Introduction

The Fabtech Technologies IPO is creating a lot of buzz in the market as it opens for subscription on September 29, 2025. Coming from a strong biopharma engineering background, Fabtech Technologies Ltd has made a name for itself in delivering turnkey solutions to pharma and life sciences companies across the globe. From designing cleanrooms to installing modular systems and advanced clean water and air solutions, the company has carved a niche in a highly specialized industry.

With its upcoming public issue, the Fabtech IPO aims to raise ₹230.35 crores through a fresh issue of shares. Given its global presence, order book strength, and decades of experience as part of the Fabtech Group, this IPO is one that both retail and institutional investors are keenly watching.

In this section, let’s break down all the important details about the offering, timeline, and objectives, before diving deep into the company’s business model and financial background.

Fabtech Technologies IPO Overview

Fabtech Technologies IPO Details

| Particulars | Details |

|---|---|

| IPO Date | September 29, 2025 – October 1, 2025 |

| Listing Date | October 7, 2025 (Tentative) |

| Face Value | ₹10 per share |

| Price Band | ₹181 – ₹191 per share |

| Lot Size | 75 Shares |

| Issue Type | Book Building |

| Fresh Issue | 1,20,60,000 shares |

| Total Issue Size | ₹230.35 Cr |

| Employee Discount | ₹9 per share |

| Lead Manager | Unistone Capital Pvt. Ltd. |

| Registrar | Bigshare Services Pvt. Ltd. |

| Pre-Issue Shareholding | 3,23,92,239 shares |

| Post-Issue Shareholding | 4,44,52,239 shares |

| IPO Documents | RHP |

The Fabtech Technologies IPO is entirely a fresh issue, ensuring all proceeds go directly to the company for expansion and working capital. With its modest size and niche sector focus, the IPO is expected to attract strong retail and institutional participation.

Important Dates of Fabtech IPO

| Event | Date |

|---|---|

| IPO Open Date | Mon, Sep 29, 2025 |

| IPO Close Date | Wed, Oct 1, 2025 |

| Basis of Allotment | Fri, Oct 3, 2025 |

| Refunds Initiation | Mon, Oct 6, 2025 |

| Credit to Demat | Mon, Oct 6, 2025 |

| Listing Date | Tue, Oct 7, 2025 |

| UPI Mandate Cut-off | Wed, Oct 1, 2025 (5 PM) |

The timeline is short and efficient, with allotment expected just two days after closing. Investors in the Fabtech IPO won’t have to wait long for listing, keeping liquidity concerns minimal.

Objects of the Issue

The Fabtech Technologies IPO aims to utilize the proceeds as follows:

- ₹1,270 Cr – Working capital requirements: To strengthen day-to-day operations, manage large project executions, and sustain order book growth.

- ₹300 Cr – Inorganic growth initiatives: Strategic acquisitions to scale faster in global markets.

- General corporate purposes: Branding, administrative expenses, and future contingencies.

The clear focus on working capital and acquisitions shows that the Fabtech IPO proceeds are growth-driven. This approach is in line with the company’s expanding international order book and rising demand for turnkey pharma projects.

Company Background – Fabtech Technologies Ltd

Fabtech Technologies Ltd, incorporated in 2018, is part of the well-established Fabtech Group, a trusted name in pharmaceutical engineering since 1995. The company specializes in designing and delivering turnkey biopharma projects, including cleanroom facilities, modular panels, HVAC systems, and process equipment.

What sets Fabtech apart is its end-to-end solutions—covering project design, engineering, manufacturing, installation, and lifecycle management. This approach ensures global compliance with regulatory standards, making it a partner of choice for pharma and biotech companies worldwide.

The company’s portfolio covers a wide range of offerings:

- Clean Water Solutions: From purified water systems to water for injection, with flow rates of 500–50,000 LPH.

- Clean Air Solutions: Supporting life sciences, IT, food, semiconductors, and aeronautics with innovative clean air technology.

- Start-to-Finish Biopharma Solutions: Helping companies from facility design to product market readiness.

Fabtech Technologies IPO benefits from the parent group’s 29 years of experience. After a strategic demerger in 2018, Fabtech inherited a robust order book worth ₹28,716.36 lakh, which has since grown consistently. By June 2024, the company had completed 35 projects across Saudi Arabia, Egypt, Algeria, Bangladesh, Ethiopia, Sri Lanka, and the UAE, demonstrating its global execution capability.

Procurement and Costs

| Particulars | Fiscal 2024 | % | Fiscal 2023 | % | Fiscal 2022 | % |

|---|---|---|---|---|---|---|

| Related Entity Equipment | ₹4,225.05 L | 34.89% | ₹3,769.04 L | 36.82% | ₹4,471.37 L | 32.89% |

| Third Party Procurement | ₹7,884.66 L | 65.11% | ₹6,468.39 L | 63.18% | ₹9,119.09 L | 67.09% |

| Total Procurement Cost | ₹12,109.71 L | 100% | ₹10,237.43 L | 100% | ₹13,590.46 L | 100% |

Procurement is well-balanced, with a larger share sourced from third-party suppliers. This reduces over-dependence on related entities and provides flexibility in cost management.

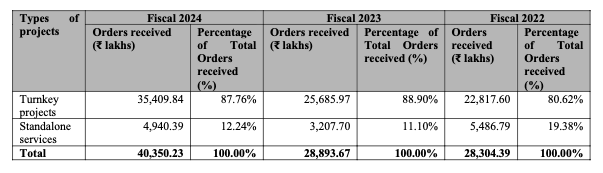

Orders Breakdown of Fabtech IPO

The dominance of turnkey projects shows Fabtech’s strength in large-scale, integrated assignments, which contribute more than 85% of revenues consistently.

Regional Distribution of Orders

| Region | FY24 | FY23 | FY22 |

|---|---|---|---|

| GCC | 56.16% | 8.94% | 8.07% |

| MENA | 22.07% | 32.03% | 69.36% |

| ECO Zone | 17.93% | 56.31% | 19.33% |

| SADAC | 3.34% | 0.24% | 0.42% |

| Europe | 0.50% | 0.57% | 0.92% |

| SEA | 0% | 1.91% | 1.65% |

| America | 0% | 0% | 0.25% |

| Total | 100% | 100% | 100% |

A major shift has happened in FY24 with the GCC region now contributing more than half of the order book, indicating strong growth in Middle East demand.

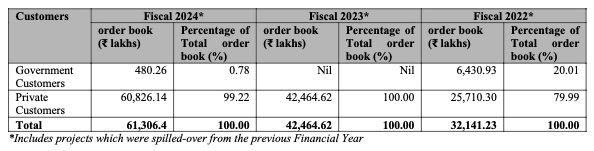

Client Profile of Fabtech IPO

Fabtech relies heavily on private clients (over 99% in FY24), though government orders in FY22 highlight diversification potential.

The strong order book, global footprint, and specialization in pharma turnkey projects make Fabtech Technologies IPO appealing to investors who want to tap into the growing demand for cleanroom and bioengineering solutions worldwide. With increasing global compliance needs, Fabtech Technologies Ltd is strategically placed to capture a bigger share of international markets.

Financial Performance of Fabtech Technologies IPO

The financial strength of Fabtech Technologies IPO is one of the most attractive aspects for investors. Over the past three years, the company has consistently expanded its revenue, profit, and operational efficiency. Between FY24 and FY25, revenue grew 46%, while profit after tax (PAT) jumped 71%, indicating strong scalability and demand for the company’s solutions.

Consolidated Financials

| Particulars | FY 2025 | FY 2024 | FY 2023 |

|---|---|---|---|

| Assets (₹ Cr) | 426.56 | 269.24 | 213.86 |

| Total Income (₹ Cr) | 335.94 | 230.39 | 199.91 |

| Profit After Tax (₹ Cr) | 46.45 | 27.22 | 21.73 |

| EBITDA (₹ Cr) | 47.28 | 40.69 | 34.86 |

| Net Worth (₹ Cr) | 173.11 | 131.88 | 88.96 |

| Reserves & Surplus (₹ Cr) | 140.72 | 128.94 | 86.18 |

| Total Borrowings (₹ Cr) | 54.62 | 9.88 | 34.29 |

The company has built a robust balance sheet while maintaining manageable debt. Borrowings increased in FY25, but strong EBITDA and PAT margins show Fabtech can comfortably service its obligations.

Operational & Financial KPIs of Fabtech IPO

To understand the operational backbone of Fabtech Technologies IPO, let’s review additional indicators:

| Metric | FY24 | FY23 | FY22 |

|---|---|---|---|

| EBITDA Margin | 17.66% | 17.44% | 13.90% |

| Net Profit Margin | 11.81% | 10.87% | 9.03% |

| ROE (%) | 24.65% | 27.80% | 41.29% |

| ROCE (%) | 29.48% | 31.74% | 49.03% |

| Current Ratio | 1.70 | 1.48 | 1.46 |

| Debt/Equity | 0.07 | 0.39 | 0.28 |

| Interest Coverage | 13.59 | 6.51 | 11.06 |

A steady EBITDA margin above 17% and improving net profit margins highlight Fabtech’s ability to manage costs efficiently while scaling operations.

Valuation & Peer Comparison of Fabtech Technologies IPO

The Fabtech Technologies IPO is being valued at a market capitalization of around ₹849.04 crore. At the upper price band, the company’s post-IPO P/E ratio stands at 18.28x, which appears moderate compared to peers in the same sector.

Valuation of Fabtech IPO

| Metric | Pre-IPO | Post-IPO |

|---|---|---|

| EPS (₹) | 14.34 | 10.45 |

| P/E (x) | 13.32 | 18.28 |

| Price to Book Value | 3.57 |

While valuations are slightly higher than industry average, the strong growth in revenue and PAT makes the IPO reasonably priced.

Peer Comparison of Fabtech IPO

Comparing Fabtech Technologies IPO with listed peers gives clarity on positioning.

| Company | Revenue (₹ Lakhs) | EPS | P/E (x) | RoNW (%) | NAV (₹) |

|---|---|---|---|---|---|

| Fabtech Technologies | 22,613.63 | 8.43 | 18.28 | 20.64% | 40.87 |

| ION Exchange (India) Ltd | 2,34,784.92 | 16.53 | 40.28 | 19.19% | 85.86 |

| VA Tech Wabag Ltd | 2,85,640.00 | 39.49 | 34.76 | 13.77% | 292.42 |

Even though Fabtech Technologies IPO is smaller in scale, it offers strong profitability metrics and a lower P/E compared to established players. This makes it appealing for growth-oriented investors.

Strengths & Risks of Fabtech Technologies IPO

Investors in the Fabtech IPO should weigh both the company’s advantages and potential risks before applying. The following side-by-side table provides a snapshot of strengths and risks:

| Strengths | Risks |

|---|---|

| Strong revenue growth: 46% YoY increase between FY24–FY25 | High dependence on turnkey projects; delays may impact revenue |

| Healthy PAT growth: 71% YoY increase | Competitive sector with established global players |

| Robust order book of ₹72,615.05 lakhs as of FY24 | Geopolitical risks in export markets like GCC and MENA |

| Diversified operations across cleanroom solutions, HVAC, and biopharma engineering | Project execution risk due to complex international operations |

| Strong operational KPIs: EBITDA margin 17.66%, PAT margin 11.81% | Raw material price fluctuations may affect margins |

| Experienced management team with proven track record | Dependence on a limited number of key clients for large projects |

| Modern technology integration, including modular systems and turnkey solutions | Regulatory risks in global markets |

The Fabtech Technologies IPO demonstrates strong financial health, operational efficiency, and international presence. Its diversified offerings and experienced management reduce business risk. However, investors should note potential exposure to international market fluctuations, project execution delays, and sector competition. Overall, the IPO offers a good risk-reward balance for growth-oriented investors.

Fabtech Technologies IPO GMP (Grey Market Premium)

The Grey Market Premium (GMP) provides an early indicator of market sentiment for the Fabtech Technologies IPO.

| GMP Date | IPO Price (₹) | GMP (₹) | Sub2 Sauda Rate | Estimated Listing Price (₹) | Estimated Profit (₹) | Last Updated |

|---|---|---|---|---|---|---|

| 27-09-2025 | 191.00 | 35 | 2,000/28,000 | 226 (18.32%) | 2,625 | No Change |

The GMP of ₹35 over the upper price band suggests strong market appetite for the Fabtech IPO. An estimated listing price of ₹226 implies a potential first-day gain of 18.32%, signaling positive investor sentiment. The steady GMP movement indicates confidence among retail and institutional buyers.

Conclusion: Fabtech Technologies IPO – Expert Analysis

The Fabtech Technologies IPO presents a compelling proposition for investors looking to enter the high-growth biopharma engineering sector. Over the past few years, the company has demonstrated strong financial performance, with a 46% increase in revenue and a 71% rise in PAT between FY24 and FY25. These figures reflect not only robust operational efficiency but also an ability to scale complex turnkey projects across domestic and international markets.

From an operational standpoint, Fabtech Technologies Ltd has built a diversified portfolio, spanning cleanroom solutions, modular systems, HVAC, and process equipment. Its international footprint across GCC, MENA, and ECO zones, coupled with a substantial order book of ₹72,615.05 lakhs, provides a stable revenue pipeline. Moreover, the company’s strategic integration of technology and project management expertise enables it to execute large-scale, high-value projects efficiently, which is a significant competitive advantage in a sector driven by precision and regulatory compliance.

Financial metrics further underscore its attractiveness. The company’s EBITDA margin of 17.66% and PAT margin of 11.81% demonstrate operational resilience, while a healthy ROE of 24.65% indicates strong returns to shareholders. The planned use of IPO proceeds for working capital and inorganic growth initiatives adds potential for further revenue expansion and market penetration.

However, investors must consider certain risk factors. Fabtech Technologies operates in a niche, project-driven industry, which makes it susceptible to execution delays, regulatory hurdles, and dependence on a few large clients. Additionally, global exposure means macroeconomic or geopolitical disruptions could affect project timelines or margins.

That said, the positive GMP of ₹35 over the upper price band and an estimated listing gain of 18.32% reflect strong market confidence and healthy demand for this IPO. For growth-oriented investors, this is a signal of both immediate listing potential and long-term value creation.

Expert Takeaway:

The Fabtech Technologies IPO is not just an offering of equity; it represents an opportunity to invest in a well-capitalized, technologically advanced, and strategically diversified company within the growing biopharma engineering sector. Considering its strong financial track record, robust order book, and favorable market sentiment, the IPO is well-positioned to reward both retail and institutional investors who are seeking growth with a moderate-to-high risk appetite.

Fabtech Technologies IPO – FAQs

Q1: What is the Fabtech Technologies IPO size?

A1: Fabtech Technologies IPO is a book building issue of ₹230.35 crores, entirely a fresh issue.

Q2: When does the Fabtech Technologies IPO open and close?

A2: The IPO opens on September 29, 2025, and closes on October 1, 2025.

Q3: What is the price band for the Fabtech Technologies IPO?

A3: The price band is ₹181 to ₹191 per share.

Q4: What is the lot size and minimum investment?

A4: Each lot consists of 75 shares, requiring a minimum investment of ₹14,325 at the upper price band.

Q5: Where will Fabtech Technologies IPO be listed?

A5: The IPO will list on BSE and NSE, with a tentative listing date of October 7, 2025.

Q6: Who are the promoters of Fabtech Technologies Ltd?

A6: The promoters include Aasif Ahsan Khan, Hemant Mohan Anavkar, Aarif Ahsan Khan, and Manisha Hemant Anavkar.

Q7: What is the objective of the Fabtech Technologies IPO?

A7: The company plans to use proceeds for working capital requirements, inorganic growth through acquisitions, and general corporate purposes.

Q8: What is the GMP and expected listing gain?

A8: As of 27-09-2025, GMP is ₹35, indicating an estimated listing price of ₹226, with a potential gain of 18.32%.

Q9: What are the key financial highlights?

A9: Revenue rose by 46%, PAT increased by 71%, and the company maintains healthy ROE (30.46%) and EBITDA margins (14.07%).

Q10: Is Fabtech Technologies IPO suitable for retail investors?

A10: Yes, for investors seeking growth in the biopharma engineering sector with moderate risk appetite, the IPO offers potential listing gains and long-term value creation.

Related Articles

How to Analyze an IPO Before Investing: A Step-by-Step Guide

One Demat vs Multiple Demat – Which is Better for IPO Allotment?