Introduction: India’s Evolving Credit Landscape

The India lending trends 2025 report reveals a changing credit landscape—one shaped by rising secured loans, NBFC dominance, and shifting borrower behavior.

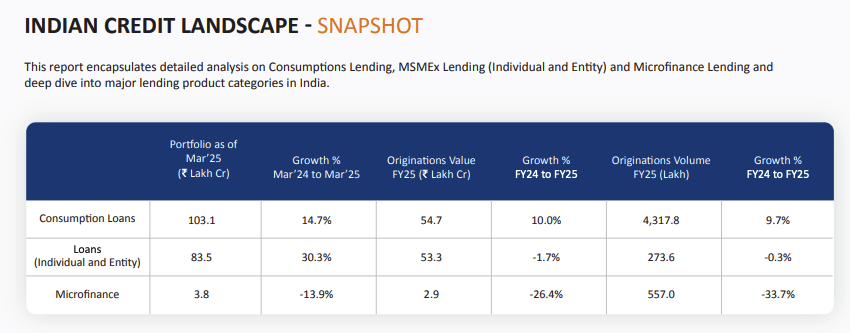

According to the latest “How India Lends FY25” report, retail credit in India grew by 14.7% year-on-year, reaching ₹103.1 lakh crore. That’s not just impressive growth—it’s a signal that credit remains the backbone of India’s consumption and economic momentum.

However, behind the headline numbers lies a powerful shift. Borrowers are taking bigger loans, microfinance is shrinking, and NBFCs are capturing serious ground in retail credit markets. At the same time, banks are becoming more selective, pushing secured loans over unsecured segments.

This transformation offers not just insight—but opportunity.

In this blog, we’ll decode the top India lending trends for 2025, and more importantly, highlight which listed stocks stand to benefit from these evolving credit patterns.

Whether you’re an investor, analyst, or just a market enthusiast, this is your roadmap to where the money—and momentum—is flowing.

India Lending Trends 2025: Credit Boom or Risk Reset?

The numbers are in—and they tell a story of both strong growth and shifting priorities in India’s credit landscape.

According to the “How India Lends FY25” report, the overall consumption loan book grew by a solid 14.7% YoY, reaching ₹103.1 lakh crore. But when you dig deeper, it’s clear that this growth is anything but uniform.

Higher Ticket Sizes Are In

Loan originations have started moving up the value chain. While volume growth remained muted across many categories, the average ticket size rose sharply. For instance:

- In home loans, the share of origination value for ₹75 lakh+ loans rose from 31.3% in FY24 to 35.0% in FY25, indicating rising demand for high-ticket housing finance

- In auto and personal loans, high-value slabs gained share, suggesting a more affluent borrower profile or inflation-led borrowing needs.

This reflects a shift in both borrower capability and lender targeting—pushing toward more secure, high-margin segments.

NBFCs Are on the Rise

One of the standout India lending trends in 2025 is the aggressive gain in market share by non-banking financial companies (NBFCs). The report highlights:

- NBFCs originated 91.2% of personal loan volumes.

- In two-wheeler loans, they hold 68.1% share by value.

- Even in home loans, where banks typically dominate, NBFCs held a steady 35%+ market share.

Their tech-first approach, flexibility, and reach into underserved geographies are clearly paying off.

Stress Shifts to Unsecured & Small-Ticket Segments

While delinquencies in high-ticket loans remained under control, risk increased in the unsecured and smaller segments:

- Microfinance originations fell by 26.4%, reflecting cautious lending.

- Delinquencies rose across small-ticket personal loans and ₹75K+ two-wheeler loans.

- On the flip side, secured credit—especially home loans—showed improved asset quality across most banks.

This trend highlights a risk reset. Lenders are moving toward lower-risk, secured products, and investors should take note.

In short, while credit growth remains strong, the strategy has shifted. Lenders are becoming more selective, focusing on bigger, safer loans and leaving behind the volume game of micro-lending and unsecured small credit.

Sector Analysis: India Lending Trends 2025 and Growth Segments

With credit demand realigning across categories, it’s important to understand which loan segments are growing, which are slowing, and which financial institutions are gaining share.

Let’s break it down.

Home Loans: Bigger Borrowers, Slower Volumes

India’s home loan portfolio grew by 13.1% YoY, reaching ₹40.6 lakh crore. But the story here isn’t just about growth—it’s about who’s borrowing and how much.

While originations grew just 2.7% YoY, the number of home loan accounts actually declined by 5.4%, indicating a shift toward higher ticket size loans.

In fact, borrowers seeking ₹75 lakh+ home loans contributed 35.0% of total origination value in FY25, up from 31.3% in FY24. On the other hand, the ₹5L–₹35L segment shrank from 30.8% to 30.0%.

Top Stocks to Watch:

- HDFC Ltd – continues to lead in premium lending

- LIC Housing Finance – exposure to mid-to-high ticket segment

- PNB Housing Finance – gaining traction in upper-middle-income loans

Personal Loans: Smaller Volumes, Rising Ticket Sizes

Total personal loan value stood at ₹8.8 lakh crore, declining by 2.9% YoY. Despite this, average ticket size increased, suggesting a focus on quality borrowers over quantity.

NBFCs dominated 91.2% of personal loan originations by volume, and their share in value increased to 36.4%—a strong sign of rising trust in alternate lenders.

Top Stocks to Watch:

- Bajaj Finance – strong control over credit quality

- Poonawalla Fincorp – scaling responsibly in unsecured lending

- Aditya Birla Capital – diversifying across personal credit segments

Two-Wheeler Loans: Strong Growth, But Stress Building

Two-wheeler loans grew by 18.2% YoY to ₹1.6 lakh crore. NBFCs led the way, commanding 68.1% share in loan value.

However, stress is rising. Particularly in the ₹75K+ slab, delinquencies are trending upward, signaling emerging risk in small-ticket, higher-value auto lending.

Top Stocks to Watch:

- Shriram Finance – deep presence in rural vehicle finance

- Muthoot Capital – leveraged in southern India’s bike finance

- L&T Finance – known for granular underwriting across auto loans

Auto Loans: Slower Growth, but Safer Asset Class

Auto loans reached ₹8.2 lakh crore, up just 5.2% YoY—a slowdown from previous years. Interestingly, loans above ₹10 lakh gained share, signaling a shift to more premium car financing.

Public sector banks and NBFCs gained market share, while private banks held steady. Despite rising ticket sizes, secured nature makes this segment relatively stable.

Top Stocks to Watch:

- Cholamandalam Investment – market leader in vehicle finance

- Mahindra Finance – rural reach and OEM-linked model

- Sundaram Finance – conservative, long-term player in auto lending

Consumer Durable Loans: Cooling Growth, Strong NBFC Play

This segment grew just 3.3% YoY, reaching ₹1.6 lakh crore. While demand slowed, NBFCs still command over 80% market share, driven by digital EMI adoption and embedded finance options.

With e-commerce players pushing zero-cost EMI schemes, volume might rise again despite current cooling.

Top Stocks to Watch:

- Bajaj Finserv – dominates the segment via digital presence

- IDFC First Bank – increasing focus on small-ticket EMI lending

- Future IPO Watch: Pine Labs or ZestMoney-type fintechs

Across all segments, one theme stands out: lenders with stronger underwriting, better digital reach, and diversified books are winning. These players are positioned not just to grow—but to grow safely.

Lending Risks in India Lending Trends 2025: Delinquencies & Defaults

While credit growth remains strong across many segments, the India lending trends in 2025 also reveal areas of rising borrower stress. Not all loan categories are equally healthy, and some are flashing early warning signs.

Let’s break down the emerging risk zones.

🔺 Microfinance – The First Red Flag

Perhaps the sharpest deterioration is in the microfinance segment:

- Originations fell by 26.4% YoY, a steep decline that reflects both cautious lending and reduced borrower demand.

- Delinquencies are rising sharply, especially in small-ticket, rural-focused loans.

- Lenders with high exposure to micro-lending are now tightening underwriting norms.

Avoid lenders heavily exposed to microfinance unless backed by strong collections and credit filters.

Unsecured Personal Loans – Risk in Small Tickets

Though high-ticket personal loans remain relatively stable, small-ticket loans are under pressure:

- Stress is growing among borrowers in the ₹1–2 lakh segment.

- NBFCs, which dominate this space, are reporting higher 31–180 DPD (days past due) rates.

- This trend could continue, especially in Tier-3 and semi-urban regions where borrower incomes remain volatile.

Focus on NBFCs with strong analytics, digital collections, and low-cost sourcing to stay ahead of risk.

Two-Wheeler Loans – Big Jumps in Stress Above ₹75K

The report highlights a worrying trend in two-wheeler loans over ₹75,000:

- This slab has seen a significant spike in PAR 31–180 rates, meaning more borrowers are late on payments by over a month.

- Delinquencies are rising even in NBFC-dominated portfolios, suggesting broader credit fatigue.

Stay cautious on lenders overexposed to mid-size vehicle loans without adequate collateral or cross-sell opportunity.

Bright Spot: Home Loans Remain Safe

Despite rising ticket sizes, home loans remain the most stable lending segment:

- PSU banks and private lenders have reported improved asset quality.

- High-ticket loans are typically backed by stronger borrower profiles and real assets, offering lower credit risk.

Housing finance companies and home loan-focused NBFCs appear to offer more stable exposure compared to unsecured peers.

What This Means for Investors

The India lending trends 2025 reveal a clear message: risk is migrating toward small, unsecured, and consumption-linked lending, while secured, asset-backed loans are emerging stronger.

For stock investors, this underscores the need to:

- Favor diversified lenders over niche, high-risk plays

- Track asset quality metrics quarterly

- Focus on underwriting strength and digital risk controls

Where the Opportunities Lie in the Stock Market – And Why

The FY25 lending data doesn’t just reflect borrower behavior—it also hints at which lenders are best positioned to grow profitably and sustainably. By examining segment-specific trends, we can identify companies aligned with favorable credit patterns and avoiding rising-risk zones.

Here’s a closer look at the top stock categories that align with the India lending trends 2025—and why they deserve attention.

1. Housing Finance Companies: Riding the High-Ticket Shift

Why this theme works:

The data shows a clear shift in housing credit toward larger ticket sizes. Origination value in the ₹75L+ home loan segment rose to 35% in FY25, up from 31.3% the previous year. At the same time, delinquencies in home loans have improved, especially for PSU and private banks.

This favors players with:

- Strong presence in high-ticket urban housing

- Conservative underwriting practices

- Low-risk balance sheets with secured loans

Who fits this trend:

- LIC Housing Finance: Well-positioned in mid-to-high value home loans

- HDFC Ltd (now merged with HDFC Bank): Deep reach across income bands, especially salaried

- PNB Housing Finance: Rebuilding with a renewed focus on profitability and high-ticket slabs

2. PSU Banks: Gaining Ground in Secured Lending

Why this theme works:

The report shows that PSU banks have improved their asset quality, especially in home and auto loans. Their focus on low-cost funding and safer loan categories has helped them expand their share in secured credit without chasing risky growth.

They are also:

- Benefiting from rising trust post-NPA clean-up

- Backed by strong capital positions and government support

- Digitally upgrading to compete with private lenders

Who fits this trend:

- State Bank of India (SBI): India’s largest lender, strong across housing, auto, and SME

- Bank of Baroda: Expanding in retail loans, especially home and vehicle segments

- Canara Bank: Solid retail loan book, conservative approach

3. Select NBFCs: Focused Growth with Risk Filters

Why this theme works:

NBFCs are dominating personal and vehicle lending, but the report makes one thing clear—not all NBFCs are equal. The winners are the ones combining tech-enabled underwriting with conservative risk models.

For example:

- NBFCs originated 91.2% of personal loan volumes

- In two-wheeler loans, NBFCs hold 68.1% of value share

- However, delinquencies are rising in small-ticket unsecured loans, so quality matters

Who fits this trend:

- Bajaj Finance: Maintains strong growth without compromising on asset quality

- Cholamandalam Investment: Focused on secured vehicle and SME lending

- Poonawalla Fincorp: Low NPAs, expanding digital lending with caution

- Shriram Finance: Deep rural presence with granular risk control

Who to Avoid (and Why):

The report warns of growing stress in:

- Microfinance: Originations fell 26.4%; rising delinquencies

- Small-ticket personal loans: High 31–180 DPD levels

- Consumer durable loans: Slowing growth, rising cost pressure

So, it’s wise to avoid small NBFCs heavily exposed to unsecured, high-risk segments, especially those without strong digital collection systems.

Conclusion: Are You Positioned for the New Lending Cycle?

India’s lending landscape is undergoing a structural shift. As the FY25 data shows, it’s no longer just about credit growth—it’s about where that growth is happening and who is lending responsibly.

Borrowers are moving toward larger, secured loans, while lenders are becoming more selective. NBFCs are gaining ground in high-volume retail categories, but only those with robust risk controls are thriving. At the same time, public sector banks are quietly regaining relevance in home and auto loans.

These patterns aren’t just statistical—they’re investable insights.

If you’re looking to position your portfolio for this evolving credit cycle, the direction is clear:

- Favor institutions that are growing with discipline, not just speed

- Prioritize businesses lending to higher-quality borrowers in secured segments

- Watch for digital-first lenders with strong collection and underwriting systems

- Stay cautious in segments where stress is building—like microfinance and small-ticket unsecured credit

The India lending trends of 2025 aren’t about a boom or a bust—they signal a realignment. Credit is still growing. But it’s flowing smarter, and to safer hands.

And that’s exactly where smart investors should be looking next.

Frequently Asked Questions (FAQs)

What is the biggest lending shift in India lending trends 2025?

Borrowers are increasingly opting for higher-ticket, secured loans. For example, home loans above ₹75 lakh now contribute 35% of origination value, up from 31.3% last year. This shift benefits lenders like HDFC Ltd, LIC Housing Finance, and PNB Housing Finance, which target premium housing segments.

Which financial stocks benefit most from rising personal loan demand?

NBFCs dominate this space. In FY25, they originated 91.2% of personal loan volumes, and their share of loan value increased to 36.4%. Stocks like Bajaj Finance, Poonawalla Fincorp, and Aditya Birla Capital are well-positioned, especially those with strong digital platforms and low delinquencies.

What does the report say about two-wheeler loan trends?

Two-wheeler loans grew by 18.2% YoY, reaching ₹1.6 lakh crore. NBFCs hold a commanding 68.1% share by value. However, loans above ₹75,000 are showing stress. Lenders like Shriram Finance, Muthoot Capital, and L&T Finance are gaining volume but must manage risk exposure carefully.

Are auto loans still a safe segment for lenders?

Yes—especially for those focused on ₹10 lakh+ loans, which are gaining share. Auto loan growth slowed to 5.2% YoY, totaling ₹8.2 lakh crore, but remains a low-risk, secured segment. Stocks like Cholamandalam Investment, Mahindra Finance, and Sundaram Finance continue to benefit from this stability.

What risks are emerging in unsecured lending?

Delinquencies are rising in small-ticket personal loans and microfinance. For example, microfinance originations dropped by 26.4% YoY, while 31–180 day past-due rates increased. Investors should be cautious with lenders that lack digital risk controls or are heavily exposed to rural unsecured borrowers.

Why are PSU banks gaining relevance in 2025?

The report shows PSU banks improving asset quality and regaining market share in home and auto loans. Their low cost of funds and focus on secured retail lending make them attractive. Stocks like SBI, Bank of Baroda, and Canara Bank stand out for conservative credit growth and digital upgrades.

What do the lending trends say about consumer durable loans?

Growth slowed to just 3.3% YoY, reaching ₹1.6 lakh crore. Still, NBFCs hold over 80% market share in this segment. Bajaj Finserv continues to lead, while lenders like IDFC First Bank are scaling up small-ticket EMI-based lending carefully.

How does loan ticket size affect stock performance?

Lenders exposed to rising ticket sizes—like those offering home loans above ₹75 lakh or auto loans above ₹10 lakh—are gaining share without increasing risk. These include HDFC Ltd, LIC Housing, and Cholamandalam Investment, which benefit from affluent borrower profiles and better margins.

Which stocks are aligned with safer growth?

The strongest candidates are those focusing on secured lending, such as:

- HDFC Ltd and LIC Housing in premium housing

- SBI and BoB in auto/home

- Cholamandalam and Mahindra Finance in vehicle loans

These stocks align with the broader shift in lending toward lower-risk, high-value credit.

How should investors use this report to guide stock picks?

Use the data to focus on lenders:

- With growing market share in secured loans

- That show low NPAs and high digital adoption

- Operating in expanding segments like housing, premium auto, and digital personal loans

Avoid stocks tied to shrinking or risky verticals like microfinance and unsecured consumer credit.

Related Articles

India’s $100 Billion Silicon Bet: The Semiconductor Investment Opportunity No One Should Ignore

How a Tea Seller Used the Power of Compound Interest to Build ₹45 Lakh

Rare Earth Magnet Manufacturing Stocks: Catch These Before India’s ₹1,000 Cr Push Lifts Off