Introduction – Market Outlook 17 September

Good morning and welcome to your Market Outlook 17 September Edition. The Indian markets continued their winning streak in the last session, powered by strong buying across large-cap and mid-cap counters. The NIFTY 50 jumped 187 points (+0.75%) to close at 25,256, while the SENSEX soared 641 points (+0.78%) to end at 82,427, marking another solid performance from Dalal Street.

The rally wasn’t confined to frontline indices. The Nifty Bank added nearly 279 points to finish at 55,166, highlighting resilience in financials, while Nifty IT surged almost 1% on the back of renewed optimism around global tech demand. Broader markets also joined the momentum — the S&P BSE SmallCap index climbed 373 points (+0.69%), signaling healthy investor appetite beyond the benchmark names.

As we step into Wednesday’s trade, Gift Nifty is indicating a flat start, suggesting a cautious but steady opening for Indian equities. The focus will now be on whether the bulls can extend this rally further or if profit booking emerges around resistance zones.

In today’s Market Outlook 17 September, we’ll break down the index outlook, top news & stocks, the latest on IPOs, and key picks in Stocks in Radar to help you navigate the session ahead.

Index Outlook – Market Outlook 17 September

According to Equitypandit Analysis, the overall sentiment in Indian equities continues to remain upbeat. The market closed higher on Tuesday with NIFTY crossing 25,200 and SENSEX nearing 82,500, showing that momentum is still strong. Let’s break down how the major indices are shaping up for Wednesday’s trade.

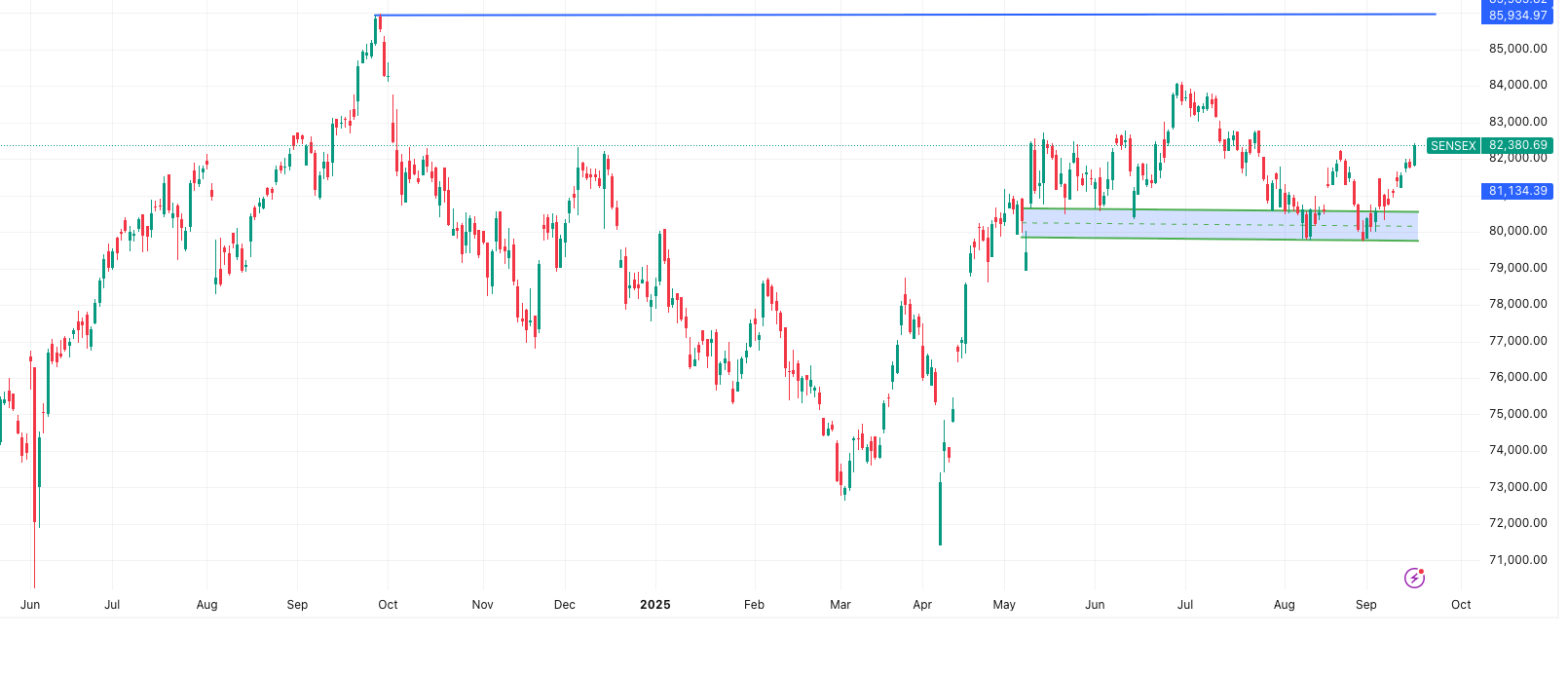

SENSEX Outlook

The SENSEX ended at 82,381 and remains firmly in a positive trend. As long as the index holds above 81,551, long positions remain safe, and traders can ride the bullish wave. However, a close below this critical level could open the door for fresh short opportunities.

- On the downside, support is placed at 81,959 – 81,538 – 81,296, which could act as cushions if profit booking emerges.

- On the upside, resistance is expected at 82,623 – 82,865 – 83,286, levels where selling pressure could cap the rally.

The tentative trading range for SENSEX is likely between 82,974 and 81,787.

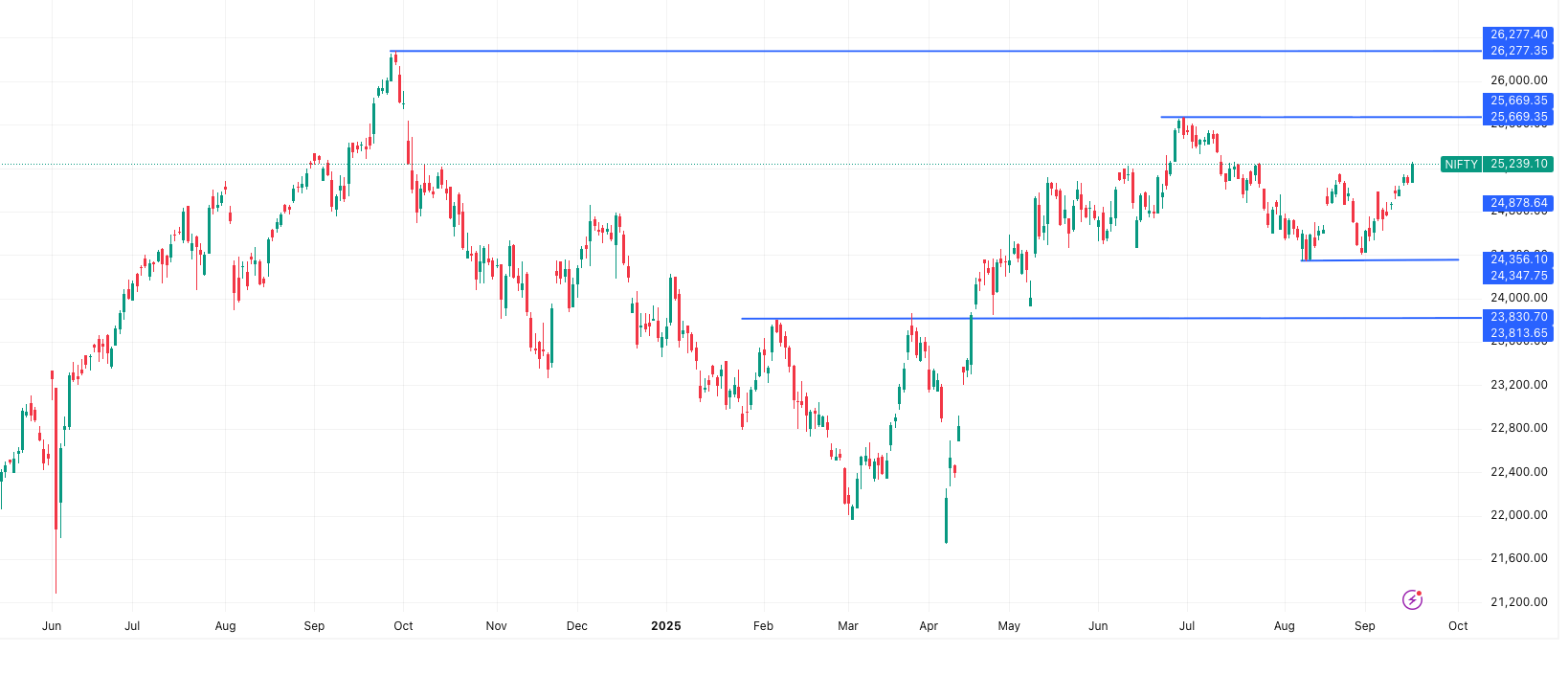

NIFTY 50 Outlook

The NIFTY 50 closed at 25,239, staying well above its stoploss level of 24,996, keeping the short-term trend positive. For investors holding long positions, the momentum suggests further upside, but caution is needed near higher resistance points.

- Support levels to watch are 25,119 – 24,999 – 24,928, providing a safety net if volatility increases.

- Resistance levels are seen at 25,310 – 25,381 – 25,501, which will be key hurdles before the index can test higher territory.

The tentative trading range for NIFTY is projected between 25,419 and 25,058.

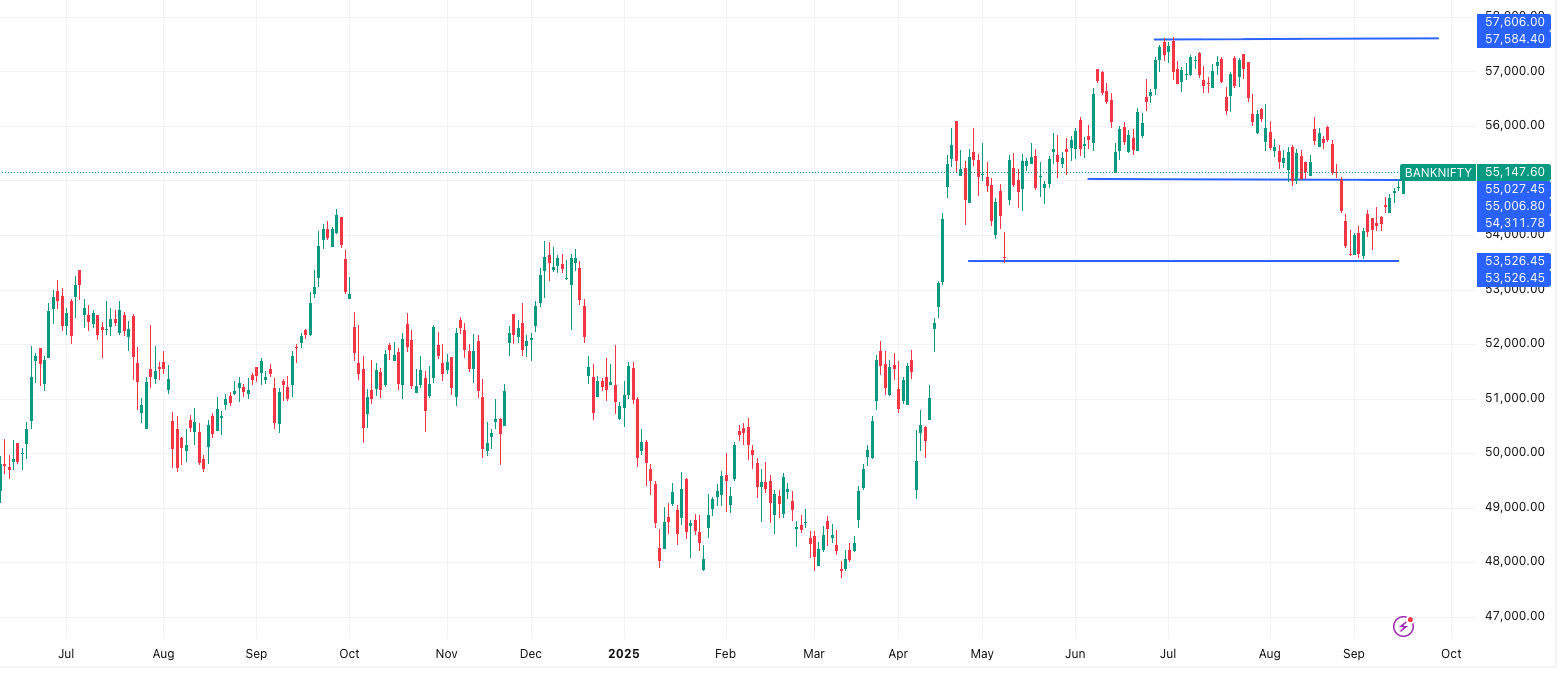

Bank Nifty Outlook

The Bank Nifty closed at 55,148, reflecting steady gains as banking stocks continue to show resilience. The index remains in a positive setup as long as it trades above the stoploss of 54,561.

- Immediate supports are placed at 54,888 – 54,629 – 54,481, ensuring stability for the index.

- On the higher side, resistance lies at 55,296 – 55,445 – 55,704, which could decide whether banking shares can fuel the next leg of the rally.

The tentative trading range for Bank Nifty is expected between 55,596 and 54,698.

In summary, the Market Outlook 17 September continues to favor the bulls, with technical charts supporting further gains. However, traders should keep an eye on key support levels as volatility may rise near resistance zones.

News & Stocks Update: Stock Market 17 September

According to the latest developments shaping the Stock Market 17 September, a mix of global trade shifts, corporate struggles, IPO buzz, and policy moves are keeping investors alert. Here’s a closer look at the big stories—and the stocks that could be in focus.

Pressure on Indian Soybean Farmers

India may soon feel the heat from global trade disruptions. With China stepping back from buying nearly 25 million tonnes of U.S. soybeans, experts believe India could face pressure to absorb part of this surplus. DN Pathak, Executive Director of the Soybean Processors Association of India (SOPA), warned that such imports could devastate India’s 12 million hectares of soybean cultivation and hurt the livelihood of nearly 7 million farmers.

Domestic soybeans are already selling below the minimum support price (MSP), while U.S. soybeans are cheaper, creating an uneven playing field. If imports open up, Indian farmers could face massive income shocks, affecting a $6–8 billion industry. This tug-of-war between global trade demands and farmer protection may ripple into agriculture and FMCG-linked sectors.

Stocks to Watch: Ruchi Soya (Patanjali Foods), Godrej Agrovet, Adani Wilmar.

L&T’s Exit Bid from Hyderabad Metro

In the infrastructure sector, Larsen & Toubro (L&T) has formally sought to exit the Hyderabad Metro Rail project, citing rising losses, lack of state support, and debt burdens. Despite carrying 4.5 lakh passengers daily, the project racks up annual losses of ₹600–700 crore due to borrowings of around ₹13,000 crore.

The company has offered to sell its more than 90% equity stake to the government through a new SPV. While Hyderabad Metro is considered one of the best-managed systems globally, it remains a financial sinkhole for L&T. The market will be closely tracking how this exit plan could reshape L&T’s balance sheet and its future infrastructure commitments.

Stocks to Watch: Larsen & Toubro, Siemens, IRCON International, IRB Infrastructure.

Carlsberg Eyes India IPO

The beverages industry is buzzing with speculation as Carlsberg A/S explores an IPO for its India business. Talks with investment banks like Citi, JPMorgan, and Deutsche Bank are underway, though the structure and valuation are yet to be decided.

Carlsberg India has shown strong growth—revenues crossed ₹8,000 crore in FY24, while profits surged 60% to ₹323 crore. With brands such as Carlsberg, Tuborg, and Elephant, the company controls 21% of India’s beer market, second only to United Breweries. If the IPO takes shape, it could mark one of the biggest beverage listings in India and provide investors with an exciting entry point in the premium beer market.

Stocks to Watch: United Breweries, Radico Khaitan, Globus Spirits, Associated Alcohols.

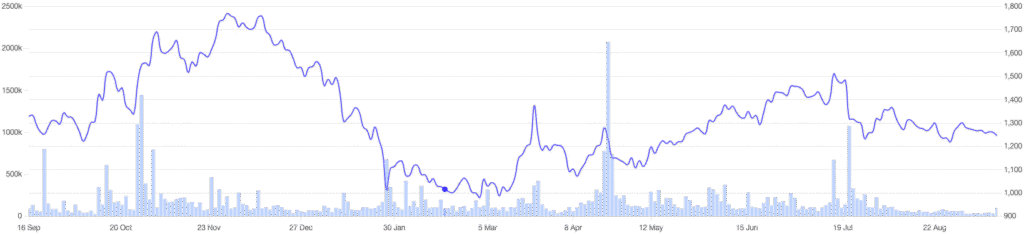

Macro Indicators: August Recap

India’s economic indicators for August painted a mixed picture. On the positive side, inflation remained low, exports posted double-digit growth, and rural demand signaled resilience with improved two-wheeler sales. However, government finances weakened due to declining capex and subsidy cuts, while equity markets showed muted inflows and shrinking trading volumes.

For traders in the Stock Market 17 September, this suggests a balancing act: while growth pockets exist in manufacturing, exports, and rural consumption, capital market activity and government spending could remain a drag in the short term.

Stocks to Watch: Bajaj Auto, Hero MotoCorp, Tata Steel, HDFC Bank, SBI.

Andhra Pradesh Seeks Relief for Aqua Exporters

Andhra Pradesh CM Chandrababu Naidu has urged the Centre to support shrimp exporters hit hard by new U.S. tariffs. Nearly 50% of shrimp export orders—worth ₹25,000 crore—have been canceled, creating a major crisis for an industry that contributes 80% of India’s shrimp exports.

Naidu has proposed a ₹100 crore support fund, loan moratoriums, GST relief, and cold storage infrastructure. The outcome of these demands will be crucial not only for exporters but also for the broader seafood supply chain, which employs millions and supports India’s trade balance.

Stocks to Watch: Avanti Feeds, Apex Frozen Foods, Zeal Aqua, Waterbase Ltd.

From soybean trade risks to L&T’s metro troubles and Carlsberg’s IPO buzz, these stories will guide investor sentiment and stock movements on the Stock Market 17 September.

Stock Watchlist Table on Stock Market 17 September:

| News/Event | Stocks to Watch |

|---|---|

| Soybean imports pressure | Ruchi Soya, Godrej Agrovet, Adani Wilmar |

| L&T Hyderabad Metro exit | Larsen & Toubro, Siemens, IRCON, IRB Infrastructure |

| Carlsberg India IPO | United Breweries, Radico Khaitan, Globus Spirits, Associated Alcohols |

| Macro indicators (August) | Bajaj Auto, Hero MotoCorp, Tata Steel, HDFC Bank, SBI |

| Andhra Pradesh shrimp export relief | Avanti Feeds, Apex Frozen Foods, Zeal Aqua, Waterbase Ltd |

IPO Update – Market Outlook 17 September

Mainboard IPOs

| IPO Name | Open Date | Close Date | Listing Date | GMP / Listing Gain |

|---|---|---|---|---|

| Jinkushal Industries IPO | 25-Sep | 29-Sep | 3-Oct | ₹51 (42.15%) |

| GK Energy IPO | 19-Sep | 23-Sep | 24-Sep | ₹– |

| Saatvik Green Energy IPO | 19-Sep | 23-Sep | 24-Sep | ₹– |

| Ivalue Infosolutions IPO | 18-Sep | 22-Sep | 23-Sep | ₹– |

| VMS TMT IPO | 17-Sep | 19-Sep | 22-Sep | ₹23 (23.23%) |

| Euro Pratik Sales IPO | 16-Sep | 18-Sep | 19-Sep | ₹– |

Hot Picks: VMS TMT and Jinkushal Industries are showing strong GMP trends, indicating positive investor sentiment and potential listing gains.

SME IPOs

| IPO Name | Open Date | Close Date | Listing Date | GMP / Listing Gain |

|---|---|---|---|---|

| DSM Fresh Foods BSE SME | 26-Sep | 30-Sep | 1-Oct | ₹– |

| Aptus Pharma BSE SME | 23-Sep | 25-Sep | 26-Sep | ₹– |

| BharatRohan Airborne Innovations | 23-Sep | 25-Sep | 26-Sep | ₹– |

| JD Cables BSE SME | 18-Sep | 22-Sep | 23-Sep | ₹25 (16.45%) |

| Sampat Aluminium BSE SME | 17-Sep | 19-Sep | 22-Sep | ₹18 (15.00%) |

| TechD Cybersecurity NSE SME | 15-Sep | 17-Sep | 18-Sep | ₹160 (82.90%) |

| L.T. Elevator BSE SME | 16-Sep | 16-Sep | 17-Sep | ₹30 (38.46%) |

| Airfloa Rail Technology BSE SME | 11-Sep | 15-Sep | 16-Sep | ₹175 (125.00%) |

SME Spotlight: TechD Cybersecurity, Airfloa Rail Technology, and L.T. Elevator are trending with high GMPs, making them key stocks to watch for listing gains today.

Listing Today – Market Outlook 17 September

- Galaxy Medicare NSE SME – ₹– (0.00%)

- Jay Ambe Supermarkets BSE SME – ₹8 (10.26%)

- Dev Accelerator IPO – ₹2 (3.28%)

- Urban Co. IPO – ₹54 (52.43%)

- Shringar House of Mangalsutra IPO – ₹26 (15.76%)

Watch Today: Urban Co. and Shringar House of Mangalsutra are expected to attract strong attention on listing, potentially delivering solid first-day gains.

Stocks in Radar – Market Outlook 17 September

Kirloskar Pneumatic Company (KKPC) – BUY | CMP: ₹1,260 | TP: ₹1,636 | Research: PL Capital

KKPC continues to demonstrate strong structural growth in the air and refrigeration compressor markets, supported by innovative product launches, strategic initiatives, and steady market share gains. According to management, while order finalizations are currently delayed, a strong rebound is expected in the second half of FY26.

Air Compression Segment – Rapid Market Traction

- KKPC’s Tezcatlipoca centrifugal compressors have crossed ~100 dispatches to date and cover around 80% of India’s domestic demand for centrifugal compressors.

- The company is booking ~30 units per quarter, targeting ~200 units annually, making Tezcatlipoca the fastest-growing centrifugal compressor in the industry.

- Backward integration of critical components like impellers, bearings, and castings ensures cost-competitiveness and positions KKPC well against established global players.

Refrigeration Compression – Fastest Growing Business

- The revenue contribution from refrigeration compressors is expected to rise from ~35% to ~45% over the next few years, driven by industrial and commercial refrigeration demand.

- Products such as Khione screw compressors and Tyche semi-hermetic compressors target Rs5–50 billion of import substitution opportunities, giving KKPC an edge in capturing previously import-dominated segments.

- Industrial refrigeration continues to see >80% market share in large-scale projects across petrochemicals, refineries, and chemical plants.

Gas Compression – Steady but Subdued

- Domestic gas compression faces challenges due to slower large pipeline orders, lowering the revenue mix from ~45% to ~35%.

- Demand remains stable through booster packages, storage cascades, and aftermarket O&M contracts, which provide recurring revenue streams.

- Biogas and CNG segments are slowly scaling up, but structural challenges in the domestic gas ecosystem continue to limit growth.

RenovAir Replacement Scheme & Aftermarket Services

- The RenovAir program enables customers to replace old compressors with discounted new units, initially launched in refrigeration and now extended to air compressors.

- Aftermarket services contribute ~15% of air and refrigeration revenue and up to ~35% of gas compression revenue, enhancing customer stickiness and recurring income.

- Rapid-response service and competitively priced spares differentiate KKPC from MNC competitors, providing superior reliability.

Financial Outlook

- FY26 estimated revenue: ₹18,973 million; EBITDA margin: 18.6%; PAT: ₹2,514 million; EPS: ₹38.8.

- FY27 projected revenue: ₹22,394 million; EBITDA margin: 19%; PAT: ₹3,027 million; EPS: ₹46.7.

- Current valuation: PE of 32.5x on FY26 and 26.9x on FY27; target price remains ₹1,636.

Why KKPC is on Radar:

KKPC’s innovative product portfolio, growing market share in both air and refrigeration segments, strong aftermarket services, and recurring revenue streams make it an attractive buy for medium- to long-term investors.

Conclusion – Market Outlook 17 September

As we enter Wednesday’s trading session, the Market Outlook 17 September signals a broadly positive sentiment across Indian equities. With NIFTY and SENSEX trading firmly above key support levels, investors have room to maintain long positions while being mindful of intraday volatility. Bank Nifty and Nifty IT indices are showing resilient momentum, reflecting strength in financials and technology sectors, which could guide broader market trends.

Sector-specific developments also merit attention today. Industrial and manufacturing names, exemplified by Kirloskar Pneumatic Company (KKPC), continue to show strong structural growth, while export-oriented and commodity-linked stocks may respond to evolving global trade dynamics, such as soybean imports or US tariff impacts on shrimp exports. At the same time, infrastructure heavyweights like L&T face operational challenges that could influence market sentiment in construction and metro-related segments.

IPO activity remains a key focus, with both mainboard and SME offerings attracting investor attention. Strong listing gains in companies like TechD Cybersecurity Ltd and Airfloa Rail Technology highlight that market appetite for new-age, high-growth businesses continues unabated. These IPOs not only provide short-term opportunities but also signal long-term investor confidence in emerging sectors.

In summary, today’s market presents a blend of cautious optimism and selective opportunities. While indices display bullish trends, staying alert to news flow, sectoral updates, and key support/resistance levels will be essential for informed trading. Investors should focus on quality companies with strong fundamentals, monitor IPO developments, and keep an eye on macroeconomic cues to navigate the session effectively. The Market Outlook 17 September suggests a day where strategic positioning, rather than speculative trades, could drive meaningful gains.

More Articles

When to Sell Mutual Funds: 5 Proven Exit Strategies

The Hidden Multibagger Stock: 5 Positive Triggers That Make Suven Life Sciences a Game-Changer

The Indian Retirement Savings Crisis: 5 Reasons EPF and PPF Won’t Be Enough