Introduction

Imagine a brand that has been a staple in East Indian households for over two decades—trusted, familiar, and always on the kitchen shelf. That’s Ganesh Consumer Products, the company behind popular wheat-based products like maida, sooji, and dalia. Over the years, the brand has expanded beyond flours into spices, instant mixes, ethnic snacks, and even specialty flours like bajri and singhara, creating a strong connection with millions of consumers.

Now, this trusted brand is opening its doors to investors through the Ganesh Consumer Products IPO, a ₹408.80 crore book-building issue. The IPO comprises a fresh issue of 0.40 crore shares worth ₹130 crore and an offer-for-sale of 0.87 crore shares worth ₹278.80 crore. Scheduled to open on September 22, 2025, and close on September 24, 2025, the IPO will list on both BSE and NSE with a tentative date of September 29, 2025.

For investors looking to participate, the Ganesh Consumer IPO represents a chance to be part of the growth of East India’s largest packaged flour brand while leveraging the company’s expanding product portfolio and strong distribution network. With the Ganesh IPO, both retail and institutional investors can access a proven FMCG story backed by consistent financial performance and ambitious expansion plans.

IPO Overview – Ganesh Consumer Products IPO Details

IPO Snapshot

| Detail | Information |

|---|---|

| IPO Size | ₹408.80 Crores |

| Fresh Issue | 0.40 Crore Shares (₹130.00 Cr) |

| Offer for Sale | 0.87 Crore Shares (₹278.80 Cr) |

| Price Band | ₹306 – ₹322 per share |

| Lot Size | 46 Shares |

| Issue Type | Book Building IPO |

| Listing | BSE, NSE |

| Face Value | ₹10 per share |

| Employee Discount | ₹30 per share |

| Pre-IPO Shares | 3,63,73,259 |

| Post-IPO Shares | 4,04,10,526 |

| IPO Document | RHP File |

| Registrar | MUFG Intime India Pvt. Ltd. |

Ganesh Consumer IPO highlights:

- Minimum retail investment: ₹14,812 (46 shares at upper price band).

- sNII minimum: 14 lots (644 shares) ₹2,07,368; bNII minimum: 68 lots (3,128 shares) ₹10,07,216.

- Sale type is a combination of fresh capital and offer for sale.

- Both retail and institutional investors can participate with defined reservation limits.

Important Dates (Tentative Schedule)

| Event | Date |

|---|---|

| IPO Open Date | Mon, Sep 22, 2025 |

| IPO Close Date | Wed, Sep 24, 2025 |

| Tentative Allotment | Thu, Sep 25, 2025 |

| Refunds Initiation | Fri, Sep 26, 2025 |

| Credit of Shares to Demat | Fri, Sep 26, 2025 |

| Tentative Listing Date | Mon, Sep 29, 2025 |

| UPI Mandate Cut-off | 5 PM on Wed, Sep 24, 2025 |

Ganesh IPO timeline highlights:

- The IPO subscription is open for 3 days only.

- Refunds and credit to Demat accounts expected on the same day (Sep 26, 2025).

- Tentative listing is on September 29, 2025 for both BSE and NSE.

Objects of the Issue – Ganesh Consumer IPO

| Object | Expected Amount (₹ in Crores) |

|---|---|

| Prepayment / repayment of borrowings | 60.00 |

| Capital expenditure for roasted gram flour & gram flour unit (Darjeeling, West Bengal) | 45.00 |

| General corporate purposes | Remaining proceeds |

Ganesh Consumer IPO objectives highlights:

- Reducing debt to strengthen the balance sheet.

- Expansion into new product lines and manufacturing facilities.

- Supporting general corporate growth and operations.

Company Background

The story of Ganesh Consumer Products is one of tradition, trust, and transformation. What began in 1936 as a small retail outlet in Burrabazar, Kolkata, has today grown into a leading FMCG company headquartered in Kolkata, West Bengal. Incorporated in 2000 under the leadership of Promoter and Managing Director Manish Mimani, the company has steadily built a brand that dominates the East Indian wheat-based products market.

According to the Technopak Report, in Fiscal 2025, Ganesh Consumer Products is the third-largest packaged whole wheat flour brand and the largest brand in wheat-based derivatives like maida, sooji, and dalia in East India. The company also ranks among the top two players for packaged sattu and besan with ~43.4% and ~4.9% market share, respectively. In West Bengal alone, it holds approximately 40.5% share by value sold for wheat-based products.

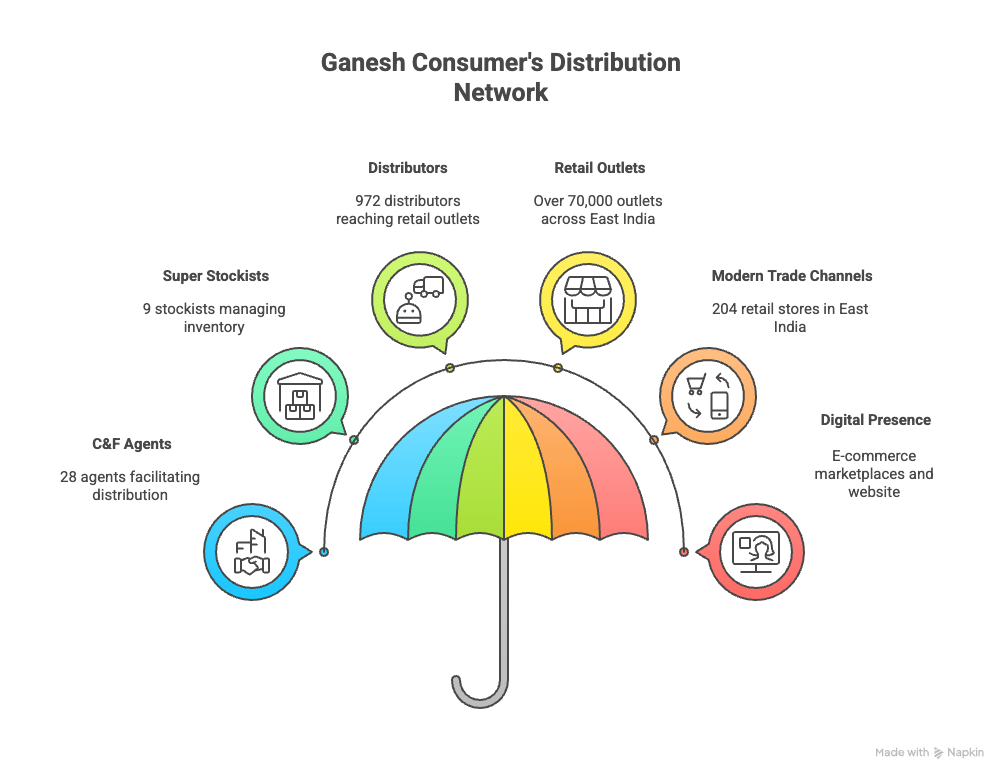

The company operates an extensive omni-channel network, servicing over 28 C&F agents, 9 super stockists, and 972 distributors, reaching more than 70,000 retail outlets across West Bengal, Jharkhand, Bihar, Odisha, and Assam. Ganesh Consumer Products also leverages modern trade channels with 204 retail stores in East India and maintains a digital presence through e-commerce marketplaces and its website.

The Ganesh Consumer IPO comes at a time when the company has expanded its product portfolio to 42 products across 232 SKUs, including:

- Whole wheat flour (Atta): Sharbati Atta, White Atta, Multigrain Atta, Diabetes Control Atta, Gluten-Free Atta.

- Wheat and gram-based value-added flours: Bakery Maida, Super Fine Maida, Tandoori Atta, Rumali Atta, Multigrain Sattu, Besan.

- Other emerging products: Packaged instant mixes (Khaman Dhokla, Bela Kachori), spices (whole, powdered, blended), ethnic snacks (Bhujia, Chanachur), and ethnic flours like Singhara and Bajri.

Business Verticals & Revenue Breakdown

Ganesh Consumer Products’ business is structured into three key verticals:

Highlights:

- B2C operations drive the majority of revenues through direct sales to consumers, leveraging the brand’s strong recall.

- B2B operations include supply to FMCG companies, HoReCa businesses, and small retailers.

- By-products such as wheat bran and chana chunni are sold as cattle feed, providing additional revenue streams.

Over the past three years, the company has launched 11 new products and 94 SKUs, expanding into spices, ethnic snacks, and innovative sattu variants. Its success is supported by a strategic procurement network across Uttar Pradesh, Bihar, Madhya Pradesh, Rajasthan, Haryana, Punjab, and Maharashtra, ensuring quality raw materials for consistent production.

Marketing investments — ₹113.72 million in Fiscal 2025 — reflect strong brand-building initiatives through print, digital, social media, and outdoor campaigns, further strengthening brand recall.

Led by an experienced management team and guided by a visionary promoter, Ganesh Consumer Products is poised for growth, making the Ganesh IPO an attractive opportunity for investors seeking a stake in a trusted, high-growth FMCG brand.

Financials of Ganesh Consumer Products IPO

Ganesh Consumer Products Ltd. has demonstrated consistent growth in both revenue and profitability over the past three years. The company’s financial performance highlights its strong operational efficiency and prudent management.

Key Financials (₹ Crore)

| Particulars | FY 2025 | FY 2024 | FY 2023 |

|---|---|---|---|

| Assets | 341.74 | 308.64 | 343.30 |

| Total Income | 855.16 | 765.26 | 614.78 |

| Profit After Tax (PAT) | 35.43 | 26.99 | 27.10 |

| EBITDA | 73.24 | 63.35 | 56.14 |

| Net Worth | 224.13 | 218.65 | 201.62 |

| Reserves & Surplus | 190.47 | 184.98 | 167.95 |

| Total Borrowings | 50.00 | 38.29 | 86.13 |

- Revenue grew 12% in FY2025 compared to FY2024, indicating steady market demand and effective distribution.

- PAT rose 31% year-on-year, reflecting improved operational efficiency and cost management.

- EBITDA margin increased, showing stronger profitability from operations.

- Total borrowings have been managed prudently, reducing leverage compared to FY2023.

Key Financial Ratios

| KPI | Value |

|---|---|

| ROE | 15.81% |

| ROCE | 19.81% |

| Debt/Equity | 0.22 |

| RoNW | 15.81% |

| PAT Margin | 4.17% |

| EBITDA Margin | 8.61% |

| Market Capitalization (Post IPO) | ₹1,301.22 Cr |

- A ROE of 15.81% and ROCE of 19.81% indicate strong returns on equity and capital employed.

- Low Debt/Equity of 0.22 reflects a healthy balance sheet and minimal reliance on debt financing.

- PAT margin of 4.17% and EBITDA margin of 8.61% demonstrate profitable operations in the FMCG sector.

- With a market capitalization of ₹1,301.22 Cr post-IPO, Ganesh Consumer Products offers investors exposure to a well-established, financially sound FMCG company.

Valuation & Peer Comparison of Ganesh Consumer IPO

Investors looking at the Ganesh Consumer Products IPO often assess its valuation relative to industry peers. Based on pre- and post-IPO numbers, the company shows moderate valuations with potential for growth in the FMCG sector.

Key Valuation Metrics

| Particulars | Pre-IPO | Post-IPO |

|---|---|---|

| EPS (₹) | 9.74 | 8.77 |

| P/E (x) | 33.06 | 36.72 |

| Price to Book Value | 5.23 | – |

- The EPS reduces slightly post-IPO due to dilution but remains healthy at ₹8.77.

- P/E ratio of 36.72x post-IPO is reasonable compared to other FMCG players, indicating moderate valuation for a growth-oriented brand.

- Price to Book Value of 5.23 reflects the premium investors are willing to pay for a trusted, market-leading FMCG brand in East India.

Peer Comparison of Ganesh Consumer Products IPO

| Company Name | EPS (Basic, ₹) | EPS (Diluted, ₹) | NAV per share (₹) | P/E (x) | RoNW (%) | P/BV Ratio | Financial Statements |

|---|---|---|---|---|---|---|---|

| Ganesh Consumer Products Ltd. | 9.74 | 9.74 | 61.62 | 36.72 | 15.81 | 5.23 | – |

| Patanjali Foods Ltd. | 35.94 | 35.94 | 300.36 | 50.15 | 11.96 | 6.01 | Consolidated |

| AWL Agri Business Ltd. | 9.44 | 9.44 | 71.91 | 27.15 | 13.12 | 3.61 | – |

- Compared to Patanjali Foods, Ganesh Consumer Products has a lower P/E, offering potential value for investors seeking growth at reasonable valuations.

- The company shows strong RoNW of 15.81%, higher than most peers, reflecting efficient capital utilization.

- P/BV ratio of 5.23 is in line with the sector, indicating investor confidence in brand strength and market leadership.

The Ganesh IPO thus presents an opportunity to invest in a market-leading FMCG company with solid financial metrics and competitive positioning in East India.

Strengths & Weaknesses / Risks of Ganesh Consumer Products IPO

Investors considering the Ganesh Consumer IPO should evaluate both the company’s strengths and the potential risks associated with its business. The table below summarizes these factors clearly:

| Strengths | Weaknesses / Risks |

|---|---|

| Market Leadership: Largest brand in wheat-based derivatives (maida, sooji, dalia) and third-largest packaged whole wheat flour brand in East India. | Concentration in East India: Majority of revenues come from East India, which exposes the company to regional market fluctuations. |

| Diversified Product Portfolio: 42 products across 232 SKUs including flours, spices, instant mixes, and ethnic snacks. | Dependence on Raw Material Prices: Wheat, gram, and spices procurement is spot-based, leading to exposure to price volatility. |

| Strong Distribution Network: Over 28 C&F agents, 9 super stockists, 972 distributors, serving 70,000+ retail outlets. | High Competition: Faces competition from large FMCG players like Patanjali Foods, regional players, and private labels. |

| B2C Focused Revenue: 76.98% of revenues from B2C operations ensures strong consumer engagement and brand loyalty. | Moderate Profit Margins: PAT margin at 4.17% and EBITDA margin at 8.61% may be lower than larger FMCG peers. |

| Experienced Management: Promoter and management team with decades of experience in FMCG sector. | Regulatory Risks: Subject to food safety regulations, labeling standards, and compliance requirements. |

| Financially Sound: ROE 15.81%, ROCE 19.81%, Debt/Equity 0.22, reflecting healthy balance sheet. | Seasonal Dependence: Raw material procurement and consumer demand may vary seasonally, impacting sales. |

| Omni-channel Presence: Strong general trade, modern trade, and e-commerce channels ensure wide reach. | Dilution Post IPO: EPS reduces from 9.74 to 8.77 post-IPO due to fresh issue shares. |

- The Ganesh Consumer IPO offers a balanced risk-reward proposition, backed by market leadership, brand trust, and strong financials.

- Key risks include geographic concentration, raw material volatility, and competitive pressures, which investors should consider before subscribing.

Ganesh Consumer Products IPO GMP

For investors tracking the Ganesh Consumer Products IPO, the Grey Market Premium (GMP) provides a short-term sentiment indicator before listing. As of 18-09-2025, the GMP for the Ganesh IPO has not shown any premium, indicating that the market is currently stable and waiting for the subscription window to open.

| GMP Date | IPO Price (₹) | GMP (₹) | Sub2 Sauda Rate | Estimated Listing Price (₹) | Estimated Profit (₹) | Last Updated |

|---|---|---|---|---|---|---|

| 18-09-2025 | 322.00 | ₹0 | Todays Movement – GMP No Change | 322 (0.00%) | ₹0 | 18-09-2025 |

- As of now, the Ganesh Consumer IPO is trading at par in the grey market, reflecting cautious investor sentiment ahead of subscription.

- No premium indicates balanced demand among retail and institutional investors before the opening on September 22, 2025.

- Investors should continue monitoring the GMP in the coming days to gauge market enthusiasm for the Ganesh IPO.

Conclusion – View on Ganesh IPO

The Ganesh Consumer Products IPO offers investors a chance to participate in a trusted FMCG brand with deep roots in East India. With strong market leadership in wheat-based derivatives, a diversified product portfolio, and a robust distribution network reaching over 70,000 retail outlets, the company combines brand trust with growth potential. Financially sound, with a healthy balance sheet and steady revenue growth, the Ganesh IPO is positioned as an attractive opportunity for both retail and institutional investors seeking exposure to a high-growth FMCG story.

Short-Term Strategy

- Subscribe at the upper price band (₹322) if you aim for listing gains, as the grey market currently indicates balanced demand.

- Focus on retail lots (46 shares) for smaller ticket exposure and reduce concentration risk.

- Track subscription trends for QIB and retail categories during the IPO period (Sep 22–24, 2025).

Long-Term Strategy

- Invest for the long term to benefit from brand expansion, new product launches, and manufacturing growth.

- Consider holding for potential dividend payouts and capital appreciation as the company strengthens its presence in East India and diversifies into ethnic snacks, spices, and value-added flours.

- Evaluate peer comparison metrics (P/E, RoNW, P/BV) to monitor relative valuation in FMCG over time.

Allotment Strategy

- Retail Investors: Apply for 1–13 lots based on risk appetite and investment size.

- HNI / NII Investors: Participate in sNII or bNII categories for larger allocations.

- Diversify across other IPOs to manage subscription risk, while keeping Ganesh Consumer IPO as a core FMCG investment.

“Ganesh IPO – A trusted East Indian brand, now inviting investors to a slice of its growth story.”

FAQs – Ganesh Consumer Products IPO

What is the opening and closing date of Ganesh Consumer Products IPO?

- The IPO opens on September 22, 2025 and closes on September 24, 2025.

What is the price band of the Ganesh IPO?

- The price band is ₹306 to ₹322 per share.

What is the minimum investment for retail investors in Ganesh Consumer IPO?

- Retail investors can apply for 1 lot (46 shares), requiring a minimum investment of ₹14,812 at the upper price band.

How many shares are being offered in Ganesh Consumer Products IPO?

- Total issue size is 1.27 crore shares (~₹408.80 Cr), comprising 0.40 crore fresh issue shares and 0.87 crore offer-for-sale shares.

Which stock exchanges will list Ganesh IPO?

- The shares will be listed on BSE and NSE, with tentative listing on September 29, 2025.

Who are the promoters of Ganesh Consumer Products Ltd.?

- Promoters include Purushottam Das Mimani, Manish Mimani, Madhu Mimani, Manish Mimani (HUF), and Srivaru Agro Private Limited.

What are the main business segments of Ganesh Consumer Products?

- The company operates in B2C (76.98%), B2B (12.54%), and by-products sales (10.48%), with products including flours, spices, ethnic snacks, and instant mixes.

What are the key financials of Ganesh Consumer IPO?

- FY2025 revenue: ₹855.16 Cr, PAT: ₹35.43 Cr, EBITDA: ₹73.24 Cr, ROE: 15.81%, Debt/Equity: 0.22.

What is the Grey Market Premium (GMP) for Ganesh IPO?

- As of 18-09-2025, the GMP is ₹0, indicating no premium in the grey market.

What is the expected listing price of Ganesh Consumer Products IPO?

- Tentatively, the listing price is expected to be around ₹322, same as the upper price band, though market dynamics may vary.

Note: All data and information in this blog are sourced from the Ganesh Consumer Products IPO Draft Red Herring Prospectus (RHP) and official disclosures.

Related Articles

How to Analyze an IPO Before Investing: A Step-by-Step Guide

One Demat vs Multiple Demat – Which is Better for IPO Allotment?