IndusInd Bank has recently found itself in the spotlight due to accounting discrepancies in its derivatives portfolio. The issue has led to a sharp drop in its stock price, raising concerns about its financial health. Investors and analysts are now debating: Is IndusInd Bank heading towards a crisis like Yes Bank, or will it recover and grow like HDFC Bank? In this blog, we analyze the future of IndusInd Bank, covering all major aspects that will determine its trajectory.

The Current Crisis: What Went Wrong?

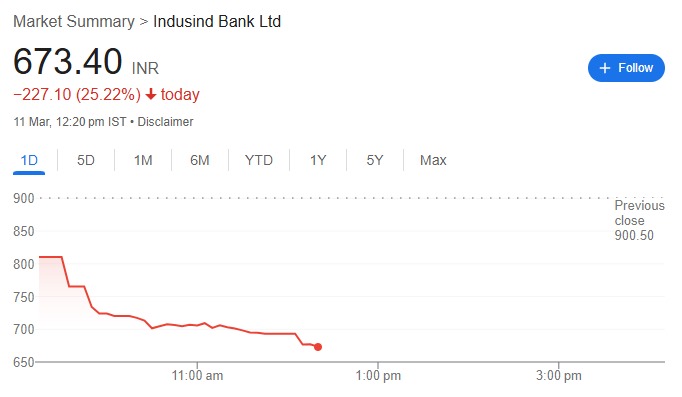

The recent financial trouble at IndusInd Bank stems from misreported foreign exchange derivative transactions spanning over 5-7 years. The bank had not accounted for these trades in its Net Interest Income (NII), resulting in a ₹1,500-2,000 crore ($171-$229 million) financial impact. This revelation led to a 25% drop in its share price as investors reacted negatively to the unexpected financial shock.

Key Reasons Behind the Crisis:

- Accounting Discrepancies: The bank failed to accurately report forex derivative transactions, causing financial miscalculations.

- New RBI Regulations: Stricter financial reporting rules forced the bank to reveal its past errors.

- Resignation of CFO: The sudden resignation of the CFO raised concerns about whether this was a cover-up or simply a corporate transition.

- Investor Panic: The market reacted strongly to the news, fearing deeper financial instability.

Is IndusInd Bank the Next Yes Bank?

Yes Bank, once a rising star in India’s banking sector, faced a liquidity crisis in 2020 due to excessive bad loans and mismanagement. RBI had to intervene and rescue the bank by getting State Bank of India (SBI) and other financial institutions to invest in it. Investors fear that IndusInd Bank could face a similar fate if its financial position deteriorates further.

Similarities with Yes Bank:

- Financial Mismanagement: Both banks failed to maintain transparency in financial reporting.

- Loss of Investor Confidence: A significant drop in stock prices triggered panic among shareholders.

- Regulatory Scrutiny: RBI is now closely monitoring IndusInd Bank to ensure compliance with financial regulations.

Why IndusInd Bank May Not Follow Yes Bank’s Path:

- Stronger Balance Sheet: Unlike Yes Bank, IndusInd Bank still has strong financial reserves and capital adequacy.

- Timely Disclosure: The bank voluntarily reported the issue rather than waiting for RBI to detect the problem.

- External Audits: IndusInd Bank has hired independent auditors to ensure transparency in its financial reporting.

- No Major Bad Loan Crisis: While Yes Bank collapsed due to excessive bad loans, IndusInd Bank’s issue is primarily an accounting miscalculation, not a debt crisis.

Can IndusInd Bank Become the Next HDFC Bank?

HDFC Bank is India’s most successful private-sector bank, known for strong governance, financial stability, and robust risk management. To follow in HDFC’s footsteps, IndusInd Bank must take immediate corrective actions and restore investor trust.

What IndusInd Bank Needs to Do:

- Improve Transparency: Implement strict internal controls to prevent future accounting discrepancies.

- Strengthen Risk Management: Adopt best practices to ensure all financial transactions are properly recorded.

- Regain Investor Trust: Clearly communicate corrective actions and long-term strategies to shareholders.

- Leverage Digital Banking: Invest in technology and digital banking solutions to remain competitive in the evolving financial landscape.

Key Factors That Could Make IndusInd Bank the Next HDFC:

✔ Strong Leadership: A competent management team committed to ethical banking practices. ✔ Stable Financials: Maintaining a healthy capital adequacy ratio and strong loan portfolio. ✔ Customer-Centric Approach: Expanding banking services while focusing on customer satisfaction. ✔ Regulatory Compliance: Ensuring full compliance with RBI guidelines to prevent future penalties.

What Lies Ahead for IndusInd Bank?

The coming months will be crucial for IndusInd Bank. If the bank fails to control the crisis, it risks losing investor confidence, facing regulatory action, and experiencing further stock declines. However, if the bank successfully navigates this crisis, it could emerge stronger and more resilient—similar to how HDFC Bank grew after challenges in its early years.

Final Verdict:

- If IndusInd Bank fails to implement reforms ➝ It risks becoming the next Yes Bank.

- If IndusInd Bank learns from mistakes and strengthens governance ➝ It can grow like HDFC Bank.

💬 What do you think about IndusInd Bank’s future? Will it recover like HDFC Bank or struggle like Yes Bank? Drop your thoughts in the comments below! Don’t forget to share this article with fellow investors. 🚀📉

🔍 Looking for more market insights? Check out our analysis on Tata Motors’ recent stock correction and what it means for investors.

FAQs:

1. Why did IndusInd Bank’s stock price fall by 25%?

The stock price dropped after the bank disclosed a ₹1,500-2,000 crore accounting discrepancy related to forex derivatives, causing investor panic.

2. Is IndusInd Bank in financial trouble?

The bank has not reported a liquidity crisis like Yes Bank, but it must regain investor trust and comply with regulations to avoid long-term damage.

3. What actions is IndusInd Bank taking to fix the issue?

It has hired external auditors, informed the RBI, and is revising financial controls to prevent future miscalculations.

4. Should I invest in IndusInd Bank now?

Short-term volatility is expected, but long-term investors should wait for clear signs of recovery before making investment decisions.

5. Will RBI take action against IndusInd Bank?

RBI has not imposed any penalties yet, but it is closely monitoring the bank’s corrective measures.