Introduction

The Glottis IPO is creating strong market buzz as it enters India’s fast-growing logistics sector. Backed by its expertise in multimodal logistics solutions—spanning ocean, air, and road freight—Glottis Limited has emerged as a vital player supporting the supply chains of industries ranging from renewable energy to consumer goods. With India’s logistics market projected to expand rapidly in the coming years, the Glottis IPO offers investors exposure to a sector that directly benefits from rising trade flows, globalization, and infrastructure development.

This IPO aims to raise ₹307 crore, split between a fresh issue and an offer for sale (OFS), enabling the company to strengthen its asset base while also offering liquidity to existing shareholders. As logistics firms play a pivotal role in India’s economic growth story, many investors are eyeing the Glottis IPO as a potential opportunity to benefit from this sector’s long-term expansion.

IPO Overview

Glottis IPO Details

| Particulars | Details |

|---|---|

| IPO Date | September 29, 2025 – October 1, 2025 |

| Listing Date | October 7, 2025 (Tentative) |

| Face Value | ₹2 per share |

| Price Band | ₹120 – ₹129 per share |

| Lot Size | 114 shares |

| Issue Type | Book Building IPO |

| Total Issue Size | 2,37,98,740 shares (₹307.00 Cr) |

| Fresh Issue | 1,24,03,100 shares (₹160.00 Cr) |

| Offer for Sale | 1,13,95,640 shares (₹147.00 Cr) |

| Listing At | BSE, NSE |

| Pre-Issue Shareholding | 8,00,00,000 shares |

| Post-Issue Shareholding | 9,24,03,100 shares |

| IPO Document | RHP File |

The Glottis IPO combines both fresh equity infusion and an OFS. The fresh issue will raise ₹160 crore to fund capital expenditure and strengthen logistics capacity, while the OFS worth ₹147 crore will provide an exit route for promoters/early shareholders. With a price band of ₹120–129, the IPO is accessible to retail investors with a minimum investment of ₹14,706. The post-issue equity base expands to 9.24 crore shares, impacting dilution but strengthening the company’s balance sheet.

Glottis IPO Important Dates

| Event | Date |

|---|---|

| IPO Open Date | September 29, 2025 (Monday) |

| IPO Close Date | October 1, 2025 (Wednesday) |

| Allotment Finalization | October 3, 2025 (Friday) |

| Refund Initiation | October 6, 2025 (Monday) |

| Credit of Shares | October 6, 2025 (Monday) |

| Listing Date | October 7, 2025 (Tuesday) |

| UPI Mandate Cut-Off | October 1, 2025, 5 PM |

The Glottis IPO follows a short but clear three-day subscription window, as is standard for book-built issues. The timeline ensures a quick turnaround, with allotments finalized within two days of closure and listing scheduled for October 7, 2025. Retail investors must ensure UPI mandates are confirmed by the cut-off to avoid application rejection.

Objects of the Issue

The proceeds from the Glottis IPO will be utilized as follows:

- ₹132.54 crore for funding capital expenditure requirements, primarily for the purchase of commercial vehicles and containers to strengthen logistics capacity.

- General corporate purposes, including working capital needs, business expansion, and strengthening operational resilience.

The major allocation towards vehicles and containers highlights Glottis Ltd.’s intent to scale its asset-backed logistics model. This investment directly supports capacity expansion, enabling the company to handle rising freight demand, especially in ocean and road logistics. The general corporate allocation provides flexibility to meet ongoing operational and strategic needs, which is crucial for a rapidly expanding logistics player.

Company Background – Glottis Limited

Incorporated in June 2024, Glottis Limited has swiftly positioned itself as a comprehensive logistics solutions provider with operations spanning ocean freight, air freight, road transportation, and value-added services. Despite being relatively young, the company has demonstrated impressive traction in handling both domestic and international cargo movements.

At its core, the company specializes in ocean freight forwarding, handling 95,000 TEUs of imports in FY24, a strong indicator of scale in a short span. Complementing this, Glottis provides air freight solutions for high-value cargo, along with robust road transportation services ensuring last-mile connectivity. To further enhance its offering, the company provides ancillary services such as warehousing, storage, cargo handling, third-party logistics (3PL), and customs clearance—creating a full-stack logistics ecosystem for its clients.

Glottis Limited operates through 8 key branch offices located in India’s top logistics hubs, including New Delhi, Mumbai, Kolkata, Bengaluru, Tuticorin, Coimbatore, Gandhidham, and Cochin, with registered and corporate offices in Chennai. This pan-India network allows the company to cater to diverse industries and geographical regions.

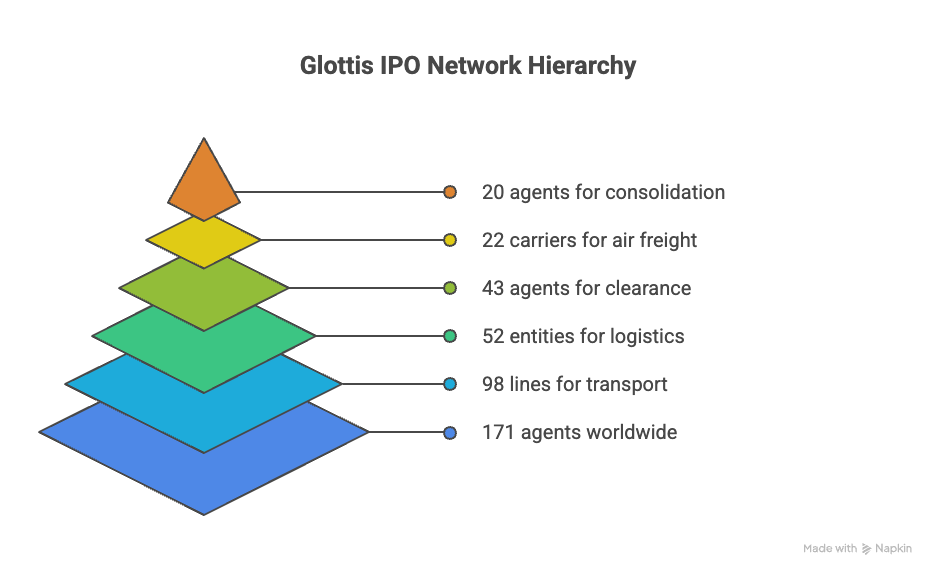

On the international front, the company has established a wide-reaching presence with 171 overseas agents, 98 shipping lines, 52 transporters, 43 customs house agents, 22 airlines, and 20 consol agents as of January 2025. This network is a testament to Glottis’ ability to scale operations globally and tap into major trade corridors.

From FY22 to FY24, Glottis has steadily increased its client base, serving 1,476 customers in 85 countries in FY22, 1,513 customers in 87 countries in FY23, and 1,662 customers in 100 countries in FY24, with further expansion to 1,246 customers across 119 countries in H1FY25 alone. This demonstrates not just scale, but diversification of revenue streams across multiple regions.

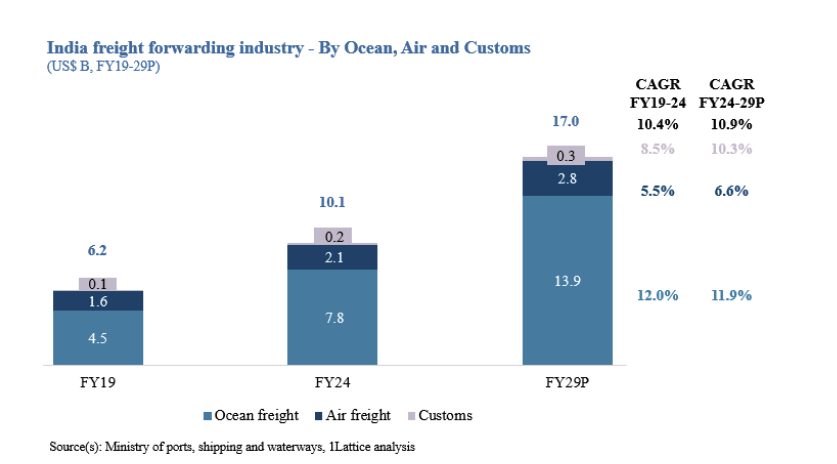

The company’s business strategy leans heavily toward ocean imports, given India’s growing trade volumes, attractive margin opportunities, and relatively streamlined processes. This is well-aligned with industry trends—India’s ocean freight market has grown from $4.5B in FY19 to $7.8B in FY24, with projections of $13.9B by FY29 (CAGR of 11.9%). By focusing on this segment, Glottis aims to ride the structural growth wave in international trade and logistics.

Key competitive strengths of Glottis Limited include:

- A strong foothold in renewable energy logistics, a sector witnessing massive global expansion.

- Wide intermediary network ensuring optimum utilization of assets.

- Scaled multimodal operations, capable of handling large and diverse projects.

- Longstanding customer relationships across industries, ensuring repeat business.

- International presence via agency and partner networks.

- A skilled management team with relevant domain expertise.

In summary, Glottis Limited may be a new entrant compared to legacy logistics players, but its rapid growth, strong sector tailwinds, and focus on scaling multimodal solutions make the Glottis IPO an interesting proposition for investors.

Financials of Glottis IPO

When analyzing any IPO, financial performance and valuation are the most critical components that help investors decide whether the issue is attractively priced or not. In the case of Glottis IPO, the company has delivered strong revenue and profit growth in recent years, signaling operational efficiency and rising market demand. Let’s break down the numbers.

Financial Performance of Glottis Ltd.

Between FY24 and FY25, Glottis Ltd. posted an 89% surge in revenue and an 81% increase in profit after tax (PAT), underlining its rapid growth trajectory in the logistics sector.

Here’s a detailed breakdown of the financial performance over the last three fiscal years:

| Particulars (₹ in Cr) | FY25 (31 Mar 2025) | FY24 (31 Mar 2024) | FY23 (31 Mar 2023) |

|---|---|---|---|

| Assets | 156.10 | 81.72 | 72.08 |

| Total Income | 942.55 | 499.39 | 478.77 |

| Profit After Tax (PAT) | 56.14 | 30.96 | 22.44 |

| EBITDA | 78.45 | 40.36 | 33.47 |

| Net Worth | 98.53 | 42.35 | 11.52 |

| Reserves & Surplus | 82.53 | 41.35 | 10.52 |

| Total Borrowing | 22.14 | 8.08 | 30.61 |

Key Takeaways:

- Revenue almost doubled in FY25, highlighting Glottis’s ability to scale quickly.

- PAT improved significantly to ₹56.14 Cr in FY25, up from ₹30.96 Cr in FY24.

- Net worth more than doubled within one year, strengthening the balance sheet.

- Borrowings increased moderately, but the leverage remains manageable.

Key Performance Indicators (KPIs)

As of March 31, 2025, Glottis IPO reflects strong operational metrics compared to industry standards.

| KPI | Value |

|---|---|

| ROE | 56.98% |

| ROCE | 72.58% |

| Debt/Equity | 29.00 |

| RoNW | 56.98% |

| PAT Margin | 5.97% |

| EBITDA Margin | 8.34% |

Analysis:

- ROE of 56.98% and ROCE of 72.58% indicate outstanding returns on shareholder capital, showcasing management efficiency.

- PAT Margin (5.97%) and EBITDA Margin (8.34%) are relatively thin but typical for logistics players, where scale and efficiency drive profitability.

- Debt/Equity looks stretched (29.0), but given the strong ROE, the company is leveraging efficiently.

Valuation & Peer Comparison Glottis IPO

The Glottis IPO is being valued at a market capitalization of ₹1,192 Cr. The valuation metrics are:

| Metric | Pre IPO | Post IPO |

|---|---|---|

| EPS (₹) | 7.02 | 6.08 |

| P/E (x) | 18.38 | 21.23 |

| Price to Book Value | – | 10.47 |

Analysis:

- At the upper band P/E of 21.23x, Glottis IPO is more expensive compared to Allcargo Logistics (17.95x) but slightly below Transport Corporation of India (25.60x).

- Price to Book Value (10.47x) looks relatively high, suggesting a premium valuation compared to peers.

- However, higher ROE (56.98%) justifies some of this premium.

Peer Comparison of Glottis IPO

Here’s how Glottis Ltd. stacks up against listed logistics peers:

| Company Name | EPS (Basic) | NAV per Share (₹) | P/E (x) | RoNW (%) | P/BV Ratio |

|---|---|---|---|---|---|

| Glottis Ltd. | 7.02 | 12.32 | 21.23 | 56.98 | 10.47 |

| Allcargo Logistics | 1.75 | 24.65 | 17.95 | 2.03 | 1.29 |

| Transport Corporation of India | 53.43 | 279.65 | 25.60 | 19.42 | 4.14 |

Peer Analysis:

- Glottis IPO commands a much higher ROE and RoNW compared to peers, reflecting efficient capital deployment.

- Despite lower NAV, its profitability metrics position it as a high-growth, premium play in the logistics sector.

- Valuations are at the higher end but in line with its growth and return profile.

Overall, Glottis IPO presents a strong growth story with industry-leading returns, but investors need to weigh its premium valuation before subscribing.

Strengths and Risks of Glottis IPO

Every IPO has its strong points that attract investors, but it also carries certain risks that should not be overlooked. For Glottis IPO, here’s a side-by-side comparison of strengths vs. risks to help investors make an informed decision:

| Strengths | Risks |

|---|---|

| Rapid Growth Momentum: Revenue surged 89% and PAT grew 81% in FY25, showing strong scalability. | Thin Margins: PAT margin at 5.97% and EBITDA margin at 8.34% are modest, leaving less cushion in downturns. |

| High Returns Ratios: ROE (56.98%) and ROCE (72.58%) are exceptional compared to industry peers. | Premium Valuation: At P/E 21.23x and P/BV 10.47x, Glottis IPO is priced at a significant premium, demanding sustained performance. |

| Diversified Logistics Solutions: Presence across ocean, air, and road logistics with value-added services like warehousing and 3PL. | High Debt/Equity: Leverage ratio of 29.0 is elevated, exposing the firm to interest rate risk. |

| Global Footprint: Operations across 119+ countries with 171 overseas agents and 98 shipping line partners. | Competitive Industry: Faces stiff competition from established players like Allcargo Logistics and TCI. |

| Promoter Expertise: Strong promoter holding (98.98% pre-IPO) reflects confidence and skin in the game. | Dependence on Trade Cycles: Business heavily influenced by global trade flows and freight rate volatility. |

Glottis IPO GMP

The Grey Market Premium (GMP) is often used by investors to gauge market sentiment before listing. As of September 25, 2025, here’s the GMP status of Glottis IPO:

| Date | IPO Price | GMP | Sub2 Sauda Rate | Estimated Listing Price | Estimated Profit* | Last Updated |

|---|---|---|---|---|---|---|

| 25-09-2025 | ₹129.00 | ₹0 (No Change) | – | ₹129 (0.00%) | ₹0 | 25-09-2025 |

Key Takeaway: Currently, Glottis IPO GMP is at ₹0, which indicates neutral market sentiment. This suggests that the IPO is expected to list close to its issue price unless institutional demand drives it higher closer to listing.

Conclusion – Should You Invest in Glottis IPO?

The Glottis IPO brings to the table a high-growth logistics player that has demonstrated impressive financial growth with an 89% revenue increase and 81% PAT growth in FY25. The company’s strength lies in its multimodal logistics solutions, global presence across 119 countries, and excellent return ratios (ROE 56.98%, ROCE 72.58%), which are far superior to industry peers.

However, investors must carefully consider the risks:

- The IPO comes at a premium valuation (P/E 21.23x) compared to peers.

- Profit margins are thin, and debt levels are higher than ideal.

- The GMP is currently flat, showing no immediate listing premium excitement in the grey market.

Final Verdict:

- For long-term investors, Glottis IPO can be a strategic bet on India’s growing logistics and freight sector, with its strong scalability and global presence.

- For short-term listing gains, the outlook seems muted at the moment due to zero GMP, though demand trends in the final subscription days could change the scenario.

Glottis IPO FAQs

Q1. What is the Glottis IPO?

A1. The Glottis IPO is a book-built issue worth ₹307 crore, consisting of a fresh issue of ₹160 crore and an offer for sale of ₹147 crore.

Q2. When will the Glottis IPO open and close?

A2. The Glottis IPO opens on September 29, 2025, and closes on October 1, 2025.

Q3. What is the price band of the Glottis IPO?

A3. The price band for the Glottis IPO is set at ₹120 to ₹129 per share.

Q4. What is the lot size for Glottis IPO retail investors?

A4. The minimum lot size is 114 shares, requiring an investment of ₹14,706 at the upper price band.

Q5. What are the Glottis IPO important dates?

A5. Allotment is expected on October 3, 2025, refund and credit on October 6, 2025, and listing on October 7, 2025.

Q6. Who are the lead manager and registrar of Glottis IPO?

A6. Pantomath Capital Advisors Pvt. Ltd. is the book-running lead manager, and Kfin Technologies Ltd. is the registrar.

Q7. What will Glottis IPO funds be used for?

A7. The net proceeds will be used for capital expenditure (purchase of vehicles and containers) worth ₹132.54 crore and general corporate purposes.

Q8. What is the GMP of Glottis IPO today?

A8. As of September 25, 2025, the Glottis IPO GMP is ₹0, indicating no premium in the grey market.

Q9. How is Glottis IPO valued compared to peers?

A9. At a P/E of 21.23x, Glottis IPO is priced at a premium to peers like Allcargo (17.95x), though it has superior ROE and growth metrics.

Q10. Should you apply for the Glottis IPO?

A10. Glottis IPO suits long-term investors betting on India’s logistics growth. Short-term listing gains look muted due to flat GMP.

Related Articles

How to Analyze an IPO Before Investing: A Step-by-Step Guide

One Demat vs Multiple Demat – Which is Better for IPO Allotment?