Introduction

A quiet revolution is underway in India’s power market — and it’s shaking up the stock charts.

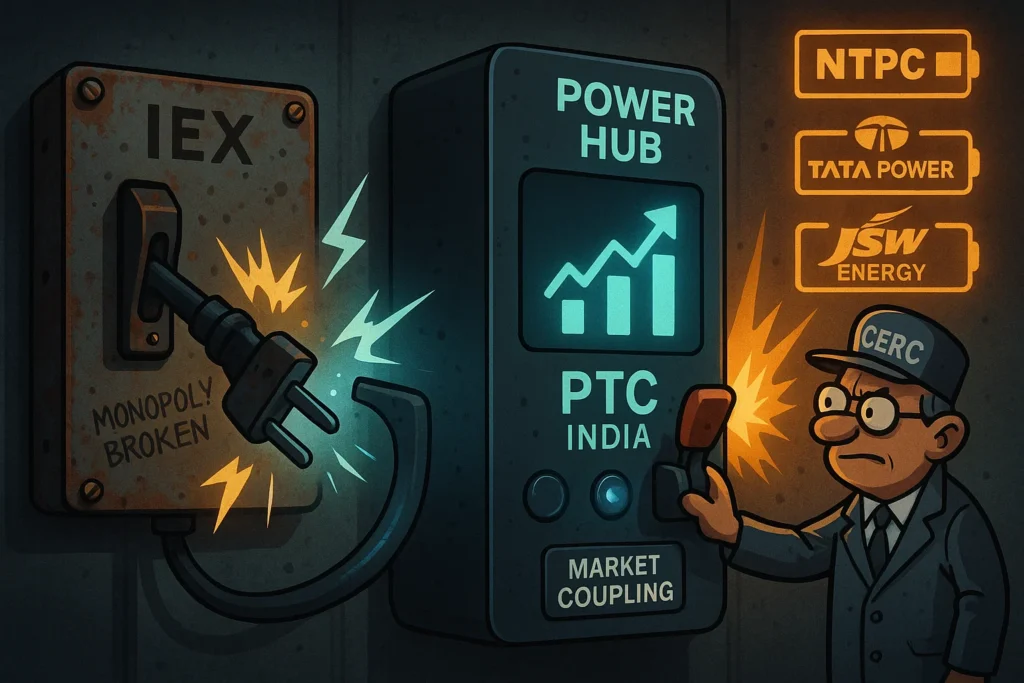

With the approval of the IEX Market Coupling mechanism, the monopoly of the Indian Energy Exchange (IEX) is being dismantled for the first time in over a decade. This bold regulatory move by the Central Electricity Regulatory Commission (CERC) is meant to unify electricity price discovery across all exchanges — and it’s already causing ripples in the market.

IEX shares have plunged over 26% in a Single Day, as investors begin to price in the loss of exclusive control over power trading. Meanwhile, a new winner is emerging: PTC India.

Thanks to its majority stake in Hindustan Power Exchange (HPX) — one of the three exchanges that will now operate under a shared, rotating model — PTC India surged nearly 9% intraday after the news broke, before settling with a strong 5% gain by market close.

In this blog, we’ll unpack what market coupling really means, how it affects the balance of power between IEX and its rivals, and why PTC India — along with a handful of smartly positioned energy stocks — could be entering their most promising phase yet.

What Is Market Coupling — And Why It Matters?

Market coupling is a regulatory framework designed to bring all power exchanges in India under a single pricing mechanism for the Day-Ahead Market (DAM) — the most crucial segment where electricity for the next day is traded.

Currently, India has three power exchanges:

- IEX (Indian Energy Exchange) – the market leader

- PXIL (Power Exchange India Ltd)

- HPX (Hindustan Power Exchange) – backed by PTC India, BSE, and ICICI Bank

Each exchange conducts its own auctions, leading to fragmented liquidity and different prices for the same electricity across platforms — a situation that isn’t ideal for price discovery, system stability, or fairness.

Let’s Simplify With an Example:

Imagine three vegetable markets in a city — all selling tomatoes, but each quoting a different price. One market (say IEX) has 80% of the buyers and sellers, so it sets the benchmark price. The others barely get any volume. That’s inefficient, right?

Market Coupling is like saying:

“Let’s gather all tomato buyers and sellers from all three markets in one virtual auction, find a single fair price, and then distribute the trade accordingly across the platforms.”

That’s exactly what India will now do with power trading.

How It Works:

- Grid-India, a central body, will run the coupling algorithm that merges all buy and sell bids from all three exchanges.

- A single market-clearing price will be determined every day.

- Exchanges will take turns acting as the Market Coupling Operator (MCO) — rotating every 3 months.

- Grid-India will act as a supervisory authority to ensure fairness and transparency.

Why This Is a Big Deal

- Improved price discovery: No more price manipulation or isolated pricing on small exchanges.

- Level playing field: Smaller exchanges like HPX (where PTC India holds a majority stake) now get access to equal trade volumes.

- More competition = better service, better tech, and lower fees.

- Less dominance by IEX = greater opportunity for investors in alternate platforms.

Why PTC India Is Emerging as the Biggest Winner

While most headlines focus on IEX losing its dominance, the real opportunity lies with PTC India, a company quietly positioned at the center of this transformation.

1. Majority Stake in HPX — A Rising Power Exchange

PTC India owns a significant stake (39.6%) in Hindustan Power Exchange (HPX), which is now set to benefit immensely from the new market coupling framework.

Until now, HPX struggled with low liquidity because most trade volumes went through IEX. But under the new model, volumes will be pooled, and all three exchanges — including HPX — will get a fair share of transactions and revenue.

That means PTC India will now earn fees on higher volumes without needing to steal market share from IEX — a huge structural advantage.

2. A Rare “Regulatory Tailwind” Stock

Unlike most reforms that create short-term uncertainty, this one directly benefits PTC India’s business model. It now owns a piece of a platform (HPX) that will become systemically important.

Think of it this way:

- IEX goes from monopoly to shared control

- HPX goes from underdog to co-equal

- PTC India becomes a long-term beneficiary — without extra effort or risk

3. Market Already Reacting — But There’s Room to Run

- On July 24, PTC India shares surged nearly 9% intraday, reacting sharply to the CERC’s market coupling announcement.

- The stock closed the day with a 5% gain, signaling sustained buying interest.

Importantly, this is likely just the initial re-rating phase. As volumes rise and HPX becomes more relevant, analysts may revise PTC India’s valuations upward, especially once fee income visibility improves.

4. Diversified Business = Bonus Upside

PTC India isn’t just about HPX. It also has:

- A strong presence in cross-border power trading

- Renewable energy services

- Its own financial arm (PTC India Financial Services) that could benefit from greater demand for power infrastructure funding

In short: PTC India is not a one-trick pony. But market coupling might just be the catalyst that unlocks its long-underappreciated value.

Other Stocks That Could Benefit from Market Coupling

While PTC India is the most direct beneficiary of the IEX Market Coupling reform, it’s far from the only stock positioned to gain. The shift toward a more unified, efficient, and transparent electricity market is likely to have a ripple effect across the entire power and infrastructure ecosystem.

Here are some other key stocks that could ride this structural tailwind:

1. NTPC Ltd. (NSE: NTPC)

India’s largest power producer stands to benefit from better price realization for surplus power, especially in the merchant market.

Market coupling will ensure:

- Easier access to buyers across regions

- More competitive pricing

- Lower curtailments of supply

Why it matters: NTPC can now dispatch power where prices are highest — increasing its profitability without needing to expand capacity.

2. Tata Power (NSE: TATAPOWER)

As a diversified energy company with exposure to thermal, solar, wind, and EV infrastructure, Tata Power can leverage market coupling to:

- Optimize energy scheduling

- Capture price arbitrage across regions

- Improve earnings from merchant sales

Why it matters: In a more dynamic market, Tata Power’s diversified portfolio becomes even more valuable.

3. Power Grid Corporation of India (NSE: POWERGRID)

As India’s backbone for power transmission, Power Grid will benefit from:

- Higher inter-regional power flows

- Increased demand for grid services

- More usage of its nationwide infrastructure

Why it matters: Efficient price signals will drive better grid utilization — boosting Power Grid’s operating margins and long-term visibility.

4. JSW Energy (NSE: JSWENERGY)

A clean energy-heavy generator with growing solar and hydro assets, JSW Energy can take advantage of:

- Uniform pricing to sell more power in spot markets

- Lower price volatility

- Strategic expansion planning based on real-time price signals

Why it matters: Market coupling gives JSW Energy better tools to optimize its portfolio and improve returns.

5. PTC India Financial Services (NSE: PTCFIN)

This often-overlooked financing arm of PTC India provides loans and credit to energy infrastructure projects. As power trading volumes grow, demand for new capacity, smart grid tech, and renewables will rise — driving financing demand.

Why it matters: PFS could become a secondary beneficiary from both regulatory and investment-led momentum in the sector.

Instead of chasing just one stock, consider creating a “Power Market Reform Portfolio” with diversified exposure across trading, generation, transmission, and finance.

What This Means for IEX – Hold or Exit?

For years, Indian Energy Exchange (IEX) enjoyed an unrivaled position in India’s power trading ecosystem — with a near-monopoly in the Day-Ahead Market (DAM). But with the approval of market coupling by CERC, the foundations of that dominance are now under serious threat.

IEX Crashed Over 26% in a Single Day

On July 23, IEX stock plunged over 26% intraday after the CERC announced the implementation of the market coupling mechanism. The market’s reaction was swift and brutal — a clear sign that investors see this as a permanent and structural disruption to IEX’s business model.

Why the Panic? Here’s What Changes for IEX:

1. Loss of Price Discovery Power

Under market coupling, Grid-India — not IEX — will centrally match trades and determine prices for all exchanges. That means IEX loses its role as the dominant price-setter in the power market.

2. Volumes Will Now Be Shared

Previously, IEX captured nearly all DAM volumes. Post-coupling, volumes will be pooled across IEX, HPX, and PXIL, and each exchange will get an equal opportunity to process trades.

3. Valuation Reset Underway

IEX was valued like a platform stock — high margins, low competition, steady growth. That narrative just broke. With tighter competition and lower control, analyst downgrades and multiple de-rating are likely.

So — Hold, Exit, or Wait?

Here’s how to think about it:

- Hold (cautiously): Only if you believe IEX can evolve — by building new segments (Green Term-Ahead Market, Real-Time Market, derivatives), strengthening brand trust, and retaining market share through technology and liquidity.

- Exit or Reduce: The safer move. Structural reforms like this are not short-term noise — they redefine the industry. It’s better to pivot early than ride out a long, uncertain phase of adjustment.

Better Opportunities Lie Elsewhere

With PTC India gaining 9% intraday (closing +5%) on the same day, and other power sector stocks like NTPC, Tata Power, and Power Grid well-positioned to benefit, this may be the perfect moment to rotate from a falling monopoly to rising disruptors.

Conclusion: This Reform Is Just the Beginning

The approval of IEX Market Coupling isn’t just a regulatory change — it’s the beginning of a new era in India’s electricity market.

For over a decade, IEX enjoyed a virtual monopoly over price discovery and volumes in the power trading space. But with the market now shifting to a centralized, transparent, and level-playing model, that dominance is quickly unraveling.

Meanwhile, PTC India, once seen as a slow-moving utility stock, is suddenly in the spotlight — thanks to its strategic stake in Hindustan Power Exchange (HPX). The market has taken notice, as reflected in its sharp 9% intraday rally following the coupling announcement.

But this isn’t just about one stock or one day. The ripple effects are likely to be long-lasting:

- Power generators like NTPC and JSW Energy could see better price realization.

- Utilities like Tata Power may unlock new margins through smarter dispatch strategies.

- Transmission players like Power Grid will benefit from increased load flows.

- Even financial arms like PTC India Financial Services could see a surge in demand as projects become more viable.

Market Coupling could do for electricity what UPI did for payments — unify access, level the field, and unlock scale.

Smart investors aren’t waiting for the change to play out — they’re already repositioning.

The era of monopolies is fading. The era of shared opportunity is just beginning.

FAQs: IEX Market Coupling

1. What is IEX Market Coupling?

IEX Market Coupling is a regulatory reform where power trades from all exchanges are pooled to determine a single electricity price.

2. How does market coupling affect IEX?

It reduces IEX’s monopoly by centralizing price discovery, impacting its revenue and volume share.

3. Why is PTC India gaining from market coupling?

PTC India owns a majority stake in Hindustan Power Exchange (HPX), which benefits as trade volumes are shared across platforms.

4. Which stocks benefit from IEX market coupling?

PTC India, NTPC, Tata Power, JSW Energy, Power Grid, and PTC Financial Services may benefit.

5. Is it the right time to buy PTC India stock?

PTC India is gaining investor interest due to structural tailwinds, but timing depends on your investment horizon.

6. Will IEX stock recover after market coupling?

IEX may stabilize long-term, but near-term pressure is expected due to rising competition and valuation reset.

7. When will market coupling start in India?

Market coupling for the Day-Ahead Market is expected to roll out by January 2026.

Related Articles

India’s $40 Billion Spending Wave: What’s Powering the Next Consumption Boom?

Battery Energy Storage in India: The $32 Billion Opportunity Powering the Green Shift

Power Sector Boom in India: Stocks to Watch and Why It’s Just Beginning

Vehicle-to-Grid (V2G) Technology: How India Is Gearing Up and 5 Stocks to Watch