GK Energy IPO – Intro

The GK Energy IPO is all set to hit the primary markets, bringing a blend of fresh issue and offer for sale worth ₹464.26 crores. Backed by a strong presence in the renewable energy EPC segment, the company focuses on solar-powered agricultural water pump systems under the Government’s flagship PM-KUSUM Scheme, making it a direct play on India’s clean energy and rural electrification drive.

The issue opens for subscription on September 19, 2025, and closes on September 23, 2025, with a tentative listing date on September 26, 2025, at both BSE and NSE. With a price band of ₹145 to ₹153 per share and a lot size of 98 shares, GK Energy IPO offers retail investors an entry at a minimum investment of just ₹14,994.

Given the company’s asset-light business model, robust financial growth, and high return ratios, this IPO has already generated significant investor interest. At the same time, the valuation and sectoral competition will remain key factors to watch before taking a call.

GK Energy IPO Details

GK Energy IPO Snapshot

| Particulars | Details |

|---|---|

| IPO Opening Date | September 19, 2025 |

| IPO Closing Date | September 23, 2025 |

| Listing Date | September 26, 2025 (Tentative) |

| Face Value | ₹2 per share |

| Price Band | ₹145 – ₹153 per share |

| Lot Size | 98 Shares |

| Total Issue Size | 3,03,43,790 shares (₹464.26 Cr) |

| Fresh Issue | 2,61,43,790 shares (₹400.00 Cr) |

| Offer for Sale | 42,00,000 shares (₹64.26 Cr) |

| Issue Type | Book Building |

| Listing At | BSE, NSE |

| Pre-Issue Shareholding | 17,66,73,476 shares |

| Post-Issue Shareholding | 20,28,17,266 shares |

| Promoters | Gopal Rajaram Kabra & Mehul Ajit Shah |

| Document | RHP |

| Registrar | MUFG Intime India Pvt. Ltd. |

GK Energy IPO Timeline (Tentative)

| Event | Date |

|---|---|

| IPO Open Date | September 19, 2025 |

| IPO Close Date | September 23, 2025 |

| Basis of Allotment | September 24, 2025 |

| Initiation of Refunds | September 25, 2025 |

| Credit of Shares to Demat | September 25, 2025 |

| Listing Date | September 26, 2025 |

| UPI Mandate Confirmation | September 23, 2025 (by 5 PM) |

Objects of the Issue

The company is not chasing diversification or debt paydown here; the focus is razor-sharp:

- ₹322.46 crore – To fund long-term working capital needs (critical in EPC contracts, ensures smooth execution without cash-flow stress).

- General corporate purposes – Provides flexibility for future growth opportunities.

This capital allocation signals that GK Energy wants to scale aggressively while keeping its asset-light DNA intact.

Company Overview & Business Model – GK Energy Limited

GK Energy Limited has positioned itself as a niche leader in India’s clean energy transition. Incorporated in 2008, the company is today recognized as the largest pure-play EPC provider of solar-powered agricultural water pump systems under the PM-KUSUM scheme (Source: CRISIL Report). This specialization makes GK Energy a direct beneficiary of India’s policy-driven push to bring affordable solar power to farmers.

End-to-End EPC Model

The company offers a single-window solution that covers survey, design, procurement, installation, testing, and long-term maintenance of solar pump systems. This reduces friction for farmers while ensuring consistent brand visibility. Notably, GK Energy operates an asset-light model, sourcing critical components like solar panels and pumps under its “GK Energy” brand from third-party vendors.

Market Presence & Government Linkages

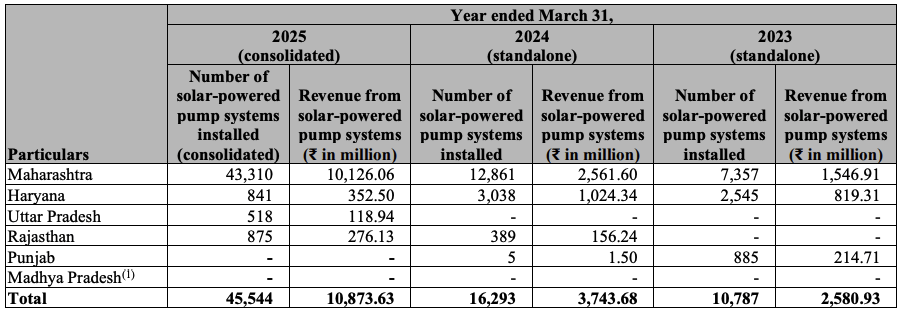

GK Energy is empanelled with the Ministry of New and Renewable Energy (MNRE) under the PM-KUSUM Scheme across five high-potential states — Maharashtra, Haryana, Rajasthan, Uttar Pradesh, and Madhya Pradesh. These states together accounted for 86% of total approved solar pump installations as of July 31, 2025. This strategic footprint ensures that the company has a front-row seat in regions where government subsidy-backed adoption is strongest.

The scale speaks for itself:

- Between Jan 2022 – Jul 2025, GK Energy installed 62,559 solar-powered pump systems, capturing a 7.37% market share of completed installations under Component B of PM-KUSUM.

- Outside PM-KUSUM, the company installed another 34,539 solar-powered pumps, showcasing strong execution capabilities beyond central schemes.

Revenue Mix & Segment Performance

GK Energy’s business is still heavily skewed towards EPC of solar-powered pump systems, which contributed over 99% of revenue in FY25. Within this:

- Direct-to-Beneficiary sales dominated, contributing 84% of FY25 revenue.

- Sales to Others (direct contracts with local bodies and institutions) contributed around 15%, offering diversification.

- Trading of PV cells, rooftop solar, and other EPC services (like Jal Jeevan Mission water distribution projects) are small contributors today, but management is consciously positioning them as growth levers for the future.

Revenue contribution trend (₹ in million):

| Segment | FY23 | FY24 | FY25 |

|---|---|---|---|

| EPC – Solar Pump Systems | 2,580.93 (90.5%) | 3,743.68 (91.1%) | 10,873.63 (99.3%) |

| Other EPC Services | 134.61 (4.7%) | 207.74 (5.0%) | – |

| Trading & Misc. | 120.09 (4.2%) | 135.51 (3.3%) | 10.01 (0.1%) |

| Total Revenue | 2,850.26 | 4,110.89 | 10,948.27 |

This indicates how the solar pump EPC business is the backbone, while other verticals remain in incubation mode.

Order Book & Growth Outlook

As of August 15, 2025, GK Energy reported an order book of ₹1,028.96 crore, with over 98% tied to solar-powered pump systems. Additionally, the company is eyeing growth in rooftop solar, having already secured 5.28 MW of rooftop solar orders.

The rooftop solar opportunity is particularly promising — India added 5.2 GW in FY25 alone, and with the government’s PM Surya Ghar Yojana targeting 10 million households, GK Energy could extend its expertise from rural irrigation to urban rooftops.

Analyst’s Take

GK Energy’s business model is a classic case of policy-backed growth meeting execution strength. The company’s dependence on government schemes is both a strength (steady demand, subsidy support) and a risk (pricing fixed through tenders, policy-driven margins). However, the shift toward rooftop solar diversification shows management’s awareness of de-risking its portfolio.

In short, GK Energy is not just riding the renewable energy wave — it has rooted itself at the intersection of clean energy, agriculture, and rural development, making it a compelling thematic play in India’s green economy.

Financial Performance of GK Energy Limited

GK Energy Limited’s financial trajectory reflects a classic policy-driven growth story — steady performance until FY23, followed by an exponential scale-up in FY24–FY25 as the PM-KUSUM scheme accelerated.

Consolidated Financial Snapshot (₹ in crore)

| Particulars | FY23 | FY24 | FY25 |

|---|---|---|---|

| Assets | 142.82 | 214.08 | 583.62 |

| Total Income | 285.45 | 412.31 | 1,099.18 |

| EBITDA | 17.18 | 53.83 | 199.69 |

| PAT | 10.08 | 36.09 | 133.21 |

| Net Worth | 19.87 | 55.96 | 209.09 |

| Reserves & Surplus | 18.57 | 54.66 | 175.07 |

| Total Borrowings | 42.61 | 62.29 | 217.79 |

Key Observations:

- 3.8x growth in PAT in FY25 vs FY24, reflecting strong operating leverage as scale kicks in.

- Assets jumped 2.7x in FY25, showing aggressive capacity expansion and working capital deployment.

- Borrowings rose sharply to ₹217.79 crore, but leverage remains under control due to robust profitability.

Revenue & Profitability Trends (₹ in million)

| Particulars | FY23 | FY24 | FY25 |

|---|---|---|---|

| Revenue from Operations | 2,850.26 | 4,110.89 | 10,948.27 |

| Revenue Growth (YoY) | – | 44.23% | 166.32% |

| EBITDA | 171.79 | 538.25 | 1,996.86 |

| EBITDA Margin | 6.03% | 13.09% | 18.24% |

| PAT | 100.80 | 360.90 | 1,332.09 |

| PAT Margin | 3.53% | 8.75% | 12.12% |

Key Observations:

- Revenue growth has been explosive, with FY25 almost tripling over FY24.

- Margins have expanded steadily — EBITDA margin moved from 6% (FY23) to 18% (FY25), while PAT margin crossed 12%.

- Rising profitability has boosted cash flow confidence, even as debt levels scaled up.

Key Performance Indicators (KPI) as of March 31, 2025

| Metric | FY23 | FY24 | FY25 |

|---|---|---|---|

| ROE | 50.73% | 64.49% | 63.71% |

| ROCE | 29.36% | 50.10% | 55.65% |

| Debt/Equity | 1.93 | 0.94 | 0.74 |

| RoNW | 50.73% | 64.49% | 63.71% |

| Net Debt/EBITDA | 2.24 | 0.98 | 0.78 |

| Receivable Days | 144 | 135 | 120 |

| Net Working Capital Days | 51 | 80 | 90 |

Key Observations:

- Return ratios are exceptional — ROE (63.7%) and ROCE (55.7%) are far above the industry average, reflecting efficient capital deployment.

- Leverage metrics are improving — Debt/Equity declined to 0.74 in FY25 from 1.93 in FY23.

- Receivables improving — Days sales outstanding reduced from 144 (FY23) to 120 (FY25), though still high compared to peers.

- Net Working Capital Days increased, suggesting greater capital lock-in with scale.

Analyst’s Take

GK Energy’s numbers tell a high-growth, high-efficiency story. With revenues compounding at triple digits and margins improving, the company is demonstrating scalability. While borrowings are rising, the debt servicing ability (Net Debt/EBITDA at 0.78x) is comfortable.

The standout metric is the ROE consistently above 60%, which is rare even among top-tier renewable EPC players. This indicates the company has been able to sweat its equity base while scaling aggressively.

In simple terms: GK Energy has cracked the code of scaling government-backed EPC projects profitably.

Valuation & Peer Comparison of GK Energy IPO

Valuation Metrics

| Particulars | Pre-IPO | Post-IPO |

|---|---|---|

| EPS (₹) | 7.54 | 6.57 |

| P/E (x) | 20.29 | 23.30 |

| Price to Book Value (P/BV) | – | 12.39 |

At the upper end of the price band, GK Energy is asking investors to value the company at a P/E of 23.3x post-issue and a P/BV of 12.39x.

Peer Comparison (as of March 31, 2025)

| Company | EPS (Basic) (₹) | NAV per share (₹) | P/E (x) | RoNW (%) | P/BV (x) |

|---|---|---|---|---|---|

| GK Energy Ltd | 7.86 | 12.35 | 23.3 (post-IPO) | 63.71 | 12.39 |

| Shakti Pumps (India) Ltd | 33.97 | 96.59 | 24.11 | 35.20 | 8.53 |

| Oswal Pumps Ltd | 28.21 | 44.56 | 29.00 | 93.00 | 18.57 |

Analyst’s View on Valuation

- Earnings Multiple: GK Energy’s post-issue P/E of 23.3x is slightly lower than Oswal Pumps (29x) and nearly in line with Shakti Pumps (24.1x).

- Return Ratios: The company stands out with RoNW of 63.7%, far superior to Shakti Pumps (35.2%) and close to Oswal Pumps (93%).

- Book Value Premium: With a P/BV of 12.39x, GK Energy is priced above Shakti (8.53x) but below Oswal (18.57x).

Bottomline: GK Energy IPO is not cheap, but the valuation premium is justified by its explosive growth, margin expansion, and high return ratios. It positions itself as a strong renewable EPC proxy, though investors should weigh policy dependence risks before fully subscribing to the growth story.

Strengths & Risks of GK Energy IPO

| Strengths | Risks |

|---|---|

| Market Leadership – India’s largest pure-play EPC provider for solar-powered agricultural water pump systems under PM-KUSUM. | Policy Dependence – Heavy reliance on central/state schemes like PM-KUSUM; any policy change or subsidy delay may directly impact revenues. |

| Robust Growth – Revenue grew ~166% YoY in FY25 with strong order book of ₹10,289.64 million. | Receivables Pressure – High receivable days (120 in FY25), exposing company to cash flow mismatches. |

| High Return Ratios – RoE of 63.7% and RoCE of 55.6%, reflecting strong capital efficiency. | Concentration Risk – Significant portion of business from Maharashtra and a few states; geographic diversification still limited. |

| Strong Execution Track Record – Over 97,000+ solar pump systems installed till July 2025. | Competitive Bidding – Price discovery via government tenders; margins vulnerable to aggressive bids. |

| Rising Rooftop Solar Opportunity – Expanding into rooftop solar solutions and water infrastructure EPC, diversifying revenue streams. | Debt Load – Borrowings rose to ₹2,177.9 million in FY25; leverage needs careful management. |

| Alignment with Renewable Push – Benefits from India’s ambitious solar and irrigation targets; long-term secular demand driver. | Execution & Scale-Up Risk – Rapid scale-up from ₹4,123 mn revenue in FY24 to ₹10,991 mn in FY25 needs consistent operational efficiency. |

GK Energy showcases a classic high-growth, high-dependence business model. On one hand, it enjoys strong government tailwinds, leadership position, and stellar return metrics. On the other hand, policy dependence, receivable challenges, and bidding competition are material risks that investors must weigh carefully.

GK Energy IPO GMP (Grey Market Premium)

As of now, the GK Energy IPO GMP has not started yet. Investors are watching closely for market signals, but early indications suggest no unofficial premium is being quoted.

Current GMP Status

| GMP Date | IPO Price | GMP | Estimated Listing Price | Estimated Profit* |

|---|---|---|---|---|

| 17-Sep-2025 | ₹153.00 | ₹0 (No Change) | ₹153 (0.00%) | ₹0 |

*Estimated profit is based on GMP and may vary once trading sentiment builds.

Analyst’s Note: Since GMP has not yet picked up, investors should not rely on early grey market signals for decision-making. The true picture will emerge closer to listing as subscription demand and market mood become visible.

Conclusion & Strategy on GK Energy IPO

The GK Energy IPO brings together strong fundamentals, government-backed demand visibility, and impressive financial growth, making it one of the noteworthy renewable energy plays in the market. With leadership in solar-powered agricultural pump systems under the PM-KUSUM scheme, the company enjoys a robust order book of over ₹1,028.96 Cr and a proven track record of execution across multiple states.

Positives for Investors

- Market leader in EPC services for solar pump systems under PM-KUSUM.

- Strong financial growth with 166% YoY revenue growth in FY25.

- Healthy margins (EBITDA 18.24%, PAT 12.12%) with high ROE of 63.71%.

- Diversification into rooftop solar and government water projects adds future growth avenues.

Risks to Watch

- Heavy dependence on government tenders and subsidy-based schemes.

- Working capital intensive model with high receivable days (120 days).

- Competition from listed peers like Shakti Pumps and Oswal Pumps.

Strategy

- Short-Term (Listing Gain): GMP trends are flat (₹0 as of now), so listing gains look uncertain. Investors should track subscription levels before betting purely on short-term upside.

- Medium-to-Long Term: The company’s strong market positioning, robust financials, and expansion into rooftop solar provide a compelling long-term story in India’s renewable push.

- Allotment View: Given the strong fundamentals, long-term investors may consider applying even if listing gains appear muted.

GK Energy IPO is a high-growth renewable energy story backed by government demand visibility. While short-term listing gains remain unclear, the company’s fundamentals make it a potential bright spot for long-term portfolios riding India’s solar energy wave.

FAQs on GK Energy IPO

1. What is the GK Energy IPO price band?

The price band is set at ₹145 to ₹153 per share.

2. What are the GK Energy IPO open and close dates?

It opens on September 19, 2025 and closes on September 23, 2025.

3. What is the lot size of GK Energy IPO?

The lot size is 98 shares, requiring a minimum investment of ₹14,994.

4. What is the total issue size of GK Energy IPO?

The IPO size is ₹464.26 crore, including a fresh issue and an OFS.

5. Who are the promoters of GK Energy Ltd.?

The promoters are Gopal Rajaram Kabra and Mehul Ajit Shah.

6. When will GK Energy IPO allotment be announced?

The allotment is expected on September 24, 2025.

7. What is the GK Energy IPO listing date?

Tentative listing date is September 26, 2025 on BSE & NSE.

8. What is the GMP of GK Energy IPO today?

As of September 17, 2025, the GMP is ₹0 (no movement yet).

9. What will be the post-issue market cap of GK Energy Ltd.?

The estimated market cap is around ₹3,103 crore.

10. Should I apply for GK Energy IPO?

It has strong fundamentals and long-term potential, but listing gains look uncertain—apply with a long-term view.

Related Articles

How to Analyze an IPO Before Investing: A Step-by-Step Guide

One Demat vs Multiple Demat – Which is Better for IPO Allotment?