Introduction – Fujiyama Power Systems IPO

The much-awaited Fujiyama Power Systems IPO is hitting the Indian markets with a strong buzz around the renewable energy and solar equipment space. Positioned as a major player in rooftop solar manufacturing, Fujiyama Power Systems Ltd. is now looking to tap public markets to fuel its next phase of growth.

The Fujiyama Power Systems IPO is a book-built issue worth ₹828.00 crores, comprising a fresh issue of ₹600 crores and an offer for sale (OFS) of ₹228 crores. The IPO will open for subscription on November 13, 2025, and close on November 17, 2025, with tentative listing scheduled on November 20, 2025, at both BSE and NSE.

Priced in the range of ₹216 to ₹228 per share, the Fujiyama Power IPO aims to attract investors looking for exposure in the fast-expanding clean energy manufacturing sector. The issue’s minimum investment size for retail investors is ₹14,820 (65 shares), while HNI investors can participate starting from ₹2.07 lakh (sNII) to ₹10.07 lakh (bNII).

Backed by Motilal Oswal Investment Advisors Ltd. as the lead manager and MUFG Intime India Pvt. Ltd. as registrar, this IPO seeks to strengthen Fujiyama’s manufacturing presence in solar energy systems and reduce debt levels.

The Fujiyama Solar IPO comes at a time when India’s renewable energy sector is witnessing massive expansion, supported by government incentives and rising rooftop solar adoption. Investors are closely watching whether this IPO could mirror the success stories of other clean-tech listings.

For a detailed look into the financials, objectives, and GMP trends, let’s dive deeper into the Fujiyama Power Systems IPO Review and explore if it truly shines bright in the solar investment space.

Fujiyama Power Systems IPO Overview

The Fujiyama Power Systems IPO offers investors a chance to participate in one of India’s fast-growing solar manufacturing companies. With a mix of fresh equity and an offer for sale, the Fujiyama Power IPO aims to raise ₹828 crore to strengthen manufacturing capacity and repay borrowings.

Let’s break down the key details, timeline, and fund utilization plan for the Fujiyama Solar IPO.

Fujiyama Power Systems IPO Details

The Fujiyama Power Systems IPO is a book-built issue comprising a fresh issue of ₹600 crore and an offer for sale (OFS) of ₹228 crore, aggregating to a total issue size of ₹828 crore. The IPO price band has been fixed at ₹216–₹228 per share, and investors can bid for a minimum of 65 shares per lot.

Here’s the complete breakdown of the Fujiyama Power IPO details:

| Particulars | Details |

|---|---|

| IPO Date | November 13, 2025 – November 17, 2025 |

| Listing Date (Tentative) | November 20, 2025 |

| Face Value | ₹1 per share |

| Price Band | ₹216 – ₹228 per share |

| Lot Size | 65 Shares |

| Issue Type | Book-Building IPO |

| Total Issue Size | 3,63,15,789 shares (aggregating up to ₹828.00 Cr) |

| Fresh Issue | 2,63,15,789 shares (aggregating up to ₹600.00 Cr) |

| Offer for Sale | 1,00,00,000 shares (aggregating up to ₹228.00 Cr) |

| Listing At | BSE, NSE |

| Promoters | Pawan Kumar Garg, Yogesh Dua, and Sunil Kumar |

| Pre-Issue Shareholding | 99.67% |

| Post-Issue Shareholding | 87.88% |

| Lead Manager | Motilal Oswal Investment Advisors Ltd. |

| Registrar | MUFG Intime India Pvt. Ltd. |

| RHP Source | Fujiyama Power Systems RHP/DRHP |

The Fujiyama Solar IPO aligns with India’s renewable push and offers investors early exposure to a growing solar manufacturing leader.

Fujiyama Power Systems IPO Timeline (Tentative Schedule)

The subscription window for the Fujiyama Power Systems IPO opens on November 13, 2025, and closes on November 17, 2025. The allotment is expected to be finalized on November 18, 2025, with listing scheduled for November 20, 2025, on both the BSE and NSE.

| Event | Date |

|---|---|

| IPO Open Date | Thursday, November 13, 2025 |

| IPO Close Date | Monday, November 17, 2025 |

| Basis of Allotment | Tuesday, November 18, 2025 |

| Initiation of Refunds | Wednesday, November 19, 2025 |

| Credit of Shares to Demat | Wednesday, November 19, 2025 |

| Listing Date (Tentative) | Thursday, November 20, 2025 |

| UPI Mandate Cut-Off Time | 5 PM on Monday, November 17, 2025 |

| Allotment Link | Check Allotment Status |

Investors can also explore our latest IPO reviews for comparison and allocation updates.

Use of IPO Proceeds – Fujiyama Power Systems IPO

The Fujiyama Power Systems IPO aims to utilize its net proceeds primarily for capacity expansion and financial strengthening. According to the RHP filing, the funds will be allocated as follows:

- ₹180.00 crore – Part financing the cost of establishing a new manufacturing facility in Ratlam, Madhya Pradesh.

- ₹275.00 crore – Repayment or prepayment of certain outstanding borrowings.

- Balance amount – For general corporate purposes, including working capital and future expansion.

This utilization strategy positions the Fujiyama Power IPO to scale up its solar production capacity and improve financial efficiency.

For more IPO insights, you can also check our PhysicsWallah IPO Review 2025 — another recent market favorite.

Company Overview – Fujiyama Power Systems Ltd

Fujiyama Power Systems Ltd is a prominent player in India’s rooftop solar energy sector, offering comprehensive products and solutions across on-grid, off-grid, and hybrid solar systems. The company manufactures a wide range of solar inverters, panels, and batteries — backed by strong R&D and innovation-driven production processes. (Source: CARE Report)

With a legacy of over 28 years through its reputed brands UTL Solar and Fujiyama Solar, the company has established a strong foothold in the renewable energy market. Fujiyama Power Systems Ltd has been instrumental in pioneering technologies such as the Online UPS with single card, Combo UPS with automatic voltage regulation (AVR), and SMT-based single card inverters — marking it as one of India’s few innovation-first companies in the power electronics space.

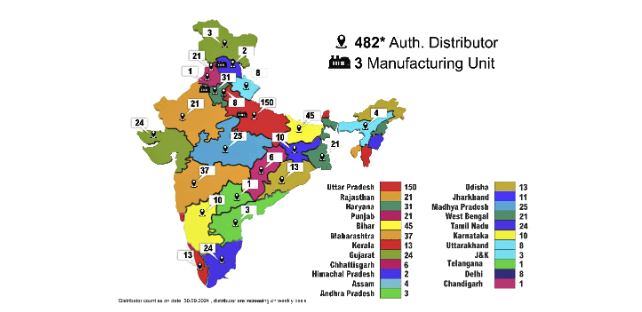

As of September 30, 2024, the company offers more than 500 SKUs, covering an extensive range of solar inverters, solar panels, and batteries. Fujiyama Power Systems Ltd operates through a pan-India distribution network comprising 480+ distributors, 3,600+ dealers, and over 1,000 exclusive UTL Solar “Shoppe” franchisees, supported by a field force of 400+ qualified service engineers.

Over the last three financial years, Fujiyama Power Systems has contributed to 1 GW+ of rooftop solar installations in India — selling over 1.22 million solar panels (458 MW), 6.31 lakh inverters (1,065 MW), and 8.52 lakh batteries (1,672 MWh). The company’s fully integrated ecosystem — from innovation and manufacturing to distribution and after-sales service — makes it a true “one-stop shop” for rooftop solar solutions in India.

Revenue Mix – Fujiyama Solar IPO

Fujiyama Power Systems derives its revenue primarily from its solar battery and solar panel divisions, supported by inverter and UPS product lines. The company’s brand Fujiyama Solar has become a trusted name across India, driving its B2C success story.

| Product Category | Revenue (₹ Cr) | Share (%) |

|---|---|---|

| Solar Battery | 1,663.12 | 32.4% |

| Solar Panel | 1,413.15 | 27.5% |

| Solar UPS / Inverter / Converter | 1,128.56 | 22.0% |

| Online UPS | 322.48 | 6.3% |

| E-Rickshaw Charger | 206.38 | 4.0% |

| Other Products & Services | 334.68 | 6.5% |

| Total | 5,068.37 | 100% |

This balanced product portfolio ensures consistent revenue growth while reducing dependency on any single segment — a major advantage for long-term investors following renewable energy IPOs.

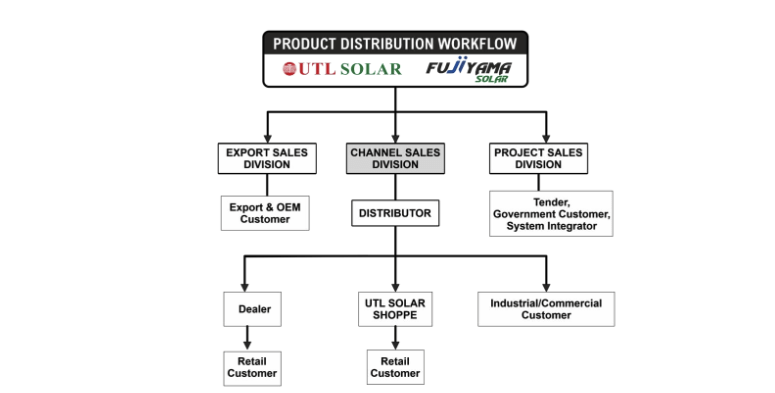

Revenue by Sales Channel

Fujiyama Power Systems operates with a strong retail presence under its UTL Solar “Shoppe” franchise model, making B2C sales the major contributor to its top line.

| Sales Channel | Revenue (₹ Cr) | Share (%) |

|---|---|---|

| B2C | 4,741.48 | 93.6% |

| B2B | 326.90 | 6.4% |

The dominance of retail-driven sales demonstrates the strength of the brand and its direct engagement with end consumers — a factor that has helped Fujiyama become one of the most recognized names in India’s rooftop solar segment.

With over 423 SKUs and 2,900+ channel partners across India, Fujiyama Power Systems Ltd has established a complete solar ecosystem — spanning manufacturing, distribution, and after-sales service. Investors can explore more about the company’s operations and sustainability goals on its official website.

With more than 60 R&D professionals and an in-house Battery Management System (BMS) for safety and reliability, the company continues to drive innovation in solar technology. Their latest upgrades include TOPCon bifacial panels (up to 590 Wp) and MonoPerc bifacial modules (up to 670 Wp).

Through continuous research, advanced validation processes, and accredited third-party testing, Fujiyama Power Systems IPO represents a company with deep technical roots, a strong domestic presence, and a forward-looking renewable energy vision.

Financial Performance – Fujiyama Power Systems IPO

The financials of Fujiyama Power Systems Ltd reflect strong growth momentum and operational efficiency in recent years. Between FY 2024 and FY 2025, the company’s revenue surged by 67%, while profit after tax (PAT) jumped by an impressive 245%, signaling robust scalability, effective cost management, and sustained demand in India’s rooftop solar sector.

The company has demonstrated consistent improvement in margins, return ratios, and asset base — reinforcing investor confidence ahead of the Fujiyama Power Systems IPO.

Key Financial Summary (₹ in Crore)

| Period Ended | 30 Jun 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

|---|---|---|---|---|

| Assets | 1,243.88 | 1,013.96 | 609.64 | 514.56 |

| Total Income | 597.79 | 1,550.09 | 927.20 | 665.33 |

| EBITDA | 105.89 | 248.52 | 98.64 | 51.60 |

| Profit After Tax (PAT) | 67.59 | 156.34 | 45.30 | 24.37 |

| Net Worth | 464.34 | 396.82 | 239.54 | 193.08 |

| Reserves & Surplus | 436.33 | 368.81 | 215.00 | 70.55 |

| Total Borrowing | 432.83 | 346.22 | 200.19 | 211.14 |

Source: Company DRHP / CARE Report

The financial performance clearly highlights a sharp rise in both income and profitability, along with a healthy expansion of net worth. The company’s increased reserves and reduced leverage ratio further underline its improving balance sheet strength before the Fujiyama Power Systems IPO.

Key Financial Ratios – Fujiyama Power Systems IPO

Fujiyama Power Systems Ltd has showcased solid operational metrics and returns in FY 2025, with strong profitability indicators such as high ROE and ROCE, demonstrating effective utilization of capital and sustainable earnings growth.

| Key Performance Indicator (KPI) | Values (FY 2025) |

|---|---|

| ROE (Return on Equity) | 39.40% |

| ROCE (Return on Capital Employed) | 41.01% |

| Debt-to-Equity Ratio | 0.87 |

| RoNW (Return on Net Worth) | 39.40% |

| PAT Margin | 10.15% |

| EBITDA Margin | 16.13% |

| Ad & Marketing Expense (% of Revenue) | 2.57% |

Fujiyama Power Systems IPO demonstrates a powerful mix of innovation, growth, and financial discipline — supported by scalable infrastructure and strong distribution economics. The combination of consistent profitability, improving ratios, and product innovation positions it as one of the standout solar energy IPOs in 2025.

For investors tracking recent IPOs, our detailed PhysicsWallah IPO Review offers a good benchmark to understand how emerging education and energy companies are shaping India’s IPO market. You can also explore all upcoming and recent issues under our IPO category.

Valuation & Peer Comparison – Fujiyama Power Systems IPO

Fujiyama Power Systems IPO Valuation

When evaluating the Fujiyama Power Systems IPO, the valuation metrics appear balanced considering the company’s rapid growth in both revenue and profitability. The post-IPO price-to-earnings (P/E) ratio is expected to be around 25.84x, which places it competitively within the solar and power solutions segment.

The Fujiyama Power IPO demonstrates strong fundamentals, supported by an expanding product range and a rising brand presence under the “UTL” name. Based on the company’s market capitalization of ₹6,986.17 crore and consistent earnings improvement, investors may find the issue attractively valued compared to several listed peers.

Fujiyama Power Systems IPO Valuation Summary

| Parameter | Pre IPO | Post IPO |

|---|---|---|

| EPS (₹) | 5.58 | 8.82 |

| P/E (x) | 40.85 | 25.84 |

| Price to Book Value | – | 16.09 |

| Market Capitalization | – | ₹6,986.17 Cr |

For detailed financial disclosures, investors can refer to the official RHP and DRHP documents on the company’s investor relations portal or visit the official UTL Solar Fujiyama website.

Once the allotment process is live, the Fujiyama Power Systems IPO allotment status can be checked here.

Fujiyama Power Systems IPO Peer Comparison

When compared with listed peers in the renewable and solar power space, the Fujiyama Solar IPO showcases a robust financial position and competitive valuation. The company’s Return on Net Worth (RoNW) of 39.40% and P/BV ratio of 16.09x suggest efficient capital use and investor confidence in growth prospects.

In contrast, larger industry players like Waaree Energies and R S Premier Energies trade at higher P/E multiples, reflecting the sector’s overall premium valuations. However, Fujiyama Power Systems Ltd. stands out with its aggressive revenue growth and strong profitability metrics despite its relatively smaller base.

Peer Comparison Table – Fujiyama Power Systems IPO

| Company Name | EPS (Basic) | EPS (Diluted) | NAV (₹) | P/E (x) | RoNW (%) | P/BV Ratio |

|---|---|---|---|---|---|---|

| Fujiyama Power Systems Ltd | 5.59 | 5.56 | 14.17 | 25.84 | 39.40 | 16.09 |

| Waaree Energies Ltd | 68.24 | 67.96 | 334.00 | 49.04 | 20.09 | 9.98 |

| R S Premier Energies Ltd | 21.35 | 21.35 | 62.61 | 47.91 | 33.21 | 16.48 |

| Exicom Tele Systems Ltd | -9.11 | -9.11 | 50.80 | – | -17.93 | 2.88 |

| Insolation Energy Ltd | 5.95 | 5.95 | 28.00 | 31.68 | 51.20 | 6.71 |

Compared to its peers, the Fujiyama Power Systems IPO reflects a compelling blend of growth and reasonable valuation, making it one of the more interesting offerings in India’s evolving renewable energy landscape.

Grey Market Premium (GMP) & Listing Expectations – Fujiyama Power Systems IPO

Fujiyama Power Systems IPO GMP Overview

The Fujiyama Power Systems IPO opened with steady investor interest in the grey market. However, the current GMP (Grey Market Premium) shows no change as of November 13, 2025, indicating that early market sentiment remains neutral.

Despite the flat GMP, it’s important to note that the company’s strong financial growth, expanding solar product portfolio, and improving profit margins could attract investor traction as the subscription window progresses.

Investors tracking new listings like the Fujiyama Power IPO often monitor GMP trends closely as an early signal of potential listing-day performance. While a low GMP doesn’t always predict weak listing gains, it does reflect current market demand and short-term liquidity sentiment.

Fujiyama Power Systems IPO Day-wise GMP Trend

| GMP Date | IPO Price (₹) | GMP (₹) | Estimated Listing Price (₹) | Estimated Profit* |

|---|---|---|---|---|

| 13-Nov-2025 (Open) | 228.00 | ₹0 (No Change) | ₹228 (0.00%) | ₹0 |

Estimated profit is based on current GMP values and may vary at the time of actual listing.

Fujiyama Power IPO Listing Expectations

Given the flat Fujiyama Power Systems IPO GMP, the estimated listing price is currently close to the issue price of ₹228 per share. However, investors shouldn’t rely solely on GMP for making investment decisions.

The company’s strong fundamentals, rapid financial growth, and established presence in the solar energy solutions market under the UTL brand could still drive positive sentiment by the listing date.

The Fujiyama Power Systems IPO currently trades at par in the grey market, but given the company’s growth trajectory and sectoral tailwinds in renewable energy, market interest could pick up as the issue progresses toward listing.

Strengths & Risks – Fujiyama Power Systems IPO

The Fujiyama Power Systems IPO offers investors exposure to India’s fast-growing solar and clean-energy equipment market. However, as with any investment, it comes with its own strengths and risks.

Here’s a balanced look at both sides before you decide whether the Fujiyama Power IPO deserves a place in your portfolio.

| Strengths – Fujiyama Power Systems IPO | Risks – Fujiyama Power Systems IPO |

|---|---|

| 1. Strong Financial Growth – Revenue grew 67% YoY, and profit after tax surged 245% between FY24 and FY25, showing improving scalability and profitability. | 1. Dependence on Solar Demand Cycles – Business performance is directly tied to the demand for solar equipment and government subsidy programs. |

| 2. Diversified Product Portfolio – The company manufactures solar panels, batteries, UPS/inverters, and e-rickshaw chargers, making Fujiyama Solar IPO an entry into multiple energy verticals. | 2. Competitive Industry – Faces stiff competition from major players like Waaree Energies and Insolation Energy, which could impact pricing power. |

| 3. Strong Retail Network – With over 2,900 channel partners across India, the company has a well-established B2C presence, ensuring consistent demand. | 3. Working Capital Intensive – High inventory levels and credit cycles could affect liquidity if sales growth slows. |

| 4. Expanding Renewable Footprint – Operating under the UTL brand, Fujiyama benefits from India’s push toward renewable and sustainable power systems. | 4. Policy & Regulatory Risks – Changes in government policies or import duties on solar components could affect margins. |

| 5. Brand Legacy & Technical Expertise – The UTL Group’s long presence in the power electronics sector gives Fujiyama a technical edge in product innovation and reliability. | 5. Borrowing and Leverage – The company’s debt-to-equity ratio of 0.87 indicates moderate leverage that must be managed carefully to sustain growth. |

The Fujiyama Power Systems IPO stands out for its rapid growth, diversified solar solutions, and solid market positioning under the UTL Group. However, investors should weigh sector volatility, policy dependence, and rising competition before subscribing.

Conclusion – Final Verdict on the Fujiyama Power Systems IPO

The Fujiyama Power Systems IPO brings a strong growth narrative from India’s booming solar energy sector. Backed by the well-established UTL Solar brand, the company’s integrated presence across solar panels, batteries, and inverters positions it as a complete solution provider in the rooftop solar ecosystem.

The company’s financials are impressive — revenue has grown by over 67% and profit surged by 245% in FY25, reflecting strong execution and rising market demand. Its consistent R&D investment and more than 2,900 distribution partners further strengthen its brand trust and scalability potential.

However, investors should note that the Fujiyama Power IPO operates in a competitive and policy-sensitive segment. Changes in subsidy structures, solar import duties, or raw material price swings could affect near-term profitability. Despite these, its strong fundamentals, wide network, and innovation-led approach make it a moderately positive listing candidate for both short-term listing gains and long-term renewable energy exposure.

💡 Final Takeaway:

If you’re bullish on India’s clean energy transition and want to ride the rooftop solar growth story, the Fujiyama Solar IPO offers a well-balanced entry point. Long-term investors can consider it for portfolio diversification, while short-term traders may watch for GMP trends and subscription data before taking positions.

FAQs – Fujiyama Power Systems IPO

1. What is the Fujiyama Power Systems IPO?

The Fujiyama Power Systems IPO is a public offering by one of India’s leading rooftop solar solution providers. The company, known for its brands UTL Solar and Fujiyama Solar, manufactures solar panels, inverters, and batteries with an integrated distribution network across India.

2. What are the IPO dates for Fujiyama Power Systems?

The Fujiyama Power IPO opened for subscription on November 13, 2025, and closed on November 15, 2025. The allotment date and listing date will be announced shortly.

You can check the official allotment status here: Fujiyama IPO Allotment Link

3. What is the issue price and lot size for the Fujiyama Solar IPO?

The Fujiyama Solar IPO has a price band of ₹228 per share, with a market lot expected to be 65 shares per application (tentative). Retail investors can apply in multiples of this lot size.

4. What will be the market capitalization of Fujiyama Power Systems post listing?

Based on the upper price band, the Fujiyama Power Systems IPO is expected to command a market capitalization of around ₹6,986 crore post-listing.

5. How is the financial performance of Fujiyama Power Systems Ltd?

The company reported strong growth in FY25 — revenue rose by 67% and profit after tax surged by 245%, showcasing operational strength and growing solar adoption. For detailed financials, you can review the official RHP report.

6. Who are the peers of Fujiyama Power Systems in the market?

While the Fujiyama Power IPO has limited direct listed peers, it can be compared with other solar energy players like Waaree Energies, Insolation Energy, and R S Premier Energies. Each operates in segments overlapping solar manufacturing and EPC services.

7. What is the Grey Market Premium (GMP) for Fujiyama Power Systems IPO?

As of November 13, 2025, the Fujiyama Power Systems IPO GMP stands at ₹0, indicating no premium or discount over the issue price. Investors should monitor GMP and subscription trends for updated market sentiment.

8. Should you invest in the Fujiyama Power Systems IPO?

Investors with a long-term outlook on India’s renewable and rooftop solar growth story can consider the Fujiyama Solar IPO. The company’s integrated operations, strong financials, and expanding distribution network add value. However, short-term traders should watch listing trends before deciding.

9. Where can I read more IPO reviews like this?

You can explore all upcoming and past IPO analyses in our dedicated IPO review section, including our detailed PhysicsWallah IPO review.

Official Company Source:Fujiyama Power Systems Ltd

RHP/DRHP Source:Investor Relations – Fujiyama Power Systems Ltd

Check Allotment (after listing):MUFGBonds IPO Allotment Page

Previous IPO Review:PhysicsWallah IPO Review 2025

Explore All IPO Reviews:OneDemat IPO Category