GNG Electronics IPO: Can This Refurbishing Giant Deliver a Shiny Listing?

GNG Electronics Limited is all set to launch its ₹460.43 crore IPO on July 23, 2025. The company operates in over 38 countries and owns the “Electronics Bazaar” retail brand in India. It specializes in refurbishing, buybacks, and last-mile delivery of electronic devices.

From sourcing and testing to doorstep delivery, GNG runs a full-stack operation. It serves both retail customers and global OEMs like HP and Lenovo. With rising demand for sustainable and affordable gadgets, its circular economy model looks well-positioned for growth.

The company has posted consistent revenue growth and improved profits. In FY25, it reported a Return on Equity (RoE) of 30.40%. However, its Debt-to-Equity ratio of 1.95 and high P/E of 39.14x may raise valuation concerns.

Is the IPO attractively priced or already priced to perfection? Let’s decode the key dates, financials, valuations, and whether retail investors should consider subscribing.

GNG Electronics IPO Details & Important Dates

GNG Electronics Limited is hitting the primary markets with a fresh issue of ₹193 crore and an Offer for Sale (OFS) of ₹267.43 crore, taking the total IPO size to ₹460.43 crore. The issue opens on July 23, 2025, and will close on July 25, 2025.

Here’s a snapshot of the key IPO details:

| Particulars | Details |

|---|---|

| IPO Open Date | July 23, 2025 |

| IPO Close Date | July 25, 2025 |

| Listing Date (Tentative) | July 30, 2025 |

| Issue Size | ₹460.43 crore |

| Fresh Issue | ₹193 crore |

| OFS (Offer for Sale) | ₹267.43 crore |

| Price Band | ₹230 – ₹243 per share |

| Lot Size | 61 shares |

| Minimum Investment | ₹14,823 |

| Face Value | ₹10 per share |

| Listing Exchanges | NSE and BSE |

| Book Running Lead Managers | Axis Capital, ICICI Securities |

| Registrar | Link Intime India Pvt Ltd |

The IPO will allocate 50% of its total issue to QIBs, 15% to HNIs, and 35% to Retail investors. We are launching this IPO under the Book Building Process and plan to list the shares on both NSE and BSE.

GNG Electronics IPO Timeline (Tentative Schedule)

| Event | Date |

|---|---|

| IPO Opening Date | Wednesday, July 23, 2025 |

| IPO Closing Date | Friday, July 25, 2025 |

| Basis of Allotment Finalization | Monday, July 28, 2025 |

| Initiation of Refunds | Tuesday, July 29, 2025 |

| Credit of Shares to Demat | Tuesday, July 29, 2025 |

| IPO Listing Date (Tentative) | Wednesday, July 30, 2025 |

| UPI Mandate Confirmation Deadline | 5 PM on July 25, 2025 |

Objects of the Issue – GNG Electronics IPO

The net proceeds from the IPO will be used for:

General Corporate Purposes:

The remainder of the net proceeds will be utilized to strengthen working capital, fund strategic initiatives, and enhance overall business growth.

Repayment/Prepayment of Borrowings:

₹320 crore will be used to repay or prepay outstanding borrowings, including loans availed by the Company and its Material Subsidiary, Electronics Bazaar FZC.

GNG Electronics Ltd – Business Overview

GNG Electronics Ltd. is India’s largest refurbisher of laptops and desktops, and ranks among the top refurbishers of ICT devices globally, by value as of March 31, 2025 (Source: 1Lattice Report). The company operates under the brand name “Electronics Bazaar” and has established a significant international presence across India, the USA, Europe, Africa, and the UAE.

GNG follows a “repair-over-replacement” approach, which not only offers cost efficiencies but also promotes sustainability by significantly reducing the carbon footprint. As India’s largest Microsoft-authorized refurbisher (FY25), GNG plays a pivotal role in providing affordable and high-quality computing solutions to both retail and institutional buyers.

A Fast-Growing Global Market

The global refurbished PC market has shown a strong growth trajectory, expanding from USD 9.7 billion in CY18 to USD 17.1 billion in CY24 (CAGR of 9.9%). It’s projected to reach USD 40.6 billion by CY29, growing at an impressive CAGR of 18.9%. The broader global used and refurbished PC market is expected to hit USD 61.0 billion by CY29 (CAGR of 10.4%).

In India, the market is expanding even faster:

- Grew from USD 0.2 billion in FY19 to USD 1 billion in FY25 (CAGR: 28%)

- Projected to reach USD 4 billion by FY30 (CAGR: 30%)

The organized market share in India has jumped from 5.2% in FY19 to 13.2% in FY25 and is expected to reach 39.7% by FY30 (CAGR: 45.5%), indicating rising trust in certified refurbishers like GNG.

End-to-End Refurbishment Capabilities

GNG Electronics operates across the full refurbishment value chain:

- Sourcing & Procurement of used ICT devices

- Screening, cosmetic and motherboard repairs

- Refurbishing, repainting, keyboard reprinting, LCD repair

- Sales, after-sales service, doorstep delivery

- Warranty-backed products

Its refurbished devices, which include laptops, desktops, tablets, servers, premium smartphones, and accessories, are positioned as “as-good-as-new”, both in terms of performance and aesthetics. GNG is also an industry pioneer in offering warranties on refurbished devices — a key differentiator that drives customer trust and premium pricing.

Devices are sold at 30%–70% discounts compared to new ones:

- Laptops: ~1/3rd the price of new

- Other ICT devices: 35%–50% cheaper

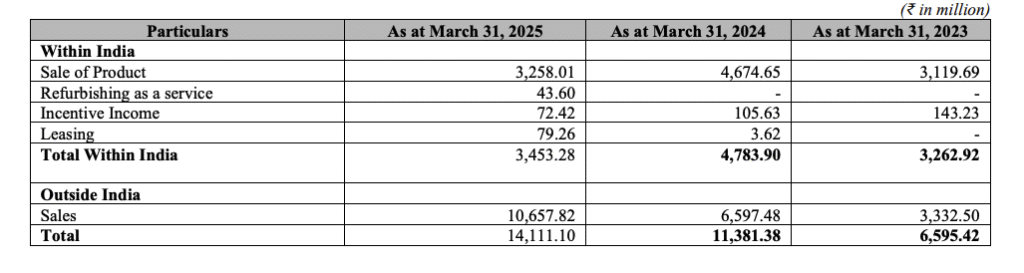

Revenue Breakdown by Product (₹ in million)

| Particulars | FY 2025 | % of Ops Revenue | FY 2024 | % of Ops Revenue | FY 2023 | % of Ops Revenue |

|---|---|---|---|---|---|---|

| Laptops | 10,667.06 | 75.59% | 7,724.16 | 67.87% | 5,274.58 | 79.97% |

| Other Devices & Services | 3,444.04 | 24.41% | 3,657.22 | 32.13% | 1,320.84 | 20.03% |

| Total Revenue | 14,111.10 | 100% | 11,381.38 | 100% | 6,595.42 | 100% |

Global Partnerships & Recognitions

GNG is an authorized refurbishment partner for global leaders Lenovo and HP, the top two PC brands worldwide. It also serves as an IT asset disposal (ITAD) partner for India’s second-largest software company and several leasing firms, OEMs, and consulting companies.

Other recognitions:

- ISO 9001, 14001, 27001, 45001 certified facility

- EPR (Extended Producer Responsibility) certified

- Responsible Recycling (R2v3) compliant

Growth in Customer & Supplier Base

| Particulars | FY 2025 | FY 2024 | FY 2023 |

|---|---|---|---|

| Number of Customers | 4,154 | 3,252 | 1,833 |

| Procurement Partners | 557 | 356 | 265 |

Global Reach and Distribution Network

- Sales in 38 countries as of March 31, 2025

- 4,154 sales touchpoints globally

- 557 procurement partners in FY25 vs 356 in FY24

Global customers include:

- Joy Systems Inc, HUBX LLC, PlanITROI LLC (US)

- PhoenixRM Ltd, ATX Computers (Europe)

- HP India, Lenovo India, Vijay Sales

GNG operates five refurbishment facilities:

- Navi Mumbai (India)

- Dallas, Texas (USA)

- 3 units in Sharjah (UAE)

- Total area: ~58,128 sq. ft

Leadership

Founded by Sharad Khandelwal, a Chartered Accountant with 29 years of experience in ICT, GNG has rapidly grown into an innovation-driven, sustainability-focused tech company. Sharad’s strategic vision benefits from a seasoned international management team that brings expertise in operations, finance, business development, and supply chain management.

GNG Electronics IPO Financials & Performance

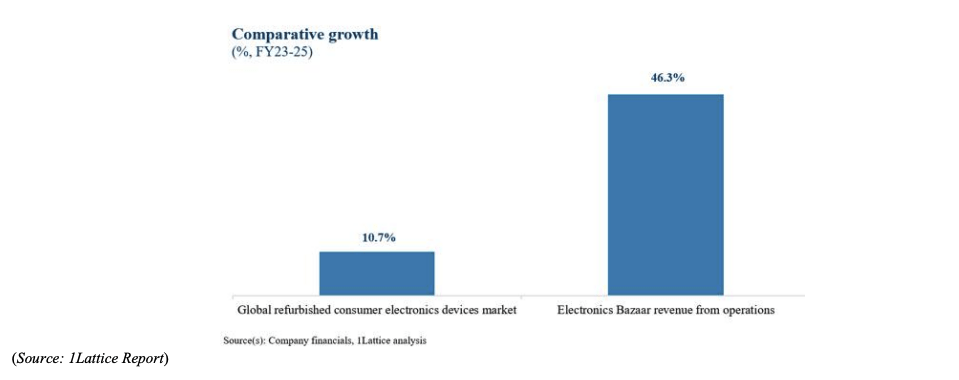

GNG Electronics has shown impressive growth over the last three fiscal years, both in terms of revenue and profitability. The company’s aggressive expansion strategy and overseas focus have started yielding visible results.

Core Financials Snapshot (₹ in Crore)

| Particulars | FY23 | FY24 | FY25 |

|---|---|---|---|

| Revenue from Operations | ₹659.54 | ₹1,138.14 | ₹1,411.11 |

| Profit After Tax (PAT) | ₹32.43 | ₹52.31 | ₹69.03 |

| Total Assets | ₹285.50 | ₹585.82 | ₹719.46 |

Financial Growth Analysis

- Revenue Surge: The company’s top line more than doubled between FY23 and FY25. This was primarily driven by strong growth in international orders.

- Consistent Profitability: PAT increased from ₹32.4 Cr to ₹69 Cr over the same period. This indicates that the company managed growth without compromising margins.

- Expanding Asset Base: Total assets grew 2.5 times in two years. This suggests that the company is investing in scaling up operations to meet future demand.

Key Ratios & Performance Indicators

| KPI | FY23 | FY24 | FY25 |

|---|---|---|---|

| Gross Margin (%) | 15.34% | 12.31% | 17.89% |

| EBITDA Margin (%) | 7.59% | 7.46% | 8.94% |

| PAT Margin (%) | 4.92% | 4.60% | 4.89% |

| Return on Equity (RoE) | 28.97% | 31.96% | 30.40% |

| Return on Capital Employed (ROCE) | 17.91% | 16.72% | 17.31% |

| Net Working Capital Cycle (in days) | 61 | 42 | 68 |

| Property, Plant & Equipment (Gross) Turnover | 60.65 | 31.97 | 30.41 |

Ratio Trend Analysis

- Improving Gross Margins: The gross margin improved sharply in FY25, rising from 12.31% to 17.89%. This improvement was likely driven by better sourcing or improved pricing in export markets.

- Stable Operating Margins: Despite scaling up, the EBITDA margin held firm around 8%. This reflects strong cost discipline.

- Attractive Returns: Return on Equity (RoE) stayed well above 30%, indicating excellent profitability for shareholders.

- Working Capital Pressure: The working capital cycle lengthened in FY25. This may signal increased inventory or slower collections from clients.

- Asset Turnover Drop: As GNG expanded its asset base, the gross asset turnover dropped. This is common in companies ramping up capacity before fresh orders fully kick in.

Operational Performance Highlights

| Operational Metric | FY23 | FY24 | FY25 |

|---|---|---|---|

| Total Revenue | ₹659.54 Cr | ₹1,138.14 Cr | ₹1,411.11 Cr |

| – Revenue from India | ₹326.29 Cr | ₹478.39 Cr | ₹345.33 Cr |

| – Revenue from Outside India | ₹333.25 Cr | ₹659.75 Cr | ₹1,065.78 Cr |

| Devices Refurbished | 2.48 lakh | 3.69 lakh | 5.91 lakh |

| No. of Customers Served | 1,833 | 3,252 | 4,154 |

| No. of Procurement Partners | 265 | 356 | 557 |

Interpretation & Takeaways

- International Expansion Pays Off: Overseas revenue made up over 75% of total revenue in FY25. This diversification reduces dependence on domestic demand.

- Sharp Scaling in Volume: The number of devices refurbished more than doubled in two years. Clearly, GNG is rapidly scaling its core business.

- Customer and Partner Growth: The growing number of customers and procurement partners reflects improved market reach and stronger procurement networks.

- Sustained Margins During Expansion: Despite rising volumes and global expansion, GNG maintained healthy EBITDA and PAT margins. That’s a strong operational signal.

GNG Electronics IPO Valuation & Peer Comparison

Earnings & Valuation Metrics

GNG Electronics’ valuation multiples reflect strong investor expectations and solid profitability.

| Metric | Pre-IPO | Post-IPO |

|---|---|---|

| Earnings Per Share (EPS) | ₹7.11 | ₹6.05 |

| Price to Earnings Ratio (P/E) | 33.35x | 39.14x |

The decline in EPS post-IPO is due to an increase in the number of outstanding shares. However, the higher post-issue P/E indicates a premium valuation based on strong future growth expectations.

GNG Electronics IPO Peer Comparison

Let’s compare GNG with its closest listed peer in the refurbished electronics segment — Newjaisa Technologies Ltd.

| Company | EPS (Basic) | EPS (Diluted) | NAV per Share (₹) | P/E (x) | RoNW (%) | P/BV Ratio |

|---|---|---|---|---|---|---|

| GNG Electronics Ltd | ₹7.09 | ₹7.09 | ₹23.31 | 39.14x | 30.40% | High |

| Newjaisa Technologies Ltd | -₹0.32 | -₹0.32 | ₹22.09 | 21.37x | -1.45% | 1.68 |

Analysis: GNG vs Newjaisa

- Profitability Edge: GNG is clearly profitable, while Newjaisa posted negative earnings and returns. GNG’s 30.4% RoNW indicates strong capital efficiency, in stark contrast to Newjaisa’s negative -1.45%.

- Premium Valuation Justified: Although GNG trades at a higher P/E (39.14x), the premium appears justified due to its consistently positive earnings and growth visibility.

- Stronger Fundamentals: GNG’s Net Asset Value (₹23.31) is only slightly higher than Newjaisa’s, but its profitability transforms this into a much stronger Price-to-Book Value multiple.

- Peer Weakness: Newjaisa’s negative EPS and RoNW highlight ongoing challenges in its operations or business model.

Valuation Takeaway

While GNG Electronics IPO may appear expensive based on P/E multiples, its robust earnings, high RoNW, and sector leadership provide solid justification. In contrast, its listed peer, Newjaisa, struggles with losses and negative shareholder returns.

As a result, GNG positions itself as a premium-grade growth stock within the refurbished electronics and reverse logistics space.

GNG Electronics IPO GMP Update

As of July 18, 2025, the grey market premium (GMP) for the GNG Electronics IPO stands at:

- GMP: ₹0

- IPO Price (Upper Band): ₹233

- Estimated Listing Price: ₹233

- Estimated Profit on Listing: ₹0 (0.00%)

Day-wise GMP Trend

| Date | IPO Price (₹) | GMP (₹) | Estimated Listing Price (₹) | Estimated Profit (₹) |

|---|---|---|---|---|

| July 18, 2025 | ₹233 | ₹0 | ₹233 | ₹0 |

🔍 Note: GMP is unofficial and purely speculative. Actual listing price may vary.

We’ll update this section daily as GMP activity begins in the grey market.

Conclusion: Listing, Allotment Strategy & Long-Term View

Listing Outlook:

With no active grey market premium (GMP) as of now, the IPO may list close to its upper price band of ₹233. However, considering GNG Electronics’ strong revenue growth, expanding export footprint, and robust return ratios, there’s a possibility of a modest listing gain if investor sentiment improves closer to the listing date.

Allotment Strategy:

Retail investors can consider applying in the retail quota, as the company’s financials and business model are likely to attract decent interest. However, oversubscription in the QIB or HNI category will reduce retail allotment chances. To improve the odds of allotment:

- Apply through multiple family accounts with different PANs.

- Opt for UPI-based applications with consistent bank mandates.

Long-Term View:

GNG Electronics is positioned well in the refurbished electronics space, especially in export-driven markets. Its consistent improvement in gross margins, stable EBITDA, and strong RoE (over 30%) indicate financial resilience. If the company sustains its current momentum and leverages IPO proceeds effectively for working capital and capex, it could emerge as a long-term compounding opportunity in the electronics circular economy theme.

However, investors should also keep an eye on:

- Execution risks in international markets

- Currency fluctuations and regulatory risks in exports

- Competition from global and local refurbishing players

Verdict:

Aggressive long-term investors looking to play the sustainable electronics or export-led SME growth story may consider holding post-listing. Conservative investors should wait for a few quarters of post-IPO performance before entering.

FAQs on GNG Electronics IPO

What is the IPO opening and closing date for GNG Electronics?

The GNG Electronics IPO opens on July 22, 2025, and closes on July 24, 2025.

What is the IPO price band of GNG Electronics?

The price band for the IPO is fixed at ₹230 to ₹233 per share.

What is the lot size for GNG Electronics IPO?

The lot size is 600 shares, and retail investors can apply for a minimum of 1 lot (₹139,800 at upper band).

What is the issue size of the GNG Electronics IPO?

The IPO is a fresh issue of ₹125.23 crore with no offer for sale (OFS) component.

When will the allotment be finalized?

The allotment is expected to be finalized on July 25, 2025.

When is the listing date for GNG Electronics IPO?

The shares are likely to list on July 29, 2025, on the NSE SME platform.

Is there any grey market premium (GMP) for GNG Electronics IPO?

As of July 18, 2025, there is no active GMP reported for this IPO.

What is the company’s post-issue P/E ratio?

The estimated post-issue P/E ratio is 39.14x based on FY25 earnings.

How does GNG Electronics compare to listed peers?

It compares favorably in profitability and return ratios, especially in RoNW (30.4%), while its peer Newjaisa Technologies has negative earnings.

Is GNG Electronics IPO suitable for long-term investment?

The company has shown strong growth and profitability, making it a potential long-term opportunity for investors seeking exposure to the refurbished electronics export market.

Related Articles

How to Analyze an IPO Before Investing: A Step-by-Step Guide

One Demat vs Multiple Demat – Which is Better for IPO Allotment?