Introduction

The Epack Prefab Technologies IPO is one of the most anticipated offerings of 2025, drawing strong attention from investors tracking India’s rapidly growing infrastructure and prefabrication sector. Backed by more than two decades of expertise, Epack Prefab Technologies Ltd. has carved out a strong position in the pre-engineered buildings (PEB) and prefabricated structures industry.

The company has evolved into a diversified player, not only delivering turnkey pre-engineered steel buildings and modular solutions but also manufacturing EPS thermocol-based packaging products that serve the packaging and insulation markets. With a presence across industrial, institutional, and commercial sectors, Epack Prefab Technologies IPO stands at the intersection of India’s construction boom and the rising demand for sustainable, time-efficient building technologies.

The ₹504 crore issue is a mix of fresh equity and an offer-for-sale, and through this public offering, the company aims to strengthen its capacity, reduce debt, and fuel expansion. For investors, Epack Prefab IPO is not just about participating in an infrastructure story—it is about tapping into a company with a demonstrated track record, strong order book, and robust financial growth.

Overall, the Epack Technologies IPO represents an interesting opportunity for both retail and institutional investors, given the company’s competitive edge, financial strength, and sectoral growth tailwinds.

IPO Overview – Epack Prefab Technologies IPO

IPO Details – Epack Prefab Technologies IPO

The Epack Prefab Technologies IPO is a book-built issue worth ₹504 crore. The structure includes:

- Fresh Issue: 1.47 crore equity shares aggregating to ₹300 crore.

- Offer for Sale (OFS): 1.00 crore equity shares aggregating to ₹204 crore.

Key highlights of the Epack Prefab IPO:

- Price Band: ₹194 to ₹204 per share.

- Face Value: ₹2 per share.

- Lot Size: 73 shares per lot.

- Minimum Retail Investment: ₹14,892 (73 shares at upper band).

- S-HNI Investment: Starts at 1,022 shares (₹2,08,488).

- B-HNI Investment: Starts at 4,964 shares (₹10,12,656).

- Total Issue Size: 2,47,05,882 shares.

- Post-Issue Shareholding: 10.04 crore shares compared to 8.57 crore shares pre-issue.

Book Running Lead Manager: Monarch Networth Capital Ltd.

Registrar: Kfin Technologies Ltd. | IPO Document: RHP

Listing: The Epack Technologies IPO will be listed on both BSE and NSE.

Important Dates – Epack Prefab IPO Schedule

The tentative timeline of the Epack Prefab IPO is as follows:

| Event | Date |

|---|---|

| IPO Open Date | Wednesday, September 24, 2025 |

| IPO Close Date | Friday, September 26, 2025 |

| Basis of Allotment | Monday, September 29, 2025 |

| Initiation of Refunds | Tuesday, September 30, 2025 |

| Credit of Shares to Demat | Tuesday, September 30, 2025 |

| Listing Date (Tentative) | Wednesday, October 1, 2025 |

| Cut-off Time for UPI Confirmation | Friday, September 26, 2025, 5 PM |

Objects of the Issue – Epack Technologies IPO Objectives

The proceeds from the Epack Technologies IPO will be used for the following purposes:

- Setting up a new manufacturing facility at Ghiloth Industrial Area, Rajasthan for continuous Sandwich Insulated Panels and pre-engineered steel buildings – ₹102.97 crore.

- Expansion of existing Mambattu (Unit 4) facility in Andhra Pradesh to enhance PEB capacity – ₹58.17 crore.

- Debt repayment / prepayment of certain borrowings – ₹70 crore.

- General corporate purposes.

Company Background – Epack Prefab Technologies IPO

Legacy and Evolution of Epack Prefab Technologies Ltd.

Incorporated in 1999, the company behind the Epack Prefab Technologies IPO carries a legacy of over 25 years. Over this journey, it has emerged as a strong and innovative player in the prefabricated construction and EPS packaging space, serving diverse industries across India and overseas.

The business operates in two key verticals:

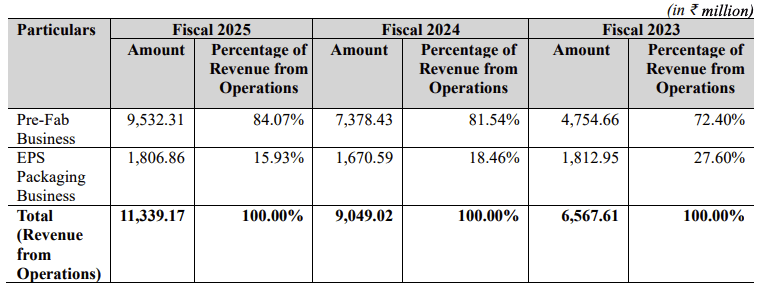

- Pre-Fab Business – Turnkey solutions for pre-engineered steel buildings and prefabricated structures, including design, engineering, manufacturing, installation, and erection. These structures are delivered not only across India but also internationally, making the Epack Prefab IPO a play on both domestic and global infrastructure expansion.

- EPS Packaging Business – Manufacturing of EPS (Expanded Polystyrene) block-molded and shape-molded products such as sheets, panels, and packaging boxes for construction, consumer goods, and industrial applications. These products, marketed under the brand EPACK PACKAGING, are known for insulation, durability, and lightweight strength.

The table below shows the revenue contribution by the Pre-Fab Business and the EPS Packaging Business for Fiscals 2025, 2024 and 2023:

Manufacturing & Design Capabilities – Epack Technologies IPO

The company has built three manufacturing facilities across Greater Noida (UP), Ghiloth (Rajasthan), and Mambattu (Andhra Pradesh), offering:

- 1,26,546 MTPA pre-engineered steel building capacity.

- 5,10,000 SQM Sandwich Insulated Panel capacity.

- 8,400 MTPA EPS packaging capacity.

Additionally, three design centres in Noida, Hyderabad, and Vishakhapatnam strengthen the company’s engineering innovation. This infrastructure, along with its focus on cost competitiveness, enables customized prefab solutions tailored to customer requirements.

Strong Industry Standing

As per the CRISIL Report:

- The company has recorded a 41.79% revenue CAGR between FY22–24, the fastest among peers.

- Its Pre-Fab Business alone grew at 55.48% CAGR, far outpacing industry growth.

- Ranked third largest in capacity in India’s pre-engineered steel buildings sector.

- Among the top three in ROE and ROCE metrics within peers in FY24.

This rapid growth positions the Epack Prefab IPO attractively against the backdrop of an industry expected to expand at a 9.5–10.5% CAGR between FY25–30.

Sustainability & Recognition

A study by Conserve Consultants highlighted that PEB structures from the company can reduce embodied carbon emissions by 52% compared to RCC buildings and cut operational carbon emissions by 6.5%, underscoring its role in promoting greener construction.

The company has received certifications like ISO 9001:2015 and ISO 14001:2015, along with accolades such as the Golden Book of World Records award for fastest erection of a pre-engineered factory building.

Financials – Epack Prefab Technologies IPO

Financial Performance – Epack Prefab IPO

| Particulars (₹ in crore) | FY23 | FY24 | FY25 | Growth Trend |

|---|---|---|---|---|

| Total Assets | 432.05 | 613.72 | 931.02 | Nearly doubled in 2 years |

| Total Income | 660.49 | 906.38 | 1,140.49 | ↑ 26% YoY (FY24–FY25) |

| EBITDA | 51.53 | 87.00 | 117.79 | Strong margin expansion |

| Profit After Tax (PAT) | 23.97 | 42.96 | 59.32 | ↑ 38% YoY (FY24–FY25) |

| Net Worth | 126.10 | 168.96 | 353.93 | Robust equity base |

| Reserves & Surplus | 122.22 | 165.08 | 337.01 | Strong accretion |

| Total Borrowings | 105.93 | 145.31 | 210.23 | Leverage under control |

Key Performance Indicators – Epack Technologies IPO

| KPI (FY25) | Value | Analyst View |

|---|---|---|

| ROE | 22.69% | Strong return profile |

| ROCE | 22.88% | Efficient capital utilization |

| Debt/Equity | 0.15 | Low leverage, financially sound |

| PAT Margin | 5.20% | Stable profitability |

| EBITDA Margin | 10.39% | Healthy operational efficiency |

| RoNW | 22.69% | Consistent with peer leaders |

| Market Cap (at issue) | ₹2,049.22 Cr | Small-cap positioning |

Analyst Note – Epack Prefab Technologies IPO

The company has delivered 26% revenue growth and 38% PAT growth in FY25, driven by robust demand in the Pre-Fab Business. Margins remain healthy, while a low debt-equity ratio (0.15) ensures balance sheet strength. At an implied market cap of ~₹2,049 crore, the Epack Prefab IPO stands well-placed to attract investor attention given its financial resilience and growth trajectory.

Valuation & Peer Comparison – Epack Prefab Technologies IPO

Valuation – Epack Prefab IPO

| Metric | Pre-IPO | Post-IPO | Analyst View |

|---|---|---|---|

| EPS (₹) | 6.92 | 5.91 | Dilution impact visible |

| P/E (x) | 29.49x | 34.54x | Slightly expensive vs peers |

| Price-to-Book (P/BV) | 9.36x | – | High, reflects premium pricing |

Takeaway: At ~34.5x post-IPO earnings, the Epack Prefab IPO is priced at a premium valuation, indicating strong growth expectations baked in by the market.

Peer Comparison – Epack Prefab Technologies IPO vs Industry Players

| Company | EPS (Basic) | EPS (Diluted) | NAV (₹/share) | P/E (x) | RoNW (%) | P/BV (x) |

|---|---|---|---|---|---|---|

| Epack Prefab Technologies Ltd. | 7.65 | 7.39 | 45.66 | 34.54 | 22.69% | 9.36 |

| Pennar Industries Ltd. | 8.84 | 8.84 | 73.99 | 27.50 | 12.74% | 3.33 |

| Everest Industries Ltd. | -2.28 | -2.28 | 377.12 | -298.20 | -0.60% | 1.80 |

| Interarch Buildings Ltd. | 68.51 | 68.03 | 451.57 | 30.32 | 18.03% | 4.61 |

| Beardsell Ltd. | 2.49 | 2.49 | 20.58 | 30.32 | 12.91% | 1.45 |

Analyst Note – Epack Prefab Technologies IPO Valuation

- The Epack Prefab IPO commands a P/E of 34.54x (post-issue), above Pennar Industries (27.5x) and close to Interarch (30.32x).

- However, its RoNW of 22.69% stands out as one of the strongest in the peer group, justifying part of the premium.

- The P/BV ratio of 9.36x is substantially higher than peers, indicating investors are paying a premium for growth visibility and scalability.

- Overall, while valuation looks stretched, the company’s robust financials and industry positioning may support demand.

Strengths & Risks – Epack Prefab Technologies IPO

| Strengths | Risks / Weaknesses |

|---|---|

| Strong revenue growth of 26% YoY and PAT growth of 38% YoY (FY24–25). | Valuations appear stretched with a P/E of 34.54x post-issue. |

| High ROE (22.69%) and ROCE (22.88%), reflecting efficient capital utilization. | High P/BV ratio (9.36x) makes the IPO relatively expensive compared to peers. |

| Robust EBITDA margin (10.39%) and PAT margin (5.2%), showing healthy operating performance. | Industry cyclicality – construction and prefab demand depends heavily on infrastructure & real estate cycles. |

| Expanding market share in the prefabricated construction solutions sector, driven by industrial and government demand. | Competition from established players like Interarch, Pennar, and Everest may impact market share. |

| Strong balance sheet with improved net worth (₹353.93 Cr) and manageable debt/equity ratio (0.15). | Rising input costs (steel, cement, raw materials) may squeeze margins. |

| Track record of consistent profitability and operational scalability. | Dependency on large contracts/projects – delays or cancellations can affect earnings stability. |

Analyst View: The Epack Prefab Technologies IPO presents a business with high growth visibility, strong returns, and robust balance sheet metrics, but investors must weigh these positives against valuation concerns, sector cyclicality, and competitive pressures.

Epack Prefab Technologies IPO GMP

Epack Prefab Technologies IPO GMP Trend- Grey Market Premium

| Date | IPO Price (₹) | GMP (₹) | Sub2 Sauda Rate | Estimated Listing Price (₹) | Estimated Profit* (₹) | Movement |

|---|---|---|---|---|---|---|

| 23-Sep-2025 | 204.00 | ₹14 | 800 / 11,200 | ₹218 (6.86%) | ₹1,022 | No Change |

📌 Estimated profit is based on one lot size.

Analyst Insights – Epack Prefab Technologies IPO GMP

- The Grey Market Premium (GMP) stands at ₹14, signaling a modest 6.8% listing gain expectation.

- The Sub2 Sauda rate of ₹800 indicates lukewarm retail demand compared to more aggressively subscribed IPOs.

- Market sentiment appears stable, with no movement in GMP on the latest update.

- Given the premium valuations highlighted earlier, the muted GMP suggests the market is cautious and pricing in limited upside on listing day.

⚖️ Expert Take: The Epack Prefab Technologies IPO is not riding a strong speculative wave in the grey market. Investors should focus more on long-term fundamentals rather than chasing short-term GMP-driven gains.

Conclusion – Outlook on Epack Prefab Technologies IPO

Epack Prefab Technologies Ltd. enters the market with a strong 25-year legacy, diversified presence across Pre-Fab and EPS Packaging segments, and a proven growth trajectory supported by impressive CAGR in revenue (41.79%) and EBITDA (56.45%). Its leadership in the pre-engineered steel building space, combined with sustainability-focused solutions (52% lower carbon emissions vs RCC), provides it with a future-ready positioning.

From a valuation standpoint, the IPO is priced at a P/E of 34.54 (post-issue) and a P/BV of 9.36, which places it at the higher end of the spectrum compared to peers like Pennar Industries and Interarch Buildings. While its ROE (22.69%) and RoCE (22.88%) reflect superior efficiency, investors should note that high valuations leave limited listing day arbitrage.

The GMP trend of ₹14 (≈6.8% premium) suggests only moderate listing gains, reflecting cautious market sentiment despite strong fundamentals.

Long-term investors may consider subscribing, given the company’s market leadership, capacity expansion, and sustainable growth story.

Short-term investors looking for large listing pop should temper expectations, as current GMP indicates modest upside.

The Epack Prefab Technologies IPO presents itself as a fundamentally strong yet fully valued offer. For those with a 2–3 year horizon, this could be a structural play on India’s rising infrastructure and prefab adoption, whereas listing gains appear capped.

FAQs — Epack Prefab Technologies IPO

Q1. What does Epack Prefab Technologies Ltd. do?

A1. Epack Prefab Technologies Ltd. operates two verticals: (1) a Pre-Fab Business offering turnkey pre-engineered steel buildings, prefabricated structures, LGSF, sandwich insulated panels and modular solutions (design → manufacture → installation), and (2) an EPS Packaging Business manufacturing EPS block-molded and shape-molded products for packaging and insulation. This is the business behind the Epack Prefab Technologies IPO.

Q2. When does the Epack Prefab Technologies IPO open and close, and when will it list?

A2. The Epack Prefab Technologies IPO opens on 24 September 2025 and closes on 26 September 2025. Tentative allotment is 29 September 2025, refunds/credit to demat begin 30 September 2025, and tentative listing date is 1 October 2025.

Q3. What is the price band, lot size and minimum retail investment for the Epack Prefab IPO?

A3. The Epack Prefab IPO price band is ₹194 – ₹204 per share. Lot size is 73 shares. Minimum retail investment (based on upper band ₹204) = 73 × ₹204 = ₹14,892.

Q4. What is the total issue size and its composition for the Epack Prefab Technologies IPO?

A4. The Epack Prefab Technologies IPO is a book-build issue of up to ₹504.00 crore, comprising a fresh issue of 1,47,05,882 shares (≈₹300.00 Cr) and an Offer for Sale of 1,00,00,000 shares (≈₹204.00 Cr). Total shares on offer: 2,47,05,882 shares (aggregating up to ₹504.00 Cr).

Q5. Where will shares of Epack Prefab Technologies list and who are the merchant banker & registrar?

A5. Shares will list on BSE and NSE. Monarch Networth Capital Ltd. is the Book Running Lead Manager and KFin Technologies Ltd. is the registrar for the Epack Prefab Technologies IPO.

Q6. What are the key financial highlights for Epack Prefab Technologies (FY25)?

A6. For the year ended 31 Mar 2025, the company reported: Total Income ₹1,140.49 Cr, EBITDA ₹117.79 Cr, PAT ₹59.32 Cr. Between FY24–FY25, revenue grew 26% YoY and PAT grew 38% YoY — important metrics for assessing the Epack Prefab IPO.

Q7. What are the valuation metrics for the Epack Prefab Technologies IPO?

A7. Valuation snapshot for the Epack Prefab IPO (as per RHP data): Market cap ≈ ₹2,049.22 Cr, Price to Book (P/BV) = 9.36x, Pre-IPO EPS = ₹6.92, Post-IPO EPS = ₹5.91, Pre-IPO P/E ≈ 29.49x, Post-IPO P/E ≈ 34.54x. These show the issue is being priced at a premium versus many peers.

Q8. Who are the promoters and what is promoter holding pre-issue?

A8. Promoters are Sanjay Singhania, Ajay DD Singhania, Bajrang Bothra, Laxmi Pat Bothra, and Nikhil Bothra. Promoter holding pre-issue is 87.27% (post-issue shareholding will change based on dilution).

Q9. What is the current Grey Market Premium (GMP) / listing expectation for Epack Prefab IPO?

A9. As per your provided GMP table (latest entry): Date: 23-Sep-2025 | IPO upper price ₹204 | GMP ₹14 → Estimated listing price ≈ ₹218 (≈6.86% premium). Estimated profit per minimum lot (73 shares) at this GMP = 73 × ₹14 = ₹1,022. Sub2 Sauda Rate shown in the data: 800 / 11,200 (as provided).

Q10. Should I apply to the Epack Prefab Technologies IPO?

A10. The Epack Prefab IPO offers a strong operating track record (robust revenue & PAT growth, healthy ROE/ROCE, low leverage) and capacity-led growth plans. However, it is priced at a premium (high P/E and P/BV) and GMP suggests moderate listing upside only. For long-term investors (2–3+ years) who back industry tailwinds in pre-engineered buildings and sustainability gains, the IPO is worth consideration. For short-term listing speculators, expectations should be conservative.

Related Articles

How to Analyze an IPO Before Investing: A Step-by-Step Guide

One Demat vs Multiple Demat – Which is Better for IPO Allotment?