Introduction: From Chip Hungry to Chip Hungry-for-More

For decades, India’s relationship with semiconductors has been simple: import, assemble, repeat. Despite powering one of the world’s largest consumer electronics markets, India has had zero chip fabs to call its own.

But that script is being flipped.

India isn’t just catching up—it’s sprinting into the semiconductor race with a $10 billion government war chest, a pipeline of strategic projects, and the backing of giants like Micron, Tata, and CG Power. This isn’t a PR move — it’s a structural overhaul.

The Indian Semiconductor Investment Opportunity isn’t about chasing hype. It’s about entering a sunrise sector just as the sun starts to rise. From chip design and OSAT to cleanroom manufacturing and IP-rich R&D, India is quietly building a silicon ecosystem with serious economic and geopolitical muscle.

For early investors, this is not a moment to watch — it’s a moment to move.

Market Size & Growth Outlook: A $100 Billion Opportunity in Motion

The semiconductor industry in India is rapidly evolving from a dormant sector to one of the most promising investment frontiers. Unlike in the past, when India remained dependent on imports, today’s momentum is driven by data-backed growth, local policy support, and global demand realignment.

Rapid Growth Trajectory

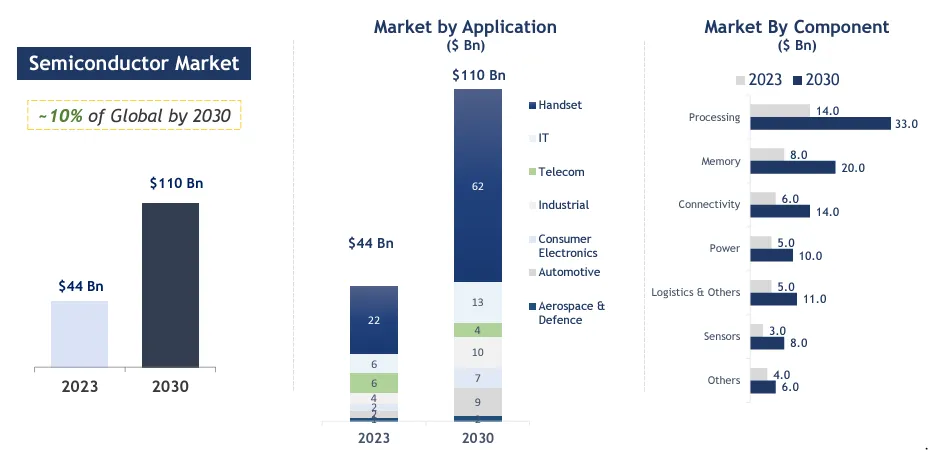

India’s semiconductor market stood at $26.3 billion in 2022. It is projected to reach $44 billion by 2024 and $110 billion by 2030, according to the India Electronics and Semiconductor Association (IESA). This reflects a compound annual growth rate (CAGR) of 26.3%, positioning India among the fastest-growing semiconductor markets globally.

Looking even further ahead, the market is forecasted to touch $271.9 billion by 2032. These figures clearly highlight the scale of the Indian Semiconductor Investment Opportunity, particularly as global supply chains diversify and seek resilient alternatives.

Strong Demand Anchors

Three sectors—mobile phones, IT hardware, and industrial applications—generate nearly 70% of India’s semiconductor consumption. This demand base is expanding due to surging adoption of electric vehicles (EVs), 5G deployment, cloud computing, and AI-powered devices.

Unlike mature markets where growth rates have begun to plateau, India still has massive headroom. With over 600 million smartphone users and rising, semiconductor usage per capita continues to climb.

Why the Momentum is Sustainable

First, global chipmakers are actively seeking production bases outside China. India offers a politically stable, cost-efficient, and policy-driven alternative. Second, the Production Linked Incentive (PLI) schemes and Semicon India Program provide direct financial support to manufacturers, designers, and OSAT players. Third, rising domestic consumption and export potential create dual revenue streams for future Indian semiconductor firms.

These factors don’t just support growth—they accelerate it.

Key Insight for Investors

This isn’t a niche story limited to one sector. It’s a multi-decade, economy-wide transformation. The Indian Semiconductor Investment Opportunity spans the full value chain—from design and R&D to testing, packaging, and contract manufacturing. Investors who enter early can benefit from the foundational phase of a sector with trillion-dollar potential.

Government Push: Where Policy Meets Capital

India’s semiconductor ambition isn’t just corporate—it’s deeply strategic. The government is directly investing, incentivizing, and structuring an ecosystem to reduce chip dependency and create a competitive edge in global electronics manufacturing.

A Mission-Driven Approach

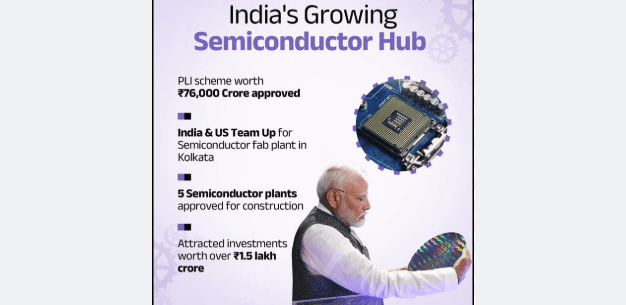

The India Semiconductor Mission (ISM) forms the backbone of this transformation. Announced in 2021 with an initial outlay of ₹76,000 crore (around $10 billion), the mission aims to build a self-reliant and globally competitive semiconductor ecosystem.

Rather than relying solely on private capital, the government has positioned itself as a co-investor. It offers up to 50% fiscal support for key segments of the value chain. This is not just rare—it’s unprecedented for a sector that typically sees high capital barriers.

Key Schemes Under the Semicon India Program

- Semiconductor Fabs Scheme

Offers 50% financial assistance for establishing greenfield silicon CMOS fabrication plants. - Display Fabs Scheme

Provides 50% support for the setup of display panel fabrication facilities. - Compound Semiconductors & OSAT Scheme

Covers 50% of capital expenditure for compound semiconductors, sensors, photonics, assembly, and testing units. - Design Linked Incentive (DLI) Scheme

- Product Design Incentive: Covers up to 50% of eligible R&D expenses (capped at ₹15 crore per application).

- Deployment Incentive: Offers 4–6% of net sales over five years (capped at ₹30 crore per applicant).

These schemes are designed to support all phases of the semiconductor lifecycle—from IP design and prototyping to mass production and export-readiness.

Building Confidence Through Execution

Government approvals have already translated into action. Major global and Indian players—Micron Technology, Tata Electronics (two projects), CG Power, and Kaynes Technology—have secured project approvals under various schemes. These include OSAT facilities, fabs, and high-tech packaging plants across Gujarat, Tamil Nadu, and Karnataka.

In parallel, the Ministry of Electronics and Information Technology (MeitY) continues to lead digital infrastructure, cybersecurity frameworks, and industry incentives.

What This Means for Investors

Government involvement significantly lowers entry risk for investors. In most sectors, policy can act as a headwind. In semiconductors, it’s a tailwind. The government is not only de-risking early capex but also accelerating demand-side growth through Make-in-India initiatives and import substitution targets.

The result is a highly favorable environment for both domestic and foreign capital. From contract manufacturers to chip designers and OSAT specialists, the Indian Semiconductor Investment Opportunity is now backed by both government will and fiscal muscle.

India in the Global Semiconductor Value Chain: From Design to Deployment

To understand the full scope of the Indian Semiconductor Investment Opportunity, it’s essential to look at where India currently stands in the global value chain—and where it’s headed.

Unlike traditional manufacturing sectors, semiconductors involve a multi-stage, deeply specialized process, with each stage contributing unique value. India, while still building capacity in fabrication, already holds competitive advantages in several upstream and downstream areas.

Strength in Chip Design

India is home to over 20% of the world’s semiconductor design engineers, working across fabless companies, multinational R&D centers, and independent design houses. Firms such as Saankhya Labs, Steradian Semiconductors, and Tata Elxsi are actively designing components for 5G, automotive radar, IoT, and satellite communications.

Additionally, global tech giants like Intel, Qualcomm, and Nvidia operate large R&D centers in India, reinforcing the country’s credibility in high-value design functions.

Role in Electronic Design Automation (EDA)

India also contributes significantly to Electronic Design Automation (EDA)—a niche but crucial segment involving tools and software that assist engineers in designing, testing, and verifying chips. Indian firms, along with global players operating locally, continue to support faster and more efficient chip development processes.

Gaining Ground in OSAT and ATMP

The most immediate manufacturing gains for India are happening in the OSAT (Outsourced Semiconductor Assembly and Testing) and ATMP (Assembly, Testing, Marking, and Packaging) segments. These are cost-sensitive, labor-intensive areas where India has a natural advantage due to its skilled engineering workforce and lower operational costs.

For example:

- Micron’s OSAT facility in Gujarat is under development with $825 million in direct investment.

- Tata Group and CG Power are building advanced packaging and assembly lines with government support.

These developments are helping India plug into the midstream of the global chip supply chain, even as full-scale fabs are still a few years away.

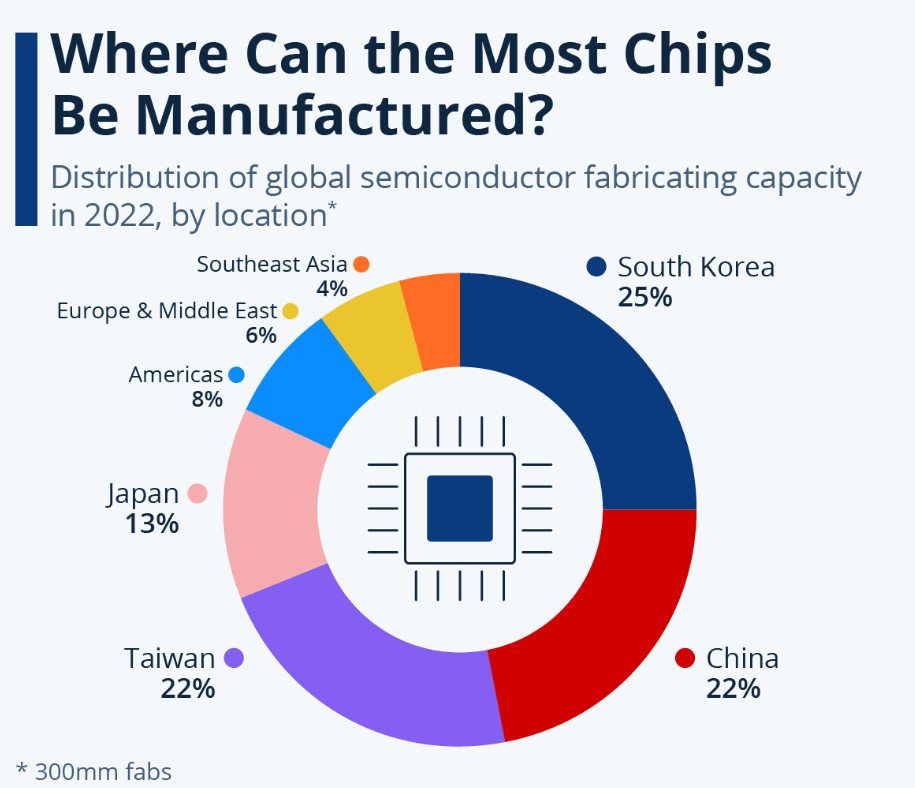

Gaps in Wafer Fabrication—For Now

At present, India does not operate any commercial semiconductor fabrication (fab) facilities. Setting up a fab involves investments exceeding $5–7 billion per plant and requires tight control over precision tools, materials, and cleanroom operations. However, proposals are now moving forward under the Semicon India Program, and Tata’s planned fab in Dholera signals the first wave of movement in this space.

While catching up with Taiwan or South Korea in fabs will take time, India doesn’t need to replicate the entire chain to succeed. Strategic participation across high-growth segments like OSAT, design, and testing can yield strong returns in the short to medium term.

Global Context: India vs. the Incumbents

- TSMC (Taiwan) dominates fabrication.

- Nvidia (USA) leads in fabless chip design and AI computing.

- Amkor (South Korea/USA) is a leader in OSAT services.

India’s approach is different. It focuses on strategic partnerships, public-private joint ventures, and localized capacity building. This model is more modular, agile, and tailored to India’s current infrastructure capabilities.

Strategic Advantage for Investors

Participating in India’s rise in the semiconductor value chain allows investors to tap into both domestic growth and global outsourcing demand. The country’s strength in design and its emerging manufacturing base offer diversified investment angles—from R&D-heavy software companies to hardware-intensive assembly players.

In short, India is not trying to replace existing global giants overnight. Instead, it is building a complementary ecosystem that leverages its demographic edge, engineering talent, and supportive policy landscape.

This multi-layered entry into the value chain is exactly what makes the Indian Semiconductor Investment Opportunity so compelling for long-term capital allocation.

Competitive Forces: An Investor’s View Through Porter’s Five Lenses

While the Indian semiconductor sector offers extraordinary upside, smart investors know that structural opportunity must be weighed against competitive risk. Porter’s Five Forces framework provides a clear, strategic view of where India stands in this complex, capital-intensive industry.

1. Threat of New Entrants: Low

Semiconductors are one of the most capital-heavy industries on the planet. Building a fabrication facility alone can cost between $5 to $7 billion, not including the operational complexities of cleanrooms, precision tooling, and R&D. Even smaller segments like OSAT or EDA demand high technical know-how and scale advantages.

This high barrier to entry protects early movers in India—such as Micron, Tata Electronics, and CG Power—from rapid domestic competition. While new players may emerge, few can match the speed, capital, and policy alignment of those already approved under government programs.

Investor Takeaway:

Early-stage Indian firms entering with government backing are likely to enjoy a first-mover advantage for the foreseeable future.

2. Bargaining Power of Suppliers: High (for now)

India still relies on global suppliers for core raw materials like silicon wafers, photomasks, specialty gases, and chipmaking tools. These inputs are controlled by a small group of international vendors, giving them significant leverage.

However, India is beginning to invest in supply chain localization. Government incentives are encouraging joint ventures and domestic sourcing of critical components. Over time, these moves will reduce supplier dominance, but the transition will require patient capital and long-term strategy.

Investor Takeaway:

Short-term margins may remain tight due to input costs, but localization offers a margin expansion opportunity in the long run.

3. Bargaining Power of Buyers: Medium to High

Large OEMs (original equipment manufacturers), especially in consumer electronics, telecom, and automotive, hold substantial leverage. With access to multiple suppliers globally, they can demand lower prices, tighter delivery windows, and higher customization.

That said, India’s domestic consumption is exploding. As more Indian companies build for Indian markets, and export capacities grow, firms can diversify their client base—reducing overdependence on any single buyer group.

Investor Takeaway:

Firms that build specialized capabilities or target diversified demand across sectors (auto, defence, wearables) will be better positioned to protect pricing power.

4. Threat of Substitutes: Negligible

There are no viable substitutes for semiconductors in the modern economy. Every phone, EV, server, wearable, and drone depends on chips. While certain architectures or packaging styles may evolve, the core reliance on silicon logic remains intact.

This gives the sector an almost unmatched level of insulation from technological obsolescence, even during economic slowdowns.

Investor Takeaway:

This is a rare industry with built-in demand resilience, regardless of macro cycles.

5. Industry Rivalry: Intensifying, Globally and Locally

India faces stiff competition from global semiconductor giants. Taiwan, South Korea, China, Singapore, and Malaysia have invested for decades in chip manufacturing infrastructure and skilled ecosystems.

Within India, rivalry is heating up among EMS providers, design service firms, and OSAT players vying for government approvals, foreign clients, and export contracts. However, demand is outpacing supply, which means rivalry is more constructive than destructive—at least in the short to mid-term.

Investor Takeaway:

Expect strong M&A activity, vertical integration, and value chain expansion as Indian firms consolidate positions and scale up.

Electronics Manufacturing Boom: Sector-wise Growth and Its Link to Semiconductors

India’s semiconductor story doesn’t exist in isolation. It’s tightly linked to the exploding growth in electronics manufacturing, which feeds the domestic demand for chips and justifies the country’s push to localize semiconductor production.

Over the past few years, India has emerged as a top global destination for electronics assembly, powered by the Production Linked Incentive (PLI) schemes and robust export growth. From smartphones to wearables to automotive electronics, nearly every vertical is scaling fast—and that’s where semiconductor integration becomes critical.

FY24–FY25 Electronics Production Data (Sector-wise)

| Category | FY24 (USD Bn) | FY24 (INR Cr) | FY25 (USD Bn) | FY25 (INR Cr) |

|---|---|---|---|---|

| Mobile Phones | 44 | 3,50,000 | 51 | 4,22,000 |

| IT Hardware (Laptops, Tablets) | 4.5 | 37,291 | 5 | 41,395 |

| Consumer Electronics (TVs, Audio) | 12 | 99,442 | 13 | 1,07,627 |

| Strategic Electronics | 4.75 | 39,363 | 5.5 | 45,534 |

| Industrial Electronics | 12 | 99,442 | 12.5 | 1,03,487 |

| Wearables & Hearables | 1.25 | 10,359 | 2.5 | 20,697 |

| Auto Electronics | 7.5 | 62,151 | 8 | 66,378 |

| LED Lighting | 3 | 24,861 | 3.5 | 28,976 |

| Telecom Equipment | 2 | 16,574 | 3.5 | 28,976 |

| Electronic Components | 10 | 82,868 | 10.5 | 86,929 |

| Total Electronics | 101 | 8,22,350 | 115 | 9,52,000 |

Sectoral Trends That Matter for Semiconductor Investors

- Mobile manufacturing continues to lead with nearly half of India’s electronics output, driven by exports and rising domestic consumption. Every smartphone contains a mix of advanced and legacy chips—creating strong demand for both design and OSAT services.

- Automotive electronics, especially in EVs and ADAS (advanced driver-assistance systems), are driving demand for sensors, controllers, and power management chips. This is a high-margin space where India is gaining investor attention.

- Wearables and IoT devices have doubled their contribution year-on-year. These require ultra-low power, high-performance chips—areas where Indian design firms and OSAT players can lead.

- Industrial and strategic electronics, including defence applications, are rising on the back of the Make in India initiative and growing private sector defence investment.

Implication for the Indian Semiconductor Investment Opportunity

This sector-wide growth validates the core thesis: India can no longer afford to import nearly all of its semiconductor requirements. The scale of electronics output is now large enough to anchor a sustainable, locally integrated semiconductor value chain.

Additionally, as demand becomes more diversified—from high-end servers to low-cost wearables—Indian companies can specialize in different chip categories based on cost structure and design expertise.

Investor Takeaway:

The electronics boom is not just a backdrop—it’s a catalyst. It provides consistent demand, reduces the risk of underutilized fabs and OSAT units, and opens the door for vertical integration by listed companies. This is a multi-sector, multi-cap opportunity in the making.

Indian Companies to Watch: Where the Investment Opportunity Is Real

As India builds out its semiconductor and electronics ecosystem, several publicly traded companies are positioning themselves to capitalize on this once-in-a-generation transformation. These companies span different stages of the value chain—from chip design and electronics manufacturing to assembly, testing, and packaging (OSAT/ATMP).

For investors, this represents a multi-pronged exposure strategy, combining growth, government support, and sectoral tailwinds.

1. Electronics Manufacturing Services (EMS) / Contract Manufacturing

These companies manufacture consumer electronics, appliances, and industrial devices for global and domestic brands. As semiconductor localization rises, EMS players will increasingly integrate chip-level design and packaging.

| Company | Market Cap (₹ Cr) | P/E | Net Sales (₹ Cr) | Operating Profit (₹ Cr) | ROCE (%) |

|---|---|---|---|---|---|

| Dixon Technologies | 89,053 | 115 | 1,76,909 | 7,264.3 | 34.65 |

| Amber Enterprises | 22,538 | 92.67 | 67,293 | 5,471.9 | 10.62 |

| Elin Electronics | 733 | 45.94 | 10,417 | 496.48 | 5.12 |

2. Industrial, Strategic & IoT Electronics

These firms focus on high-value industrial applications including automotive, medical, and aerospace-grade electronics. They often collaborate on defence contracts and IoT modules—fields requiring advanced chip integration.

| Company | Market Cap (₹ Cr) | P/E | Net Sales (₹ Cr) | Operating Profit (₹ Cr) | ROCE (%) |

|---|---|---|---|---|---|

| Syrma SGS Technology | 9,281 | 76.85 | 31,538 | 2,605.8 | 10.19 |

| Kaynes Technology | 37,788 | 99.9 | 18,046 | 3,125.8 | 14.79 |

| Avalon Technologies | 5,949 | 115.87 | 8,671 | 773.54 | 7 |

3. Semiconductor Design, IP, and R&D

This is where India holds a long-standing edge. These companies provide chip design, simulation, IP development, and embedded software services for global semiconductor clients. This segment scales well and often delivers high margins with minimal capex.

| Company | Market Cap (₹ Cr) | P/E | Net Sales (₹ Cr) | Operating Profit (₹ Cr) | ROCE (%) |

|---|---|---|---|---|---|

| Tata Elxsi | 34,738 | 35.35 | 8,494 | 1,813.3 | 60.02 |

| L&T Technology Services | 47,116 | 44.56 | 96,473 | 21,263 | 38 |

| HCLTech | 4,32,965 | 26.68 | 10,99,130 | 2,56,930 | 31.13 |

| MosChip Technologies | 3,383 | 101 | 467 | 56 | 12 |

MosChip Technologies deserves special attention. It operates in semiconductor design services, turnkey ASIC solutions, and embedded systems. The company has also partnered with global players for chip tape-out, testing, and package delivery. Though still a small-cap stock, it offers early-stage exposure to India’s design-led chip ambitions.

4. OSAT / ATMP / Fab-Linked (Emerging Manufacturing)

This category includes companies either building or operating advanced packaging, assembly, and future chip fabrication facilities.

| Company | Market Cap (₹ Cr) | P/E | Net Sales (₹ Cr) | Operating Profit (₹ Cr) | ROCE (%) |

|---|---|---|---|---|---|

| CG Power & Industrial Solutions | 1,00,905 | 57.79 | 80,460 | 12,485 | 48.88 |

| Vedanta Ltd. | 1,63,571 | 10.86 | 14,37,270 | 3,77,480 | 25.2 |

These companies are involved in large-scale semiconductor projects—Vedanta has proposed a fab with Foxconn (though currently paused), while CG Power has partnered with Renesas and the government for chip packaging facilities.

Investor Summary:

- High-cap investors may prefer stability via Tata Elxsi, L&T Tech, or HCLTech.

- Mid-cap investors can track Kaynes, Dixon, or Syrma SGS for growth from scale.

- Small-cap and early-stage investors looking for potential high reward may explore MosChip for its niche role in chip design and IP.

- Manufacturing-focused investors can monitor Vedanta or CG Power for government-backed OSAT and fab initiatives.

Each segment supports a different layer of the value chain—and together, they form a diversified portfolio of exposure to the Indian Semiconductor Investment Opportunity.

Key Risks: What Investors Need to Watch

Although the Indian Semiconductor Investment Opportunity is strong, investors must consider a few important risks before entering.

1. Execution Delays

While many projects are announced, actual construction and operational timelines often slip due to land, equipment, or approval issues.

What to watch: Look for firms with proven execution or milestone updates—not just MoUs.

2. Import Dependence

Currently, India imports most critical chip materials. Therefore, global disruptions (like geopolitical conflict or trade restrictions) could impact timelines and costs.

What to watch: Companies that are actively localizing supply or forming joint ventures for raw materials.

3. Talent Constraints in Manufacturing

Though India excels in design talent, it lacks skilled technicians for fabrication and packaging. As a result, operational efficiency could suffer.

What to watch: Firms that invest in workforce training or global talent acquisition.

4. Global Competition

India is stepping into a space dominated by giants like TSMC and Samsung. Hence, competing without scale or specialization may lead to pricing pressure.

What to watch: Businesses with niche capabilities or local demand integration.

5. Policy Risk

Since much of the investment depends on government support, any policy change, delay in fund disbursal, or administrative shift could stall momentum.

What to watch: Projects with central and state-level backing and financial closure.

In Summary:

While the macro opportunity is real, investors should focus on execution capability, localized strategies, and strong policy linkages to navigate the risks effectively.

Long-Term Investment Strategy: How to Play the India Chip Boom

The semiconductor opportunity in India is not a short-term trade—it’s a decade-long structural shift. As the country evolves from a chip consumer to a co-creator in the global value chain, investors must think across phases, segments, and risk profiles.

Here’s how to approach it strategically:

1. Segment-Based Allocation

The semiconductor ecosystem offers multiple entry points. Rather than betting on just one company type, consider allocating across:

- Design/R&D (Asset-light, IP-driven):

Examples: Tata Elxsi, MosChip, L&T Technology

These companies scale with demand, offer high margins, and benefit from India’s engineering edge. - OSAT/ATMP (Emerging manufacturing):

Examples: CG Power, Kaynes

Ideal for exposure to the growing domestic packaging and testing capacity. - EMS/Contract Manufacturers:

Examples: Dixon, Syrma SGS

Benefit from electronics growth and rising chip content per device.

2. Blend of Market Caps

- Large-caps (Stability & cash flow):

Firms like HCLTech or L&T Tech offer strong fundamentals, low volatility, and long-term government partnerships. - Mid-caps (Scalable execution stories):

Companies like Kaynes or Avalon may offer outsized returns as they win large contracts and expand capacity. - Small-caps (High risk, high reward):

MosChip and similar niche players may provide asymmetric upside—but require close monitoring.

3. Track Incentives, Not Just Narratives

Many companies are riding the sector buzz. However, true investment merit lies in whether they have approved government incentives, signed technology partnerships, or are actively spending on capex.

Check:

- Project status updates

- State and central policy alignment

- Execution milestones (not just MoUs)

4. Think in Horizons

- Short Term (1–2 years):

Focus on design companies and EMS players. These are revenue-generating and linked to existing electronics demand. - Mid Term (3–5 years):

Watch OSAT firms and strategic electronics providers as manufacturing scales up. - Long Term (5–10 years):

Fab-level investments and upstream supply chain firms could deliver exponential returns—once infrastructure and scale mature.

Final Thought: Choose Exposure, Not Hype

The semiconductor sector will be multi-layered and capital-intensive, but it also offers India a chance to lead in advanced tech. Rather than waiting for the perfect company or timing, investors should build diversified, research-backed exposure—aligned with their risk appetite and horizon.

The Indian Semiconductor Investment Opportunity is no longer aspirational. It’s unfolding—right now.

Conclusion: A New Chip Power Is Rising

India stands at a defining moment in its technological evolution. For decades, the country remained a consumer of semiconductors, dependent on imports and vulnerable to supply chain shocks. But today, a powerful shift is underway.

With over $10 billion in approved investments, a committed policy framework, and a booming electronics market to anchor demand, India is no longer on the sidelines—it is entering the semiconductor arena with intent and scale.

What makes this moment investable is not just the vision, but the execution unfolding across design, packaging, and manufacturing. From Micron’s OSAT plant to Tata’s fab initiatives and MosChip’s niche design plays, the ecosystem is forming rapidly—layer by layer.

Yes, challenges remain—execution, competition, and supply constraints are real. However, with the right blend of research, diversification, and horizon planning, investors now have a rare chance to participate in the making of a future tech superpower.

The Indian Semiconductor Investment Opportunity is more than a theme.

It is a transformation—and the smartest capital is already moving.

FAQs

Why is the Indian semiconductor sector gaining attention?

India is investing over ₹76,000 crore to build a domestic semiconductor ecosystem. With rising demand and policy support, it presents a strong growth opportunity.

Which Indian companies are involved in semiconductors?

Tata Elxsi, MosChip, Kaynes Technology, CG Power, and Dixon Technologies are key players across design, packaging, and manufacturing.

Is India building its own chip fabs?

Yes. Tata has announced a fab, and Micron is setting up a chip packaging (OSAT) plant. Full-scale fabs may take several years to be operational.

What government schemes support this sector?

The Semicon India Program offers up to 50% capital support for fabs, OSAT, and design-linked incentives for R&D and chip development.

What risks should investors be aware of?

Execution delays, global competition, reliance on imports, and policy changes are key risks. Company fundamentals and timelines matter.

How is MosChip positioned in this space?

MosChip focuses on chip design, ASIC development, and embedded systems, making it a niche player with long-term potential.

Can retail investors benefit?

Yes. By investing in listed semiconductor and electronics companies, retail investors can gain diversified exposure to this growth sector.

What’s the long-term market outlook?

India’s semiconductor market is expected to double from $52 billion in 2024 to over $103 billion by 2030, driven by mobile and industrial demand.

Related Articles

China’s Fertilizer Export Halt to India: Stocks Set to Gain from the Supply Shock

India’s Manufacturing PMI Hits 14-Month High: Stocks That Could Benefit From the Surge

How to Transfer Shares from Groww to Zerodha – Full Guide (2025)