Market Outlook 23 October: Markets Set for a Powerful Rebound After Diwali Calm

Good morning and welcome to your Market Outlook 23 October — your first trading day briefing after the festive pause!

After a quiet Muhurat Trading session on Diwali, the Indian market ended on a mildly positive note. The Nifty 50 gained 0.09% to close at 25,868.60, while the Sensex rose 0.56% or +474.16 points to settle at 84,426.34. The broader sentiment remained steady as investors participated in the symbolic trade to mark the start of the new Samvat year.

However, beneath that calm, global and domestic triggers are setting the stage for a high-voltage comeback today. The much-anticipated India–US Trade Deal Tariff Cut 2025 has finally been announced — slashing average tariff rates from nearly 50% to just 15–16%. This sweeping policy move is expected to supercharge Indian exports, especially in textiles, pharma, and auto components, while reviving U.S. supply chains strained by recent geopolitical tensions.

Adding to the excitement, the GIFT Nifty surged over 1.6% in early trade, pointing to a strong gap-up opening for domestic markets. With fresh optimism, easing trade barriers, and festive liquidity still in the system, bulls seem ready to take charge in today’s session.

As we step into this new trading week, Market Outlook 23 October will guide you through —

📈 Key index technical views,

🗞️ Top market-moving news,

💰 The latest IPO updates, and

🎯 Stocks that should be on your radar before the bell rings.

Index Technical View | Market Outlook 23 October

As trading resumes after the festive break, the Market Outlook 23 October signals strong bullish undertones across key indices. According to EquityPandit analysis, all major indices — Sensex, Nifty, and Bank Nifty — continue to maintain their positive trajectory, reflecting resilience in broader market sentiment. Let’s decode the current technical setup before the bell rings.

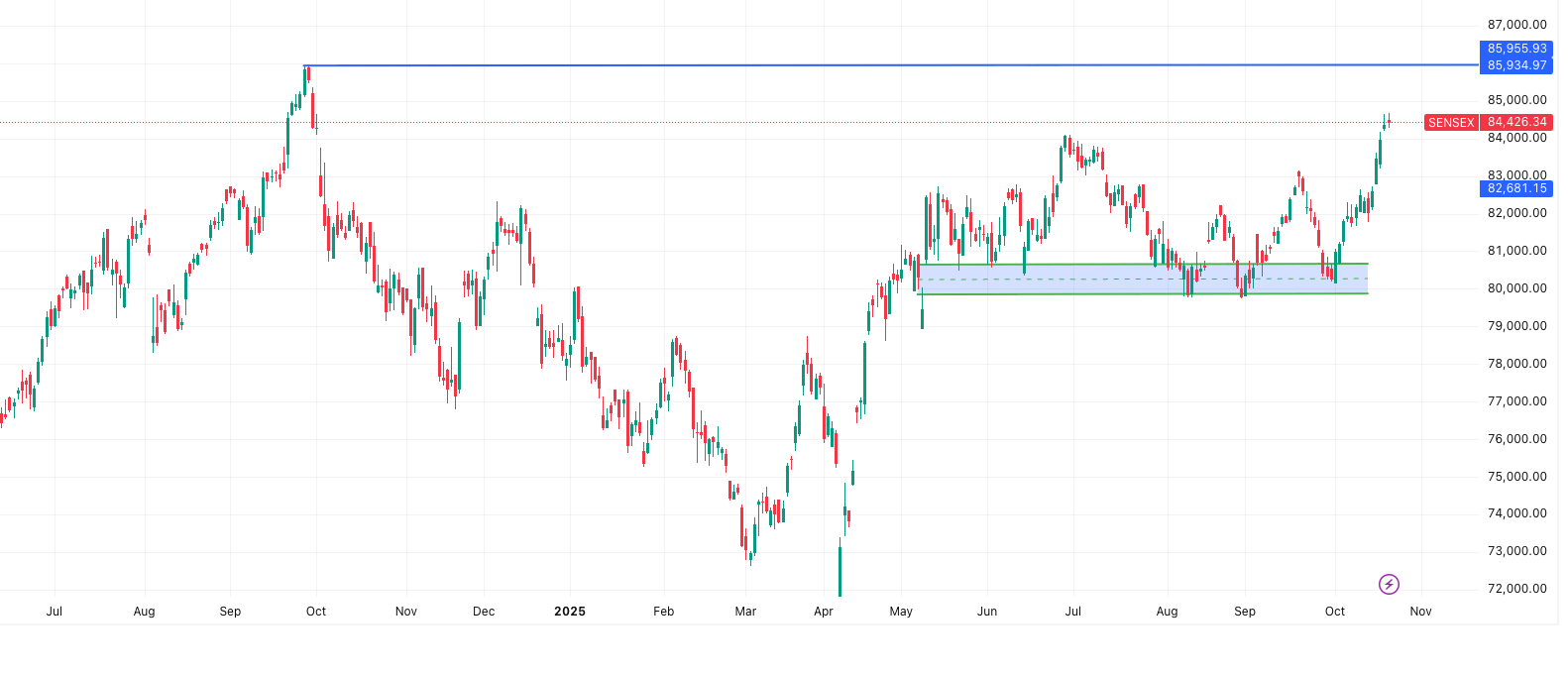

Sensex Outlook (84,426)

The Sensex remains firmly in a positive trend, continuing its upward journey after a strong Muhurat Trading session. The index closed near the upper end of its short-term range, backed by gains in IT and banking heavyweights.

- Trend: Positive

- Trading View: Long positions can be held with a daily closing stoploss at 83,728.

- Fresh Shorts: Can be considered only if Sensex closes below 83,728 levels.

Support Levels:

- 84,155

- 83,946

- 83,695

Resistance Levels:

- 84,614

- 84,865

- 85,074

Tentative Range: 83,692 – 85,034

With global optimism from the India–US trade deal and festive buying momentum, Sensex could soon attempt to break above the 85,000 mark, setting a new milestone for Market Outlook 23 October.

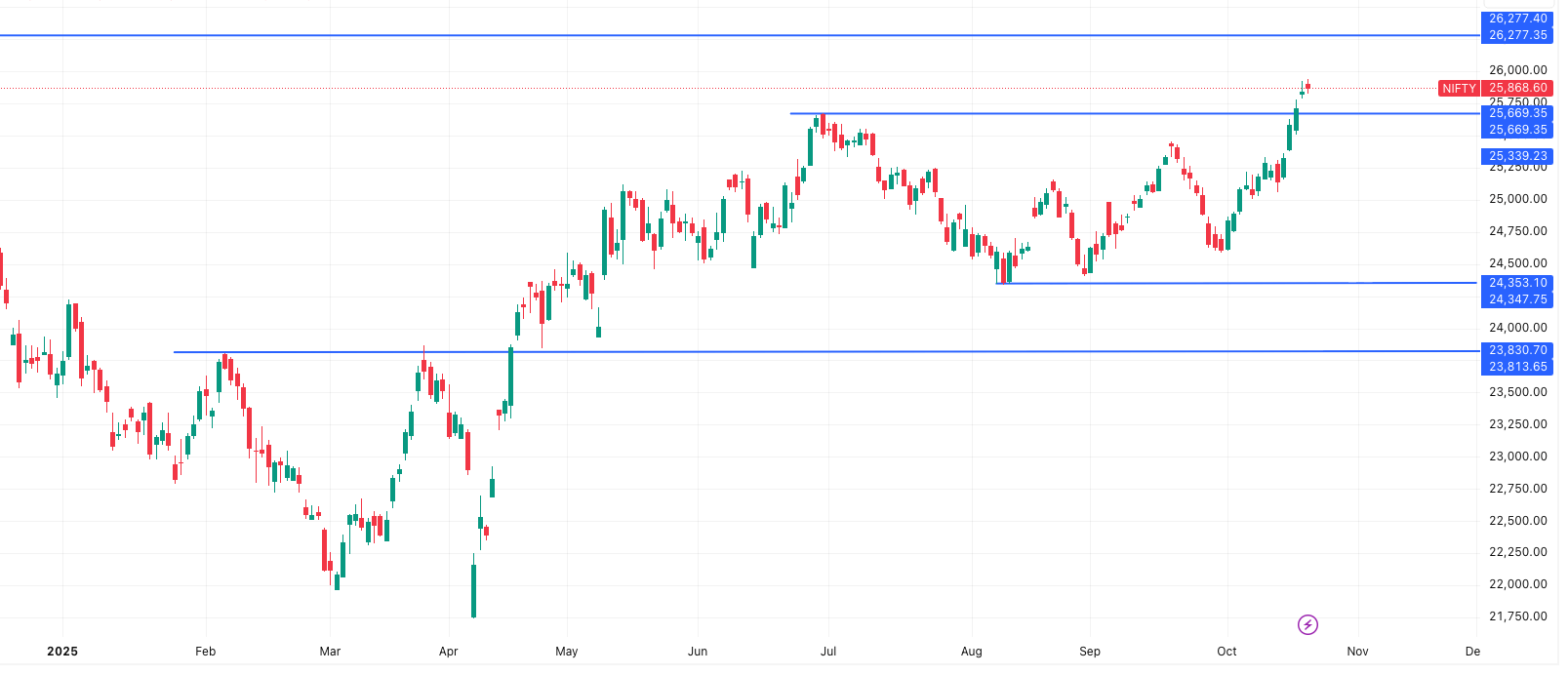

Nifty 50 Outlook (25,869)

The Nifty 50 mirrors a similar positive structure, consolidating near all-time highs. Momentum indicators continue to support the bull camp, while volumes remain healthy post-holiday.

- Trend: Positive

- Trading View: Continue holding longs with a daily closing stoploss at 25,649.

- Fresh Shorts: Only if the index closes below 25,649 levels.

Support Levels:

- 25,779

- 25,715

- 25,641

Resistance Levels:

- 25,917

- 25,990

- 26,054

Tentative Range: 25,642 – 26,043

If GIFT Nifty’s 1.6% jump translates into early momentum, Nifty could easily retest the 26,000 psychological barrier today — a key number to watch for Market Outlook 23 October.

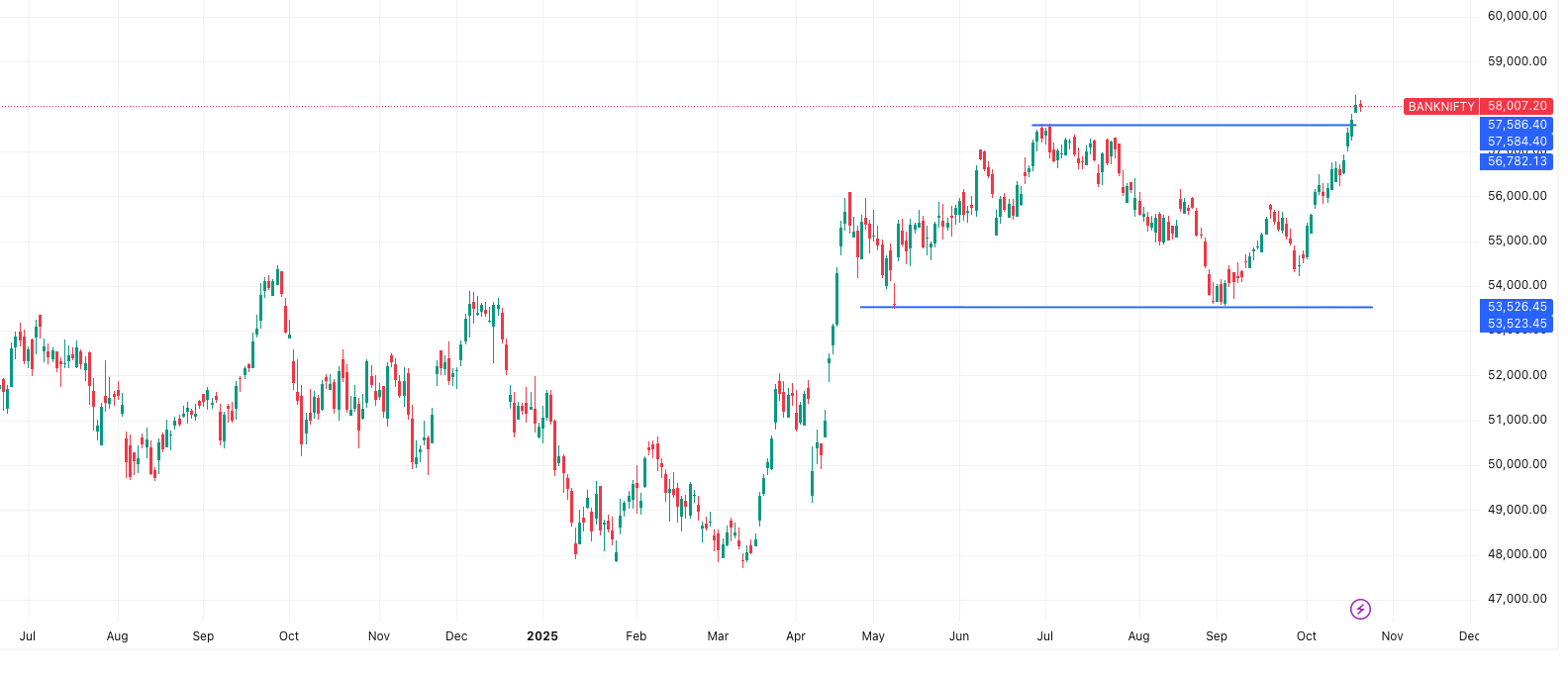

Bank Nifty Outlook (58,007)

The Bank Nifty continues to remain in a positive trend, though sector rotation has kept upside moves modest. PSU banks and private lenders are expected to gain traction as credit growth remains robust.

- Trend: Positive

- Trading View: Hold long positions with a daily closing stoploss at 57,545.

- Fresh Shorts: May be initiated only if Bank Nifty closes below 57,545 levels.

Support Levels:

- 57,850

- 57,667

- 57,461

Resistance Levels:

- 58,239

- 58,445

- 58,628

Tentative Range: 57,525 – 58,540

Given rising optimism in financials, Bank Nifty could emerge as the key driver of today’s rally, reinforcing the bullish sentiment outlined in Market Outlook 23 October.

News & Stocks to Watch | Market Outlook 23 October

In today’s Market Outlook 23 October, key economic updates and corporate actions set the tone for an eventful trading day. From record-breaking Diwali sales to trade partnerships and renewable energy expansions, here are the stories — and the stocks likely to react when the market opens.

Diwali 2025 Sales Surge

India celebrated a record-breaking Diwali season with ₹6.05 trillion in total retail and service sales, up 25% YoY, according to CAIT. Consumer demand rebounded across electronics, jewelry, apparel, and FMCG, fueled by GST cuts and bigger value packs at traditional price points.

Stocks to Watch: Dixon Technologies, Titan, Trent, Hindustan Unilever, Avenue Supermarts (DMart)

Expect positive momentum in retail, consumer, and FMCG counters.

India–EFTA Trade Partnership

India’s trade pact with the European Free Trade Association (EFTA) — including Switzerland, Norway, Iceland, and Liechtenstein — officially came into force. It targets $100 billion in investments and over 1 million jobs by 2030. Focus areas: renewables, healthcare, manufacturing, and fintech.

Stocks to Watch: ABB India, Siemens, Dr. Reddy’s, Apollo Hospitals, TCS

The move could boost capital goods, pharma, and IT export sectors.

Mumbai GDP Growth Targets

Mumbai aims for a USD 1.5 trillion GDP by 2047, driven by rapid infrastructure and real estate development. Projects like Marathon-Adani’s Monte South Commercial JV are examples of the city’s long-term urban expansion push.

Stocks to Watch: Adani Realty (unlisted), Marathon Nextgen Realty, L&T, IRB Infra, PNC Infratech

Infra and construction stocks may see renewed investor interest.

Services Exports Growth

India’s services exports are outpacing goods exports, growing at 14.8% CAGR versus 9.8% for goods, supported by IT, financial services, and digital outsourcing. Government reforms and global tech demand continue to drive this trend.

Stocks to Watch: Infosys, TCS, Tech Mahindra, HCLTech, Wipro

Likely to lift IT and BPM sector sentiment in Market Outlook 23 October.

RBI Raises GDP Forecast

The Reserve Bank of India upgraded India’s FY25 GDP forecast to 6.8%, citing strong consumption, stable inflation, and a resilient banking sector. The upbeat view also follows festive-season liquidity and market momentum.

Stocks to Watch: SBI, HDFC Bank, ICICI Bank, Axis Bank, Bajaj Finance

Positive for financials and cyclical sectors.

Marathon–Adani JV Details

The Monte South Commercial project, a JV between Marathon Realty and Adani Realty, will create high-end office and retail spaces worth ₹3,400 crore GDV in Mumbai. The project reinforces optimism in India’s commercial property market.

Stocks to Watch: Marathon Nextgen Realty, Adani Enterprises, DLF, Godrej Properties

Realty stocks could gain traction as commercial demand strengthens.

Waaree Energies Solar Expansion

Waaree Energies inaugurated a 950 MW solar module factory in Gujarat, strengthening India’s domestic solar manufacturing ecosystem. This aligns with the national target for clean energy capacity addition.

Stocks to Watch: Waaree Energies, Adani Green, Tata Power, Sterling & Wilson Solar

Renewables sector likely to stay in focus in Market Outlook 23 October.

REC Power Transmission Divisions

REC Limited launched two new power transmission divisions to accelerate India’s grid modernization and renewable connectivity. This move supports the government’s push for infrastructure-linked power reforms.

Stocks to Watch: REC, Power Grid, NTPC, NHPC

Transmission and energy infra plays may extend their rally.

CMS Info Systems Restructuring

CMS Info Systems announced a 10% workforce reduction while converting ₹100 crore one-time income into ₹225 crore recurring revenue. The company is pivoting toward managed services, fintech software, and ATM security solutions.

Stocks to Watch: CMS Info Systems, Hitachi Payment, AGS Transact Technologies

Short-term pressure possible, but restructuring could enhance long-term margins.

IPO Update — Market Outlook 23 October

Mainboard IPOs

| IPO Name | Open Date | Close Date | Listing Date | GMP (Listing Gain) |

|---|---|---|---|---|

| Midwest IPO | 15-Oct | 17-Oct | 24-Oct | ₹100 (+9.39%) |

Midwest IPO continues to hold investor attention with a healthy ₹100 GMP, indicating a ~9.39% potential listing gain. Strong subscription figures (92.36x overall) and bullish secondary market trends add confidence ahead of the 24th October listing.

SME IPOs

| IPO Name | Open Date | Close Date | Listing Date | GMP (Listing Gain) |

|---|---|---|---|---|

| No active SME IPOs with GMP data available | — | — | — | — |

The SME IPO segment remains quiet this week, with no active listings showing grey market movement. However, new SME issues are expected to debut post-Diwali as investor liquidity improves.

Stocks in Radar — Market Outlook 23 October

Dalmia Bharat Ltd— Profitable Growth Ahead!

CMP: ₹2,185 | Target Price: ₹2,620

Upside Potential: +17.1% | Dividend Yield: 0.4%

Research: Choice Institutional Equities

Sector: Basic Materials – Cement | View: BUY (Positive)

Business Overview

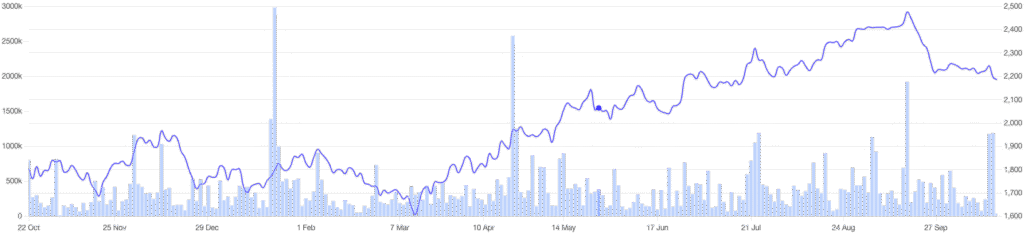

Dalmia Bharat Ltd., one of India’s leading cement producers, continues to impress investors with strong fundamentals and aggressive expansion plans. The company aims to add 25.5 Mtpa capacity by FY28E, entering new regional markets with efficient capital allocation and steady cost optimization. Supported by GST rate cuts and sustainable energy initiatives, Dalmia Bharat stands out in the post-Diwali rally, strengthening the bullish sentiment in the Market Outlook 23 October.

Financial Highlights

| Metric | FY25 | FY26E | FY27E | FY28E |

|---|---|---|---|---|

| Revenue (₹ Bn) | 139.8 | 159.2 | 178.7 | 200.5 |

| EBITDA (₹ Bn) | 24.1 | 33.8 | 39.5 | 49.4 |

| EBITDAM (%) | 17.2 | 21.2 | 22.1 | 24.6 |

| PAT (₹ Bn) | 6.8 | 12.9 | 16.0 | 22.3 |

| EPS (₹) | 36.4 | 68.7 | 85.3 | 118.8 |

| ROCE (%) | 5.0 | 8.3 | 9.4 | 11.8 |

The company’s EBITDA margins expanded sharply to 20.4% in Q2FY26, beating estimates on cost efficiency and renewable energy savings. This margin improvement adds a positive tone to Market Outlook 23 October, reinforcing investor confidence in cyclical recovery and profitability growth.

Key Growth Drivers

- Capacity Expansion: Targeting 75 Mtpa by FY28E with ongoing projects in Belgaum, Pune, and Kadapa.

- Renewable Push: Renewable energy capacity increased to 387 MW, expected to hit 576 MW by FY26E.

- Cost Reduction Plan: Expected savings of ₹150–200/ton by FY28E through operational optimization and energy mix shift.

- Sector Tailwinds: Cement demand recovery post-GST reform and infrastructure push from Union Budget priorities.

Valuation & Outlook

Choice Institutional Equities maintains a BUY rating with a target price of ₹2,620, implying a 17% upside. At this valuation, FY28E EV/EBITDA and P/E multiples stand at 10.9x and 23.1x, respectively — reasonable given expected margin expansion and improved ROCE.

In the broader Market Outlook 23 October, Dalmia Bharat emerges as a core cement sector play, benefiting from India’s infrastructure momentum, capacity growth, and fiscal policy support.

Risks

- Delay in commissioning of new plants (25.5 Mtpa target).

- Fluctuations in petcoke or coal prices.

- Regional taxation changes (like Tamil Nadu mineral tax).

A strong buy for long-term investors eyeing the infrastructure boom. Dalmia Bharat fits perfectly in the bullish momentum of the Market Outlook 23 October, backed by robust earnings, cost control, and structural demand visibility.

Conclusion — Market Outlook 23 October

As the Market Outlook 23 October unfolds, Indian equities continue to ride on festive optimism, strong macro indicators, and renewed global confidence. The Diwali sales surge, robust RBI growth forecast, and healthy participation in mainboard IPOs reflect broad-based market strength and investor enthusiasm.

Indices like NIFTY, SENSEX, and BANKNIFTY remain firmly in a positive trend, supported by stable domestic liquidity, improving earnings visibility, and favorable policy cues. The consistent inflow from retail and institutional investors underscores that the Indian market remains the preferred growth destination amid global uncertainty.

Sectors such as cement, renewable energy, banking, and infrastructure are likely to outperform in the coming quarters. Stocks like Dalmia Bharat showcase India’s industrial and infrastructure momentum, while upcoming IPO listings signal sustained primary market appetite.

Looking ahead, traders are advised to maintain a bullish stance with strict stop-loss adherence, while long-term investors should focus on quality mid-cap and sectoral leaders poised for multi-year growth.

In short, the Market Outlook 23 October captures the perfect blend of festive tailwinds, economic expansion, and policy stability — a setup that positions Indian markets for continued upward momentum through the rest of FY26.

💡 Stay invested, stay selective, and let the trends guide your trades!

More Articles

5 Ways Volume Analysis Reveals How Smart Money Moves in Indian Stocks

ESG Investing for 2030: The Ultimate Green Wealth Guide for Smart Investors

Midwest IPO Review 2025: Strong Fundamentals, Impressive Growth & GMP Outlook