. However, as the subscription window opens and demand builds up, investors should track GMP trends for better insight into potential listing gains.

Conclusion & Investment Strategies

The Ivalue Infosolutions IPO comes with strong fundamentals, consistent revenue growth, and leadership in the technology services integration space. With PAT rising 21% YoY in FY25 and a market capitalization of around ₹1,600 crore, the company demonstrates both scale and profitability.

While the Ivalue IPO GMP is yet to begin, investors should watch subscription data and institutional participation closely for cues on demand. The company’s diversification across cybersecurity, data center infrastructure, and lifecycle management makes it well-positioned to benefit from the ongoing digital transformation wave in India.

Investment View

- Short-term (Listing Gain Strategy):

Since the GMP trend has not yet started, immediate listing gains are uncertain. If strong demand comes from QIBs and retail investors, there could be healthy upside. - Medium to Long-term (Growth & Expansion Play):

With a CAGR of ~19% in PAT between FY23–FY25 and solid KPIs like ROE of 21% and ROCE of 29%, the Ivalue Infosolutions IPO offers potential for long-term wealth creation. Growing digital adoption, cybersecurity demand, and enterprise IT spending in India could act as strong growth drivers. - Allotment Strategy:

Investors seeking listing gains may keep a close watch on grey market updates and subscription levels. Long-term investors can consider applying irrespective of short-term GMP movements, as fundamentals remain attractive.

👉 In short, the Ivalue Infosolutions IPO is a compelling opportunity for investors who want exposure to India’s fast-growing digital and cybersecurity solutions market. The company’s strong financial performance and scalable business model make the Ivalue IPO worth considering both for listing play and long-term portfolio allocation.

FAQs on Ivalue Infosolutions IPO

Q1. What is the Ivalue Infosolutions IPO?

The Ivalue Infosolutions IPO is a mainboard public issue from Ivalue Infosolutions Ltd., a technology services and solutions integrator.

Q2. What is the IPO price band for Ivalue Infosolutions IPO?

The IPO price is set at ₹284 to ₹299 per share.

Q3. When will the Ivalue Infosolutions IPO open?

The IPO opens on September 18, 2025, and closes on September 22, 2025.

Q4. What is the minimum lot size for Ivalue IPO?

The minimum lot size is 50 shares, requiring an investment of ₹14,950.

Q5. On which exchange will the Ivalue Infosolutions IPO list?

It will list on both NSE and BSE mainboard platforms.

Q6. What is the GMP of Ivalue Infosolutions IPO?

Currently, the GMP (Grey Market Premium) for Ivalue IPO has not started yet.

Q7. What are the financial highlights of Ivalue Infosolutions IPO?

The company’s revenue rose 19% and PAT grew 21% between FY24 and FY25, showcasing consistent growth.

Q8. What is the market cap of Ivalue Infosolutions IPO?

The estimated post-issue market capitalization is ₹1,600 crore.

Q9. Who are the peers of Ivalue Infosolutions Ltd.?

Its listed peer includes Multi Chem Ltd., which trades at a lower P/E multiple.

Q10. Should investors apply for Ivalue IPO?

Investors with a medium to long-term horizon may consider applying, as the company operates in a fast-growing digital transformation and cybersecurity space.

Related Articles

How to Analyze an IPO Before Investing: A Step-by-Step Guide

One Demat vs Multiple Demat – Which is Better for IPO Allotment?