Israel Strikes on Iran Rattle Market

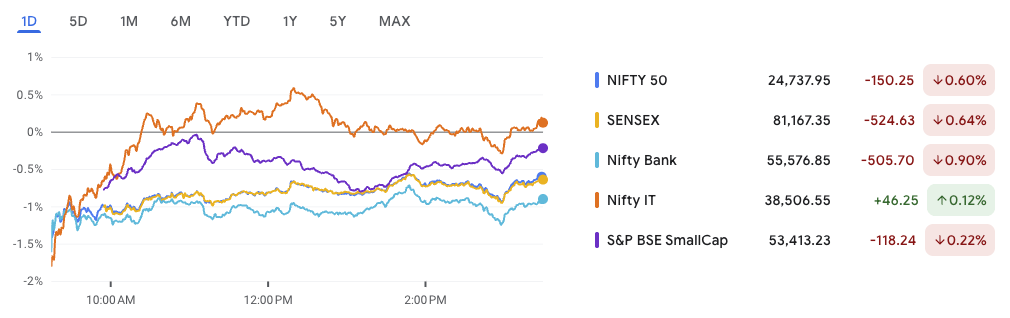

Geopolitical jitters resurfaced as fresh Israeli strikes on Iran spooked global sentiment, triggering a broad-based selloff across Indian equities. The Israel Iran conflict impact was clearly felt on Dalal Street, with the Sensex tumbling 573 points and Nifty slipping below 24,750, ending the week on a cautious note.

Major indices closed in the red:

- Sensex: 81,118.60 (−573.38 pts / −0.70%)

- Nifty 50: 24,718.60 (−169.60 pts / −0.68%)

- Nifty Bank: 55,527.35 (−555.20 pts / −0.99%)

Sector snapshot: Barring media, every other sector saw cuts as investors turned risk-averse:

- Worst hit sectors: PSU Banks (-1.18%), Oil & Gas, FMCG, Power, and Telecom.

- Only green tick: Nifty IT (+0.02%), showing relative strength amid global risk-off mood.

In the broader market, midcaps and smallcaps joined the correction, indicating widespread caution.

Top Nifty gainer: Bharat Electronics (+1.76%)

Top loser: Adani Ports (−2.82%)

This newsletter will break down:

- The real Israel Iran conflict impact on market sentiment

- Which sectors look vulnerable (and which might benefit)

- Trade-ready Nifty 50 technical levels

- Top stories & IPOs that matter

- A fresh small-cap watchlist for bold traders

Stay with us as we decode Monday’s opening game plan and prepare to navigate through global uncertainty.

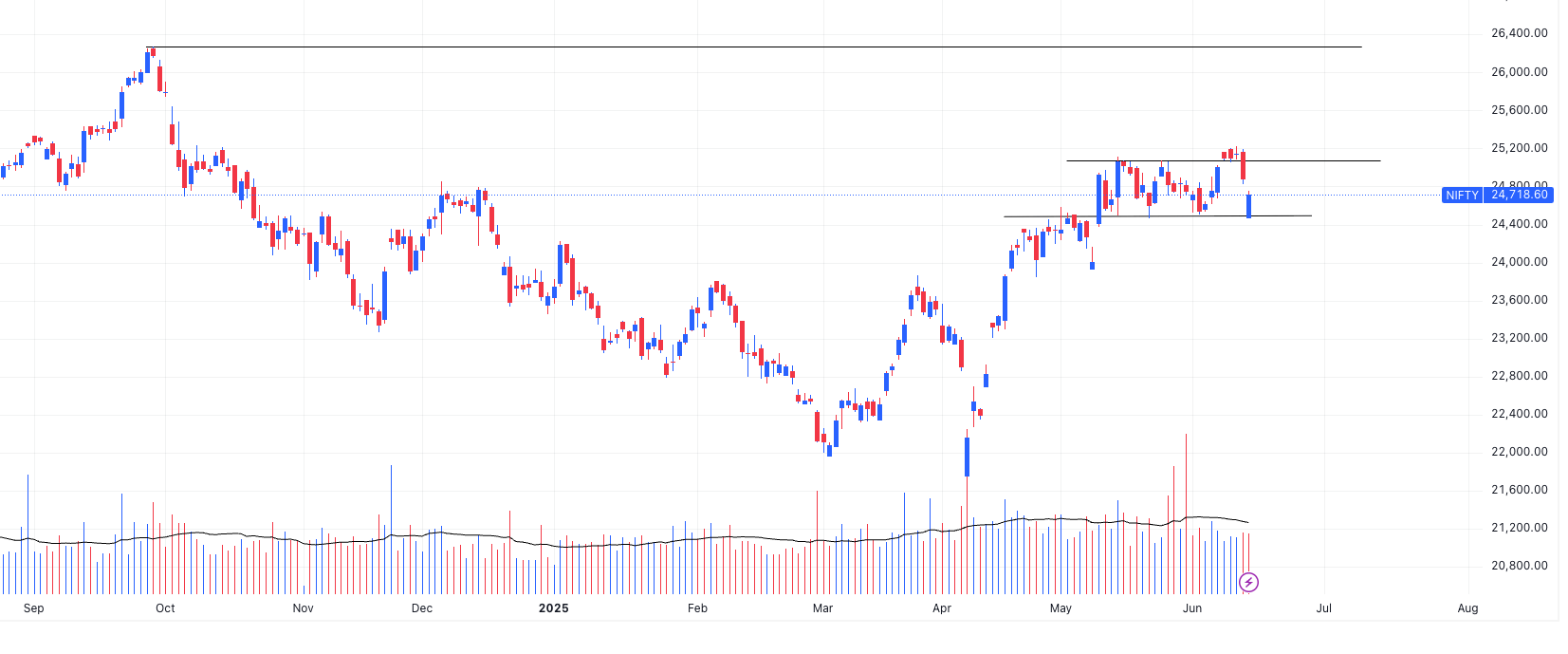

Nifty 50 – Technical View After Global Shockwaves

The Nifty 50 closed at 24,718, ending the session with a bearish candle. This move came on the heels of heightened geopolitical risk, as the Israel Iran conflict impact weighed heavily on investor sentiment.

🔸 Chart Structure: Rangebound, But Fragile

The index remains in a consolidation zone:

- Resistance Zone: 25,200–25,300 (rejection seen again)

- Support Zone: 24,400–24,500 (held up so far)

The price action resembles a rectangle pattern, hinting at indecision and waiting for a trigger — something the global headlines may have just provided.

🔻 Bearish Signals:

- A strong rejection at resistance with a gap-down open and red-bodied candle suggests growing supply at the top.

- Volume on red candles is slightly rising — a classic caution sign.

🔺 Bullish Hints:

- Price still holds above the 24,400 key level — buyers are not out yet.

- Broader trend remains up since April, meaning pullbacks may find dip-buyers.

Possible Scenarios

📌 Scenario 1: Breakout Above 25,300

- Confirmation: Daily close above 25,300

- Target 1: 25,800

- Target 2: 26,400 (ATH zone)

- Bias: Short-term bullish momentum resumes

- Support: 24,400 – 24,500

📉 Scenario 2: Breakdown Below 24,400

- Confirmation: Daily close below 24,400

- Target 1: 24,050

- Target 2: 23,700 (gap-fill zone)

- Resistance on pullback: 24,700 – 24,800

- Bias: Short-term bearish correction triggered by geopolitical fears

Range Trading Strategy (Until Breakout/Breakdown)

| Action | Entry Level | Stop-Loss | Target Zone |

|---|---|---|---|

| Buy | 24,400 – 24,500 | 24,300 | 25,200 – 25,300 |

| Sell | 25,200 – 25,300 | 25,400 | 24,500 |

Key Levels to Watch

- Support: 24,400

- Resistance: 25,300

- Breakout Confirmation: Daily candle close outside the range with volume

Final View:

While the Israel Iran conflict impact has triggered fresh caution, Nifty is still consolidating within a well-defined 900-point zone. A breakout will define the next directional move. Until then, smart range-trading or waiting on the sidelines may offer better risk-reward setups.

Market News & Stocks in Focus – What Moved & Why

As geopolitical and sectoral news continues to drive sentiment, several stocks found themselves at the center of attention. Here’s what stood out and why it matters for your Monday watchlist:

CNG Boom: Mahanagar Gas & Gujarat Gas

The City Gas Distribution (CGD) sector is witnessing strong tailwinds, driven by:

- Rising CNG adoption

- Expanding gas pipeline infrastructure

- Competitive fuel pricing vs petrol/diesel

🔎 Stocks in Focus:

Mahanagar Gas, Gujarat Gas

📈 Analyst View: Siddhartha Khemka sees 10–20% upside potential as long-term growth trends support re-rating.

Takeaway: Look for momentum in CGD stocks, especially if oil prices remain volatile due to global tensions.

Adani Group & the Israel Iran Conflict Impact

Gautam Adani’s strategic bets in the Middle East—Haifa Port, a defence JV with Elbit Systems, and a semiconductor unit—are facing scrutiny.

⚠️ Why It Matters:

While the group’s direct financial exposure is moderate, investor sentiment may get hit amid heightened regional risks and operational uncertainty.

🔎 Stock in Focus:

Adani Ports – already among the top losers in Friday’s session (-2.82%)

Takeaway: Expect volatility in Adani Group stocks as the Israel Iran conflict impact deepens and global investors reassess geopolitical exposure.

Canara Bank: Fundraise Approved

The board of Canara Bank has cleared a plan to raise ₹9,500 crore in FY26 via Tier II and AT1 bonds.

Why It Matters:

- Fund infusion supports capital adequacy

- Strong Q4 earnings (+33% YoY)

- Slight concern: marginal uptick in slippages

🔎 Stock View: Positive for long-term capital buffers but watch for near-term market reaction due to overhang of bond supply.

Garuda Aerospace: Agri-Tech Expansion

Garuda Aerospace launched a 35,000 sq ft agri-drone indigenisation facility near Chennai, flagged off by Union Minister Kamlesh Paswan.

Why It Matters:

- Boost to Make-in-India & agri-tech

- Growing demand for precision farming tools

🔎 Stock Impact: Not yet listed, but the agri-drone space is one to watch in upcoming IPOs or innovation-linked funds.

Rayzon Solar: IPO Buzz

Surat-based Rayzon Solar is preparing to file DRHP for a ₹1,500 crore IPO. The company plans to use the funds for scaling capacity amid strong demand for domestic solar solutions.

🔎 Sector Outlook:

- Strong government push for solar manufacturing

- Solar adoption rising across industrial and residential segments

Takeaway: Could be a promising entrant if valuations are reasonable; keep an eye on DRHP and peer benchmarking.

IPO Dashboard – Market Buzz Amid Geopolitical Tensions

Despite the recent pullback in equities due to the Israel Iran conflict impact, the primary market remains active. Mainboard and SME IPOs continue to attract investor attention with selective enthusiasm. Here’s a snapshot of where the action is:

Mainboard IPOs

1. Arisinfra Solutions Ltd

- GMP: ₹30 (13.51%)

- Issue Price: ₹222

- Estimated Listing: ₹252

- Size: ₹499.60 Cr

- Lot Size: 67 Shares

- Open–Close: 18–20 Jun

- Listing Date: 25 Jun

💡 Strong domestic infrastructure play with moderate GMP. Stable listing expected, though broader sentiment is cautious amid global tensions.

2. Oswal Pumps Ltd

- GMP: ₹70 (11.4%)

- Issue Price: ₹614

- Estimated Listing: ₹684

- Size: ₹1,387.34 Cr

- Lot Size: 24 Shares

- Open–Close: 13–17 Jun

- Listing Date: 20 Jun

💡 One of the larger mainboard offerings this month, Oswal’s listing may see a muted pop depending on how global tensions influence sentiment.

SME IPO Highlights – Selective Heat in the Smallcap Lane

| IPO Name | GMP | Price | Listing Est. | Size | Open | Close | Listing |

|---|---|---|---|---|---|---|---|

| Monolithisch India | ₹46 (32.17%) | ₹143 | ₹189 | ₹82.02 Cr | 12-Jun | 16-Jun | 19-Jun |

| Eppeltone Engineers | ₹60 (46.88%) | ₹128 | ₹188 | ₹43.96 Cr | 17-Jun | 19-Jun | 24-Jun |

| Influx Healthtech | ₹24 (25.00%) | ₹96 | ₹120 | ₹58.57 Cr | 18-Jun | 20-Jun | 25-Jun |

| Patil Automation | ₹17 (14.17%) | ₹120 | ₹137 | ₹69.61 Cr | 16-Jun | 18-Jun | 23-Jun |

| Aten Papers & Foam | ₹– (0%) | ₹96 | ₹96 | ₹31.68 Cr | 13-Jun | 17-Jun | 20-Jun |

| Samay Project Services | ₹– (0%) | ₹34 | ₹34 | ₹14.69 Cr | 16-Jun | 18-Jun | 23-Jun |

| Mayasheel Ventures | ₹– (0%) | ₹47 | ₹47 | ₹27.28 Cr | 20-Jun | 24-Jun | 27-Jun |

IPO Outlook:

While recent weakness in the broader markets (due to the Israel Iran conflict impact) could affect listing optimism, SME investors remain active in quality names with strong order books or sectoral tailwinds. GMP trends are encouraging, but volatility may test conviction—apply with clarity, not just sentiment.

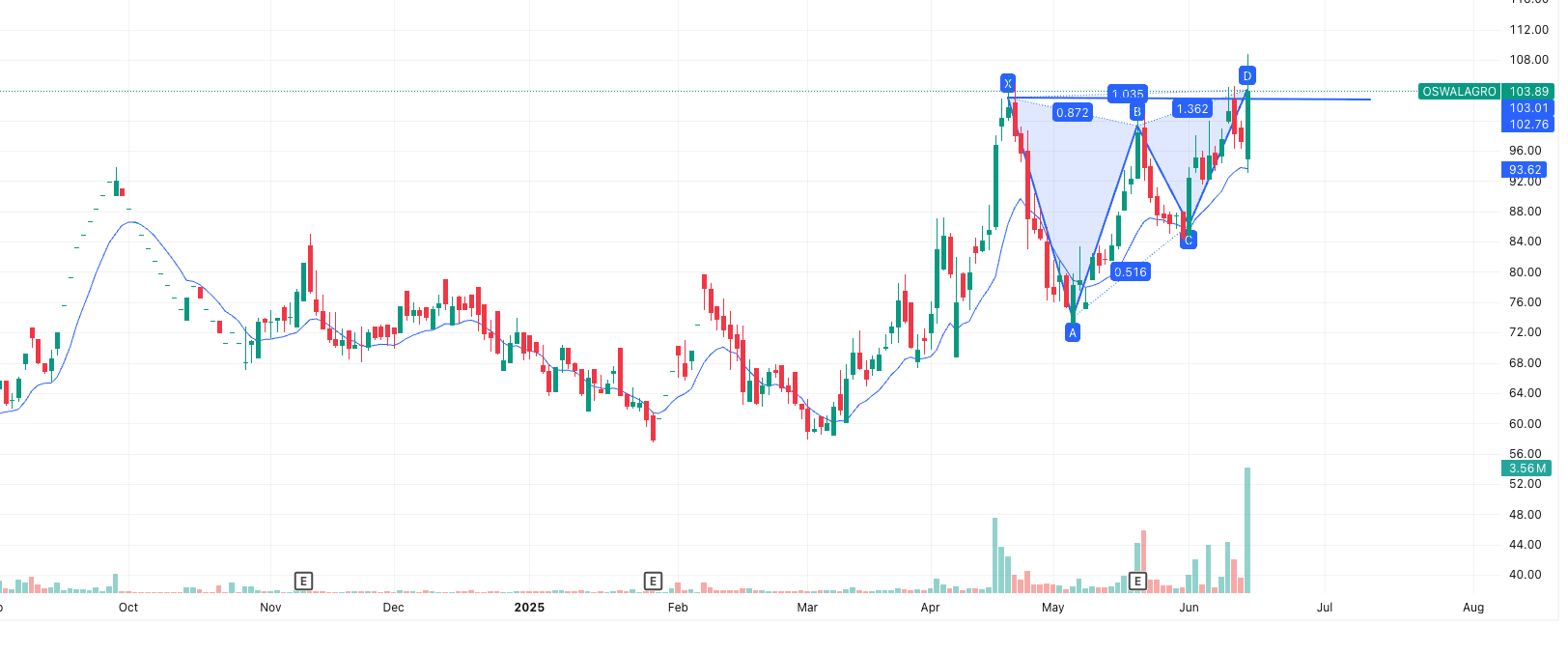

Techno-Funda Radar: Oswal Agro Mills Ltd – Breakout With Bite

While broader indices are reeling from the Israel Iran conflict impact, Oswal Agro Mills (₹103) is quietly staging a breakout with strong momentum. Here’s why it’s drawing attention from high-risk swing traders:

Technical Setup: Bullish Harmonic Breakout

- Pattern: Likely a Bullish Bat or AB=CD – both harmonic reversal setups.

- Breakout Candle (June 13):

✔ Up 6.83%, closed at ₹103.89

✔ Broke past key resistance zone ₹102.76–₹103.01

✔ Highest volume in months (3.56M) → suggests big players entering - Momentum:

- Trades far above 9 EMA (₹93.62)

- Cleared prior consolidation zone of ₹88–₹103

- No major resistance until ₹112–₹118

Short-Term Swing Trade Levels

| Action | Entry Zone | Stop Loss | Target 1 | Target 2 |

|---|---|---|---|---|

| Buy | ₹103–105 | ₹98 | ₹112 | ₹118 |

🔎 Risk-Reward: ~1:2.5 – attractive for a short-term swing with strict risk controls.

📉 A close below ₹98 would invalidate this bullish thesis.

Fundamental Overview

Founded in 1979, Oswal Agro Mills has evolved into a multi-segment entity:

- Trading: Commodities and general goods

- Real Estate: Development and asset trading

- Investments: Deploys surplus into inter-corporate deposits, mutual funds, and securities

- Unallocable Income: Primarily interest from FDs

Associate Link: Oswal Greentech Ltd (OGL), also in real estate and investments.

Related Party Transactions: ₹50 Cr with Jindal Steel & Power Ltd in FY23.

Key Financial Metrics

- Market Cap: ₹1,386 Cr | CMP: ₹103

- P/E: 12.3 | Book Value: ₹70.8 | P/B: 1.46

- ROE: 12.6% | ROCE: 16.3%

- Zero Debt | NPM (FY23): 245%

- Cash Equivalents: ₹97.9 Cr | Sales: ₹162 Cr

- Intrinsic Value Estimate: ₹244 (per model)

Our View

With a breakout backed by volume and improving fundamentals, OSWALAGRO offers a high-risk, high-reward swing trade opportunity. Still, macro tensions from the Israel Iran conflict impact may introduce volatility. Enter with strict stop-loss discipline and partial allocations.

🔔 Not a recommendation, but a strategic case for watchlisting with caution.

👉 Explore smart trades with Angel One – tap into swing setups with confidence.

Final Thoughts

The markets closed the week on a cautious note, rattled by escalating geopolitical stress from the Israel Iran conflict impact. Both Nifty and Sensex slipped notably, breaking recent upward momentum. With sectoral weakness across the board (except IT and Media), and risk-off sentiment rising, traders and investors are now watching global cues with greater intensity.

Technically, Nifty 50 continues to consolidate within a 900-point range (24,400–25,300), and while short-term selling pressure is evident, the broader trend remains intact until key support levels are breached. Range-trading strategies and capital protection are likely to dominate in the early part of the week.

On the stock front, select themes still shine through:

- City gas players like MGL and Gujarat Gas may benefit from long-term tailwinds in CNG adoption.

- Adani-linked assets are under watch as tensions in the Middle East rise.

- IPO action remains red-hot in the SME segment, led by listings like Arisinfra Solutions and Oswal Pumps.

- Oswal Agro Mills is showing a high-risk, high-reward breakout setup — a rare technical bright spot in a jittery market.

As we move into the new week, a breakout (or breakdown) in Nifty will likely set the tone for broader participation. Until then, it’s a phase to stay nimble, cautious, and selectively opportunistic.

Related Articles

India Becomes the Cheapest Manufacturing Hub: Stocks Set to Win Big