Euro Pratik Sales IPO – Introduction

The Euro Pratik Sales IPO is generating significant buzz among investors as one of the most awaited book-building offers of 2025. With a total issue size of ₹451.31 crore, this IPO is structured entirely as an Offer for Sale, giving investors an opportunity to buy shares from existing promoters. The company operates in the high-growth decorative wall panels and laminates sector, offering eco-friendly, durable, and modern design solutions that cater to both residential and commercial markets.

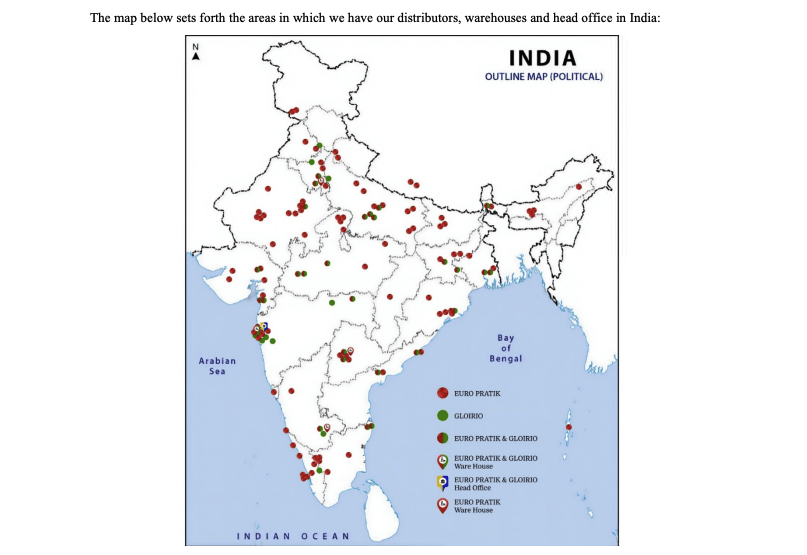

Founded in 2010, Euro Pratik Sales has carved a niche as a trend-setting fast-fashion brand in home and commercial décor. Its pan-India distribution network, covering 116 cities with 180 distributors, ensures deep market penetration, while exports to countries like Singapore, UAE, and Australia highlight its global appeal.

For investors, this Euro Pratik IPO presents a chance to participate in a company with strong financials, a robust product portfolio of 3,000 designs across 30+ categories, and a scalable, asset-light business model. As the IPO opens on 16th September 2025 and closes on 18th September 2025, market watchers are keen to see how this decorative powerhouse performs on listing day.

Euro Pratik Sales IPO Details

Euro Pratik IPO Snapshot

| Particulars | Details |

|---|---|

| IPO Type | Bookbuilding – Offer for Sale |

| Issue Size | 1,82,71,862 shares (~₹451.31 Cr) |

| Face Value | ₹1 per share |

| Price Band | ₹235 – ₹247 per share |

| Lot Size | 60 shares |

| Employee Discount | ₹13 per share |

| Issue Open | 16 Sep 2025 |

| Issue Close | 18 Sep 2025 |

| Tentative Allotment | 19 Sep 2025 |

| Listing Date | 23 Sep 2025 (BSE & NSE) |

| Book Running Lead Manager | Axis Capital Ltd. |

| Registrar | MUFG Intime India Pvt. Ltd. |

| Promoter Holding Pre-IPO | 87.97% |

| Promoter Holding Post-IPO | 70.1% |

| Document (RHP) | RHP |

Important Dates (Tentative)

| Event | Date |

|---|---|

| IPO Opens | Tue, 16 Sep 2025 |

| IPO Closes | Thu, 18 Sep 2025 |

| Allotment Finalization | Fri, 19 Sep 2025 |

| Refunds Initiated | Mon, 22 Sep 2025 |

| Shares Credit to Demat | Mon, 22 Sep 2025 |

| Tentative Listing | Tue, 23 Sep 2025 |

| UPI Mandate Cut-off | 5 PM, Thu, 18 Sep 2025 |

Objects of the Issue

- Carry out the Offer for Sale of shares by the selling shareholders, aggregating up to ₹451.31 Cr.

- Achieve the benefits of listing the equity shares on stock exchanges.

Company Overview & Business Model – Euro Pratik Sales Ltd.

The Euro Pratik Sales IPO represents an opportunity to invest in one of India’s leading decorative wall panel and laminate companies. Incorporated in 2010, Euro Pratik Sales operates as a seller and marketer of Decorative Wall Panels and Decorative Laminates, offering innovative and eco-friendly alternatives to traditional wall décor solutions like wallpapers, paints, and wood.

According to the Technopak Report, Euro Pratik Sales is one of the largest organized wall panel brands in India, commanding a 15.87% market share by revenue in the organized decorative wall panels industry. The company is recognized as a product innovator, with award-winning designs such as Louvres, Chisel, and Auris, and operates fast-fashion-like product cycles with over 113 catalogs launched in the last four years.

The company manages a diversified product portfolio, covering 30+ categories and 3,000 unique designs, catering to residential and commercial applications. Its products are eco-friendly, anti-bacterial, anti-fungal, and free from harmful heavy metals, while sourcing manufacturing through long-term partnerships with 36 contract manufacturers across India, South Korea, and China. This asset-light business model allows Euro Pratik Sales to stay agile and incorporate the latest design trends efficiently.

Euro Pratik Sales has built a robust pan-India distribution network, spanning 116 cities, 180 distributors, and 25 states plus 5 union territories, ensuring wide market reach. Warehouses totaling ~194,877 sq. ft. in Bhiwandi, Maharashtra, support operations and quick distribution, while proximity to Nhava Sheva port aids exports. Internationally, the company exports to Singapore, UAE, Australia, Bangladesh, Burkina Faso, and Nepal, with plans for further global expansion.

The company’s branding strategy is strengthened by celebrity endorsements: Hrithik Roshan represents the “Euro Pratik” brand, while Kareena Kapoor Khan endorses the subsidiary Gloirio brand.

Euro Pratik Sales has strategically expanded via recent acquisitions, consolidating related businesses to diversify product offerings and strengthen distribution channels. Notable acquisitions include Vougue Decor, Euro Pratik Laminate LLP, Millenium Decor, EuroPratik Intex LLP, and Euro Pratik USA, LLC. These acquisitions have enhanced both domestic and international market presence, enabling scale, profitability, and access to new geographies.

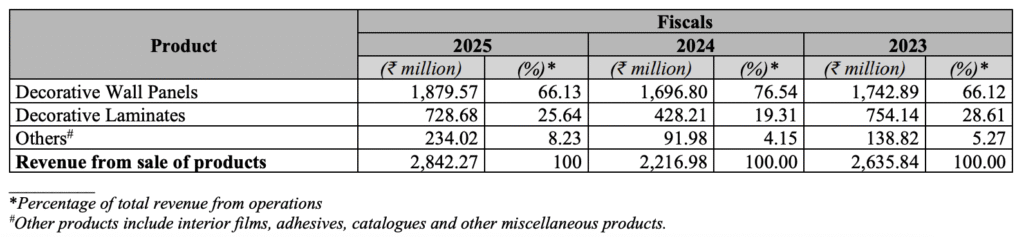

Revenue Breakdown by Product (FY23–25, ₹ million):

The company’s business model focuses on offering a wide product assortment, innovative designs, and eco-conscious solutions. Coupled with its asset-light operations, strong branding, strategic acquisitions, and expansive distribution network, Euro Pratik Sales has established itself as a market leader in the decorative wall panel and laminates industry.

The Euro Pratik IPO provides investors a chance to participate in a company with proven operational expertise, strong market share, and growth potential across India and overseas.

Euro Pratik IPO – Financial Performance

The Euro Pratik Sales IPO presents a company with strong financial performance and healthy growth metrics. Over the past three fiscal years, the company has consistently increased revenue and profitability, reflecting both operational efficiency and strategic expansion.

Financial Summary (₹ Crore)

| Particulars | FY25 | FY24 | FY23 |

|---|---|---|---|

| Total Assets | 273.84 | 174.49 | 159.12 |

| Total Income | 291.52 | 230.11 | 268.55 |

| EBITDA | 110.10 | 89.00 | 83.63 |

| Profit After Tax (PAT) | 76.44 | 62.91 | 59.57 |

| Net Worth | 234.49 | 155.73 | 130.02 |

| Reserves & Surplus | 223.88 | 153.75 | 129.51 |

| Total Borrowings | 2.68 | 3.00 | – |

Observations:

- Revenue grew by 27% in FY25 compared to FY24, while PAT increased by 22%, indicating healthy margin expansion and operational efficiency.

- EBITDA margin stands at 38.74%, reflecting strong cost management and value addition in product offerings.

- The company operates with minimal debt (Debt/Equity 0.01), highlighting a robust balance sheet and low financial risk.

Key Performance Indicators (FY25)

| KPI | FY25 | Analysis |

|---|---|---|

| ROE | 39.18% | High return on equity, signaling effective shareholder value creation |

| ROCE | 44.58% | Efficient utilization of capital for profitable operations |

| RoNW | 32.60% | Strong return relative to net worth |

| PAT Margin | 26.08% | Healthy profitability across operations |

| EBITDA Margin | 38.74% | Reflects robust operational efficiency |

| EPS (Rs) | 7.48 | Stable earnings per share post IPO |

Financial Insights:

- The company demonstrates consistent revenue growth, supported by a diverse product portfolio and expansive distribution network.

- High ROE and ROCE indicate efficient deployment of capital and strong profitability.

- With low debt levels, Euro Pratik Sales maintains financial flexibility, providing a strong base for further expansion or strategic acquisitions.

The Euro Pratik IPO is backed by strong financial fundamentals, making it an attractive consideration for investors seeking exposure to a high-growth, asset-light, and innovative company in the decorative wall panel and laminates sector.

Valuation & Peer Comparison of Euro Pratik IPO

The Euro Pratik Sales IPO presents a company trading at a reasonable valuation considering its strong fundamentals and growth potential in the decorative wall panels and laminates industry.

Valuation Metrics

| Metric | Pre-IPO | Post-IPO | Analysis |

|---|---|---|---|

| EPS (Rs) | 7.48 | 7.48 | Stable earnings per share indicate consistent profitability |

| P/E (x) | 33.02 | 33.02 | Attractive relative to peers considering growth prospects |

| Price to Book Value | 10.77 | 10.77 | Reflects market premium for brand, distribution, and product innovation |

Insights:

- The P/E multiple of 33.02x is reasonable when considering the company’s high ROE (39.18%) and EBITDA margin (38.74%).

- Price to Book Value of 10.77 shows investors are paying a premium for a strong market position, innovative product portfolio, and asset-light business model.

- EPS stability pre- and post-IPO reflects resilient earnings despite market expansion and acquisitions.

Peer Comparison of Euro Pratik Sales IPO

| Company Name | EPS (Basic) | EPS (Diluted) | NAV per Share (Rs) | P/E (x) | RoNW (%) |

|---|---|---|---|---|---|

| Euro Pratik Sales Ltd. | 7.53 | 7.53 | 22.91 | 32.65 | 32.60 |

| Greenlam Industries Ltd | 2.68 | 2.68 | 44.17 | 87.54 | 6.07 |

| Asian Paints Ltd. | 38.25 | 38.25 | 201.84 | 62.64 | 19.16 |

| Berger Paints India Ltd. | 10.13 | 10.12 | 52.78 | 55.77 | 19.22 |

| Indigo Paints Ltd. | 29.76 | 29.68 | 216.35 | 40.32 | 13.79 |

Analysis:

- Euro Pratik Sales trades at a P/E of 32.65x, significantly lower than Greenlam and Asian Paints, highlighting relative undervaluation compared to some listed peers in the paints and laminates sector.

- RoNW of 32.60% is the highest among listed peers, signaling excellent return generation for shareholders.

- NAV per share is moderate, but the company’s brand equity, product innovation, and extensive distribution network justify the premium market valuation.

Final Thought:

In terms of valuation, the Euro Pratik IPO balances attractive pricing with strong financial metrics and market leadership, making it a compelling pick for investors seeking growth in the organized decorative panels and laminates sector.

Strengths & Risks of Euro Pratik IPO

| Strengths | Risks |

|---|---|

| Market Leader: One of India’s largest organized decorative wall panel brands with ~15.87% market share. | Market Competition: Intense competition from organized and unorganized players in wall panels and laminates. |

| Diverse Product Portfolio: Over 30 product categories and 3,000 designs with fast-fashion approach. | Dependence on Distributors: Heavy reliance on distributors; any disruption can impact sales. |

| Asset-Light Model: Outsourced manufacturing ensures scalability and flexibility with lower fixed costs. | Raw Material & Import Risks: Dependence on imported materials for certain products could lead to price volatility. |

| Strong Financial Metrics: ROE 39.18%, ROCE 44.58%, EBITDA Margin 38.74%, PAT Margin 26.08%. | Economic Slowdown Risk: Slowdown in construction, real estate, or interior sectors may impact demand. |

| Pan-India Presence: Distribution across 116 cities with 180 distributors and strong brand visibility. | Regulatory Risks: Any changes in environmental or import regulations could affect production or costs. |

| Celebrity Brand Endorsements: Hrithik Roshan & Kareena Kapoor enhance brand credibility and consumer trust. | Offer for Sale Risk: IPO is purely an offer for sale; company will not receive fresh capital. |

| Export Footprint: Presence in 6 international markets with growth potential. | Exchange Rate Risk: Overseas operations may expose the company to currency fluctuations. |

| Innovation & R&D: Recognized as a product innovator with modern, eco-friendly designs. | Dependence on Promoters: Business strategy and execution heavily influenced by promoters’ expertise. |

Insights:

- The strengths outweigh the risks for long-term growth, especially considering the company’s market leadership, asset-light model, and innovative products.

- Risks are mostly external and operational, which can be mitigated over time with diversification and scaling of the business.

Euro Pratik Sales IPO GMP (Grey Market Premium)

As of 10th September 2025, the Grey Market Premium (GMP) for the Euro Pratik Sales IPO has not shown any movement.

| GMP Date | IPO Price (₹) | GMP (₹) | Estimated Listing Price (₹) | Estimated Profit (₹) |

|---|---|---|---|---|

| 10-09-2025 | 247.00 | ₹0 | 247 (0.00%) | 0 |

Join Us On Telegram for Daily IPO GMP Update

Insights:

- Currently, the Euro Pratik Sales IPO GMP is at par with the issue price, indicating stable market sentiment ahead of the subscription period.

- Since this is a pure Offer for Sale, investors can anticipate GMP trends to pick up closer to the listing date, depending on market interest and demand from retail and institutional investors.

- Early investors may want to monitor GMP daily, as movement in the grey market can provide clues about listing gains and market appetite.

Pro Tip: For FS investors, zero GMP at this stage reflects cautious investor sentiment, which can change rapidly once subscription numbers and demand from QIB, NII, and retail investors are known.

Conclusion – View on Euro Pratik Sales IPO

The Euro Pratik Sales IPO presents a well-established market opportunity in the organized decorative wall panel and laminates industry. With a 15.87% market share, diversified product portfolio, asset-light business model, and strong financial metrics (ROE 39.18%, ROCE 44.58%, PAT Margin 26.08%), the company demonstrates robust growth potential.

Being a pure offer for sale, the IPO does not raise fresh capital for the company but offers investors a chance to own shares in a profitable and innovative brand with pan-India distribution and international presence. The brand endorsements, product innovation, and fast-fashion approach further strengthen its market positioning.

Overall, for investors, the Euro Pratik Sales IPO offers moderate-to-high growth potential with relatively lower execution risk, given the company’s established operations and promoter expertise.

Short-Term Strategy

- Monitor the IPO subscription status for QIB, NII, and retail segments.

- GMP is currently flat, but early momentum may appear closer to the listing date.

- Ideal for listing gains, considering the strong brand equity and demand for decorative wall products.

Long-Term Strategy

- Focus on the company fundamentals: growth in revenue, profitability, and market expansion.

- Suitable for investors looking for long-term exposure to the decorative wall panel and laminates industry, backed by a robust distribution network and innovative products.

- Potential for dividend income in the future as the company scales and consolidates.

Allotment Strategy

- For retail investors, applying for 1-2 lots is reasonable to balance risk and potential gain.

- HNI investors can consider multiple lots, but should monitor market sentiment and grey market trends.

- Since this is an offer for sale, the company’s capital won’t increase, so focus is primarily on market liquidity and post-listing gains.

“Euro Pratik Sales IPO – Where innovation meets décor, giving investors a chance to wall in profitable growth!”

Euro Pratik Sales IPO – FAQs

What is the Euro Pratik Sales IPO?

The Euro Pratik Sales IPO is a book-built Offer for Sale of ₹451.31 crore, providing investors an opportunity to invest in one of India’s leading decorative wall panel brands.

When does the Euro Pratik Sales IPO open and close?

The IPO opens on 16th September 2025 and closes on 18th September 2025.What is the price band for the Euro Pratik Sales IPO?

The issue price band is ₹235 to ₹247 per share.

What is the lot size for the Euro Pratik Sales IPO?

Investors can apply for a minimum of 60 shares, and in multiples thereof.

Who are the promoters of Euro Pratik Sales Ltd.?

The promoters include Pratik Gunvantraj Singhvi, Jai Gunvantraj Singhvi, and their respective HUFs, holding pre-IPO 87.97% equity.

Is this a fresh issue or an offer for sale?

It is a 100% Offer for Sale (OFS), meaning the company will not receive fresh capital; existing shareholders are selling their shares.What are the main objects of the Euro Pratik Sales IPO?

The IPO aims to achieve the benefits of listing on stock exchanges and provide an exit opportunity to selling shareholders.

Which exchanges will list the Euro Pratik Sales IPO?

The IPO will be listed on BSE and NSE, with a tentative listing date of 23rd September 2025.

What is the minimum investment required for retail investors?

At the upper price band of ₹247, the minimum investment is ₹14,820 for 1 lot (60 shares).

Who is managing the Euro Pratik Sales IPO?

Axis Capital Ltd. is the book running lead manager, and MUFG Intime India Pvt. Ltd. is the registrar of the issue.

Related Articles

How to Analyze an IPO Before Investing: A Step-by-Step Guide

One Demat vs Multiple Demat – Which is Better for IPO Allotment?