Globe Civil Projects IPO: A New Opportunity in the Infrastructure Space

The Globe Civil Projects IPO is set to open for subscription on June 24, 2025, offering investors a chance to participate in the growth of a well-established EPC company with a proven track record across multiple Indian states. With a total issue size of 1.68 crore shares, this IPO is entirely a fresh issue, aimed at funding working capital, acquiring construction equipment, and supporting general corporate purposes.

Backed by a robust order book of over ₹890 crore and a growing profit base, Globe Civil Projects Limited has carved a niche for itself in both infrastructure and non-infrastructure segments. In this blog, we will take you through all the key aspects of the Globe Civil Projects IPO — including its timeline, financial performance, promoter background, IPO objectives, and a balanced review to help you evaluate the investment opportunity.

We break down the Globe Civil Projects IPO in detail — exploring the company’s business model, revenue streams, financial indicators, potential risks, and listing expectations. Whether you’re a retail investor or a long-term value seeker, this analysis is designed to help you decide if this IPO fits your investment strategy.

Globe Civil Projects IPO Details and Timeline

The Globe Civil Projects IPO is a book-built issue of 1.68 crore equity shares, entirely comprising a fresh issue. The company aims to raise funds to support its growing operations, including working capital needs and acquisition of construction equipment.

The IPO will be listed on both BSE and NSE, with a tentative listing date of July 1, 2025. Here’s a snapshot of the key IPO information:

IPO Overview

| Particulars | Details |

|---|---|

| IPO Opening Date | June 24, 2025 |

| IPO Closing Date | June 26, 2025 |

| Issue Type | Book Building Issue |

| Face Value | ₹10 per share |

| Issue Price Band | ₹67 to ₹71 per share |

| Lot Size | ₹119.00 Cr |

| Total Issue Size | 1,67,60,560 shares (100% fresh issue) |

| Listing At | BSE, NSE |

| Market Lot | 211 Shares |

| Pre-Issue Shareholding | 4,29,58,439 shares |

| Post-Issue Shareholding | 5,97,18,999 shares |

IPO Reservation Breakdown

| Investor Category | Shares Offered |

|---|---|

| QIB | Not more than 50% of the issue |

| Retail | Not less than 35% of the issue |

| NII (HNI) | Not less than 15% of the issue |

Important IPO Dates (Tentative)

| Event | Date |

|---|---|

| IPO Opens | June 24, 2025 |

| IPO Closes | June 26, 2025 |

| Basis of Allotment | June 27, 2025 |

| Refunds Initiated | June 30, 2025 |

| Shares Credited to Demat | June 30, 2025 |

| IPO Listing Date | July 1, 2025 |

| UPI Mandate Cut-off Time | 5 PM on June 26, 2025 |

Objectives of the Globe Civil Projects IPO

The Globe Civil Projects IPO aims to support the company’s future expansion by strengthening its finances and improving operational efficiency. As the company continues to grow across both infrastructure and non-infrastructure verticals, it plans to utilize the IPO proceeds in three key areas:

1. Meeting Working Capital Requirements – ₹75.00 crore

Globe Civil Projects will allocate the largest portion of the proceeds to fulfill its growing working capital needs. With projects expanding across 11 states, the company requires consistent liquidity for material procurement, labor payments, and smooth execution of contracts.

2. Investing in Construction Equipment – ₹14.26 crore

The company intends to use a part of the funds to purchase advanced construction machinery. This investment will not only increase its project delivery capacity but also improve efficiency and competitiveness in large-scale EPC contracts.

3. Supporting General Corporate Purposes

Additionally, the company will reserve a portion of the funds for general corporate purposes. These may include brand-building initiatives, business development efforts, strengthening the team, or addressing unforeseen operational needs.

By focusing on these objectives, Globe Civil Projects Limited positions itself to capitalize on upcoming opportunities in India’s growing infrastructure sector. The company’s use of IPO funds signals a clear intent to scale sustainably and enhance execution capabilities.

About Globe Civil Projects Limited

Globe Civil Projects Limited, incorporated in 2002 and headquartered in New Delhi, is a well-established integrated Engineering, Procurement, and Construction (EPC) company. Over the last two decades, the company has built a strong reputation by delivering high-quality infrastructure and non-infrastructure projects across 11 Indian states.

Diverse Project Portfolio

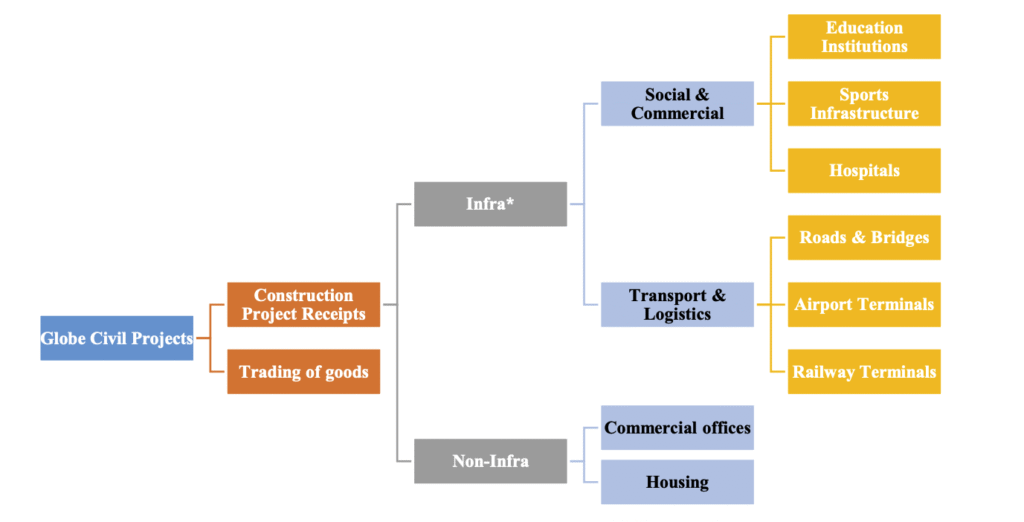

Globe Civil Projects operates across three core verticals:

- Transport and Logistics Projects – including railway terminals, roads, bridges, and elevated rail infrastructure.

- Social and Commercial Infrastructure – such as educational institutions, hospitals, sports facilities, and airport terminals.

- Non-Infrastructure Projects – including residential housing, office complexes, and commercial buildings.

Segment-Wise Revenue Contribution (% of Total Revenue)

| Business Segment | 9M FY2025 | FY2024 | FY2023 | FY2022 |

|---|---|---|---|---|

| Transport & Logistics Projects | 9.45% | 13.53% | 21.75% | 32.05% |

| Social & Commercial Infrastructure | 70.82% | 60.78% | 56.74% | 51.40% |

| Non-Infrastructure Projects | 16.60% | 13.98% | 6.59% | 5.30% |

| Other – Trading (TMT Steel) | 3.14% | 11.71% | 14.92% | 11.23% |

| Total | 100.00% | 100.00% | 100.00% | 100.00% |

Source: RHP

While the company initially specialized in building educational institutions and railway infrastructure, it has gradually expanded into more complex and diverse sectors. These include projects like railway bridges, airport terminals, hospitals, and commercial office buildings.

In addition to EPC activities, Globe Civil Projects also engages in the trading of goods, primarily TMT steel, which contributes a stable revenue stream.

Business Strengths and Capabilities

The company provides end-to-end services that go beyond traditional construction. These include mechanical, electrical, and plumbing (MEP) works, HVAC systems, fire safety systems, and architectural and structural solutions. This integrated capability helps the company deliver turnkey solutions and maintain quality control throughout the project lifecycle.

As of March 31, 2025, Globe had successfully completed 37 projects and was executing 13 ongoing projects, distributed across social infrastructure, transport logistics, residential, and office categories. The company has also built strong relationships with reputed clients, enabling it to secure large and recurring contracts.

Revenue Performance and Order Book

Globe Civil Projects has shown consistent growth in its construction segment revenues, increasing from ₹2,536.17 million in FY22 to ₹2,932.67 million in FY24 (CAGR: 7.53%). Its TMT steel trading business also witnessed growth, with revenues rising from ₹320.92 million in FY22 to ₹388.95 million in FY24 (CAGR: 10.09%).

As of December 31, 2024, the company reported a strong order book of ₹7,785.27 million, with a book-to-bill ratio of 3.16x, indicating robust future revenue visibility.

Client Credentials and CPWD Registration

One of the company’s major strengths is its registration as a Class-1 Super Contractor with the Central Public Works Department (CPWD), Government of India. This prestigious classification allows Globe Civil Projects to bid for government contracts up to ₹6,500 million. Since such high-value projects face less competition, the license significantly enhances the company’s competitive edge in the infrastructure space.

Financial Performance of Globe Civil Projects Limited

Globe Civil Projects Limited has demonstrated consistent financial growth over the last three years. The company’s steady revenue, expanding margins, and increasing net worth paint a picture of a business that is scaling operations while managing profitability effectively.

Key Financial Figures (₹ in Crores)

| Period Ended | 31 Dec 2024 | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|---|

| Revenue from Ops | 256.74 | 334.81 | 235.17 | 286.78 |

| Total Assets | 374.60 | 317.83 | 275.04 | 229.79 |

| Profit After Tax | 17.79 | 15.38 | 4.85 | 5.20 |

| Net Worth | 99.83 | 77.67 | 62.44 | 57.45 |

| Total Borrowings | 137.97 | 124.48 | 97.00 | 70.76 |

| Reserves & Surplus | – | 75.19 | 59.97 | 54.98 |

Key Financial Ratios

| Ratio | Value |

|---|---|

| Return on Equity (ROE) | 21.95% |

| Return on Capital Employed (ROCE) | 23.07% |

| Return on Net Worth (RoNW) | 19.80% |

| Debt-to-Equity Ratio | 1.60 |

| PAT Margin | 4.59% |

What Do These Numbers Tell Us?

- Profitability: PAT has grown more than 3x from FY22 to FY24, showcasing improved operational efficiency and execution strength.

- Leverage: A Debt-to-Equity ratio of 1.60 indicates a moderately leveraged position—manageable but worth monitoring.

- Return Metrics: ROE and ROCE both hover above 20%, suggesting efficient capital utilization and strong shareholder returns.

- Revenue Mix: While construction remains the core revenue driver, the company has also seen a decent uptick in TMT steel trading.

Revenue Growth Outlook

Between FY22 and FY24, revenue from operations grew at a CAGR of 7.53%, while PAT grew at an even faster clip. This is largely driven by the company’s diversified project portfolio and increasing presence in high-value infrastructure segments like railway terminals and institutional buildings.

Valuation and Peer Comparison of Globe Civil Projects IPO

Valuing an infrastructure player like Globe Civil Projects Limited requires context. When placed alongside its listed peers in the EPC and civil construction space, the company’s earnings and return metrics offer a balanced picture—but also highlight areas where it has room to grow.

Peer Group Comparison

| Company Name | EPS (₹) | P/E (x) | RoNW (%) | P/BV Ratio |

|---|---|---|---|---|

| Globe Civil Projects Ltd | 3.58 | 18.71–19.83 | 19.80% | 3.70–3.92 |

| B.L. Kashyap and Sons Ltd. | 2.33 | 29.57 | 10.58% | 3.09 |

| Ceigall India Ltd | 19.37 | 12.88 | 33.57% | 2.35 |

| PSP Projects Ltd | 34.16 | 20.38 | 13.49% | 3.09 |

| Capacite Infraprojects Ltd | 16.09 | 20.56 | 7.93% | 1.46 |

| Ahluwalia Contracts (India) Ltd | 55.95 | 16.41 | 23.43% | 4.28 |

Note: Globe Civil’s valuation is based on its EPS of ₹3.58 and book value of ₹18.10.

- P/E Range = 67 ÷ 3.58 = 18.71 to 71 ÷ 3.58 = 19.83

- P/BV Range = 67 ÷ 18.10 = 3.70 to 71 ÷ 18.10 = 3.92

Key Takeaways from Peer Analysis

- Earnings Power: At an EPS of ₹3.58, Globe Civil Projects trails behind larger players like PSP Projects and Ahluwalia Contracts. However, for a smaller mid-cap company with high growth potential, this is quite acceptable.

- Profitability: With a Return on Net Worth of 19.80%, Globe Civil beats Capacite and B.L. Kashyap and comes close to sector leaders like Ahluwalia (23.43%). This suggests efficient use of capital.

- Valuation Fairness: At a P/E range of 18.71–19.83, Globe Civil is priced reasonably when compared to peer companies with slower growth or lower returns. It’s also below high P/E stocks like B.L. Kashyap (29.57x), which bodes well for listing interest.

- Mid-Cap Advantage: While it lacks the scale of players like PSP or Ahluwalia, Globe Civil’s nimbleness and order book growth give it a strong rerating potential in a bullish EPC cycle.

Verdict on Valuation

Now that the IPO is priced at ₹67–₹71, Globe Civil Projects IPO appears reasonably valued among its peers. With solid return metrics, a diversified project pipeline, and credible growth runway, it could deliver decent returns—especially if subscribed at the lower end of the price band.

This pricing leaves room for upside both in the short term and as the company scales further.

Strengths and Risks of Globe Civil Projects IPO

Key Strengths:

- Diversified Project Portfolio: Experience across transport, logistics, education institutions, hospitals, and housing.

- Robust Order Book: ₹6,691 million as of March 31, 2025, with marquee clients and government contracts.

- CPWD Class-1 Super Contractor: Eligibility for large-scale projects up to ₹650 crore improves growth visibility.

- Healthy Financial Ratios: ROE of 21.95% and RoNW of 19.80% reflect strong capital efficiency.

- Steady Revenue Growth: Construction revenue grew at a CAGR of 7.53% (FY22–FY24), with consistent profitability.

Key Risks:

- Project Execution Delays: Time and cost overruns in large infrastructure projects could affect margins.

- Client Concentration: A significant portion of revenue depends on a few key contracts.

- Competitive Industry: Faces stiff competition from larger, well-established EPC players.

- Debt-Heavy Balance Sheet: Debt-to-equity ratio of 1.60 indicates moderate financial leverage.

Grey Market Premium (GMP) Update: What Can Be Expected?

The Globe Civil Projects IPO has begun to see grey market activity, with the GMP currently standing at ₹9 per share as of June 19, 2025. While the premium has remained steady since June 18, it marks a positive sentiment shift from earlier levels.

Day-wise GMP Trend

| Date | GMP | Estimated Listing Price | Expected Profit (%) |

|---|---|---|---|

| 19-Jun-2025 | ₹9 | ₹80 | 12.68% |

| 18-Jun-2025 | ₹9 | ₹80 | 12.68% |

| 17-Jun-2025 | ₹7 | ₹78 | 9.86% |

Note: Estimated profit is calculated against the upper IPO price band of ₹71.

Our View on GMP & Listing Sentiment

- Stable Premium: The GMP of ₹9 has remained consistent over the last two days, reflecting cautious optimism. This indicates moderate listing gains for early investors, especially if sentiment strengthens closer to listing.

- Strong Business Support: With a robust order book, healthy RoNW (19.80%), and a P/E range of 18.7–19.8, Globe Civil Projects is priced reasonably. This underpins the sustained GMP and could even lead to an uptick if broader markets remain supportive.

- Retail Appetite Growing: 35% of the net offer is reserved for retail investors, and if subscription demand spikes mid-way through the issue, GMP could firm up further.

Final Word

GMP is a grey market sentiment indicator—not a guarantee of listing price or long-term performance. While a ₹9 premium suggests potential listing gains of ~12%, investors should prioritize business fundamentals, valuation comfort, and risk tolerance over speculative signals.

Conclusion: Is the Globe Civil Projects IPO Worth Investing In?

Globe Civil Projects IPO is now priced at ₹67 to ₹71 per share, placing it at a P/E of ~19.8x, which aligns fairly with mid-sized EPC peers like PSP Projects and Capacite Infraprojects. With a solid order book of ₹669 crore, strong revenue growth, and a respectable RoNW of 19.80%, the IPO offers a decent mix of growth and valuation comfort.

The IPO is entirely a fresh issue of ₹119 crore, aimed at bolstering working capital and upgrading construction capabilities—both of which support long-term scalability.

Moreover, the grey market premium (GMP) of ₹9 (as of June 19) signals moderate positive sentiment, suggesting early interest among investors.

Short-Term View:

With the GMP hovering at ₹9 and estimated listing gains near 12%, Globe Civil Projects looks reasonably attractive for short-term participants. The infrastructure sector’s continued policy push, along with the company’s CPWD Class-1 license, could further amplify demand. However, monitor final-day subscription figures before making a listing play.

Long-Term View:

For long-term investors, Globe’s transition from education infrastructure to more complex civil projects like railway bridges and airport terminals presents clear diversification and margin expansion opportunities. If the company continues improving cash flows and project execution timelines, this stock can evolve into a strong mid-cap infra play. Debt levels and cyclical risks must still be tracked.

Allotment Strategy:

With 35% of the issue reserved for retail, allotment chances may shrink in the event of oversubscription. A minimum bid of 211 shares (1 lot) is required, costing approximately ₹14,981 at the upper band. One effective way to boost your odds? Apply through multiple demat accounts within your family.

👉 Want to increase your chances of IPO allotment?

Open a free demat account with Angel One today and apply smart!

Open Your Account with Angel One Now →

FAQs: Globe Civil Projects IPO

1. What is the Globe Civil Projects IPO opening and closing date?

The IPO opens on June 24, 2025, and closes on June 26, 2025.

2. What type of IPO is Globe Civil Projects launching?

It is a book-built IPO consisting of a fresh issue of 1.68 crore shares.

3. What is the purpose of the IPO?

The proceeds will be used for working capital, purchase of construction equipment, and general corporate purposes.

4. Who are the promoters of Globe Civil Projects?

The promoters are Ved Prakash Khurana, Nipun Khurana, and Vipul Khurana.

5. When is the allotment date?

The tentative allotment date is June 27, 2025.

6. When will the shares be listed?

The listing is expected on July 1, 2025, on both BSE and NSE.

7. How is the financial performance of the company?

The company reported a profit of ₹17.79 Cr for the 9 months ending Dec 2024, with a RoNW of 19.8% and a healthy revenue CAGR.

8. What sectors does Globe Civil Projects operate in?

It operates in transport, logistics, social infrastructure, housing, and also trades TMT steel.

9. Is there any grey market premium (GMP) available?

As of now, GMP shows 12% listing Gain for this IPO.

10. How can I increase my allotment chances?

Applying through multiple demat accounts within your family increases your chances. You can also open a free demat account with Angel One for easy application.

Related Articles

Energy Storage Policy Reform: Stocks to Watch as India Targets ₹5 Lakh Crore Investment