Introduction: LG Electronics IPO – India’s Next Big Consumer Electronics Listing

The LG Electronics IPO is set to be one of the most anticipated public offerings in India in 2025, giving investors a chance to own a stake in LG Electronics India Ltd., a leading player in the home appliances and consumer electronics sector. With a robust parentage under LG Electronics, a globally recognized brand, the LG Electronics IPO opens a gateway for investors to participate in the growth of a company with strong market leadership, pan-India distribution, and high operational efficiency.

Incorporated in 1997, LG Electronics India Ltd. has established itself as a dominant force in home appliances, air solutions, and home entertainment, supported by advanced manufacturing units in Noida and Pune, a pan-India supply chain, and over 1,000 service centers. The company’s philosophy, “Life’s Good When We Do Good,” reflects its commitment to quality, innovation, and customer experience, which are key drivers for its consistent revenue growth and profitability.

The LG Electronics IPO is a book-built offer for sale of 10.18 crore shares, aggregating up to ₹11,607.01 crore, and is scheduled to open on October 7, 2025, closing on October 9, 2025. Investors can expect a listing on BSE and NSE tentatively on October 14, 2025, making this IPO a high-profile opportunity for both retail and institutional investors to invest in India’s thriving consumer electronics market.

IPO Overview: LG Electronics IPO Details, Dates & Objectives

LG Electronics IPO Details

The LG Electronics IPO is a book-built Offer for Sale (OFS) with a total issue size of ₹11,607.01 crore. The IPO offers 10.18 crore shares and is entirely an OFS, meaning the company will not receive any proceeds from this issue.

| Particulars | Details |

|---|---|

| IPO Size | ₹11,607.01 crore |

| Issue Type | Book-building, Offer for Sale |

| Price Band | ₹1,080 – ₹1,140 per share |

| Face Value | ₹10 per share |

| Lot Size | 13 shares |

| Listing Exchanges | BSE, NSE |

| Promoter Holding Pre-Issue | 100% (LG Electronics Inc.) |

| Promoter Holding Post-Issue | 85% |

| Employee Discount | ₹108 per share |

| Lead Manager | Morgan Stanley India Co. Pvt. Ltd. |

| Registrar | Kfin Technologies Ltd. |

| IPO Document | RHP |

The LG Electronics IPO caters to retail, HNI, and institutional investors, offering a slice of one of India’s leading home appliances and consumer electronics companies. With a robust brand and high market share, the IPO provides a chance to invest in a capital-efficient, profitable business.

LG Electronics IPO Important Dates

| Event | Date |

|---|---|

| IPO Open Date | Tue, Oct 7, 2025 |

| IPO Close Date | Thu, Oct 9, 2025 |

| Tentative Allotment | Fri, Oct 10, 2025 |

| Refund Initiation | Mon, Oct 13, 2025 |

| Credit of Shares | Mon, Oct 13, 2025 |

| Tentative Listing | Tue, Oct 14, 2025 |

| UPI Cut-off | 5 PM, Thu, Oct 9, 2025 |

The IPO window is short, spanning 3 days, with allotment and refunds processed quickly to enable listing within a week. Retail investors should note the UPI mandate cut-off time to ensure successful applications.

LG Electronics IPO Objects / IPO Objectives

Since the LG Electronics IPO is an Offer for Sale, the company will not receive any proceeds from this issue. Therefore, there is no requirement for a monitoring agency, and the promoter, LG Electronics Inc., will sell shares to facilitate stake diversification.

Implications:

- The OFS allows the promoter to reduce holding while maintaining majority control.

- Investors gain access to a profitable, market-leading company without diluting management control.

- Risk is minimal for the company since no capital expenditure or debt repayment is involved.

Company Overview: LG Electronics IPO

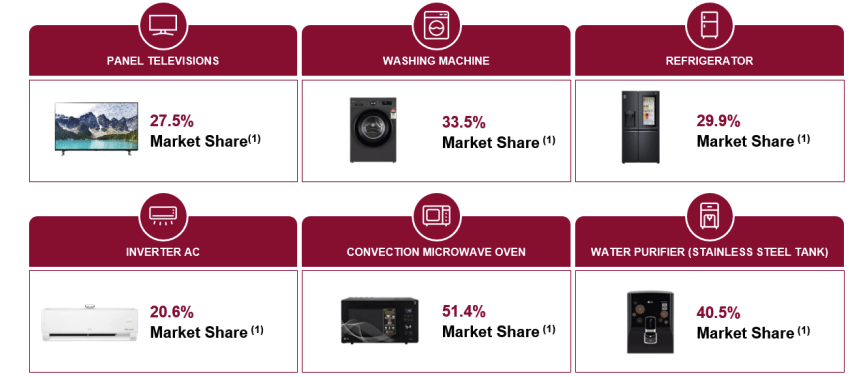

The LG Electronics IPO offers investors a chance to invest in one of India’s top home appliance and consumer electronics brands. Incorporated in 1997 as a wholly owned subsidiary of LG Electronics, the company has consistently held #1 market share across multiple product categories including washing machines, refrigerators, televisions, inverter air conditioners, and microwaves. According to the Redseer Report, offline sales contribute roughly 78% of the market, reflecting the company’s dominant presence.

With a wide product portfolio, LG Electronics India serves both B2C and B2B customers, offering installation, repair, and maintenance services for all products. Approximately eight out of ten air conditioners sold in India use inverter technology, highlighting the company’s technological leadership.

Business Segments & Revenue Contribution

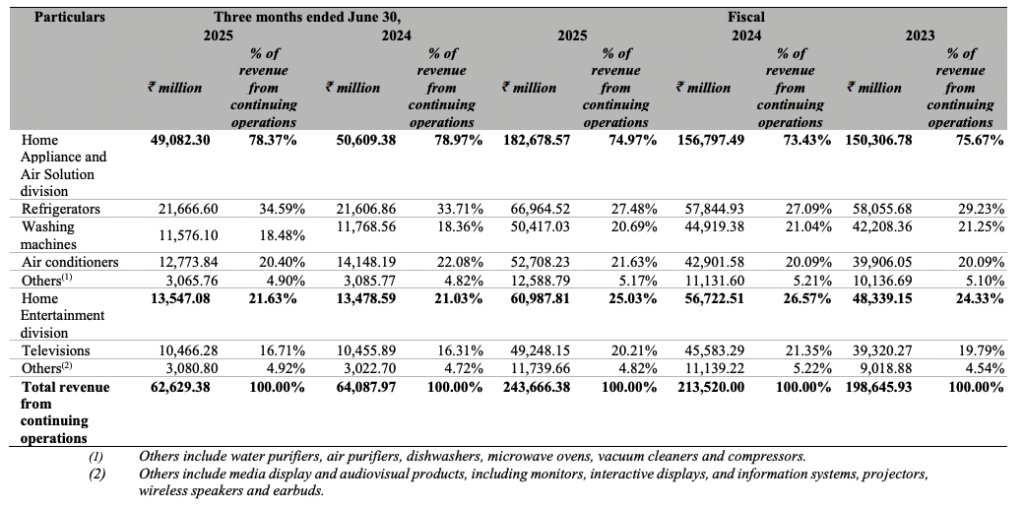

LG Electronics India operates across two main business segments:

1. Home Appliances & Air Solutions – The largest segment, contributing ~75% of total revenue. Key products include:

- Refrigerators: ₹66,965 million in FY25 (≈27% of revenue)

- Washing Machines: ₹50,417 million (≈21% of revenue)

- Air Conditioners: ₹52,708 million (≈22% of revenue)

- Others: Water purifiers, dishwashers, microwaves, vacuum cleaners, compressors (~5% of revenue)

2. Home Entertainment – Contributing ~25% of total revenue, including:

- Televisions: ₹49,248 million (≈20% of revenue)

- Other audiovisual products: Monitors, projectors, wireless speakers, interactive displays (~5% of revenue)

In total, LG Electronics India generated ₹243,666 million in revenue in FY25, reflecting a 14% growth over the previous year.

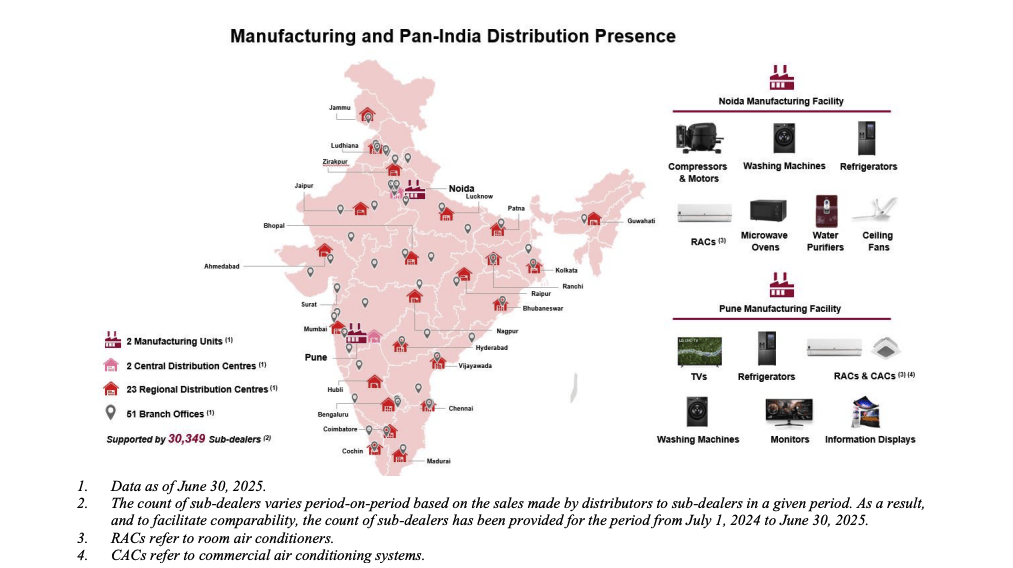

Manufacturing & Distribution Strength

LG Electronics India operates two advanced manufacturing units in Noida and Pune, with a combined capacity of 14.5 million products annually, including key components like compressors and motors. The company also plans a third manufacturing unit in Andhra Pradesh with an investment of ₹50 billion, expected to be operational by FY27.

To support sales, the company maintains a pan-India supply chain with:

- 2 central distribution centers and 23 regional distribution centers

- 35,640 B2C touchpoints and 463 B2B trade partners

- 1,006 service centers with 13,368 engineers providing installation and repair services

This extensive network ensures quick product delivery and superior after-sales service, strengthening its market leadership.

Parentage & Technological Edge

Being part of the global LG Electronics family, India’s subsidiary benefits from strong branding and access to cutting-edge technology. The company has pioneered several firsts in India, including inverter air conditioners in 2014 and stainless steel tanks in water purifiers in 2013.

With 3,796 dedicated employees, a pan-India distribution network, and a focus on operational efficiency, LG Electronics India combines innovation, market leadership, and brand trust, making the LG Electronics IPO an attractive opportunity in the consumer electronics and home appliance sector.

LG Electronics IPO – Financials & Key Performance Indicators

LG Electronics India Ltd.’s revenue grew 14% and profit after tax (PAT) rose 46% in FY2025 compared to FY2024. Key numbers are summarized below:

| Period Ended | 30 Jun 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

|---|---|---|---|---|

| Assets (₹ Cr) | 11,516.44 | 11,517.15 | 8,498.44 | 8,992.12 |

| Total Income (₹ Cr) | 6,337.36 | 24,630.63 | 21,557.12 | 20,108.58 |

| Revenue Growth | (2.28)% | 14.12% | 7.47% | 17.11% |

| Profit After Tax (₹ Cr) | 513.26 | 2,203.35 | 1,511.07 | 1,344.93 |

| EBITDA (₹ Cr) | 716.27 | 3,110.12 | 2,224.87 | 1,895.12 |

| EBITDA Margin | 11.44% | 12.76% | 10.42% | 9.54% |

| Net Worth (₹ Cr) | 6,447.85 | 5,933.75 | 3,735.82 | 4,319.82 |

| Net Profit Margin | 8.10% | 8.95% | 7.01% | 6.69% |

| Reserves & Surplus (₹ Cr) | 5,805.50 | 5,291.40 | 3,659.12 | 4,243.12 |

| Total Borrowings (₹ Cr) | 0.00 | 0.00 | 0.00 | 0.00 |

Key Performance Indicators (KPI)

| KPI | Value |

|---|---|

| Market Capitalization | ₹77,380.05 Cr |

| ROCE | 42.91% |

| RoNW | 37.13% |

| PAT Margin | 8.95% |

| EBITDA Margin | 12.76% |

Highlights:

- Home Appliances & Air Solution drives ~75% of revenue.

- Home Entertainment contributes ~25% of revenue.

- Zero borrowings indicate a strong balance sheet.

- High ROCE and RoNW highlight operational efficiency and profitability.

LG Electronics IPO – Valuation & Peer Comparison

LG Electronics IPO Valuation

| Metric | Pre IPO | Post IPO |

|---|---|---|

| EPS (₹) | 32.46 | 30.25 |

| P/E (x) | 35.12 | 37.69 |

| Price to Book Value (P/BV) | 13.04 | 13.04 |

Key Takeaways:

- The LG Electronics IPO shows strong profitability with EPS of ₹32.46 pre-IPO and P/E of 35.12x.

- Price-to-book value of 13.04 indicates premium valuation, reflecting brand strength and market leadership.

LG Electronics IPO Peer Comparison

| Company Name | EPS (Basic) | EPS (Diluted) | NAV (₹ per share) | P/E (x) | RoNW (%) | P/BV Ratio |

|---|---|---|---|---|---|---|

| LG Electronics India Ltd. | 32.46 | 32.46 | 87.42 | 37.69 | 37.13 | 13.04 |

| Havells | 23.49 | 23.48 | 133.05 | 64.14 | 17.63 | 11.32 |

| Voltas | 25.43 | 25.43 | 197.66 | 52.68 | 12.76 | 6.80 |

| Whirlpool | 28.30 | 28.30 | 314.52 | 43.53 | 9.09 | 3.92 |

| Blue Star | 28.76 | 28.76 | 149.19 | 65.59 | 19.27 | 12.66 |

Insights:

- LG Electronics IPO trades at a moderate P/E compared to peers like Havells and Blue Star, despite higher RoNW, highlighting efficient profitability.

- Strong P/B ratio reflects the company’s market-leading position in the home appliances and consumer electronics sector.

- Consistently higher RoNW compared to peers demonstrates capital efficiency and robust operational performance.

LG Electronics IPO – Strengths & Risks

| Strengths | Risks |

|---|---|

| #1 market leader in home appliances and consumer electronics in India across key categories. | Highly competitive industry with several established players like Havells, Voltas, Blue Star. |

| Strong brand recognition backed by parent company LG Electronics, a global leader. | Revenue dependent on consumer demand; slowdown in discretionary spending may impact sales. |

| Diverse product portfolio: Home Appliances, Air Solutions, Home Entertainment. | Vulnerability to supply chain disruptions, including domestic and imported components. |

| Pan-India distribution and extensive after-sales service network with 1,006 service centers. | Regulatory changes, import duties, or GST variations may affect pricing and margins. |

| Advanced manufacturing units in Noida and Pune, with plans for a new unit in Andhra Pradesh. | High P/B and P/E ratios suggest premium valuation, which may limit short-term listing gains. |

| Operational efficiency and capital-efficient model with strong RoNW (37.13%) and ROCE (42.91%). | Foreign exchange fluctuations could impact costs for imported components. |

| Proven technology leadership with early adoption of inverter ACs and stainless steel tanks in water purifiers. | Dependence on a single parent brand; reputational or strategic issues at LG Electronics globally could impact the Indian subsidiary. |

LG Electronics IPO GMP– Grey Market Premium & Estimated Listing Gains

| GMP Date | IPO Price (₹) | GMP (₹) | Sub2 Sauda Rate | Estimated Listing Price (₹) | Estimated Profit (%) | Remarks / Movement |

|---|---|---|---|---|---|---|

| 03-10-2025 | 1,140 | 173 | 1,700 / 23,800 | 1,313 | 15.18% | GMP Up |

| 02-10-2025 | 1,140 | 146 | 1,400 / 19,600 | 1,286 | 12.81% | GMP Up |

| 01-10-2025 | 1,140 | 145 | 1,400 / 19,600 | 1,285 | 12.72% | GMP Stable |

Key Insights – LG Electronics IPO:

- GMP indicates strong market demand for LG Electronics IPO.

- Estimated listing gains are consistently above 12%, signaling positive investor sentiment.

- Upward GMP trend suggests robust subscription and retail interest in the IPO.

Conclusion – Should You Apply for LG Electronics IPO?

The LG Electronics IPO offers investors a chance to participate in a leading player in India’s home appliances and consumer electronics sector. With a dominant market position across key categories like refrigerators, washing machines, air conditioners, and televisions, the company benefits from the strong global brand and technological leadership of LG Electronics.

Financially, the company has demonstrated healthy growth, with revenue rising by 14% and profit after tax increasing by 46% in FY 2024-25. Key performance indicators such as a ROCE of 42.91% and a RoNW of 37.13% reflect strong operational efficiency and profitability.

From a valuation perspective, the post-IPO P/E of 37.69 and P/BV of 13.04 position the company in line with premium peers like Havells, Voltas, and Blue Star, indicating a market perception of quality and growth potential. Moreover, the grey market premium trends suggest expected listing gains of 12–15%, reflecting healthy investor interest.

However, potential investors should also consider the high valuation relative to certain peers, the company’s dependence on discretionary consumer spending, and competitive pressures within the consumer electronics space.

Overall, for retail investors seeking a stable, high-quality brand with the potential for listing gains and medium-to-long term value appreciation, the LG Electronics IPO presents a compelling opportunity. Institutional and HNI investors may view this as an attractive addition to a diversified portfolio, balancing growth and brand strength against valuation considerations.

LG Electronics IPO – FAQs

Q1: When does the LG Electronics IPO open and close?

A1: The IPO opens on October 7, 2025, and closes on October 9, 2025.

Q2: What is the price band for LG Electronics IPO?

A2: The price band is ₹1080 to ₹1140 per share.

Q3: What is the lot size for the IPO?

A3: One lot consists of 13 shares. Retail investors can apply for a minimum of 1 lot and up to 13 lots.

Q4: How many shares are being offered in the IPO?

A4: The issue size is 10.18 crore shares aggregating up to ₹11,607.01 crore.

Q5: Is this a fresh issue or an offer for sale?

A5: It is an Offer for Sale; the company will not receive proceeds from the IPO.

Q6: Where will LG Electronics IPO be listed?

A6: The IPO will list on NSE and BSE, with a tentative listing date of October 14, 2025.

Q7: Who is the book running lead manager for the IPO?

A7: Morgan Stanley India Co. Pvt. Ltd. is the lead manager.

Q8: What is the promoter holding post-IPO?

A8: LG Electronics Inc., the promoter, will hold 85% of the company post-IPO.

Q9: What are the key business segments of LG Electronics India?

A9: The company operates in Home Appliances & Air Solution and Home Entertainment segments.

Q10: Should retail investors consider applying?

A10: Yes, given the strong market position, healthy financials, and expected listing gains, it may be attractive for medium-to-long term investment, keeping valuation in mind.

Related Articles

How to Analyze an IPO Before Investing: A Step-by-Step Guide

One Demat vs Multiple Demat – Which is Better for IPO Allotment?