Introduction

🏢 From Cubicles to Customizable Campuses – Indiqube Spaces IPO Journey Begins!

The world of work is changing fast—and riding that wave is Indiqube Spaces, one of India’s rising stars in the flexible workspace market. With a stronghold in cities like Bengaluru, Pune, Chennai, and Hyderabad, the company has carved a niche in offering tech-powered, tailor-made work environments for enterprises and startups alike.

Now, Indiqube is stepping into the public spotlight with its ₹700 crore IPO. Backed by a solid expansion story and a sharp turnaround in profits, the Indiqube Spaces IPO is creating quite a buzz among investors looking to cash in on India’s growing demand for managed office spaces.

Whether you’re in it for listing gains, or thinking long-term growth, this IPO offers an exciting mix of numbers, narratives, and next-gen office vibes.

So, what’s the deal with the Indiqube Spaces IPO? Let’s decode it, section by section.

Details & Dates of Indiqube Spaces IPO

The Indiqube Spaces IPO is a ₹700 crore mainboard issue, opening for subscription from July 23 to July 25, 2025. This IPO consists of a fresh issue of ₹650 crore and an offer for sale (OFS) worth ₹50 crore.

The price band has been set at ₹225 to ₹237 per share, with a minimum lot size of 63 shares for retail investors, translating to a starting investment of approximately ₹14,931.

This IPO is being managed by ICICI Securities Ltd as the Book Running Lead Manager, while MUFG Intime India Pvt Ltd (formerly Link Intime) is the registrar. The equity shares are proposed to be listed on both NSE and BSE, with a tentative listing date of July 30, 2025.

Indiqube Spaces IPO Snapshot

| Particulars | Details |

|---|---|

| Issue Size | ₹700 crore |

| Fresh Issue | ₹650 crore (2.74 crore shares) |

| Offer for Sale | ₹50 crore (21.09 lakh shares) |

| Price Band | ₹225 to ₹237 per share |

| Face Value | ₹1 per share |

| Market Lot | 63 shares |

| Minimum Retail Investment | ₹14,931 |

| Listing Exchange | NSE, BSE |

| BRLM | ICICI Securities Ltd |

| Registrar | MUFG Intime India Pvt Ltd |

| Employee Discount | ₹22 per share |

| IPO Type | Book Building |

| Issue Structure | QIB: 75%, NII: 15%, Retail: 10% |

Indiqube Spaces IPO Important Dates (Tentative)

| Event | Date |

|---|---|

| IPO Opens | July 23, 2025 (Wed) |

| IPO Closes | July 25, 2025 (Fri) |

| Allotment Finalization | July 28, 2025 (Mon) |

| Refunds Initiation | July 29, 2025 (Tue) |

| Credit of Shares to Demat | July 29, 2025 (Tue) |

| Listing Date | July 30, 2025 (Wed) |

| UPI Mandate Cut-off Time | 5 PM, July 25, 2025 |

IPO Objectives: Where Will Indiqube Use the Funds?

The Indiqube Spaces IPO aims to strengthen the company’s presence in high-demand office markets by raising capital through a mix of expansion and debt reduction. Here’s how the net proceeds from the fresh issue will be utilized:

- Capital expenditure for setting up new centers – ₹462.65 crore

To fund fit-outs, interiors, and sustainable enhancements across new properties in major Indian cities. - Repayment or pre-payment of certain borrowings – ₹93.04 crore

To reduce interest burden and improve the company’s debt profile. - General corporate purposes

To meet working capital needs, strengthen the balance sheet, and support growth initiatives.

This fund allocation shows a clear roadmap toward expansion and financial de-leveraging, making the Indiqube Spaces IPO a strategic capital raise.

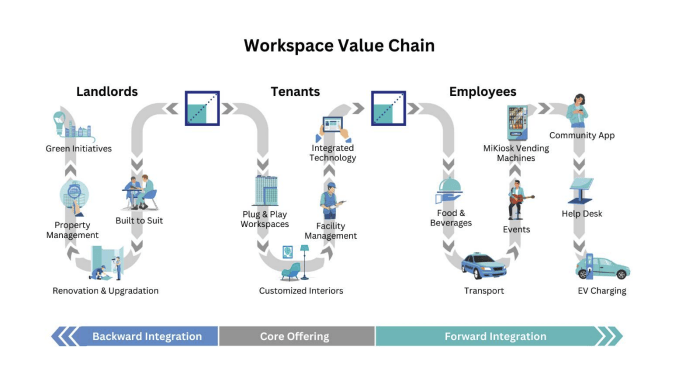

Company Overview & Business Model

Smartworks Coworking Spaces Ltd is one of India’s largest providers of flexible managed office solutions, focusing primarily on large enterprises and global capability centres (GCCs). Founded in 2016, the company has grown rapidly by offering fully serviced, technology-integrated office spaces that allow businesses to operate without the hassle of managing real estate, fit-outs, or day-to-day operations.

As of March 31, 2024, Smartworks manages over 8.43 million sq. ft. of space across 115 centres in 13 cities, including Bengaluru, Delhi-NCR, Mumbai, Hyderabad, Pune, Chennai, and Kolkata. Out of these, 105 centres are currently operational, with a total seating capacity of 1,86,719 seats, while 10 new centres are under development.

Service Offerings

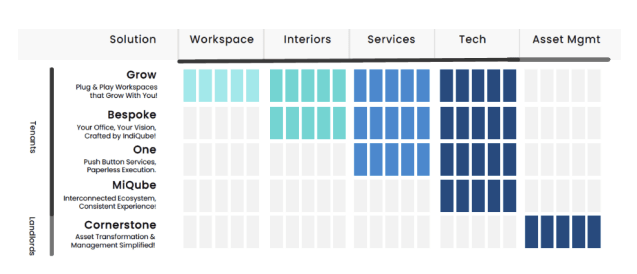

Smartworks’ business model is built around a comprehensive full-stack workspace solution, divided into three core verticals:

- Smartworks Grow: Offers plug-and-play coworking spaces, day passes, virtual office services, and access to shared infrastructure such as meeting rooms and common areas. Designed for flexibility and speed of access.

- Smartworks Bespoke: Focuses on fully customized, enterprise-grade office solutions. Clients can choose from standard, premium, or luxury fit-outs tailored to their branding and functional needs.

- Smartworks One: Provides tech-enabled property and facility management services. This includes ISO-certified processes for safety, security, housekeeping, energy management, and space optimisation across office centres.

Target Market & Client Profile

Smartworks serves a wide range of enterprise clients, including:

- IT & ITeS

- Banking and Financial Services (BFSI)

- Pharmaceuticals, Manufacturing, Logistics, and Consulting

- Global Capability Centres (GCCs), which represent 43.1% of the client base

As of FY24, the company had over 769 clients, most of whom sign multi-year lock-in agreements—ensuring strong revenue visibility and client stickiness.

Revenue Model

Smartworks generates revenue primarily through:

- Workspace rentals (core offering)

- Facility and property management services

- Interior design and custom fit-outs

- Add-on value services like cafeteria, mobility solutions, concierge, and digital productivity tools

These multiple revenue streams, backed by long-term contracts and enterprise-grade clientele, enable predictable cash flows and high utilisation of real estate assets.

Financial Overview Of Indiqube Spaces IPO

Smartworks has shown consistent revenue growth over the past three years, although it continues to post net losses due to expansion and operational investments. The company’s strong EBITDA margin and reduction in losses signal improving operational efficiency.

Key Financials (₹ in million)

| Particulars | FY23 | FY24 | FY25 |

|---|---|---|---|

| Revenue from Operations | 5,797.38 | 8,305.73 | 10,592.86 |

| Total Income | 6,012.75 | 8,676.60 | 11,029.31 |

| Total Assets | 29,693.17 | 36,679.13 | 46,851.23 |

| Profit / (Loss) After Tax | (1,981.09) | (3,415.08) | (1,396.17) |

Financial Highlights Explained

- Revenue Growth: Smartworks’ operational revenue jumped by 27.5% in FY25, continuing its impressive 3-year CAGR growth trend. This reflects increased occupancy and client additions across key metros.

- Asset Expansion: Total assets increased by over 58% in two years, driven by new centres, infrastructure investment, and scaling of service verticals.

- Losses Narrowing: Net loss reduced significantly in FY25 to ₹1,396.17 million, from ₹3,415.08 million in FY24—indicating better cost control and margin discipline.

- Equity Position: The company reported a negative net equity of ₹31.11 million in FY25, but this is likely to be addressed post-IPO via fund infusion and debt optimisation.

Key Ratios and Operational Metrics

| Metric | FY23 | FY24 | FY25 |

|---|---|---|---|

| EBITDA (before fair value adj.) (₹ mn) | 3,489.39 | 4,952.89 | 6,165.42 |

| EBITDA Margin (%) | 60.19 | 59.63 | 58.20 |

| Cash EBIT (₹ mn) | 477.03 | 1,133.23 | 1,145.30 |

| Net Debt (₹ mn) | 6,127.00 | 1,635.67 | 3,379.27 |

| Return on Capital Employed (ROCE, %) | 15.66 | 38.52 | 34.21 |

Ratio Insights

- Stable Margins: EBITDA margins remained strong, consistently above 58%, underscoring Smartworks’ operational efficiency despite rising scale.

- Cash EBIT: The company has started generating positive cash EBIT, showing improvements in core profitability and reduction in non-cash adjustments.

- Net Debt Position: After significantly lowering its debt in FY24, net debt increased again in FY25, likely due to expansion-linked capex. The IPO proceeds are expected to further optimise the balance sheet.

- Strong ROCE: Return on Capital Employed remained robust, reaching 34.21% in FY25, suggesting efficient use of capital in revenue-generating assets.

Valuation & Peer Comparison of Indiqube Spaces IPO

To evaluate the valuation of Indiqube Spaces IPO, let’s compare it with its closest listed peers in the flexible workspace and managed office space segment. The primary comparables are Awfis Space Solutions Ltd, which recently listed, and Smartworks Coworking Spaces Ltd, which listed just 2 days ago.

Indiqube Spaces IPO Peer Comparison

As on March 31, 2025

| Company Name | EPS (Basic) | NAV per Share (₹) | P/E (x) | RoNW (%) | P/BV Ratio | Remarks |

|---|---|---|---|---|---|---|

| Indiqube Spaces Ltd (IPO) | -7.65 | -0.24 | Loss-making | Negative | NA | Standalone |

| Awfis Space Solutions Ltd | 9.75 | 64.71 | 66.66 | 14.78% | 10.06 | Listed |

| Smartworks Coworking Spaces Ltd | -6.18 | 1,078.81 | Loss-making | -58.76% | 0.38 (Est.) | Listed recently |

Key Observations:

- Indiqube is loss-making, similar to Smartworks, but has shown significant improvement in EBITDA and reduction in net losses over the past three years.

- Its NAV per share is negative (-₹0.24), indicating an erosion of equity due to accumulated losses.

- Awfis stands out as the only peer with positive EPS and RoNW, but also trades at a premium valuation.

- Smartworks, despite having a high NAV, has a severely negative RoNW, which reflects stress on return metrics despite large asset backing.

While a direct P/E comparison isn’t possible for Indiqube due to negative earnings, investors can look at EBITDA growth, operational margins, and turnaround potential as indicators of forward-looking strength.

Grey Market Premium (GMP) Update for Indiqube Spaces IPO

As of July 18, 2025, the grey market premium (GMP) for the Indiqube Spaces IPO stands at:

- GMP: ₹0

- IPO Price (Upper Band): ₹237

- Estimated Listing Price: ₹237

- Estimated Profit on Listing: ₹0 (0.00%)

Day-wise GMP Trend of Indiqube Spaces IPO

| Date | IPO Price (₹) | GMP (₹) | Estimated Listing Price (₹) | Estimated Profit (₹) |

|---|---|---|---|---|

| July 18, 2025 | 237 | 0 | 237 | 0 |

What Does This Mean?

At the moment, no premium or discount is observed in the grey market, indicating neutral investor sentiment. This may reflect cautiousness or a “wait-and-watch” stance by retail and HNI investors due to the company’s recent financial losses or sector-related concerns.

However, GMP is an informal and speculative metric and should not be the sole basis for investment decisions. Investors are encouraged to evaluate fundamentals, growth outlook, and risk factors before applying.

Conclusion: Should You Apply for Indiqube Spaces IPO?

Listing Gain Potential

As of now, the GMP stands at ₹0, indicating muted grey market interest. While GMP is not a reliable predictor, it reflects current sentiment, which appears cautious. Given the company’s loss-making financials, but improving EBITDA margins and strong cash flow from operations, short-term listing gains are uncertain.

However, the coworking sector is gaining traction, and a positive market environment could still support a decent debut if sentiment picks up closer to listing.

Allotment Strategy

- HNI and Retail portions are likely to be subscribed modestly unless institutional demand surprises.

- If you are applying for listing gains, monitor subscription levels on the last day, especially in QIB and NII categories.

- Consider applying through multiple demat accounts (if available in the family) to improve chances in case of oversubscription.

Long-Term Investment View

Indiqube operates in a fast-growing flexible workspace segment, backed by marquee clients like NPCI, Grant Thornton, Firstsource, and Unacademy. While losses persist, the improving operating metrics (EBITDA margin >58%) and differentiated business model — with customized and managed spaces under brands like IndiQube Grow, Bespoke, and One — provide scalability potential.

However, investors should consider:

- The negative net worth and accumulated losses.

- Competition from larger, better-capitalized players like Awfis.

- The need for sustainable profitability to justify long-term investment.

Verdict

- Risk-tolerant investors with a long-term horizon may consider applying after evaluating institutional interest and final day demand.

- Conservative investors may prefer to watch post-listing performance before entering.

FAQs on Indiqube Spaces IPO

🔹 What is the Indiqube Spaces IPO issue size?

The IPO size is ₹760 crore, comprising a fresh issue of ₹550 crore and an offer for sale (OFS) of ₹210 crore by existing investors.

🔹 What is the IPO price band and lot size?

The price band is ₹225 to ₹237 per share. The minimum lot size is 62 shares, requiring an investment of ₹14,694 at the upper price band.

🔹 When does the Indiqube IPO open and close?

The IPO will open on Tuesday, July 23, 2025, and close on Thursday, July 25, 2025.

🔹 What is the Indiqube IPO allotment date?

The basis of allotment is expected to be finalized on Friday, July 26, 2025.

🔹 What is the listing date for Indiqube Spaces IPO?

The shares are proposed to be listed on Tuesday, July 30, 2025, on both the NSE and BSE.

🔹 Is Indiqube a profitable company?

No. Indiqube has posted net losses in FY23, FY24, and FY25. However, it has reported positive EBITDA margins and improved cash flows from operations.

🔹 Who are some of Indiqube’s key clients?

Key clients include Unacademy, Grant Thornton, NPCI, Firstsource, Upgrad, and Spice Money.

🔹 What are the major risks in this IPO?

- Consistent financial losses

- High dependence on Bengaluru operations

- Competition from peers like Awfis and Smartworks

- Real estate and economic cycle sensitivity

🔹 What is the Grey Market Premium (GMP) for this IPO?

As of now, the GMP is ₹0, indicating no premium or discount in the grey market.

🔹 Should I apply for the Indiqube Spaces IPO for listing gains?

With no visible GMP and continued losses, listing gains are not guaranteed. Investors should watch for QIB/NII demand and assess based on their risk tolerance.

Related Articles

Smartworks Coworking IPO: A ₹582.56 Cr Bet on India’s Office of the Future

India’s Startup IPO Boom: 5 High-Growth Companies Planning to Go Public in 2025

More Articles

DRDO’s Emergency Weapon Orders: Defence Stocks Set to Gain

Discounted Cash Flow (DCF): The King of Stock Valuation Methods

Strategic Shifts to High-Margin Segments: Future Multibagger Stocks to Watch