Introduction

The Stock Market 26 September witnessed yet another weak trading session, extending the losing streak for Indian equities. The benchmarks opened lower, dragged down by global cues and fresh U.S. trade-related worries. As the day progressed, selling pressure intensified across pharma, IT, banking, midcap, and smallcap stocks, pushing the indices deep into the red.

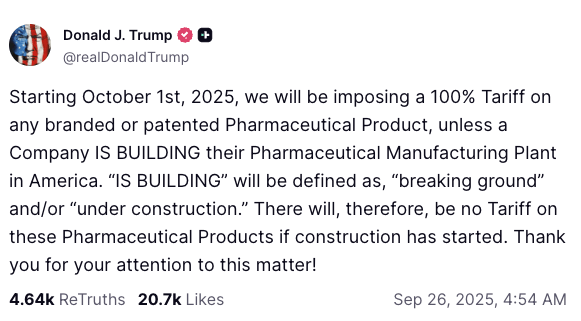

The biggest spotlight was on the pharma sector, which tumbled more than 2% after the U.S. announced a 100% tariff on branded drug imports, triggering panic among investors and sparking heavy sell-offs in pharmaceutical counters. Adding to the pain, IT stocks slumped sharply, mirroring weak global demand outlook and foreign fund outflows.

By the close, the markets failed to recover, and the mood stayed risk-off, with FIIs continuing to offload positions, while domestic investors also turned cautious.

Index Performance on Stock Market 26 September

The market witnessed a sharp decline across indices as selling pressure intensified in IT, pharma, and banking names. Here’s how the key benchmarks performed today:

| Index | Closing Value | Change (Pts) | Change (%) |

|---|---|---|---|

| NIFTY 50 | 24,663.90 | -226.95 | -0.91% |

| SENSEX | 80,493.62 | -666.06 | -0.82% |

| Nifty Bank | 54,406.90 | -569.30 | -1.04% |

| Nifty IT | 33,750.80 | -797.50 | -2.31% |

| S&P BSE SmallCap | 52,316.46 | -1,056.42 | -1.98% |

| Nifty Pharma Index | 21,507.20 | -470.50 | -2.14% |

📉 Clearly, pharma, IT, and financials led the downfall, while smallcaps and midcaps saw sharp corrections due to broad-based selling.

Read More: Pharma Tariff Effect – 100% Tariff Creates Big Risks & Hidden Opportunities

Top Gainers on Stock Market 26 September

Amid the gloom, a handful of stocks shone bright thanks to strong company-specific news:

- Godrej Agrovet – ▲ 4.09%, LTP ₹715.8

Boosted by analyst upgrades and positive sentiment in the agri-inputs sector, this stock drew strong buying interest. - Jupiter Wagons – ▲ 3.88%, LTP ₹336.4

Riding on sustained demand in railway infrastructure, the stock continued to attract investors betting on long-term growth. - Tata Investment – ▲ 3.51%, LTP ₹8,666

After its stock split, optimism remains strong as investors eye value unlocking and participation from broader retail. - Larsen & Toubro (L&T) – ▲ 2.34%, LTP ₹3,729.5

Driven by project buyouts and a robust order pipeline, L&T stood out as a large-cap anchor in today’s volatile session. - Netweb Technologies – ▲ 2.27%, LTP ₹3,695.4

The stock scaled a 10-year high, powered by strong demand in digital infrastructure and cloud solutions.

💡 These gainers show that even on weak days, sectoral triggers and growth stories can still create opportunities for investors.

Top Losers on Stock Market 26 September

The bulk of the pain was concentrated in pharma, telecom, and IT stocks, which witnessed heavy profit booking:

- Wockhardt – ▼ -9.46%, LTP ₹1,336.5

Suffered the steepest fall amid high volume selling, reflecting broader pharma weakness. - Vodafone Idea – ▼ -7.60%, LTP ₹8.02

The stock slumped after its AGR dues hearing got deferred, stoking uncertainty about the company’s financial path. - Laurus Labs – ▼ -7.15%, LTP ₹832.3

A casualty of the pharma sector rout, with concerns on pricing and earnings outlook. - Intellect Design Arena – ▼ -6.91%, LTP ₹986.15

Profit booking hit IT names hard, with Intellect witnessing a steep correction after recent gains. - Waaree Energies – ▼ -6.89%, LTP ₹3,207.6

Investors grew cautious over the company’s large-scale investment plans, leading to heavy selling.

⚠️ The dominance of pharma and IT in the losers’ list highlights how sector-specific news dictated today’s negative sentiment on Stock Market 26 September.

Summary Table of Top Gainers & Losers – Stock Market 26 September

| Top Gainers | % Change | LTP | Reason |

|---|---|---|---|

| Godrej Agrovet | +4.09% | ₹715.8 | Analyst Buy |

| Jupiter Wagons | +3.88% | ₹336.4 | Rail Infra Demand |

| Tata Investment | +3.51% | ₹8,666 | Stock Split Optimism |

| Larsen & Toubro | +2.34% | ₹3,729.5 | Project Buyout |

| Netweb Technologies | +2.27% | ₹3,695.4 | 10-Year High |

| Top Losers | % Change | LTP | Reason |

|---|---|---|---|

| Wockhardt | -9.46% | ₹1,336.5 | Heavy Sell-off |

| Vodafone Idea | -7.60% | ₹8.02 | AGR Case Hearing |

| Laurus Labs | -7.15% | ₹832.3 | Pharma Weakness |

| Intellect Design Arena | -6.91% | ₹986.15 | IT Weakness |

| Waaree Energies | -6.89% | ₹3,207.6 | Investment Concerns |

Why Did the Market Fall on 26 September?

The fall in Stock Market 26 September can be attributed to a cocktail of global and domestic headwinds:

- U.S. Tariffs on Branded Pharma

The announcement of a 100% tariff on branded drug imports by the U.S. rattled the Indian pharma sector. Stocks like Laurus Labs, Wockhardt, Sun Pharma saw significant selling, pulling down the entire sector. - IT Sector Weakness

The Nifty IT index tanked 2.31%, weighed down by global growth concerns, currency fluctuations, and the ongoing U.S. visa policy uncertainty. This triggered steep declines in Intellect Design, Infosys, and TCS. - FII Outflows

Persistent foreign portfolio investor (FPI) selling continued to hurt market liquidity. Concerns about India’s valuation premium compared to other emerging markets kept FIIs on the sidelines. - Currency Pressure

The rupee remains under stress against the U.S. dollar, impacting foreign investor confidence and raising import costs. - Broad-based Weakness

The sell-off was not restricted to large caps. Smallcaps and midcaps fell nearly 2%, highlighting risk aversion across the market.

Conclusion: Stock Market 26 September

The Stock Market 26 September ended sharply lower, weighed down by pharma and IT stocks, alongside continued foreign investor outflows. While a few names like Godrej Agrovet, Tata Investment, and L&T managed to shine, the broader sentiment remained bearish.

Going forward, investors will closely watch:

- Developments around the U.S. tariff policy on pharma exports

- Clarity on FII flows and currency stability

- Quarterly earnings from IT and pharma majors

In short, today’s decline reflects global trade worries meeting domestic vulnerabilities, keeping markets on edge.

More Articles

How to Transfer Shares from Groww to Zerodha – Full Guide (2025)

Best Screener Queries for Stock Selection: Find Hidden Gems Before Others Do

How a Tea Seller Used the Power of Compound Interest to Build ₹45 Lakh