Introduction: A New Era for Indian Exporters to China

Indian exporters to China are standing at the edge of a historic opportunity. For years, India’s trade relationship with China was lopsided — China flooded Indian markets with manufactured goods, while Indian exports struggled to make a mark.

But global trade winds are shifting. The prolonged US-China trade war has forced China to rethink its global partnerships and diversify its import sources. In a major policy shift in 2025, China announced it was ready to open its markets wider to Indian goods, urging a “non-discriminatory” approach for Chinese companies operating in India as well.

This opens up a rare and powerful opportunity.

This blog dives deep into which Indian sectors are poised to gain, the companies already leading the way, and how big this export opportunity could become.

India’s Merchandise Exports to China: 2023 Snapshot

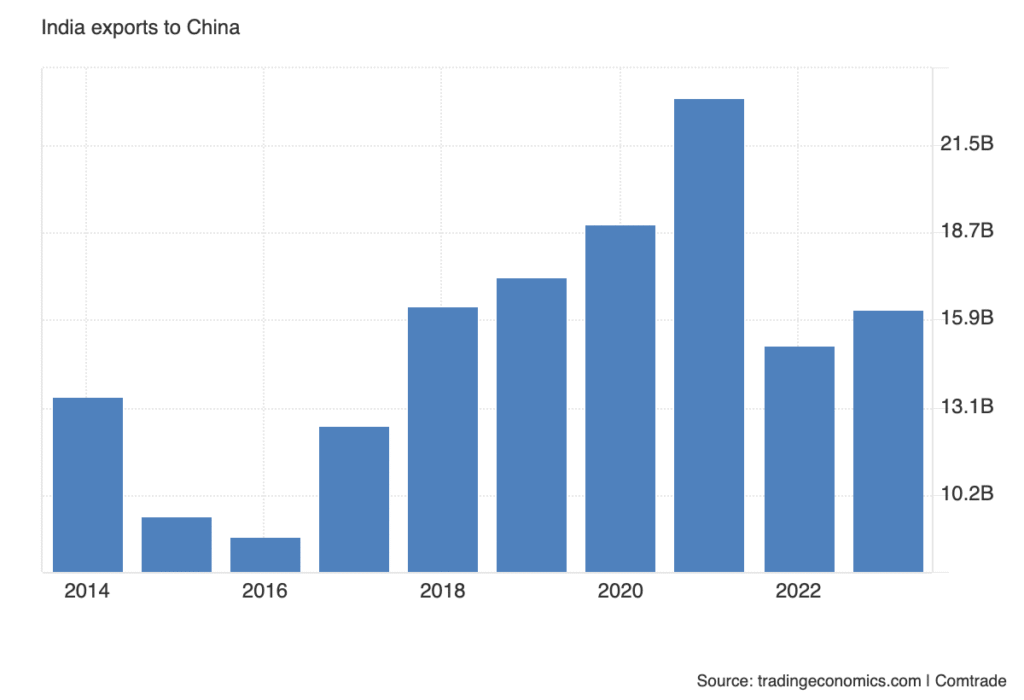

Despite geopolitical tensions, India exported goods worth $16.25 billion to China in 2023, up from $14.5 billion in 2022, marking a growth of nearly 12% year-on-year.

Here is a snapshot of India’s top merchandise exports to China:

| Product Category | 2023 Export Value (USD Billion) | 3-Year CAGR (%) |

|---|---|---|

| Ores and Minerals | 4.2 | 8.1 |

| Organic Chemicals | 3.5 | 7.4 |

| Petroleum Products | 2.1 | 12.8 |

| Pharmaceuticals and APIs | 1.5 | 10.5 |

| Seafood | 1.2 | 9.6 |

| Engineering Goods | 0.8 | 6.9 |

Key Trends:

- Ores and minerals like iron ore remain the largest category, despite China’s slowdown.

- Pharma and chemicals have emerged as sunrise sectors for Indian exporters to China.

- Petroleum product exports (mainly refined fuels) are rising due to China’s energy needs.

Top Services Exporters to China: Rising Yet Underrated

While merchandise often steals the spotlight, India’s services exports are a hidden strength.

India’s total global services exports hit $341 billion in 2023. Though China accounts for a modest 3% share, this number is growing fast, driven by:

- IT services

- Financial services

- R&D and engineering consulting

- Educational services

Top Indian service exporters to China include:

| Sector | Company Names |

|---|---|

| IT Services | Infosys, TCS, Wipro |

| Financial Services | HDFC Bank, State Bank of India |

| Pharmaceutical Research | Sun Pharma Advanced Research, Biocon |

| Engineering Consulting | L&T Technology Services, Tata Projects |

Insights:

- TCS operates multiple delivery centers in China, employing over 2,000 people.

- Infosys provides enterprise tech consulting to Chinese manufacturers.

- L&T Technology Services is helping Chinese auto firms design EV platforms.

- Sun Pharma conducts clinical trials and research collaborations in Chinese labs.

Services exports are growing at 15% CAGR in India-China corridors — much faster than merchandise trade.

Leading Indian Companies Exporting to China

Export success to China is not random — it is dominated by a few aggressive players who invested early in understanding Chinese demand.

Here is a sector-wise breakdown:

| Sector | Major Exporting Companies |

|---|---|

| Ores & Minerals | NMDC, Vedanta |

| Refined Petroleum | Reliance Industries, Nayara Energy |

| Organic Chemicals | Aarti Industries, Jubilant Ingrevia, Alkyl Amines |

| Pharmaceuticals & APIs | Dr. Reddy’s, Sun Pharma, Aurobindo Pharma |

| Seafood | Avanti Feeds, Devi Seafoods |

| IT Services | Infosys, TCS, Wipro |

| Financial Services | HDFC Bank, SBI |

Observations:

- Reliance and Nayara (Not Listed) dominate refined fuel exports.

- Aarti Industries and Jubilant have built deep B2B chemical export pipelines to China.

- Dr. Reddy’s has shifted from pure API sales to branded generics in Chinese cities.

Notable Corporate Presence and Trends in China

Indian companies are not just exporting to China — many have boots on the ground, setting up offices and partnerships.

TCS:

- Active since 2002.

- Offices in Beijing, Shanghai, Shenzhen, Hangzhou.

- Services Chinese telecom, banking, and manufacturing clients.

Dr. Reddy’s Laboratories:

- Expanded its presence after the 2020 China pharma reforms.

- Launched five generic drugs in China in 2023 alone.

- Focused on anti-diabetics and oncology therapeutics.

Reliance Industries:

- Maintains oil trading offices in Singapore and China.

- Regular supplier of naphtha, fuel oil to Chinese state refiners.

New Trend:

- Many Indian exporters now hire local Chinese sales managers to bridge the language and regulatory gap.

- Joint ventures in pharma, chemicals, and EV components are becoming common.

Why Indian Exporters to China Will Benefit Now

Several major trends are aligning to favor Indian exporters to China:

- China’s De-Risking from the West

China is gradually reducing its trade reliance on the U.S. and Europe post-pandemic and post-tariff wars. India stands to gain. - Internal Demand Recovery in China

- Construction demand is rebounding after stimulus policies.

- Pharma and healthcare spending is growing due to China’s aging population.

- Seafood and agriculture imports are rising due to domestic production gaps.

- Government Push from India

- Production Linked Incentive (PLI) Schemes encouraging exports.

- RoDTEP (Remission of Duties and Taxes on Export Products) making Indian goods cost-competitive.

- Dedicated trade fairs and exhibitions in China for Indian exporters.

Risks to Watch

Despite the strong tailwinds, Indian exporters must tread carefully:

- Political Risks:

Any deterioration in India-China relations can quickly impact trade channels. - Regulatory Barriers:

Chinese market access remains tightly controlled in sectors like IT, telecom, and finance. - Commodities Risk:

Heavy dependence on a few commodity categories like ores and fuels can be risky if Chinese demand fluctuates.

Smart exporters are diversifying products, creating local partnerships, and securing multiple regulatory approvals to stay ahead.

Final Outlook: A Golden Window for Indian Exporters to China

The opportunity for Indian exporters to China in 2025–26 is real and growing.

According to CRISIL Research, Indian exports to China could grow at 10–15% CAGR over the next three years if current trends hold.

Sectors like pharma, chemicals, engineering goods, and services are expected to lead the charge. Companies that invest early in understanding the Chinese market, securing regulatory approvals, and building local relationships will be the biggest winners.

While risks remain, the reward is a massive untapped consumer market hungry for quality products and services — and Indian exporters are better positioned than ever before to deliver.

Ready to take advantage of this growing opportunity? Open an account with Angel One today and start trading with the expertise you need to succeed in the evolving global markets.

FAQs: Indian Exporters to China

1. What products does India export to China?

India exports ores, organic chemicals, refined petroleum, machinery, and seafood to China.

2. Why is China opening its market to more Indian goods now?

China is diversifying trade partners due to the US-China trade war and aims to reduce reliance on Western markets.

3. How has the US-China trade war affected India’s trade with China?

The trade war has led China to seek alternative markets, creating an opportunity for increased Indian exports.

4. Which Indian companies are leading the charge in exports to China?

Top exporters include Reliance Industries, Vedanta, Aarti Industries, Dr. Reddy’s Laboratories, and Bharat Forge.

5. How can Indian businesses benefit from this new opportunity?

By focusing on high-demand sectors like chemicals, pharma, and machinery, and expanding into new markets and e-commerce.

6. What are the risks associated with exporting to China?

Challenges include regulatory hurdles, intellectual property concerns, and geopolitical tensions.

7. How can Angel One help me in exporting to China?

Angel One provides a range of trading and investment services, helping you stay updated on market trends, trade data, and international regulations. Opening an account can give you the tools and insights needed to make the most of these export opportunities.

Related Articles

Vehicle-to-Grid (V2G) Technology: How India Is Gearing Up and 5 Stocks to Watch