Introduction: A Volatile Week for Dalal Street

In this Indian stock market weekly update for the period of 7 to 11 July 2025, we witnessed a sharp reversal in sentiment across Indian equities. After weeks of steady climbs, the major indices—Nifty 50 and Sensex—saw a broad-based correction. Investors were caught between domestic earnings disappointments, global trade tensions, and profit-booking across sectors.

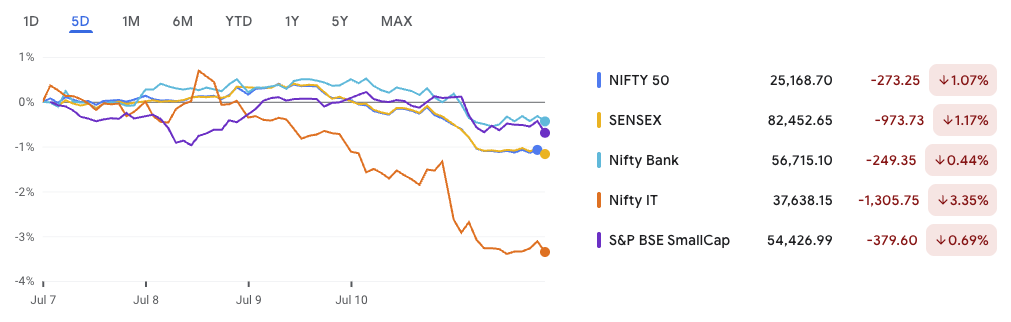

By the end of the week:

- Nifty 50 dropped by 273 points (1.07%) to close at 25,168.70

- Sensex tumbled 973 points (1.17%) to settle at 82,452.65

- Nifty IT saw a significant drop of 3.35%

- Even broader market indices like Nifty Bank (-0.44%) and BSE SmallCap (-0.69%) failed to offer shelter

In this blog, you’ll find a full breakdown of:

- Sector-wise performance

- Top stock gainers and losers

- Reasons behind the fall in markets

- Key takeaways and next week’s outlook

Let’s dive into this comprehensive Indian stock market weekly update.

Sector Update: FMCG and Media Shine While IT & Telecom Bleed

Despite overall weakness, a few sectors managed to outperform and deliver solid returns, particularly those seen as defensive or consumption-oriented.

🔼 Top Performing Sectors This Week

| Sector | Weekly Gain (%) |

|---|---|

| FMCG | +4.55% |

| Media | +4.47% |

| Hotels, Restaurants & Tourism | +1.64% |

| Transportation | +1.46% |

| Utilities | +1.42% |

- FMCG stocks led the rally as investors turned defensive. Strong demand visibility and cooling inflation raised hopes for margin expansion.

- The Media sector bounced back on hopes of increased ad revenue and content monetization.

- Hospitality and travel stocks gained as July holiday momentum picked up.

🔻 Worst Performing Sectors

| Sector | Weekly Loss (%) |

|---|---|

| Telecom Services | -4.86% |

| Telecommunications Equipment | -3.54% |

| Hardware Technology & Equipment | -3.49% |

| Software & Services | -2.70% |

| Retailing | -2.59% |

- IT and Telecom were the biggest drag this week, with weak earnings and global uncertainty dampening sentiment.

- Telecom operators were hit hard due to fears of ARPU stagnation and regulatory scrutiny.

These contrasting movements made it a mixed bag in this Indian stock market weekly update, with investors rotating out of overvalued names and into defensive bets.

Top Stock Gainers and Losers

This week saw massive movements in individual stocks—some rallying to new 52-week or decade-highs, while others tanked on company-specific news.

Top Gainers of the Week

| Stock | Weekly Change (%) | LTP | Highlights |

|---|---|---|---|

| Jaiprakash Power Ventures | +24.7% | ₹23.63 | Hit 10-year high |

| Glenmark Pharma | +19.16% | ₹2,181.10 | Licensing deal boost |

| ACME Solar Holdings | +18.36% | ₹295.39 | Renewable sector rally |

| Syrma SGS Technology | +11.3% | ₹678.45 | Investment-led rally |

| Lemon Tree Hotels | +10.73% | ₹153.38 | Strong occupancy recovery |

- Glenmark soared after signing a high-value global licensing agreement, boosting future revenue visibility.

- ACME Solar hit 10-year highs on strong investor interest in clean energy.

- Syrma SGS gained on fresh institutional investments, hitting its 52-week high.

Top Losers of the Week

| Stock | Weekly Change (%) | LTP | Reason |

|---|---|---|---|

| BSE Ltd. | -10.02% | ₹2,371.10 | Regulatory probe |

| MCX | -9.42% | ₹8,048 | SEBI investigation |

| Titan | -8.82% | ₹3,361.60 | Valuation correction |

| Solar Industries | -8.52% | ₹15,420 | Profit booking |

| Bharat Forge | -7.58% | ₹1,214.80 | Demand concerns in defense exports |

This week’s biggest loser, BSE, saw double-digit losses after reports surfaced about a regulatory probe by SEBI, which also dragged MCX into negative territory.

Why Did the Market Fall This Week?

Several factors contributed to this week’s decline, making this Indian stock market weekly update critical for understanding investor sentiment:

1. Weak IT Earnings (TCS Disappoints)

TCS, one of India’s largest software exporters, posted weaker-than-expected Q1 results. This dragged down not only its own stock but also sector peers like Infosys and Tech Mahindra, leading to a 3.35% drop in the Nifty IT index.

2. Global Trade Tensions Resurface

The U.S. administration hinted at renewed tariffs involving India and other countries. This spooked markets as trade uncertainty could dampen exports and increase costs for domestic manufacturers.

3. Regulatory Overhang on Exchanges

News of SEBI launching investigations into BSE and MCX triggered a massive sell-off in both stocks, denting sentiment in the financial services segment.

4. Profit Booking in Midcaps and IT Stocks

After a sharp June rally, many investors booked profits in smaller companies, especially in auto, retail, and capital goods stocks.

5. FII Selling and Liquidity Pressure

Foreign Institutional Investors (FIIs) were net sellers this week, pulling money out of largecaps and IT, thereby weakening overall market momentum.

Economic Calendar & Dividend Tracker: What to Watch

Next week is packed with macro indicators and dividend actions that could influence both stock prices and sector sentiment. Here’s a detailed breakdown.

Key Economic Data to Watch

| 📆 Date | 🏛️ Event | 📊 Forecast | 📈 Prior | 💡 Impact Area |

|---|---|---|---|---|

| Mon, Jul 14 | WPI Food Index (YoY) | 1.72% | 2.5% | Input cost trend for FMCG & Agri |

| WPI Fuel (YoY) | -2.27% | 2.82% | Fuel cost impact on logistics/manufacturing | |

| WPI Manufacturing (YoY) | 0.52% | 0.8% | Industry margins | |

| WPI Inflation (YoY) | 0.39% | 0.21% | Wholesale inflation trend | |

| CPI Inflation (MoM) | 0.21% | 0.39% | Short-term consumer inflation | |

| CPI Inflation (YoY) | 2.04% | 2.5% | Key for RBI policy decisions | |

| Tue, Jul 15 | Passenger Vehicle Sales (YoY) | >5% expected | 0.8% | Auto demand & OEM stocks |

| Balance of Trade | -$21.88B | -$21.88B | Forex outlook, export health | |

| Exports | $38.73B | $38.73B | Export-focused sectors | |

| Imports | $60.61B | $60.61B | Raw material pricing | |

| Fri, Jul 18 | Bank Loan Growth (YoY) | >10% expected | 9.6% | Banking credit outlook |

| Deposit Growth (YoY) | >10% expected | 10.4% | Banking system liquidity | |

| Forex Reserves | $700B+ expected | $699.74B | Rupee stability buffer |

Investor Tip:

Watch out for CPI YoY below 3% and loan growth above 10% — both signal bullish triggers for banks, consumption, and rate-sensitive sectors.

Dividend Announcements (Ex-Date: 14 July 2025)

If you’re a dividend investor, Monday brings multiple corporate payouts across sectors. Below is a complete table of dividends, yields, and pay dates:

| 🏢 Company | 💸 Dividend | 🗓️ Ex-Date | 📅 Pay Date | 📈 Yield (%) |

|---|---|---|---|---|

| Bimetal Bearings Ltd. | ₹13.00 | Jul 14, 2025 | Aug 20, 2025 | 1.90% |

| Craftsman Automation Ltd. | ₹5.00 | Jul 14, 2025 | Aug 20, 2025 | 0.08% |

| GHCL Textiles Ltd. | ₹0.50 | Jul 14, 2025 | Aug 20, 2025 | 0.55% |

| Persistent Systems Ltd. | ₹15.00 | Jul 14, 2025 | Aug 20, 2025 | 0.63% |

| RR Kabel Ltd. | ₹3.50 | Jul 14, 2025 | Aug 20, 2025 | 0.45% |

| Super Sales India Ltd. | ₹— | Jul 14, 2025 | Aug 20, 2025 | 0.27% |

| Wendt India Ltd. | ₹20.00 | Jul 14, 2025 | Aug 12, 2025 | 0.44% |

Investor Tip:

- Persistent Systems and Bimetal Bearings offer the highest yields among this batch.

- Ex-date means stock must be bought before July 14 to receive the dividend.

Conclusion: A Volatile Week Ends with Clues for the Next Rally

This week’s Indian stock market weekly update reflects a reality check for the bulls. With benchmark indices like Nifty 50 and Sensex shedding over 1%, the market responded to weak IT earnings, regulatory jitters, and global trade uncertainty. Yet, the strength in FMCG, Media, and Renewables shows that stock selection and sector rotation are more important than ever.

Looking ahead, next week’s action will likely be driven by:

- Inflation data (CPI & WPI) – A softer-than-expected print could cheer rate-sensitive sectors.

- Auto sales & credit growth – These will indicate the real economy’s momentum.

- Dividend-paying stocks – Names like Persistent Systems, Bimetal Bearings, and Wendt India offer opportunities for yield-focused investors.

For investors, the strategy should be cautious but opportunistic:

- Stick with quality stocks in strong sectors like FMCG, Pharma, and Renewable Energy.

- Use any dip in fundamentally strong IT stocks as a long-term entry point.

- Watch for volatility around macro announcements and corporate earnings.

In short, while the broader indices may pause or consolidate, opportunities remain abundant — provided you’re tracking the right signals.

Stay informed, stay selective — and keep checking back for your next Indian stock market weekly update.

Related Articles

Is Your Broker Safe? How the Jane Street vs SEBI Scandal Shook Indian Markets

Trump’s Big Beautiful Bill: Impact on Indian Stock Market and Key Stocks to Watch

SEBI’s Equity Derivatives Report 2025: Key Trends, Risks & Retail Trader Insights