Introduction — Weekly Market Update

Welcome to the Weekly Market Update November 2nd Week, your complete breakdown of how Indian equities performed through a data-packed and sentiment-driven week. This edition of our Weekly Stock Market Update brings together market momentum, sector-wise trends, top performers, and macroeconomic drivers shaping trading behaviour.

With the Nifty 50, Sensex, and broader indices showcasing resilience amid global volatility, this week was filled with strong earnings, political clarity, and improved investor confidence. If you missed our previous market recap, feel free to check the last weekly update blog here.

For readers who follow market commentary closely, you can browse all our market update blogs anytime.

Let’s dive into the deeper analysis for the Weekly Market Update November 2nd Week and understand what moved markets this time.

Indian Market Overview — Weekly Market Update November 2nd Week

Indian equity markets ended the week with notable gains, supported by strong corporate earnings, positive commentary from Moody’s, and a decisive political outcome with the NDA winning the Bihar elections. The broader narrative of this Weekly Stock Market Update highlights improving sentiment despite global currency and commodity pressures.

The Nifty 50 climbed nearly 1.8% for the week, the Sensex advanced 1.40%, and the Bank Nifty gained 0.98%. IT index outperformed major sectors amid the US government reopening news, while the rupee hovered around ₹88.71 per USD, signaling weakness due to global dollar strength.

Brent crude declined to $63.82 per barrel, indicating weakening global demand.

Index Performance — Weekly Market Update November 2nd Week

| Index | Last Price | Weekly Change | % Change |

|---|---|---|---|

| NIFTY 50 | 25,778.20 | +238.95 | 0.94% |

| SENSEX | 84,630.96 | +1,172.11 | 1.40% |

| Nifty Bank | 58,535.05 | +569.95 | 0.98% |

| Nifty IT | 36,368.40 | +1,033.60 | 2.93% |

| S&P BSE SmallCap | 53,141.84 | +192.51 | 0.36% |

If you’re someone who prefers pre-market analysis, check our daily premium insights.

Sectoral Highlights — Weekly Market Update November 2nd Week

Sector performance remained largely positive this week, with IT, Defence, Pharma, and Infrastructure leading the rally. This part of the Weekly Market Update November 2nd Week shows that most sectors benefited from stable macro conditions and investor confidence.

Defence stocks surged 4.1%, driven by strong order inflows, while IT gained 3.4% as global tech sentiment improved. Pharma and Infrastructure continued their upward momentum. On the weaker side, Realty (–0.6%) and Media (–0.7%) closed slightly negative.

Best Performing Sectors

Below are the top-performing sectors of the week:

| Sector | Weekly Change % |

|---|---|

| Hardware Technology & Equipment | 9.16% |

| Commercial Services & Supplies | 3.20% |

| Transportation | 3.16% |

| Consumer Durables | 3.09% |

| Software & Services | 2.43% |

These gains reflect strong demand cycles, supply-chain improvements, and heightened investor interest—key insights needed for this Weekly Stock Market Update.

Weakest Sectors

| Sector | Weekly Change % |

|---|---|

| Others | –4.13% |

| Healthcare | –2.81% |

| Chemicals & Petrochemicals | –1.23% |

| Retailing | –1.23% |

| Media | –0.83% |

Weakness in healthcare and chemicals highlights margin pressures and global demand uncertainty.

Industry Movers — Weekly Market Update November 2nd Week

Industry-level action was even more dynamic this week, showing where sharp money is flowing. In this segment of the Weekly Market Update November 2nd Week, industries linked to capital markets, paints, and manufacturing saw significant momentum. Meanwhile, healthcare-related industries struggled amid cost pressures and slow global demand recovery.

This deeper breakdown will help traders and investors identify rotation trends that often precede larger market moves—a core part of every Weekly Stock Market Update.

Top Performing Industries — Weekly Market Update November 2nd Week

| Industry | Weekly Change % |

|---|---|

| Capital Markets | 13.19% |

| IT Networking Equipment | 13.13% |

| Paints | 10.09% |

| Commercial Vehicles | 8.08% |

| Castings & Forgings | 6.36% |

Strong gains in Capital Markets and IT Networking indicate recovery in transactional volumes and digital infrastructure spending—an important positive indicator for upcoming weeks.

Worst Performing Industries— Weekly Market Update November 2nd Week

| Industry | Weekly Change % |

|---|---|

| Medical Equipment | –4.78% |

| Other Leisure Facilities | –4.26% |

| Petrochemicals | –4.23% |

| Investment Companies | –4.13% |

| Healthcare Facilities | –3.85% |

Despite broader market strength, medical and healthcare-related industries faced pressure due to weak quarterly earnings and margin challenges.

Top Weekly Gainers & Losers (Stocks)

This week’s stock performance shows strong traction in automobiles, technology, financial services, and telecom. High-volume buying in quality names defines the stock action for the Weekly Market Update November 2nd Week, while certain pockets saw sharp correction due to valuation concerns or weak financial commentary.

These insights add strong value to your Weekly Stock Market Update as they capture short-term sentiment and long-term opportunities.

Top Gainers — Weekly Market Update November 2nd Week

| Stock | Weekly Change % | LTP |

|---|---|---|

| Tata Motors CV | 21.8% | 317.6 |

| Data Patterns | 18.52% | 3100.7 |

| Muthoot Finance | 15.34% | 3725.6 |

| Vodafone Idea | 13.84% | 10.94 |

| AIA Engineering | 13.41% | 3693 |

Auto, fintech, defence tech, and telecom dominated buying interest due to strong results and improved demand visibility.

Top Losers — Weekly Market Update November 2nd Week

| Stock | Weekly Change % | LTP |

|---|---|---|

| Transformers & Rectifiers | –18.81% | 318.2 |

| Cohance Lifesciences | –13.02% | 615.5 |

| Ola Electric | –9.15% | 42.29 |

| Sapphire Foods | –9.06% | 245.8 |

| Krishna Institute | –8.67% | 665 |

Losers came from a mix of sectors such as EV, QSR, healthcare, and industrials—mainly driven by earnings disappointment or sector-wide selling.

Global Market Overview

Global markets remained largely negative this week, putting pressure on risk sentiment. The U.S. Dow and S&P 500 stayed slightly weak, while Nasdaq saw mild gains supported by tech stocks. European indices such as FTSE 100, CAC 40, and DAX posted steady declines, indicating caution ahead of economic data releases.

Asian markets like Nikkei 225 and Hang Seng corrected sharply due to mixed macro numbers and concerns around corporate earnings.

This global setup in the Weekly Stock Market Update signals that Indian markets may remain volatile but relatively resilient, supported by domestic liquidity and strong earnings.

| Global Index | Last | Change | % Change |

|---|---|---|---|

| Dow 30 | 47,147.50 | -309.74 | -0.65% |

| S&P 500 | 6,734.11 | -3.38 | -0.05% |

| Nasdaq Composite | 22,900.60 | +30.23 | +0.13% |

| FTSE 100 | 9,698.37 | -109.31 | -1.11% |

| CAC 40 | 8,170.09 | -62.40 | -0.76% |

| DAX | 23,876.60 | -165.07 | -0.69% |

| Nikkei 225 | 50,376.50 | -905.30 | -1.77% |

| Hang Seng | 26,572.50 | -500.57 | -1.85% |

| Shanghai Composite | 3,990.49 | -39.01 | -0.97% |

For live global references, readers may check:

• Economic Times: https://economictimes.indiatimes.com/

• Moneycontrol: https://www.moneycontrol.com/

• NSE: https://www.nseindia.com/

• BSE: https://www.bseindia.com/

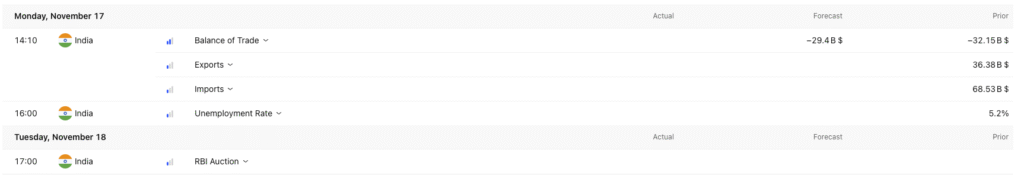

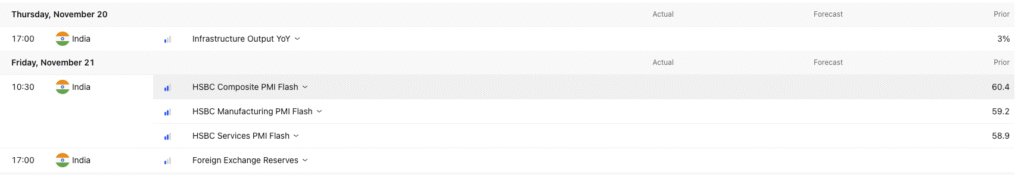

Upcoming Economic Events Next Week

As we wrap up the Weekly Market Update November 2nd Week, it’s important to prepare for the upcoming macro triggers that could influence market direction. The economic calendar for next week includes a series of key domestic indicators such as trade balance updates, PMI prints, RBI auction activity, and forex reserve data.

These events often create short-term volatility and contribute significantly to the sentiment captured in every Weekly Stock Market Update. Traders should closely track these numbers, especially PMI and unemployment rate data, which reflect real economic momentum.

Upcoming Data Releases — India

These indicators will be closely monitored by institutional investors and traders alike, forming the foundation of next week’s analysis.

For more detailed day-wise market recaps, always explore our entire library:

➡️ https://onedemat.com/category/day-end-market-summary/

Conclusion — Weekly Market Update November 2nd Week

This Weekly Market Update November 2nd Week highlighted strong performance across most indices, powerful sectoral recovery, and impressive industry-level breakouts. From capital markets to IT networking and paints, the momentum signaled robust investor confidence. At the same time, declines in medical equipment, chemicals, and healthcare industries showed that selective caution remains essential.

Global markets traded weak, hinting that external pressures may continue to influence the upcoming week. Still, domestic fundamentals remain supportive, which is why the Weekly Stock Market Update continues to reflect resilience and steady upward momentum.

As we move into the next trading week, keep an eye on macro events, stability in crude oil prices, and currency movement—these will be key drivers for market sentiment.

If you want deeper morning commentary, check our pre-market analysis newsletter:

➡️ https://onedemat.com/category/newsletter/

And if you missed the previous edition of our weekly analysis, revisit it here:

➡️ https://onedemat.com/weekly-market-update-october-4th-week-analysis/

Stay tuned for more insights and timely updates. See you in the next Weekly Stock Market Update!

References

- NSE India — for benchmark index data & FPI flows.

- BSE India — for corporate results and announcements.

Read Daily Market Update here: