Introduction: The Rising Relevance of Mid Cap Mutual Funds in Modern Portfolios

In 2025, Indian investors are shifting focus. They’re moving beyond market trends and chasing real, long-term growth. At the heart of this shift lies one clear strategy—investing in the Best Mid Cap Mutual Funds.

Mid cap companies are often past the startup stage but not yet market giants. They sit in a dynamic zone—agile enough to grow fast, yet stable enough to survive tough cycles. That balance makes them ideal for investors seeking both returns and resilience.

Mid cap mutual funds are built to tap into this growth. They identify scalable businesses with sound management and strong sector trends. When chosen wisely, these funds offer more than performance—they help build wealth steadily over time.

In this blog, we look at the Best Mid Cap Mutual Funds in 2025. Our focus isn’t just on numbers, but on what makes these funds stand out—strategy, sectors, and long-term potential.

Mid Cap Segment: The Sweet Spot Between Stability and Growth

Mid caps occupy a unique space in the stock market. They aren’t as established as large caps, but they’ve moved beyond the early-stage risks of small caps. For many investors, this makes mid caps a balanced choice—offering the growth potential of emerging companies with more stability than startups.

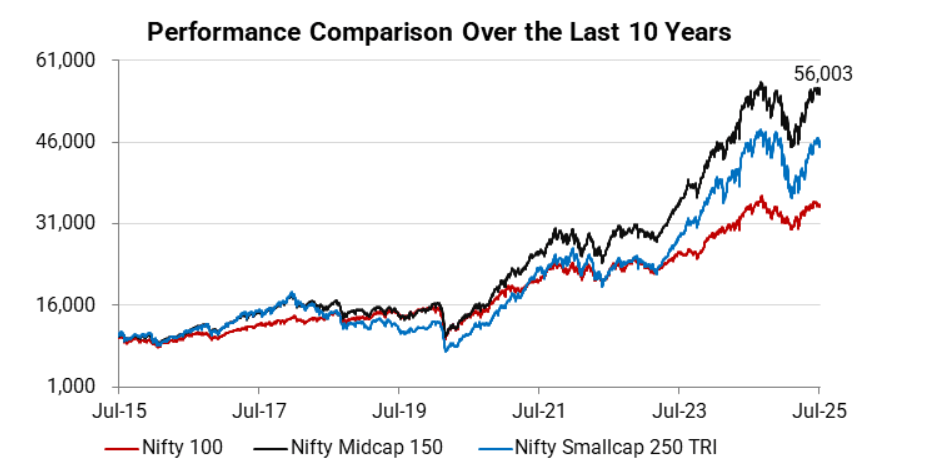

Over the past decade, mid cap indices have consistently outperformed. The Nifty Midcap 150 TRI, for instance, has delivered stronger returns than both large and small cap benchmarks—especially since 2020. As of July 2025, it’s already up over 21% this year alone.

This strong performance isn’t just luck. It’s backed by real change in the Indian economy—rising manufacturing, digital adoption, and formalisation of key sectors. Mid-sized companies are no longer just part of a market cycle. They’re becoming structural growth drivers.

That’s why the Best Mid Cap Mutual Funds are getting renewed attention. They don’t just invest in mid caps—they curate portfolios designed to capture long-term transformation across sectors.

Key Traits of Winning Mid Cap Mutual Funds

Not all mid cap funds are built the same. Some outperform because they follow clear processes, stick to well-defined strategies, and stay disciplined through market cycles. These qualities are what separate the Best Mid Cap Mutual Funds from the rest.

Here’s what top-performing funds typically have in common:

1. Focused Stock Selection

Top funds don’t chase every mid cap that’s trending. Instead, they look for companies with strong business models, visible earnings growth, and solid corporate governance. A bottom-up approach helps them find quality early—and hold on through volatility.

2. Sector Insight

The best funds aren’t just lucky—they’re prepared. They identify long-term trends in sectors like IT, healthcare, manufacturing, or retail, and build positions early. This sector foresight often plays a big role in sustained performance.

3. Risk Management

Returns are only half the story. The top mid cap funds also manage downside risks well. They keep volatility in check, focus on companies with healthy balance sheets, and avoid over-concentration in risky bets.

4. Consistency Over Time

Anyone can outperform in a bull market. What makes the Best Mid Cap Mutual Funds different is consistency—beating the benchmark across 3-year, 5-year, and 10-year periods. They don’t just ride trends; they stick to a strategy.

5. Fund Manager Experience

Experienced managers know when to be aggressive and when to be cautious. Many high-performing funds are led by professionals who’ve handled multiple market cycles and know how to navigate both upturns and downturns.

In the next section, we’ll look at five such funds that reflect these traits—and have delivered impressive long-term results.

5 High-Conviction Mid Cap Funds (2025) – A Strategic Review

The Best Mid Cap Mutual Funds aren’t defined by a single year of high returns. What makes them stand out is a mix of strategy, consistency, and the ability to adapt to changing market conditions.

Below are five mid cap funds that have delivered strong long-term performance while maintaining discipline in portfolio construction and risk management:

Motilal Oswal Midcap Fund – Focused Bets, High Conviction

This fund takes a concentrated approach. It holds fewer stocks but invests with strong conviction. That strategy has paid off—delivering a 10-year CAGR of 20.5%, one of the highest in the mid cap category.

Its top holdings include Coforge, Persistent Systems, and Trent—companies with dominant positions in IT and retail. With over 24% exposure to tech and a bias toward consumer themes, the fund targets scalable businesses aligned with India’s long-term growth story.

👉 Ideal for: Investors who believe in a buy-and-hold strategy with a focus on high-growth themes.

Edelweiss Mid Cap Fund – Disciplined, Yet Flexible

Edelweiss Mid Cap Fund strikes a balance between growth and valuation. It follows a bottom-up stock-picking approach, but adapts to macro conditions smartly. Its 10-year CAGR of 20.03% shows strong execution over time.

The fund spreads its bets across 55–65 stocks, with notable investments in Persistent Systems, Max Healthcare, and Coforge. Sector allocations lean toward financials, healthcare, and tech—pillars of India’s medium-term expansion.

👉 Ideal for: Investors looking for diversification, steady alpha, and smart sector rotation.

Kotak Mid Cap Fund – Early Movers with a Valuation Lens

Kotak’s strategy focuses on identifying mid-sized companies with long growth runways—early, and at fair valuations. The fund has delivered a 10-year CAGR of 19.8%, supported by consistent stock selection.

Its top holdings include Fortis Healthcare, Mphasis, and Solar Industries. Sector weight is tilted toward IT, chemicals, and healthcare. The fund stays away from speculative themes and emphasizes balance sheet strength.

👉 Ideal for: Investors seeking long-term compounders backed by sound financials and valuation discipline.

Invesco India Mid Cap Fund – Quality-First, Focused Portfolio

Invesco follows a clear quality-growth approach. It picks companies with strong governance, clean balance sheets, and consistent earnings. Its 10-year CAGR stands at 19.48%—solid performance, especially during volatile phases.

The portfolio has around 40–50 stocks, including BSE, L&T Finance, and Prestige Estates. Financials and healthcare dominate the fund’s exposure. It doesn’t chase momentum, preferring sustainable growth drivers.

👉 Ideal for: Investors who value steady growth with a strong emphasis on risk control.

HDFC Mid Cap Fund – Conservative, Yet Consistent

This fund is known for its conservative stance. It avoids momentum trades and prefers companies with stable cash flows and efficient capital use. The result: a 10-year CAGR of 19.03%—with relatively lower downside risk.

Top holdings include Max Financial, Coforge, and Federal Bank. Automobile, banking, and healthcare make up the largest sector weights. The fund’s size is large, but it remains disciplined in execution.

👉 Ideal for: Investors seeking steady returns without excessive volatility.

Each of these funds reflects a different style—concentrated vs diversified, aggressive vs conservative—but they all share the ability to deliver long-term value.

Risk and Return: What the Numbers Really Say

When evaluating the Best Mid Cap Mutual Funds, it’s easy to focus only on returns. But smart investors know that risk metrics are just as important. High returns are meaningful only when they come with controlled volatility and consistent risk-adjusted performance.

Let’s decode the data behind the top funds we discussed:

| Scheme Name | 1Y (%) | 3Y CAGR (%) | 5Y CAGR (%) | 10Y CAGR (%) | Volatility (SD%) | Sharpe | Sortino |

|---|---|---|---|---|---|---|---|

| Motilal Oswal Midcap Fund | 40.22 | 33.94 | 35.01 | 20.50 | 17.68 | 0.43 | 0.80 |

| Edelweiss Mid Cap Fund | 33.96 | 27.17 | 32.91 | 20.03 | 16.22 | 0.43 | 0.85 |

| Kotak Mid Cap Fund | 27.66 | 23.60 | 29.86 | 19.80 | 15.30 | 0.39 | 0.76 |

| Invesco India Mid Cap Fund | 35.30 | 26.46 | 30.18 | 19.48 | 16.57 | 0.45 | 0.88 |

| HDFC Mid Cap Fund | 25.00 | 28.15 | 31.21 | 19.03 | 14.19 | 0.50 | 1.08 |

| Category Average | 25.95 | 23.19 | 28.47 | 17.63 | 15.42 | 0.43 | 0.79 |

| Benchmark – Nifty Midcap 150 | 22.39 | 24.14 | 30.05 | 18.55 | 15.98 | 0.39 | 0.80 |

What Do These Numbers Tell Us?

- CAGR Performance: All five funds have beaten the benchmark over 10 years. This confirms they aren’t just lucky in one phase—they’re built to deliver over the long haul.

- Volatility (Standard Deviation): HDFC Mid Cap Fund shows the lowest volatility, ideal for conservative investors. Motilal Oswal, with higher volatility, is more suited for aggressive investors comfortable with short-term swings.

- Sharpe & Sortino Ratios: These ratios show risk-adjusted performance. HDFC leads on both—suggesting better returns per unit of risk. Invesco and Edelweiss also maintain strong scores.

While return percentages attract attention, these risk measures reveal how sustainably those returns were generated. The Best Mid Cap Mutual Funds combine both—delivering alpha while managing risk responsibly.

Lessons from the Best Mid Cap Mutual Funds

What separates the Best Mid Cap Mutual Funds from the rest? It’s not just performance—it’s consistency, clarity, and control. Here are five quick takeaways to keep in mind when choosing the right fund:

First, process beats performance.

Top funds stick to a defined strategy—whether it’s concentrated bets or diversified holdings. Don’t chase returns; choose a fund that follows a repeatable method.

Next, sector focus makes a difference.

Funds that invested early in themes like IT, healthcare, and retail outperformed. A strong sector view often drives long-term alpha.

Also, risk must be measured.

Metrics like Sharpe and Sortino matter. Funds with steady ratios—like HDFC and Invesco—prove that high returns can come with controlled volatility.

Moreover, consistency counts.

The best funds deliver across 3, 5, and 10 years. That’s a sign of discipline, not luck.

Lastly, size supports stability.

Big doesn’t mean bad. Larger AUMs, like in Kotak or HDFC, reflect trust—so long as the fund remains agile.

In short: focus on quality, not just recent winners. The best funds succeed with s

Final Thoughts: How to Invest in Mid Cap Funds for the Long Haul

Mid caps aren’t just a phase—they’re becoming a long-term engine of India’s economic story. From digital transformation to domestic manufacturing, mid-sized businesses are at the center of it all.

That’s why the Best Mid Cap Mutual Funds deserve a place in your portfolio—not for short-term gains, but for decade-long compounding.

Here’s how to make the most of them:

- Stay invested: Don’t panic during corrections. Mid caps are volatile, but that’s the price of higher growth.

- Use SIPs: Systematic investing helps smooth out market fluctuations and builds wealth over time.

- Diversify: Choose 1–2 mid cap funds that complement your large and flexi-cap holdings.

- Review yearly: Track performance, but don’t overreact to temporary dips. Focus on consistency and strategy.

- Have patience: True wealth in mid caps comes not in one year, but over many.

As India enters a new growth phase, mid cap funds offer a unique opportunity to participate in the rise of tomorrow’s leaders. Invest wisely, hold firmly—and let time do the rest.

FAQs: Best Mid Cap Mutual Funds

What are mid cap mutual funds?

Mid cap mutual funds invest in medium-sized companies with market capitalisation between ₹5,000 crore and ₹20,000 crore.

Are mid cap mutual funds risky?

Yes, they carry moderate risk—more than large caps but less than small caps.

Who should invest in mid cap mutual funds?

Investors with a long-term horizon and moderate risk tolerance should consider them.

What is the ideal holding period for mid cap funds?

At least 5–7 years to ride out volatility and benefit from compounding.

How do I choose the best mid cap mutual fund?

Look for consistent performance, strong fund management, and reasonable risk metrics.

Which are the best mid cap mutual funds in 2025?

Some top funds include Motilal Oswal, Edelweiss, Kotak, Invesco, and HDFC Mid Cap Fund.

Do mid cap funds beat large cap funds in the long run?

Historically, mid cap funds have outperformed large caps over 7–10 year periods.

Can I start a SIP in mid cap mutual funds?

Yes, SIPs are ideal for investing in mid cap funds as they manage volatility better.

Are mid cap mutual funds suitable for first-time investors?

They may be too volatile for beginners; consider starting with large cap or balanced funds.

Do mid cap funds pay dividends?

Some do, but most investors opt for the growth option for better long-term returns.

Related Articles

IEX Market Coupling Triggers Power Market Shift: These 5 Stocks Could Rally Next

Luxury Housing Boom: Real Estate Stocks to Watch in 2025

How to Read Quarterly Results: A Beginner’s Guide to Earning Reports