Introduction: The Silent Sector That’s Suddenly Booming

In a market obsessed with tech, EVs, and defense, one sector has quietly turned into a multibagger zone—fertilizers stocks.

Yes, the very industry that powers the humble wheat and pulses you eat every day is suddenly catching fire on the stock market. In April 2025, fertilizer stocks have jumped between 10–30% in just a few weeks.

So, what’s changed? Why are big investors loading up on companies like Coromandel, RCF, FACT, and Chambal Fertilisers?

Let’s break it all down.

The Big Picture: What’s Driving Fertilizer Stocks Up?

Before we jump into company details, here are five big macro-level reasons why fertilizer stocks are on fire:

- Massive Government Subsidy Boost for Kharif 2025

- Strong Rabi Sowing Trends – meaning more demand for fertilizers

- Global Urea Prices Rising, which supports pricing power

- Strong Q3 Earnings from leading fertilizer firms

- Technical Momentum in charts – traders are chasing breakouts

Now let’s dive deeper into each.

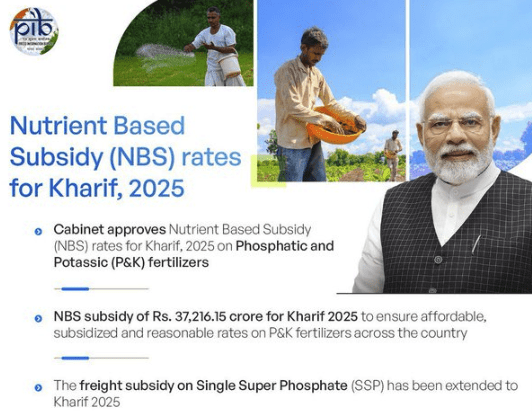

1. Government Subsidy: ₹37,216 Crore of Pure Fuel

Every fertilizer rally in India starts with one word: subsidy.

And this time, the government didn’t just whisper support—they made it official.

In April 2025, the Union Cabinet approved ₹37,216.15 crore under the Nutrient-Based Subsidy (NBS) scheme for the Kharif 2025 season (April to September). This is a ₹13,000 crore jump compared to the Rabi 2024 season.

Key Changes:

- P2O5 (Phosphate) subsidy increased by 42%

- Freight subsidy for Single Super Phosphate (SSP) continued

- Advance supply planning approved for all states and companies

Investor Takeaway: With input costs partially covered, companies like Coromandel and RCF can offer lower prices to farmers without sacrificing margins. That’s a rare combo in any business.

2. Rabi Sowing Trends Show Real Demand

Real demand is always rooted in farming activity—and this year’s data is bullish.

According to the Ministry of Agriculture:

- Rabi sowing area (2024–25): 656 lakh hectares

- Up from 644 lakh hectares in 2023–24

- Crops driving the growth: Wheat and pulses

More area under cultivation = more fertilizer needed.

And with farmers incentivized by MSP (minimum support price) hikes and good monsoon expectations, the fertilizer offtake is expected to remain high through June.

3. Global Urea Prices Are Climbing Again

Urea is one of the most widely used fertilizers in India—and we import a lot of it. So, global prices matter.

According to Trading Economics:

- Urea prices have risen 4.74% year-to-date

- Expected to hit $343.51/ton by Q2 2025-end

Though this makes imports costlier, it helps domestic producers with pricing power and better realizations. More importantly, it keeps the government subsidy stable by justifying its necessity.

4. Company Earnings: The Numbers Tell the Story

Let’s break down the recent quarterly results of top fertilizer companies to see how fundamentals are catching up with the narrative.

➤ Coromandel International (CMP ~ ₹2,118)

- Q3 FY25 Revenue: ₹7,038 crore (+28% YoY)

- Net Profit: ₹525 crore (+116%)

- EBITDA: ₹727 crore (+103%)

Why it matters: Strong volumes in both fertilizers and crop protection segments show this isn’t just subsidy-driven growth—it’s solid execution.

➤ Rashtriya Chemicals & Fertilizers (RCF) (CMP ~ ₹138.95)

- Q3 Net Profit: ₹80.23 crore (YoY growth of 615%)

- Revenue: ₹4,518 crore

Stock movement: On April 17, RCF gained 4% in a single session. Traders are clearly waking up to this sleeper stock.

➤ Chambal Fertilisers (CMP ~ ₹673.60)

- Hit 52-week high of ₹654.80 on April 11

- Benefits from strong urea production and improved gas cost efficiency

Investor Buzz: Chambal has become the FII favorite in the fertilizer basket.

➤ National Fertilizers Limited (NFL) (CMP ~ ₹85.38)

- Q3 Profit: ₹45.81 crore (down 70% YoY)

- Revenue: ₹5,855.85 crore (down 23%)

Despite weak results, the stock is stabilizing as investors bet on subsidy support and Rabi recovery.

5. Technical Charts Don’t Lie: Momentum Is Strong

Traders are loving this sector too.

Mid-cap names like:

- FACT (Fertilisers and Chemicals Travancore)

- Paradeep Phosphates

…are showing classic bullish setups:

- Double bottom patterns

- High RSI with positive divergence

- Breakouts above 50-day and 200-day moving averages

If you’re a short-term trader, this could be the rotation trade of the season.

But Don’t Forget the Risks

Every rally has speed bumps. Watch out for:

- Volatile input costs like gas and sulfur

- Policy uncertainty—what if subsidy reform comes?

- Weak export demand, especially if global supply outpaces demand

These won’t kill the rally, but they might limit upside.

What Should Investors Do Now?

Here’s how you can position smartly:

✅ Long-Term Investors:

- Look at Coromandel or Chambal for stable growth + dividends

- Use dips to accumulate, especially pre-monsoon (May-June)

⚡ Traders:

- Monitor technical charts of FACT, Paradeep, and RCF

- Use trailing stops; don’t get greedy

🔍 Watch List:

- Upcoming monsoon forecast

- Q4 results in May

- New fertilizer policy updates

Final Word: Time to Dig Into This Sector?

In the world of cyclical investing, fertilizers are a classic “buy when ignored, sell when hyped” story.

April 2025 is showing signs that we are still early in the rerating cycle. With subsidy strength, sowing support, and global pricing aligned, fertilizer stocks may continue to outperform.

If you’ve ignored this sector till now, it might be time to get your hands dirty (financially speaking).

Want to start investing in fertilizer stocks today?

👉 Open your FREE Angel One Demat Account and explore stocks powering India’s food security—while also fertilizing your portfolio returns!

FAQs on Fertilizer Stocks

Q1. Why are fertilizer stocks rising in April 2025?

Fertilizer stocks are rallying due to a ₹37,216 crore government subsidy, strong Rabi crop sowing, rising global urea prices, and robust Q3 earnings from top companies like Coromandel and RCF.

Q2. Which fertilizer stocks are performing well right now?

Coromandel International, RCF, Chambal Fertilisers, FACT, and Paradeep Phosphates have shown strong price momentum and earnings growth in April 2025.

Q3. Will the fertilizer stock rally sustain in 2025?

If favorable monsoon trends, global price stability, and government support continue, the rally could sustain at least until the Kharif season. However, investors should watch input costs and policy updates.

Q4. Is this a good time to invest in fertilizer stocks?

Yes, from a cyclical and policy support standpoint, it’s a favorable entry point. Long-term investors may consider stocks with consistent profitability and strong balance sheets.

Q5. What risks should investors be aware of?

Key risks include volatility in natural gas prices, reduction in subsidies, weak global demand, and policy shifts toward direct cash transfers.

Related Articles

Indian Exporters to China: Top Opportunities in 2025