Introduction— Market Outlook 14 November

Good Morning and Welcome to Your Pre-Market Newsletter — Market Outlook 14 November

After a cautious start to the week, Indian equities ended the last trading day flat, reflecting a phase of consolidation as investors awaited fresh global and domestic cues.

The Nifty 50 closed nearly unchanged at 25,877.30 (+0.0058%), while the Sensex settled at 84,467.51 (+0.0012%), both showing minimal movement after a volatile intraday session. The Bank Nifty managed to outperform with a modest 0.20% rise at 58,389.60, supported by private banking counters, whereas the IT index slipped 0.51% amid renewed weakness in global tech stocks. The BSE SmallCap Index saw mild profit booking, ending down 0.36%, as traders shifted focus toward large-cap stability.

Overall, the session reflected a market in wait-and-watch mode — cautious optimism dominated as investors continued to monitor U.S. inflation trends, domestic CPI data, and ongoing corporate earnings.

In today’s edition of Market Outlook 14 November, we’ll break down:

- The key index levels for Nifty, Sensex, and Bank Nifty.

- The top market-moving news and stocks to watch today.

- Fresh IPO updates and listing highlights.

- A deep dive into the Stock in Focus for the day — with target, upside, and expert rating.

Stay tuned as we decode what lies ahead for your trading day. Explore more daily market insights here → OneDemat Daily Newsletter

Index Outlook — Market Outlook 14 November

After a muted session in the previous trade, Indian indices are expected to open on a steady note today as technical indicators suggest a continuation of the positive bias. The broader sentiment remains constructive, supported by sustained buying in banking and large-cap counters. According to the latest analysis from EquityPandit, both Nifty and Sensex are currently in a positive trend, though traders are advised to stay alert near key resistance zones as consolidation may follow after recent gains.

You can also check live index updates and stock-wise performance directly on NSE India and BSE India for more detailed insights.

Here’s a detailed look at the major indices for Market Outlook 14 November 👇

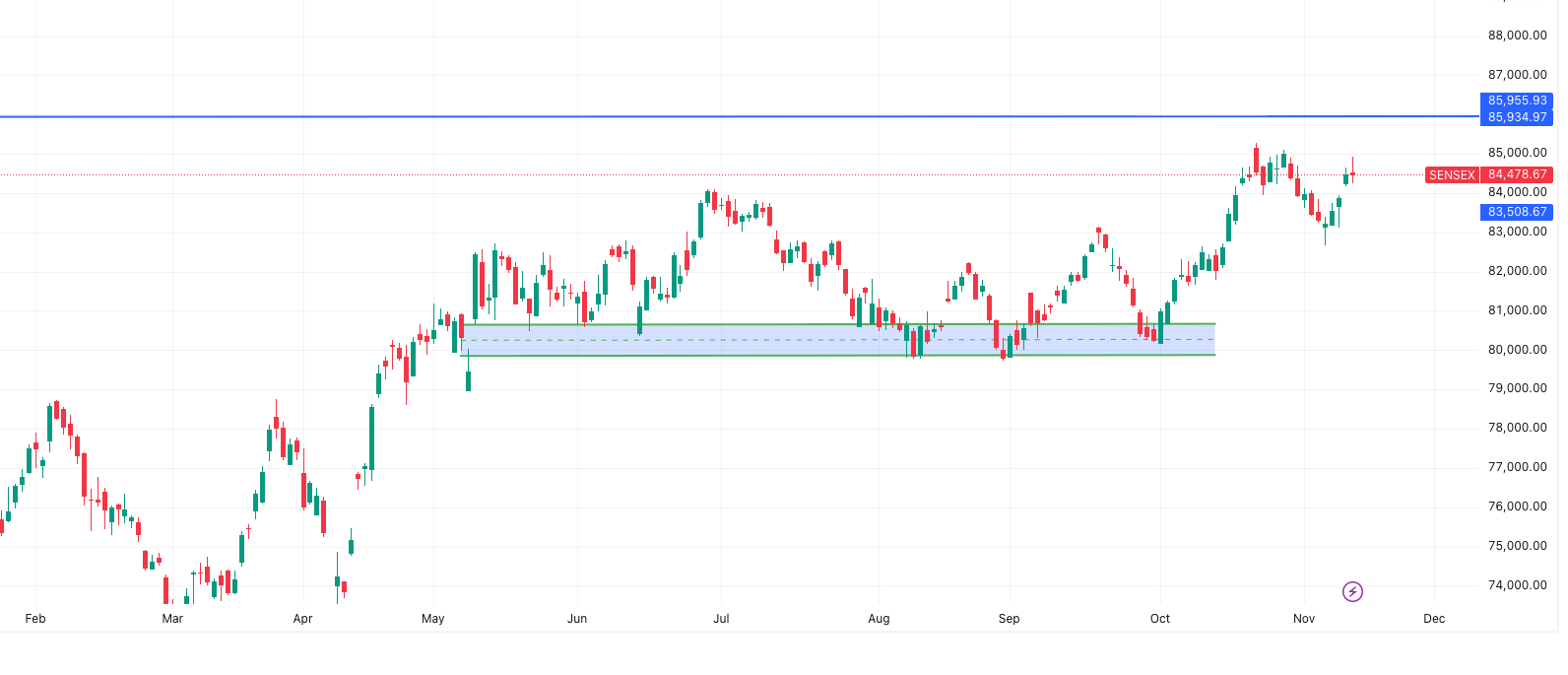

SENSEX (84,479) — Positive Trend Continues

The Sensex has maintained its upward trajectory, supported by strength in financials and energy names. Analysts suggest holding long positions as long as the index sustains above its immediate support.

- Current Trend: Positive

- Strategy: Continue holding long positions with a stoploss at 83,902.

- Fresh Shorts: Can be initiated only if Sensex closes below 83,902 levels.

Key Levels:

- Support: 84,181 – 83,884 – 83,515

- Resistance: 84,848 – 85,217 – 85,514

The tentative trading range for the day is expected between 83,800 – 85,156. Sustained movement above 84,848 may open the door for another leg of rally toward 85,200+.

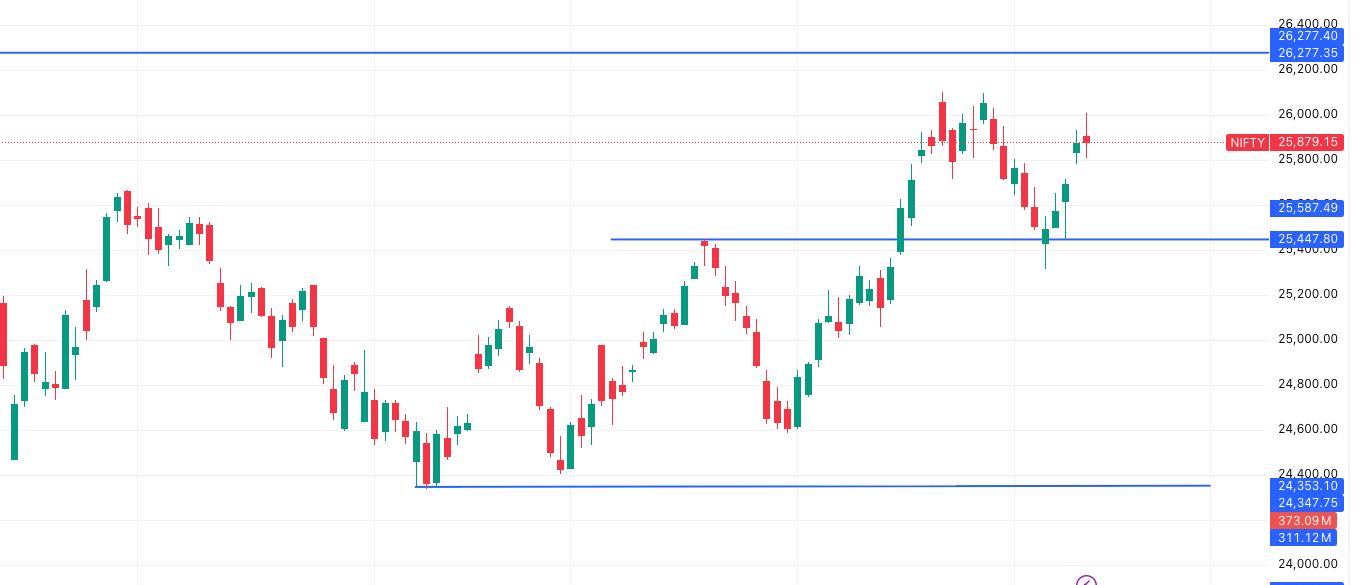

NIFTY 50 (25,879) — Holding Steady with Bullish Bias

The Nifty 50 continues to hold above its crucial support zone, signaling a stable outlook for the session. The index remains in a positive structure, though a breakout above 26,100 will be key for further momentum.

- Current Trend: Positive

- Strategy: Continue holding long positions with a stoploss at 25,699.

- Fresh Shorts: Only below 25,699 on a closing basis.

Key Levels:

- Support: 25,788 – 25,697 – 25,586

- Resistance: 25,990 – 26,102 – 26,193

The tentative intraday range is likely to remain between 25,672 – 26,085. A sustained close above 26,100 could trigger renewed buying momentum from FIIs.

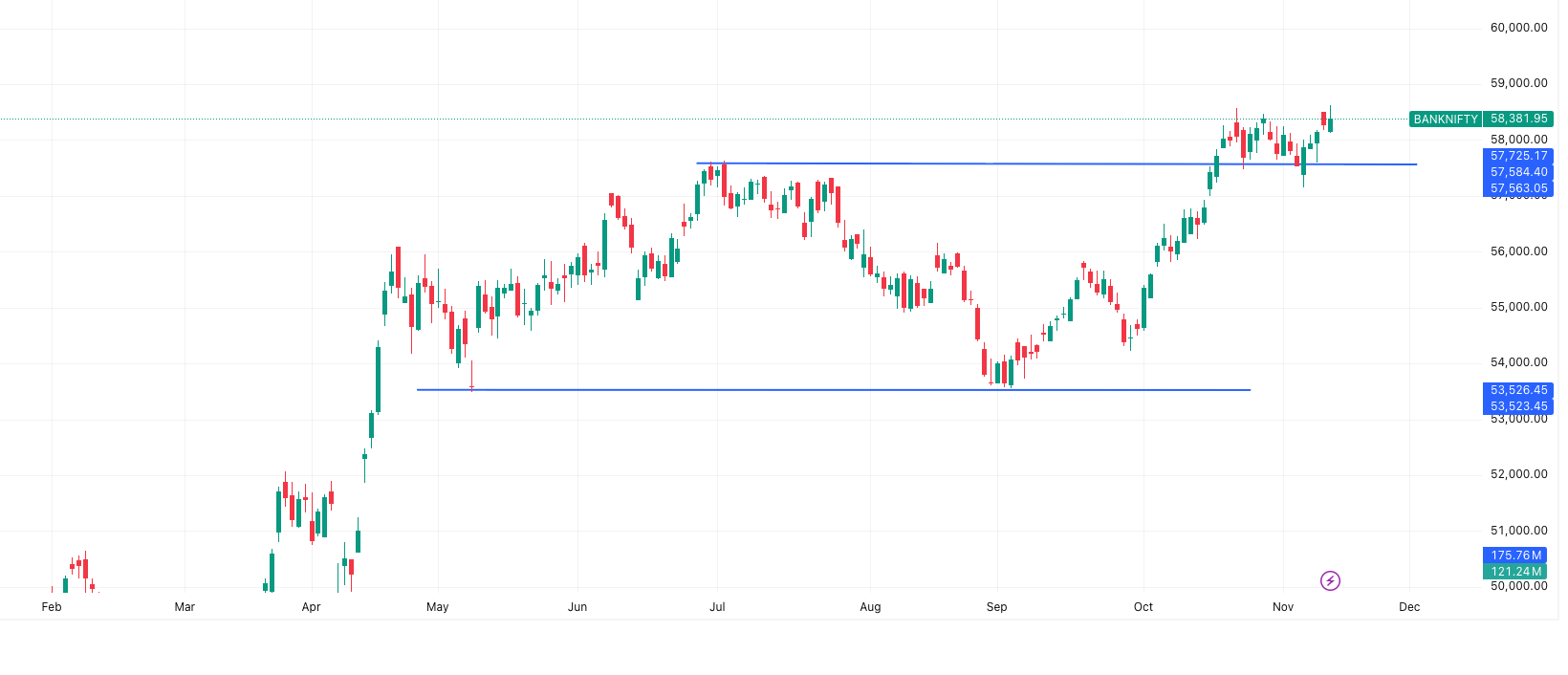

BANK NIFTY (58,382) — Financials Drive the Momentum

The Bank Nifty index remains the standout performer, aided by positive commentary from private lenders and improving liquidity conditions. Momentum indicators suggest further strength if the index holds above 58,100 levels.

- Current Trend: Positive

- Strategy: Continue holding long positions with a stoploss at 57,876.

- Fresh Shorts: Can be considered only if the index closes below 57,876.

Key Levels:

- Support: 58,134 – 57,886 – 57,645

- Resistance: 58,623 – 58,864 – 59,112

The expected trading range for the day stands between 57,882 – 58,881. A decisive breakout above 58,860 could lift the index toward the 59,100 zone in the near term.

Overall View – Market Outlook 14 November:

The short-term outlook remains constructively bullish, with Bank Nifty continuing to lead the charge. Traders should maintain a buy-on-dips strategy as long as Nifty holds above 25,700 and Sensex sustains above 84,000. However, volatility could rise as markets approach key resistance levels near 26,100 and 85,200 respectively.

Market News & Stocks to Watch – Market Outlook 14 November

As part of today’s Market Outlook 14 November, we take a look at some of the biggest corporate and macro developments that could shape the trading day ahead. From India’s largest asset manager gearing up for a billion-dollar IPO to the surge in textile exports and the return of FII interest — here’s what’s driving market sentiment today.

You can read more verified updates directly on Economic Times, MSN Money and NDTV Profit.

SBI Funds Management Plans $1.2 Billion IPO in 2026

Source: Economic Times

India’s largest asset manager, SBI Funds Management Ltd, is preparing for one of the biggest fund offerings in the domestic market — a $1.2 billion IPO, planned for the first half of 2026.

The company, jointly owned by State Bank of India (SBI) and France’s Amundi SA, is in the process of inviting bids from banks to manage the offering. Early estimates suggest that SBI Funds could be valued at nearly $12 billion, making it one of the most valuable AMC listings in Indian history.

The development underscores the continuing confidence in India’s asset management industry amid strong domestic inflows and robust financial markets. The IPO will also mark the second major AMC listing after HDFC AMC’s 2018 debut.

Stock to Watch: State Bank of India (SBI)

The Market Outlook 14 November suggests SBI could see renewed investor attention as the AMC listing process gains traction in coming quarters.

FIIs Pull Out ₹80,000 Crore from Top Bluechips — But Selling May End Soon

Source: MSN Money

Foreign Institutional Investors (FIIs) have withdrawn a staggering ₹80,000 crore from just 10 blue-chip Indian stocks, including Reliance Industries, TCS, HDFC Bank, Titan, Infosys, and ICICI Bank. This massive outflow pushed foreign ownership in Indian equities to its lowest level in over a decade.

The biggest losers in FII holdings were:

- TCS: ₹12,911 crore sold, stake down from 11.5% → 10.3%

- Reliance Industries: ₹10,042 crore sold, stake down from 19.2% → 18.7%

- ICICI Bank: ₹9,375 crore sold

- HCL Tech, Kotak Bank, Axis Bank, Titan also saw declines

Despite the exodus, global institutions such as Goldman Sachs and HSBC have turned optimistic again. Goldman now expects Nifty to touch 29,000 by 2026-end, citing earnings revival and policy support.

💡 Stocks to Watch:

- Reliance Industries (RIL)

- ICICI Bank

- TCS

As per Market Outlook 14 November, the return of FII inflows could act as a key market catalyst heading into the December quarter.

India’s Textile Exports to 111 Countries Rise 10% in H1 FY26

Source: NDTV Profit

In a strong sign of resilience, India’s textile exports grew 10% year-on-year during April–September 2025, reaching $8.49 billion, up from $7.72 billion a year earlier.

Exports to major markets such as UAE (+14.5%), Japan (+19%), and France (+9.2%) led the growth, alongside emerging demand from non-traditional regions like Egypt (+27%) and Hong Kong (+69%).

The government attributed this momentum to the success of ‘Make in India’ and ‘Aatmanirbhar Bharat’ policies, as well as the rapid diversification into global value chains.

💡 Stocks to Watch:

- Welspun India

- Arvind Ltd

- Trident Ltd

In today’s Market Outlook 14 November, the textile sector stands out as a key export-driven theme to monitor.

Andhra Pradesh Signs ₹18,400 Crore Investment MoUs with Taiwan Firms

Source: NDTV Profit

Andhra Pradesh has inked two major investment deals worth ₹18,400 crore with Taiwanese companies Allegiance Group and Creative Sensor Inc. The collaboration aims to set up India’s first 23 GWh precursor-free solid-state battery manufacturing facility in Kurnool district through eJoule India JV.

This move is expected to generate 2,000 direct jobs and 50,000 indirect jobs, reinforcing Andhra’s position as a hub for advanced manufacturing and clean-tech innovation.

💡 Stocks to Watch:

- Amara Raja Energy & Mobility

- Exide Industries

This development could add medium-term momentum to EV and battery manufacturing stocks, a key theme in Market Outlook 14 November.

Sovereign Gold Bonds (SGB) Deliver 328% Return Over 8 Years

Source: NDTV Profit

The Reserve Bank of India has announced the final redemption price for Sovereign Gold Bond (SGB) 2017–18 Series VII, maturing on November 13, 2025, at ₹12,350 per unit.

Issued at ₹2,884 in 2017, investors have earned an absolute return of 328.22% over eight years — excluding the annual interest component.

With gold prices hovering near record highs, SGBs remain one of the most rewarding long-term instruments for conservative investors.

Stocks to Watch:

- Titan Company Ltd., Kalyan Jewellers

For Market Outlook 14 November, the sustained strength in gold prices may continue to boost jewelry and gold financing companies.

IPO Updates & Events – Market Outlook 14 November

The IPO market continues to buzz with activity as several key listings capture investor attention this week. From Tenneco Clean Air IPO to PhysicsWallah and Emmvee Photovoltaic, investors have multiple options to consider before subscription windows close. Additionally, Pine Labs IPO is set to list today, drawing focus on its debut performance.

Let’s take a closer look at the active IPOs in the Market Outlook 14 November.

Mainboard IPOs

| Name | GMP (Est. Listing Gain) | Open Date | Close Date | Listing Date |

|---|---|---|---|---|

| Tenneco Clean Air IPO | ₹83 (20.91%) | 12-Nov | 14-Nov | 19-Nov |

| PhysicsWallah IPO CT | ₹0 (0.00%) | 11-Nov | 13-Nov | 18-Nov |

| Emmvee Photovoltaic IPO CT | ₹0 (0.00%) | 11-Nov | 13-Nov | 18-Nov |

| Pine Labs IPO | ₹6.5 (2.94%) | 7-Nov | 11-Nov | 14-Nov (Listing Today) |

Highlight: Pine Labs IPO will make its stock market debut today — investors are closely watching its listing gains amid moderate GMP trends.

SME IPOs

| Name | GMP (Est. Listing Gain) | Open Date | Close Date | Listing Date |

|---|---|---|---|---|

| Workmates Core2Cloud BSE SME CT | ₹51 (25.00%) | 11-Nov | 13-Nov | 18-Nov |

No new SME IPOs opened today, but Workmates Core2Cloud remains the highlight in the SME space with strong investor demand and a 141.38x subscription rate.

Stocks to Watch – Market Outlook 14 November

In today’s Market Outlook 14 November, one stock clearly stands out in the life insurance and financial services space — Max Financial Services Ltd. The company continues to impress investors with robust growth in protection and non-participating (NPAR) products, strong margin expansion, and a confident management outlook for FY26 and beyond.

Max Financial Services (MAXF IN)

Rating: BUY | CMP: ₹1,718 | Target Price (TP): ₹1,925

Upside Potential: ~12.05% | Recommended by: Prabhudas Lilladher (PL Capital)

🔗 Full Research Report (PDF)

Quick Snapshot:

- Q2FY26 APE Growth: 15% YoY, led by NPAR and Protection segments.

- VNB Margin: Improved sharply to 25.5%, despite GST exemption drag.

- FY26E VNB Margin Outlook: 24–25%, driven by better product mix.

- Embedded Value (EV): ₹269.0bn; Operating RoEV: 16.3% (expected to rise to 18–19%).

- Key Drivers:

- Strong protection and annuity growth post-GST exemption.

- Robust proprietary channel performance (+22% YoY).

- Healthy solvency ratio at 208%.

- New product launches like Smart VIBE and SWAG Pension boosting retail demand.

Analyst Takeaway:

Max Financial Services is well-positioned to sustain its growth trajectory with APE growth expected at 16% in FY26, supported by a favorable product mix and improved cost efficiency. The strong margin visibility, embedded value growth, and leadership in online protection make it one of the top picks in the financial services sector for the medium term.

Conclusion – Market Outlook 14 November

As we wrap up the Market Outlook 14 November, the sentiment across Indian equities remains cautiously optimistic. With both Nifty and Sensex maintaining their positive bias and Bank Nifty continuing to show strength, investors appear to be positioning for a steady move toward upper resistance zones. However, global cues, inflation data, and foreign fund flows are likely to play a decisive role in sustaining this upward momentum.

On the IPO front, the market is buzzing with multiple listings and ongoing subscriptions — from Tenneco Clean Air to Workmates Core2Cloud — signaling continued retail and institutional interest in the primary market. Meanwhile, in the stock-specific space, Max Financial Services stands out as a compelling opportunity backed by improving margins and resilient business growth, making it one to keep on your radar this week.

In summary, while the short-term trend remains positive, traders should maintain disciplined stop-losses and investors can look for accumulation opportunities in fundamentally strong counters. The market tone is constructive — yet selective — making this an ideal time to focus on quality and consistency rather than momentum alone.

🔗 Stay updated with more daily insights:

👉 Explore All Pre-Market Newsletters