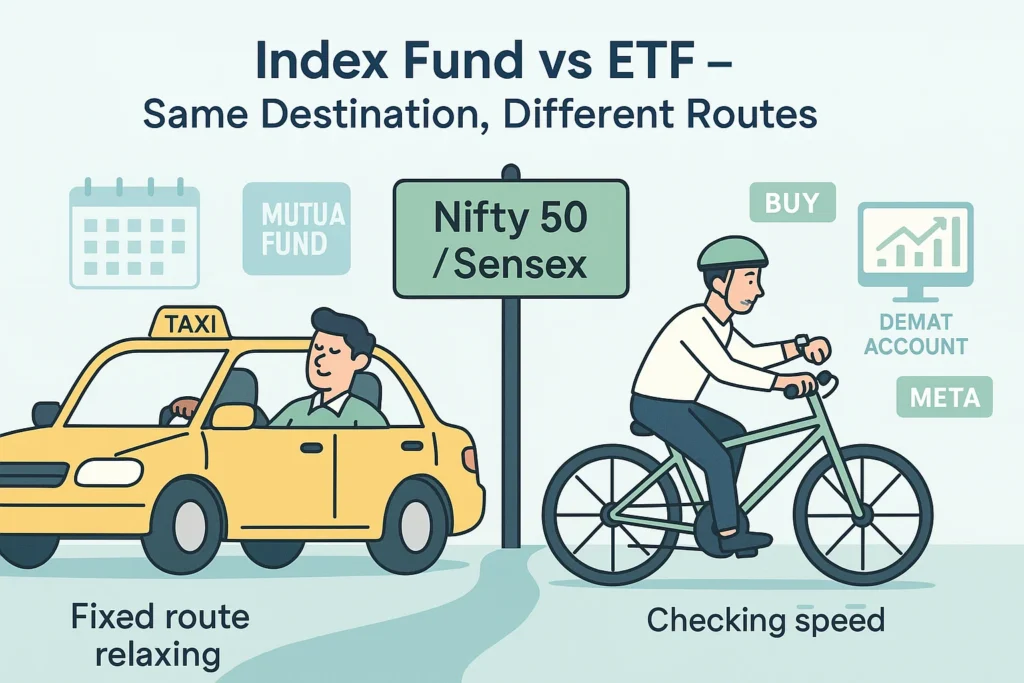

Introduction: Two Similar Roads, But Very Different Rides

In the world of investing, there are two kinds of people — those who chase returns with active strategies, and those who quietly ride the index and still reach their goals (with fewer bruises). If you belong to the latter group or are curious about passive investing, you’ve likely bumped into two terms that sound like financial twins: Index Funds and ETFs.

At first glance, they look the same. Both mirror a market index, both are low-cost, and both don’t promise any “alpha” like a star fund manager might. But dig a little deeper, and you’ll see — they behave quite differently.

Understanding these differences isn’t just about being a smart investor — it’s about choosing an investment that fits your lifestyle, comfort, and goals.

So, let’s break down the truth, gently and beautifully.

The Basics: Same Genes, Different Personalities

Imagine two cousins. Both grew up in the same town (let’s say the Nifty 50). But one went to business school and wears a suit (that’s your ETF). The other lives next door, more relaxed, enjoys automation, and doesn’t check market prices every five minutes (hello, Index Fund).

Both ETFs and Index Funds aim to replicate the performance of a market index. They invest in the same stocks, in the same weightage, and are not actively managed. So far, so good.

But while an ETF trades on the stock exchange like a share, with prices that change every second, an Index Fund behaves like a regular mutual fund, where you buy or sell at the day’s Net Asset Value (NAV). That one difference alone creates a world of impact.

Demat Account or Not: The Convenience Factor

Let’s talk access.

If you want to invest in an ETF, you’ll need a Demat account. It’s like booking a train ticket through IRCTC — very DIY. You buy ETF units just like you’d buy shares of Reliance or TCS. One click, and you’re in.

Index Funds, however, are the friendly neighbourhood option. You don’t need a Demat account. Just pick your fund on a mutual fund platform, start a SIP, and go back to your day.

So, if you’re someone who enjoys checking the stock market app every hour, ETFs might be your jam. If not, Index Funds are a great passive companion.

What About Costs? The Game of Rupees and Percentages

Let’s address the elephant in the portfolio — fees.

ETFs are known for being lean machines. With expense ratios as low as 0.05% to 0.3%, they hardly eat into your returns. But there’s a hidden cost: brokerage charges every time you transact, and annual Demat maintenance fees.

Index Funds usually charge a bit more — 0.5% to 1.2%, depending on the AMC and plan (regular or direct). There’s no brokerage, and you can invest tiny sums, even ₹100, without worrying about liquidity.

So here’s the thing: ETFs are cheaper if you know what you’re doing. Index Funds are slightly pricier but much simpler for long-term investing.

A Gentle Table for Relief

| Feature | ETF | Index Fund |

|---|---|---|

| Traded On | Stock Exchange (real-time) | Fund house platform (once a day NAV) |

| Demat Account | Required | Not required |

| Expense Ratio | Lower (0.05–0.3%) | Slightly higher (0.5–1.2%) |

| Investment Mode | Buy/Sell anytime | Lump sum or SIP |

| Price Movement | Intraday (like stocks) | One price per day |

Returns: Are They Really That Different?

You’d think that if both track the same index, their returns would be identical.

Well… not quite.

ETFs can trade at a slight premium or discount to the actual NAV based on market demand and supply. Index Funds, meanwhile, carry something called a tracking error — the tiny gap between the fund’s return and the actual index due to factors like expense ratios, timing, and liquidity buffers.

In most cases, both stay fairly close to the index. But if precision is your thing, ETFs usually track a bit more tightly — especially in India’s large-cap segments like Nifty 50.

2025: Why This Debate Even Matters More Now

India’s investor base is booming. First-time investors are flooding platforms like Zerodha, Groww, and Angel One, eager to “do SIP” and “start passive investing.”

At the same time, SEBI’s push toward cost transparency, the rise of DIY investing, and fintech apps’ clean interfaces have made Index Funds and ETFs more mainstream than ever.

But here’s the kicker — while ETFs are extremely popular globally, in India, Index Funds are still leading, mostly because:

- Investors don’t want to open a Demat account just for one ETF

- SIPs are smoother with Index Funds

- The liquidity in many ETFs isn’t always great

That said, ETF popularity is catching up, especially with younger investors who like control, real-time prices, and lower costs.

The Final Take: So… Which One Wins?

Honestly? Neither wins. You win — if you choose the one that suits your personality.

- If you want simplicity, automatic investments, no learning curve — go for Index Funds (direct plan).

- If you love to take control, understand trading platforms, and can keep an eye on prices — explore ETFs.

And if you’re still unsure?

There’s no rule that says you can’t try both. In fact, a diversified passive portfolio could have both ETFs and Index Funds, working together like a dream team.

Conclusion: Different Roads, Same Destination

In the race of Index Funds vs ETFs, the debate is never really about which one performs better. It’s about which one fits your lifestyle, time, and comfort with technology.

After all, both are designed for the same goal:

👉 Give you market returns, with minimum cost and maximum peace of mind.

Whether you choose to click “Buy ETF” on your trading app like Angel One, or set up a monthly SIP in an Index Fund — you’re already doing better than 90% of people chasing hot stock tips on WhatsApp.

And that, dear investor, is a win.

Open a free Angel One account today and start investing in index funds or ETFs with zero fuss and full control.

FAQs

1. Are index funds and ETFs the same?

Not really. Both track an index, but ETFs trade like stocks while index funds behave like mutual funds.

2. Do I need a Demat account to invest?

Only for ETFs. Index funds can be bought without a Demat account through any mutual fund platform.

3. Which is cheaper – index fund or ETF?

ETFs usually have a lower expense ratio, but include brokerage and Demat charges. Index funds are slightly costlier but easier to manage.

4. Can I do SIP in ETFs?

Not directly. You’ll have to manually invest each time. SIPs work smoothly with index funds.

5. Are ETFs riskier than index funds?

No. Both carry the same market risk. But ETFs may have liquidity risk in low-volume markets.

6. Which gives better returns?

Both aim to match the index, but ETFs may track the index slightly more closely if liquidity is high.

7. Which is better for beginners?

Index funds. They’re simple, set-and-forget investments.

8. Can I invest in both?

Yes! You can mix them based on your goals, comfort, and investment style.

9. What is tracking error?

It’s the difference between the index’s return and your fund’s return — usually due to expenses and timing.

10. What are some popular ETFs and index funds in India?

Nippon India ETF Nifty 50, ICICI Prudential Nifty Next 50 ETF, and UTI Nifty Index Fund are popular options.

Related Articles

Natural Hydrogen Fuel: Could It Power the Future of Clean Energy?