Introduction

The Canara HSBC Life Insurance IPO brings one of India’s largest bank-led life insurers to the public markets — but this is not a capital-raising sprint; it’s a ₹2,517.50 crore Offer for Sale (OFS) that hands existing shareholders a route to liquidity. Promoted by Canara Bank and HSBC Insurance (Asia-Pacific) Holdings Ltd., Canara HSBC Life enters the listing arena backed by deep bancassurance distribution, improving profitability and a robust solvency cushion.

Why this listing matters: the insurer combines a massive bank-channel reach (access to over 15,700 branches through promoter and bancassurance partners) with a rapidly growing embedded value and a solvency ratio well above regulatory minimums. For investors thinking about insurance sector exposure, the Canara HSBC Life IPO is less about fresh equity for growth and more about getting a piece of a bank-promoted insurer whose underlying business metrics — persistency, APE mix, embedded value and solvency — have steadily strengthened through FY2023–FY2025.

Canara HSBC Life IPO Overview

Canara HSBC Life Insurance IPO Details

| Item | Details |

|---|---|

| Issue Type | Book-built IPO — Offer for Sale (OFS) of up to 237,500,000 equity shares |

| Total Issue Size | Up to 23,75,00,000 shares (aggregating up to ₹2,517.50 crore) |

| Price Band | ₹100 – ₹106 per share |

| Face Value | ₹10 per share |

| Lot Size | 140 shares |

| Minimum Retail Investment (at upper band) | ₹14,840 (140 shares × ₹106) |

| Employee Discount | ₹10 per share |

| Listing | NSE, BSE (Tentative listing date: Oct 17, 2025) |

| Book Running Lead Manager (BRLM) | SBI Capital Markets Ltd. |

| Registrar | KFin Technologies Ltd. |

| Pre-Issue Shares | 95,00,00,000 shares |

| Post-Issue Shares | 95,00,00,000 shares (OFS — no fresh shares issued; no dilution) |

| Promoters | Canara Bank; HSBC Insurance (Asia-Pacific) Holdings Ltd. |

| IPO Documents | RHP/DRHP |

Important Dates (Tentative Schedule)

| Event | Date |

|---|---|

| IPO Open Date | Friday, October 10, 2025 |

| IPO Close Date | Tuesday, October 14, 2025 |

| Tentative Allotment | Wednesday, October 15, 2025 |

| Initiation of Refunds | Thursday, October 16, 2025 |

| Credit of Shares to Demat | Thursday, October 16, 2025 |

| Tentative Listing Date | Friday, October 17, 2025 |

| Cut-off time for UPI mandate confirmation | 5:00 PM on Tuesday, October 14, 2025 |

Note: because this is a pure OFS, allotment mechanics follow standard book-build allocation across QIB / NII / Retail quotas as per subscription and BRLM rules.

Objects of the Issue (Use of Proceeds)

Key points — the company will not receive proceeds from this Offer for Sale. The stated objectives are:

- Offer for Sale by existing shareholders: To enable the Selling Shareholders to monetize/partially exit up to 237,500,000 equity shares (aggregate amount up to ₹2,517.50 crore).

- Achieve benefits of listing: Provide liquidity, broaden the shareholder base and enhance the company’s public profile via listing on NSE and BSE.

Because this is an OFS, there are no fresh proceeds to the company for capex, working capital or debt reduction — the financials of the company remain unaffected by the issue size (except improved market visibility and potential secondary market liquidity).

Company Background — Canara HSBC Life Insurance

The Canara HSBC Life Insurance IPO introduces investors to a leading Indian life insurer backed by two financial powerhouses — Canara Bank, one of India’s largest public sector banks, and HSBC Insurance (Asia-Pacific) Holdings Ltd., a part of the global HSBC Group.

Incorporated in 2007, Canara HSBC Life Insurance Company Limited is a bank-promoted private life insurer that blends the deep domestic reach of Canara Bank with HSBC’s international expertise and financial discipline. This dual lineage provides the company a strong foundation of trust, financial stability, and cross-border operational excellence — a hallmark of the Canara HSBC Life IPO story.

Product Suite & Business Model

Canara HSBC Life Insurance offers a diverse product portfolio catering to multiple customer segments — protection, savings, annuity, and group business — while also participating in government schemes such as Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY).

The company currently provides:

- 20 individual products

- 7 group products

- 2 optional riders

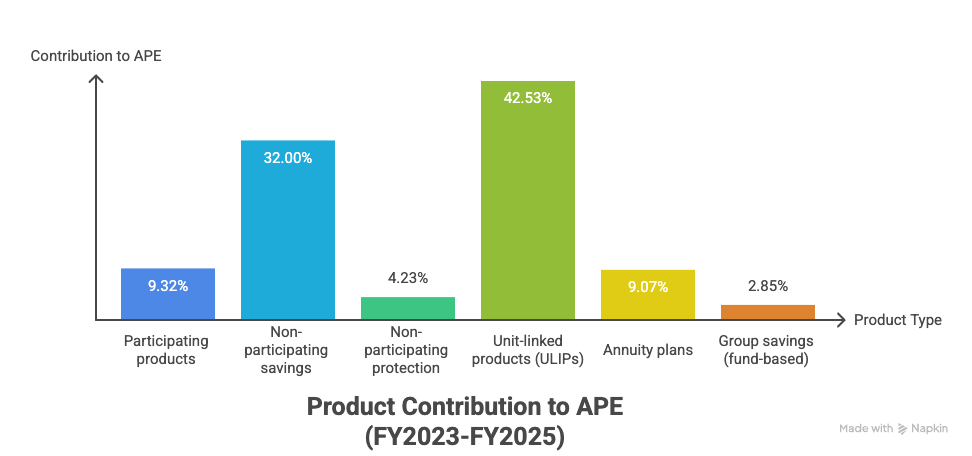

Product Contribution to APE (FY2023–FY2025):

- Participating products: 9.32%

- Non-participating savings: 32.00%

- Non-participating protection: 4.23%

- Unit-linked products (ULIPs): 42.53%

- Annuity plans: 9.07%

- Group savings (fund-based): 2.85%

This mix reflects a strategic tilt towards ULIPs and savings products, a hallmark of bank-led insurers leveraging existing customer bases and relationship banking. The company continues to focus on increasing its protection mix to enhance margins and long-term profitability.

Distribution Strength — Bancassurance at the Core

The Canara HSBC Life Insurance IPO is rooted in a powerful distribution model centered on bancassurance. This remains the company’s core business engine and competitive advantage.

For the three-month period ended June 30, 2025, the contribution to Individual Weighted Premium Income (WPI) was as follows:

- Canara Bank: ₹2,732.28 million — 68.49% of individual WPI

- HSBC India: ₹695.98 million — 17.45%

- Regional Rural Banks (RRBs): ₹174.63 million — 4.38%

- Other bancassurance relations: ₹19.15 million — 0.48%

- Brokers & corporate agents: ₹209.80 million — 5.26%

- Direct sales & digital: ₹157.50 million — 3.95%

- Total (3-month period ended Jun 30, 2025): ₹3,989.33 million (100%)

This data highlights the dominance of Canara Bank and HSBC as key contributors to new business growth.

The company enjoys access to over 15,700 branches across India through its bancassurance partners — including Canara Bank’s ~9,849 branches, multiple Regional Rural Banks (RRBs), and Dhanlaxmi Bank — offering deep penetration into Tier-2, Tier-3, and rural India.

Historically, bancassurance accounted for more than 90% of new business premium in several reporting periods, reflecting an unmatched channel strength. Across key fiscal periods, bancassurance contributed 92.33%, 91.71%, 87.07%, 78.71%, and 57.20% of new business premiums — a testament to the company’s consistent bank-led growth model.

Operational Highlights

Embedded Value (EV):

The company’s Embedded Value, which measures the present value of future profits, has grown impressively — from ₹42,719.35 million (Mar 31, 2023) to ₹51,798.61 million (Mar 31, 2024), ₹61,107.40 million (Mar 31, 2025), and further to ₹63,526.41 million (Jun 30, 2025). This consistent EV growth signals a strong in-force portfolio and long-term profitability.

Assets Under Management (AUM):

According to CRISIL, Canara HSBC Life ranks third among public sector bank-promoted life insurers in terms of AUM, demonstrating robust asset growth and prudent investment management.

Lives Covered:

As of June 30, 2025, the company had covered 10.51 million lives, reflecting its wide and growing customer base.

Solvency Ratio:

With a solvency ratio of 200.42% (as of June 30, 2025) — well above the regulatory minimum of 150% — the company maintains a strong capital position, ensuring its ability to meet policyholder obligations and future growth needs.

Operational & Digital Excellence

The Canara HSBC Life Insurance IPO is also a story of digital transformation and operational efficiency.

- Straight-Through Processing (STP): Approximately 67% of policy applications (excluding term & medical) were processed via STP in Q1 FY2026, while over 99.70% of all applications** were digitally processed**, significantly reducing turnaround time and improving distributor productivity.

- Persistency Improvement: The 13th-month individual persistency ratio (by premium) improved to 84.25% for the quarter ended June 30, 2025 — among the highest in the bank-led insurer category. Similarly, 61st-month persistency also improved, reflecting greater long-term policy renewals and customer loyalty.

- Customer Experience: The Net Promoter Score (NPS) — a measure of customer satisfaction — rose sharply from 50 (Mar 2023) to 70 (Mar 2025) and further to 75 (Jun 2025), reflecting improved service quality and client trust.

- Tech & Analytics Recognition: The company has been recognized for digital innovation, winning:

- Best Use of Technology to Enhance Customer Experience — Customer Fest Leadership Awards 2023

- Best Use of Data Analytics in Predictive Modeling — Martech Leadership Award 2022

These achievements underscore Canara HSBC Life’s focus on automation, predictive analytics, and data-driven underwriting to enhance both efficiency and customer experience.

Market Position & Peer Standing

According to CRISIL, the company stands among the top-performing bank-led life insurers in India on multiple parameters, including individual Weighted Premium Income (WPI) and year-on-year growth rates.

- It ranked third in individual WPI among bank-led peers during FY2021–FY2025.

- It also achieved the second-highest Y-o-Y growth in FY2025 among comparable insurers.

This strong performance, coupled with a dominant bancassurance network, gives Canara HSBC Life Insurance IPO a clear edge over peers. The synergy between Canara Bank’s massive distribution base and HSBC’s global insurance expertise remains the company’s strongest moat — positioning it as a scalable, capital-efficient, and trusted brand in India’s expanding life insurance landscape.

Canara HSBC Life Insurance IPO Financials Performance

The financial performance of Canara HSBC Life Insurance Co. Ltd. reflects consistent profitability and a robust asset base, even amid a challenging macro environment. Between FY2023 and FY2025, the company demonstrated resilience, maintaining profitability while strengthening its balance sheet.

During FY2025, total revenue stood at ₹234.01 crore, compared to ₹240.88 crore in FY2024 — a marginal 3% decrease, primarily due to market fluctuations in investment income. However, profit after tax (PAT) rose 3% year-on-year to ₹116.98 crore, underscoring improved operational efficiency and disciplined cost management.

Assets under management (AUM) surged from ₹30,548.89 crore in FY2023 to ₹41,852.09 crore in FY2025, reflecting the company’s expanding customer base and healthy inflows across product categories.

The EBITDA also improved from ₹118.82 crore in FY2023 to ₹149.91 crore in FY2025, indicating steady core operational performance. The net worth increased to ₹1,516.86 crore in FY2025, supported by strong reserves and consistent profitability.

Financial Summary (₹ in Crore)

| Particulars | 30 Jun 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

|---|---|---|---|---|

| Assets | 44,047.98 | 41,852.09 | 37,815.80 | 30,548.89 |

| Total Income | 42.35 | 234.01 | 240.88 | 261.59 |

| Profit After Tax (PAT) | 23.41 | 116.98 | 113.32 | 91.19 |

| EBITDA | 31.28 | 149.91 | 146.56 | 118.82 |

| Net Worth | 1,540.28 | 1,516.86 | 1,418.88 | 1,353.07 |

| Reserves & Surplus | 590.28 | 566.86 | 468.88 | 403.07 |

The data underscores Canara HSBC Life Insurance’s stable revenue base, expanding asset portfolio, and rising profits — all of which contribute positively to investor confidence ahead of its IPO launch.

Canara HSBC Life Insurance IPO KPIs

The Canara HSBC Life Insurance IPO is backed by a company that has consistently delivered on critical business metrics such as persistency, solvency, and embedded value growth. The insurer’s persistency ratio, a key measure of customer retention, shows a steady upward trend — with the 13th-month persistency improving to 84.25% as of June 2025, compared to 82.73% a year ago.

Profit before tax for FY2025 rose to ₹1,281.45 crore, up from ₹1,238.73 crore in FY2024, reflecting operational robustness. The claim settlement ratio remained exceptionally high at 99.38%, highlighting the company’s customer-centric claims management process.

Meanwhile, the embedded value (EV) — a vital metric for life insurers — jumped to ₹61,107 crore in FY2025 from ₹51,798 crore in FY2024, reflecting a strong business franchise and sustainable value creation. The Operating Return on EV (RoEV) improved to 19.53%, reinforcing operational efficiency.

Another highlight is the insurer’s Value of New Business (VNB) margin, which remained strong at 19.07% in FY2025, indicating healthy profitability from new policies written during the year.

Key Performance Indicators (₹ in Million)

| Metric | Jun 30, 2025 | Mar 31, 2025 | Mar 31, 2024 | Mar 31, 2023 |

|---|---|---|---|---|

| Individual Weighted Premium Income (WPI) | 3,989.33 | 21,786.83 | 17,026.49 | 16,575.69 |

| Annualized Premium Equivalent (APE) | 4,927.54 | 23,393.88 | 18,877.94 | 18,837.15 |

| Renewal Business Premium | 9,137.38 | 49,059.27 | 42,276.19 | 34,807.46 |

| Claim Settlement Ratio | 99.38% | 99.38% | 99.31% | 99.11% |

| Embedded Value (EV) | 63,526.41 | 61,107.40 | 51,798.61 | 42,719.35 |

| VNB Margin | 19.48% | 19.07% | 20.00% | NA |

| Solvency Ratio | 200.42% | 205.82% | 212.83% | 251.81% |

| Assets Under Management (AUM) | 436,394.98 | 411,664.11 | 373,804.41 | 302,044.00 |

Overall, the insurer’s strong solvency ratio, rising embedded value, and superior claim settlement record make the Canara HSBC Life Insurance IPO stand out among upcoming insurance listings. These fundamentals underscore its ability to maintain growth momentum while safeguarding policyholder interests — a key factor for both retail and institutional investors evaluating this issue.

Valuation & Peers– Canara HSBC Life IPO

Canara HSBC Life Insurance IPO Valuation

At the upper price band of ₹106, Canara HSBC Life Insurance Company Limited is valued at a Price-to-Earnings (P/E) ratio of approximately 86.18x, based on its FY2025 EPS of ₹1.23.

This valuation positions the company in line with other listed private life insurers, though slightly below the premium valuations commanded by established peers such as HDFC Life and SBI Life, which trade at P/E multiples of 90.27x and 74.16x, respectively.

Canara HSBC Life IPO Peer Comparison

| Company Name | EPS (Basic) | NAV (₹ per share) | P/E (x) | RoNW (%) | P/BV Ratio |

|---|---|---|---|---|---|

| Canara HSBC Life Insurance Co. Ltd. | 1.23 | 15.97 | 86.18 | 7.97 | 15.97 |

| SBI Life Insurance Company Ltd | 24.09 | 169.49 | 74.16 | 15.13 | 10.56 |

| HDFC Life Insurance Company Ltd | 8.41 | 75.03 | 90.27 | 11.75 | 10.12 |

| ICICI Prudential Life Insurance Company Ltd | 8.21 | 82.57 | 73.66 | 10.34 | 7.33 |

Valuation Analysis

From a valuation standpoint, Canara HSBC Life Insurance IPO appears fairly priced relative to the life insurance sector’s average trading multiples. While its earnings base (EPS) remains modest compared to large peers, the embedded value (EV) of ₹61,107 crore and a VNB margin of 19% highlight strong long-term profitability potential.

Despite being smaller in scale, the company benefits from a powerful parentage — Canara Bank and HSBC Insurance (Asia-Pacific) — ensuring trust, brand strength, and bancassurance distribution reach across India.

However, the Return on Net Worth (RoNW) at 7.97% remains lower than its peers (SBI Life: 15.13%, HDFC Life: 11.75%), suggesting room for improvement in capital efficiency. The IPO’s pricing thus factors in future growth expectations, particularly from product diversification, digital transformation, and steady improvement in persistency and solvency ratios.

Overall, while the P/E of 86x might look slightly elevated on a near-term earnings basis, the Canara HSBC Life Insurance IPO aligns well with sector benchmarks, supported by stable financials, high claim settlement ratio (99.38%), and strong embedded value growth trajectory.

Strengths & Risks of Canara HSBC Life Insurance IPO

Every IPO comes with both growth levers and potential challenges. The Canara HSBC Life Insurance IPO presents a unique mix of strong fundamentals, powerful promoter backing, and bancassurance dominance — but also faces competition and structural risks inherent to India’s life insurance industry.

| Strengths | Risks / Concerns |

|---|---|

| 1. Strong promoter backing: Jointly promoted by Canara Bank and HSBC Insurance (Asia-Pacific), giving the company a solid foundation of trust, governance, and access to international best practices. | 1. High reliance on bancassurance: Over 90% of new business comes through Canara Bank and partner banks — concentration risk if bank partnerships underperform or face regulatory hurdles. |

| 2. Expansive distribution network: Access to over 15,700 bank branches, including Canara Bank (~9,849 branches), RRBs, and Dhanlaxmi Bank — providing unmatched rural and semi-urban reach. | 2. Intense industry competition: Faces strong competition from larger private insurers like SBI Life, HDFC Life, and ICICI Prudential, which have higher brand recall and digital penetration. |

| 3. Consistent embedded value (EV) growth: EV rose from ₹42,719 million (FY23) → ₹61,107 million (FY25) → ₹63,526 million (Jun 2025), highlighting sustained business expansion and profitability potential. | 3. Slower EPS and RoNW: FY25 EPS of ₹1.23 and RoNW of 7.97% remain modest compared to leading peers — indicating efficiency improvements are still underway. |

| 4. High solvency and financial strength: Solvency ratio at 200.42%, well above the regulatory minimum of 150%, reflects a strong ability to meet future liabilities. | 4. Sensitivity to market volatility: A large proportion of business comes from ULIPs (42–49%), exposing earnings to equity market fluctuations. |

| 5. Technology-driven operations: 99.7% digital application processing, 67% straight-through processing (STP), and industry awards for analytics & customer experience — enhancing efficiency and scalability. | 5. Low protection mix: Protection business contributes only 4–10% of APE, lower than industry standards. A shift towards protection-led growth is still evolving. |

| 6. Improved customer metrics: Net Promoter Score (NPS) improved from 50 → 75 (FY23–Jun 2025) and 13th-month persistency increased to 84.25%, reflecting strong service quality. | 6. Regulatory and interest rate risks: Life insurance products are sensitive to IRDAI regulatory changes and interest rate cycles that can impact product attractiveness. |

The Canara HSBC Life IPO stands out for its strong distribution moat, financial stability, and digital adoption — all key levers for long-term scalability. However, near-term earnings remain modest, and the over-dependence on bancassurance warrants cautious optimism.

From a fundamentals perspective, this IPO appeals to investors seeking exposure to India’s underpenetrated life insurance sector, backed by a trusted promoter group and improving financial parameters.

Canara HSBC Life Insurance IPO GMP

As of October 9, 2025, the Canara HSBC Life Insurance IPO is witnessing moderate traction in the grey market, reflecting stable investor sentiment and steady subscription expectations.

Grey Market Premium (GMP) Trend

| Date | IPO Price (₹) | GMP (₹) | Estimated Listing Price (₹) | Estimated Profit |

|---|---|---|---|---|

| 09-10-2025 | ₹106.00 | ₹10 (No Change Today) | ₹116 (+9.43%) | ₹1,400 |

The GMP of ₹10 indicates a modest premium of around 9–10% over the issue price, translating to an expected listing price near ₹116 per share. The grey market trend has remained stable over the past few days, suggesting balanced demand and a fair valuation perception among investors.

While the GMP is not overly aggressive, it shows a positive bias — particularly for an insurer with strong brand lineage (Canara Bank + HSBC) and consistent EV growth. This modest premium suggests that investors expect a steady listing debut rather than a speculative surge.

Should You Apply for the Canara HSBC Life Insurance IPO?

The Canara HSBC Life Insurance IPO represents the entry of a strong, well-established insurer backed by two powerful promoters — Canara Bank and HSBC Insurance (Asia-Pacific). The company has a clear advantage through its bancassurance-led distribution, digital transformation, and consistent embedded value (EV) growth, which together underline its long-term sustainability.

From a financial perspective, Canara HSBC Life Insurance has maintained steady profitability (PAT up 3% YoY in FY25), rising embedded value (₹63,526 crore as of Jun 2025), and a robust solvency ratio (200.42%). The company’s strong digital adoption (99.7% digital processing and 67% straight-through processing) enhances operational efficiency, while its high claim settlement ratio of 99.38% reflects reliability.

However, investors should note that earnings remain modest (EPS ₹1.23, RoNW 7.97%), and the business is still highly dependent on bancassurance, with over 90% of individual premiums sourced through banks. In addition, a P/E valuation of ~86x places it in line with large peers like SBI Life and HDFC Life — implying that most positives may already be priced in at the issue level.

The Canara HSBC Life Insurance IPO looks fundamentally sound and structurally strong — suitable for investors seeking exposure to the life insurance sector’s long-term growth story in India. While listing gains may be moderate (GMP ~₹10 or ~9% premium), the company’s brand strength, improving profitability, and distribution-led scalability make it a steady long-term investment candidate rather than a pure listing-play IPO.

FAQs – Canara HSBC Life Insurance IPO

Q1. What is the Canara HSBC Life Insurance IPO price band?

A1. The IPO price band is set at ₹100 to ₹106 per share.

Q2. What is the GMP (Grey Market Premium) of Canara HSBC Life IPO?

A2. The latest GMP stands at ₹10, indicating an expected 9–10% premium over the issue price.

Q3. When will the Canara HSBC Life Insurance IPO open and close?

A3. The IPO dates are October 10, 2025 to October 14, 2025.

Q4. What is the lot size for Canara HSBC Life IPO?

A4. Retail investors can apply for one lot of 140 Shares with Minimum Retail Investment (at upper band) of ₹14,840 (140 shares × ₹106).

Q5. Who are the promoters of Canara HSBC Life Insurance Company?

A5. The company is jointly promoted by Canara Bank and HSBC Insurance (Asia-Pacific) Holdings Ltd.

Q6. How has Canara HSBC Life Insurance performed financially?

A6. In FY2025, revenue fell 3%, but PAT rose 3% YoY, with EV reaching ₹63,526 crore.

Q7. What is the solvency ratio of Canara HSBC Life Insurance?

A7. As of June 30, 2025, the solvency ratio was 200.42%, well above regulatory norms.

Q8. What is the embedded value (EV) of Canara HSBC Life Insurance?

A8. The embedded value stood at ₹63,526 crore as of June 30, 2025, showing consistent growth.

Q9. How does the company compare with peers like HDFC Life or SBI Life?

A9. Its P/E of ~86x is in line with top peers but with lower RoNW (7.97%) and smaller scale.

Q10. Should investors apply for Canara HSBC Life Insurance IPO?

A10. Yes, investors with a long-term horizon may consider applying, given strong promoter backing and consistent financial growth.

Related Articles

Canara Robeco AMC IPO: Hot Investment Opportunity in 2025

Copper Stocks in India 2025: The Metal That Powers Growth and Investment

More Articles

One Demat, Multiple Benefits: Power of a Single Demat Account

One Demat vs Multiple Demat – Which is Better for IPO Allotment?