Introduction

India’s power and electrical infrastructure sector is buzzing with opportunities, and the upcoming Atlanta Electricals IPO is set to spark strong investor interest. Known for its expertise in power, auto, and inverter-duty transformers, the company has built a solid footprint across state electricity boards, private players, and renewable energy projects — positioning itself as a trusted partner in India’s electrification drive.

The Atlanta IPO aims to raise ₹687.34 crore through a mix of fresh issue and offer for sale. Proceeds will be directed toward debt reduction, working capital funding, and general corporate purposes, strengthening both liquidity and growth visibility.

With India targeting 500 GW of renewable capacity by 2030 and accelerating investments in transmission, distribution, and rural electrification, Atlanta Electricals is strategically aligned with this transformation. In FY25, the company delivered revenues of over ₹1,250 crore with improving double-digit margins, reflecting strong operational momentum.

This IPO presents an opportunity for investors to participate in India’s power infrastructure story through a company that combines manufacturing scale, sector relevance, and financial growth. In the following sections, we’ll deep-dive into the Atlanta Electricals IPO details, financial performance, GMP trends, strategies, and expert view to help you decide whether this IPO deserves a spot in your portfolio.

Atlanta Electricals IPO Details

IPO Snapshot

| Particulars | Details |

|---|---|

| IPO Size | ₹687.34 crore |

| Fresh Issue | 0.53 crore shares (aggregating up to ₹400.00 crore) |

| Offer for Sale (OFS) | 0.38 crore shares (aggregating up to ₹287.34 crore) |

| Face Value | ₹2 per share |

| Price Band | ₹718 to ₹754 per share |

| Lot Size | 19 shares |

| Minimum Investment (Retail) | ₹14,326 (1 lot, 19 shares at upper band) |

| Retail Max Investment | 13 lots (247 shares) – ₹1,86,238 |

| sNII Investment | Min: 14 lots (266 shares) – ₹2,00,564; Max: 69 lots (1,311 shares) – ₹9,88,494 |

| bNII Investment | Min: 70 lots (1,330 shares) – ₹10,02,820 |

| Employee Discount | ₹70 per share |

| Issue Type | Book-Building IPO |

| Total Shares Offered | 91,15,934 shares |

| Listing Exchange | BSE, NSE |

| Pre-Issue Shareholding | 7,15,84,800 shares |

| Post-Issue Shareholding | 7,68,89,839 shares |

| Promoter Holding (Pre-Issue) | 94.36% |

| Promoter Holding (Post-Issue) | 86.97% |

| IPO Documents | RHP file |

| Registrar | MUFG Intime India Pvt. Ltd. |

Important Dates (Tentative Schedule)

| Event | Date |

|---|---|

| IPO Open Date | Mon, Sep 22, 2025 |

| IPO Close Date | Wed, Sep 24, 2025 |

| Basis of Allotment | Thu, Sep 25, 2025 |

| Initiation of Refunds | Fri, Sep 26, 2025 |

| Credit of Shares to Demat | Fri, Sep 26, 2025 |

| Listing Date | Mon, Sep 29, 2025 |

| Cut-off Time for UPI Mandate Confirmation | 5 PM, Wed, Sep 24, 2025 |

Objects of the Issue-Atlanta IPO

The Company proposes to utilize the Net Proceeds from the fresh issue towards the following objectives:

- Repayment / prepayment of certain borrowings – ₹79.12 crore

- Funding working capital requirements – ₹210.00 crore

- General corporate purposes – Balance amount

Company Background & Business Model- Atlanta Electricals IPO

Atlanta Electricals Limited, a pioneer in India’s transformer manufacturing sector, stands as one of the leading producers of power, auto, and inverter duty transformers in the country. As of FY25, the company ranks among the few capable of manufacturing transformers up to 200 MVA / 220 kV, and after acquiring BTW-Atlanta Transformers India Pvt. Ltd. and commissioning the Vadod Unit, it has scaled up to produce 500 MVA / 765 kV transformers. This places Atlanta in an exclusive league of advanced transformer manufacturers in India (Source: CRISIL Report).

Over the last three fiscals, Atlanta Electricals has posted impressive growth, with revenue rising from ₹8,738.83 million in FY23 to ₹12,441.80 million in FY25, clocking a CAGR of 19.32%. This performance underscores its strong execution capability, robust order pipeline, and industry tailwinds.

Growth Drivers & Industry Alignment

- Power Sector Demand: India’s power sector is witnessing a transformation, with strong demand from data centres, EV charging networks, and high-speed rail projects, all requiring modern transformers across voltage ranges (Source: CRISIL Report).

- Renewable Push: With India targeting 500 GW non-fossil capacity by 2030, renewable expansion is fueling transformer demand. Atlanta has already aligned with this shift — e.g., it won a major order for 8×80 MVA transformers for the Ultra Mega Solar Park in Andhra Pradesh.

- Product Innovation: Atlanta has developed specialized solutions like the 14/17 MVA aluminium foil wound inverter duty transformer tested successfully for solar power applications in 2022.

- Strong Domestic & Export Presence: With over 4,400 transformers supplied aggregating 94,000 MVA, the company serves state/national grids, private players, and renewable developers, and has also expanded to markets like the U.S., Kuwait, and Oman.

Manufacturing Infrastructure

Atlanta operates five manufacturing facilities, with four fully operational and one (Vadod Unit) starting commercial production in July 2025. Collectively, these facilities offer a capacity of 63,060 MVA spread across Gujarat and Karnataka.

- NABL-accredited labs ensure in-house testing for transformers up to 200 MVA / 245 kV.

- Facilities are certified with ISO 9001:2015, ISO 14001:2015, ISO 45001:2018, reflecting a strong focus on quality, environment, and safety.

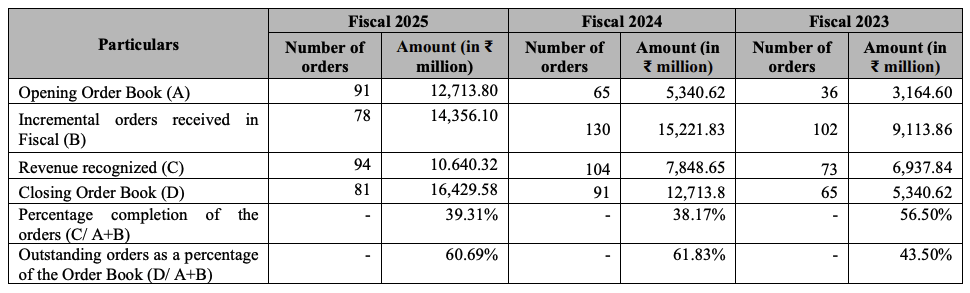

Order Book & Execution Strength

Atlanta Electricals has maintained a robust and diversified order book:

- FY25 Closing Order Book: ₹16,429.58 million

- Public vs. Private Contribution: 82.08% PSU orders, 17.92% private sector

- Execution Efficiency: Order completion rate ~39.31% in FY25, demonstrating efficient delivery while maintaining a high pipeline.

Customer Base & Partnerships

As of March 31, 2025, Atlanta Electricals catered to 208 customers across 19 states and 3 UTs. Its client list includes marquee names such as:

- GETCO (Gujarat Energy Transmission Corp. Ltd.)

- Adani Green Energy

- TATA Power

- SMS India

The company’s strong reputation, coupled with long-standing relationships in transmission, renewable energy, and mobility sectors, has positioned it as a reliable partner in India’s infrastructure growth story.

Financial Performance of Atlanta Electricals IPO

Atlanta Electricals Ltd. has demonstrated strong revenue growth and robust profitability over the past three fiscal years, reflecting a resilient business model and consistent execution. Between FY24 and FY25, the company’s revenue surged by 43%, while profit after tax (PAT) increased by 87%, highlighting operational efficiency and margin expansion.

Financial Summary (in ₹ Crore)

| Particulars | FY25 | FY24 | FY23 |

|---|---|---|---|

| Assets | ₹866.19 | ₹559.25 | ₹560.76 |

| Revenue from Operations | ₹1,244.18 | ₹867.55 | ₹873.88 |

| Growth in Revenue (%) | 43.41% | -0.72% | 39.67% |

| EBITDA | ₹199.88 | ₹123.16 | ₹143.12 |

| EBITDA Margin (%) | 16.07% | 14.20% | 16.38% |

| Profit After Tax (PAT) | ₹118.65 | ₹63.36 | ₹87.47 |

| PAT Margin (%) | 9.54% | 7.32% | 10.01% |

| Net Worth | ₹349.90 | ₹228.47 | ₹164.90 |

| Total Borrowing | ₹141.03 | ₹48.60 | ₹73.09 |

| Net Working Capital | ₹2207.60 | ₹1,586.35 | ₹1,365.52 |

| Order Book | ₹1,642.96 | ₹1,271.38 | ₹534.06 |

| Order Book – Govt/PSU | ₹1,348.52 | ₹937.52 | ₹330.67 |

| Order Book – Private | ₹294.44 | ₹333.86 | ₹203.39 |

Analysis:

- Revenue growth of 43% in FY25 underscores Atlanta Electricals’ ability to scale its operations amid rising demand for transformers in renewable energy, railways, and industrial sectors.

- EBITDA margin improved to 16.07%, reflecting disciplined cost management and operational efficiencies.

- PAT margin at 9.54% demonstrates healthy profitability in a capital-intensive business.

- The net worth increase from ₹228.47 Cr in FY24 to ₹349.90 Cr in FY25 highlights strengthened financial stability post-expansion.

- A strong order book of ₹1,642.96 Cr ensures sustained revenue visibility over the near term, with ~82% from government and public sector entities.

Key Ratios of Atlanta IPO

| Key Ratio | FY25 | Benchmark / Notes |

|---|---|---|

| ROE (%) | 33.91 | Strong return indicating efficient equity utilization |

| ROCE (%) | 39.43 | High capital efficiency in a capital-intensive industry |

| Debt/Equity (x) | 0.40 | Conservative leverage and strong balance sheet |

| PAT Margin (%) | 9.54 | Solid profitability for infrastructure manufacturing |

| EBITDA Margin (%) | 16.07 | Consistent operational performance |

| Price to Book Value | 23.62 | Indicates valuation premium in IPO pricing |

Analysis:

- ROE at 33.91% and ROCE at 39.43% reflect the company’s capability to generate high returns on both equity and total capital.

- Debt/Equity ratio of 0.40 signals low financial risk, providing comfort to investors considering the Atlanta Electricals IPO.

- Margins and ratios demonstrate Atlanta’s robust profitability and efficiency, making the company well-positioned for future growth in India’s expanding transformer and renewable energy markets.

Valuation & Peer Comparison – Atlanta Electricals IPO

Atlanta Electricals IPO is priced with a Price to Book Value (P/BV) of 23.62, reflecting a premium over its peers but supported by strong growth, diversified order book, and high return ratios. The company’s Pre-IPO EPS stands at ₹16.57 with a P/E multiple of 46.33x, indicating market expectations for robust future earnings growth.

Peer Comparison Table

| Company Name | EPS (Basic) | NAV per Share (₹) | P/E (x) | RoNW (%) | P/BV Ratio |

|---|---|---|---|---|---|

| Atlanta Electricals Ltd. | 16.57 | 48.88 | 46.33 | 33.91 | 23.62 |

| Voltamp Transformers Ltd. | 321.65 | 1,569.24 | 22.15 | 20.50 | 4.54 |

| Transformers And Rectifiers (India) Ltd. | 7.21 | 41.71 | 69.97 | 17.29 | 12.29 |

| Danish Power Limited | 34.55 | 162.50 | 25.80 | 18.00 | 5.50 |

Valuation Analysis

- Premium Pricing Justification: Atlanta Electricals commands a higher P/BV and P/E multiple relative to its peers due to strong return on equity (33.91%), robust order book, and a diversified product portfolio catering to high-growth sectors such as renewable energy and railways.

- Profitability Edge: The company’s PAT margins of 9.54% and EBITDA margins of 16.07% position it ahead of peers in operational efficiency.

- Peer Benchmarking: While Voltamp Transformers and Danish Power show strong NAVs, Atlanta’s focus on high-capacity transformers, renewable projects, and a pan-India presence justifies a valuation premium.

- Future Growth Potential: With India targeting 500 GW of renewable capacity by 2030 and expansion in industrial electrification, Atlanta Electricals is poised to capitalize on these trends, making the Atlanta IPO attractive for long-term investors.

Takeaway:

Atlanta Electricals’ valuation reflects a growth premium, supported by consistent financial performance, sector tailwinds, and a strong competitive moat. Compared to its peers, the company offers a combination of profitability, scale, and strategic market positioning, making the Atlanta Electricals IPO a compelling opportunity for investors seeking exposure to India’s expanding transformer and power infrastructure sector.

Strengths & Risks – Atlanta Electricals IPO

| Strengths | Risks |

|---|---|

| Market Leader in Transformers: One of India’s leading manufacturers of power, auto, and inverter duty transformers with a presence across 19 states and three union territories. | Sector Cyclicality: The power and electrical equipment sector is sensitive to economic cycles and government spending on infrastructure. |

| Strong Financial Performance: Revenue growth of 43% and PAT growth of 87% in FY25, with healthy EBITDA margins of 16.07% and ROE of 33.91%. | High Valuation: Pre-IPO P/E of 46.33x and P/BV of 23.62x implies a premium, which may limit upside for short-term investors. |

| Diversified Product Portfolio: Offers power, inverter-duty, furnace, generator, and special-duty transformers catering to multiple industries. | Order Execution Risks: Delays in project execution or supply chain disruptions could affect revenue recognition and profitability. |

| Robust Order Book: Closing order book of ₹1,642.96 crore as of FY25, with strong contributions from government and private sectors. | Regulatory & Compliance Risks: Changes in policies, tariffs, or compliance requirements could impact operations. |

| Strategic Expansion: Addition of Vadod Unit and BTW-Atlanta subsidiary enhances manufacturing capacity up to 63,060 MVA. | Competition: Intense competition from established and new players may pressure margins and market share. |

| Exposure to Growth Sectors: Increasing demand from renewable energy projects, EV infrastructure, and high-speed railways. | Foreign Exchange Risk: Export exposure may lead to forex fluctuations impacting profitability. |

| Experienced Management: Leadership with over 30 years in transformer manufacturing ensures strategic execution. | Raw Material Dependency: Fluctuations in copper, steel, and oil prices can impact manufacturing costs. |

Takeaway:

The Atlanta Electricals IPO offers a mix of robust growth potential, sector leadership, and diversification, balanced against valuation premium and sector risks. Investors should weigh both strengths and risks before subscribing.

Atlanta Electricals IPO GMP / Grey Market Premium

The grey market activity for the Atlanta Electricals IPO indicates moderate positive sentiment among investors ahead of the listing. The GMP provides a glimpse of expected listing gains and investor appetite in the informal market.

| GMP Date | IPO Price (₹) | GMP (₹) | Sub2 Sauda Rate | Estimated Listing Price (₹) | Estimated Profit (₹)* |

|---|---|---|---|---|---|

| 18-09-2025 | 754.00 | ₹40 – GMP Up | 600 / 8400 | 794 (5.31%) | 760 |

Analysis:

- The GMP of ₹40 suggests a positive but moderate listing sentiment.

- Based on grey market trends, the estimated listing price is around ₹794, translating to an estimated profit of ~5.31% for investors subscribing at the upper price band.

- Substantial sub2 sauda activity (600/8400) indicates strong retail participation and HNI interest in the Atlanta IPO.

- Investors should note that GMP is indicative only and can fluctuate until actual listing.

Investor Insight:

The Atlanta Electricals IPO shows promising initial market sentiment, reflecting confidence in the company’s growth story, sector positioning, and robust order book.

Conclusion – View on Atlanta Electricals IPO

The Atlanta Electricals IPO offers investors a chance to participate in India’s growing power and electrical infrastructure story. With a robust order book of ₹1,642.96 Cr, diversified customer base across 19 states, and proven manufacturing capabilities (up to 500 MVA, 765 kV), the company is well-positioned to capitalize on India’s renewable energy expansion and electrification drive.

The IPO proceeds will strengthen the balance sheet by reducing debt, funding working capital, and supporting general corporate purposes. Financially, the company has demonstrated 43% revenue growth and 87% PAT growth in FY25, with healthy margins (EBITDA ~16%, PAT ~9.5%) and ROE of 33.9%, reflecting operational efficiency.

Investors seeking exposure to the transformer manufacturing sector aligned with India’s infrastructure and renewable energy boom may find Atlanta IPO compelling.

Short-Term Strategy

- Listing Gains: With a GMP of ₹40, the Atlanta IPO shows potential for 5–6% listing gains for retail investors.

- Quick Flip Opportunity: Investors with a short-term horizon could consider subscribing at the upper price band and booking profits on listing day.

- Market Monitoring: Track grey market trends and sectoral news, especially orders from renewable and industrial projects, for short-term momentum.

Long-Term Strategy

- Growth Play: With diversified products, a pan-India presence, and entry into high-capacity transformers (up to 500 MVA), the company is poised for long-term growth.

- Renewable & Infrastructure Exposure: Investors gain exposure to India’s power, transmission, and renewable energy sectors, which are expected to see strong expansion.

- Stable Returns: Healthy ROE and ROCE, coupled with a growing order book, indicate sustainable profitability and potential for wealth creation over time.

Allotment Strategy

- Retail Investors: Apply for at least 1–2 lots to maximize chances of allotment without overcommitting.

- HNI Investors: Ensure bids within sNII and bNII limits to improve allocation probability.

- Employee Category: Eligible employees can take advantage of the employee discount of ₹70/share, enhancing potential gains.

“Atlanta Electricals IPO: Powering your portfolio with India’s electrifying growth story.”

FAQs – Atlanta Electricals IPO

1. What is the issue size of Atlanta Electricals IPO?

The Atlanta Electricals IPO is a book-built issue of ₹687.34 crore, comprising a fresh issue of ₹400 crore and an Offer for Sale of ₹287.34 crore.

2. What is the price band of Atlanta Electricals IPO?

The IPO price band is ₹718 to ₹754 per share.

3. How many shares are being offered in the Atlanta IPO?

A total of 91,15,934 shares are being offered, including 53,05,039 fresh shares and 38,10,895 shares under OFS.

4. What is the lot size and minimum investment for retail investors?

The lot size is 19 shares, with a minimum retail investment of ₹14,326 (based on the upper price band).

5. When does Atlanta Electricals IPO open and close?

The IPO opens on September 22, 2025, and closes on September 24, 2025.

6. Where will Atlanta Electricals IPO be listed?

The IPO will list on BSE and NSE, with a tentative listing date of September 29, 2025.

7. What is the company’s business and product portfolio?

Atlanta Electricals manufactures power, auto, and inverter duty transformers, serving state grids, private players, and renewable energy projects across India.

8. What are the objects of the Atlanta IPO?

Proceeds will be used for repayment of borrowings (₹79.12 Cr), funding working capital (₹210 Cr), and general corporate purposes.

9. Who are the promoters of Atlanta Electricals?

The promoters include Krupeshbhai Narharibhai Patel, Niral Krupeshbhai Patel, Amish Krupeshbhai Patel, Tanmay Surendrabhai Patel, Patel Family Trustee Pvt. Ltd., and Atlanta UHV Transformers LLP.

10. How has the company performed financially in FY25?

In FY25, Atlanta Electricals reported revenue of ₹1,250.49 Cr, PAT of ₹118.65 Cr, EBITDA of ₹199.88 Cr, with ROE of 33.91% and EBITDA margin of 16.07%, reflecting strong growth and profitability.

Related Articles

How to Analyze an IPO Before Investing: A Step-by-Step Guide

One Demat vs Multiple Demat – Which is Better for IPO Allotment?