Introduction

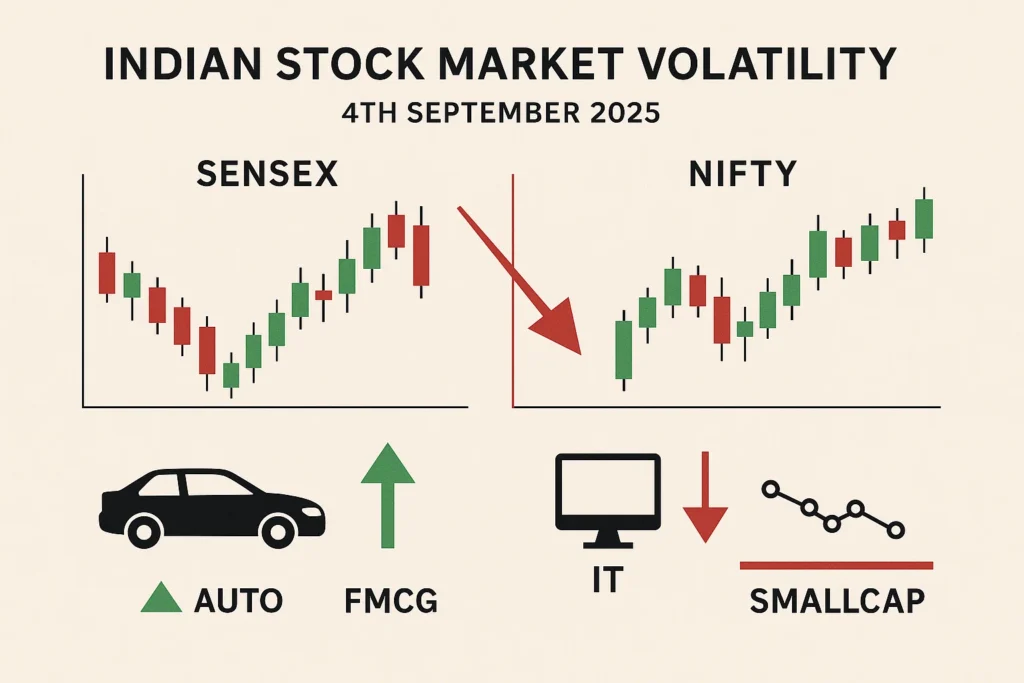

The Stock Market 4th September turned out to be a roller-coaster ride for investors. The session began on a euphoric note with benchmark indices scaling fresh highs, driven by optimism around GST reforms and strong buying in auto and FMCG stocks. The Sensex briefly crossed the 81,000 mark, and the Nifty inched closer to 24,900, sparking hopes of yet another record-setting rally.

However, the euphoria didn’t last long. By mid-session, profit booking kicked in across sectors, while IT stocks dragged benchmarks lower. Adding to the pressure, smallcap and midcap indices—which have been the key drivers of the recent bull run—saw heavy selling, reflecting investor caution at elevated valuations.

The final picture of the day was mixed: frontline indices managed to hold on to minor gains, but the broader market slipped into the red. In essence, Stock Market 4th September reminded investors of one key lesson: momentum-driven rallies can often fizzle out just as quickly, and volatility remains high.

Index Performance on Stock Market 4th September

The performance of major indices on Stock Market 4th September highlighted the split nature of the session:

- Nifty 50 closed at 24,733.65, up 18.60 points (0.075%). While the index touched an intraday high near 24,900, it could not sustain the momentum as profit booking erased most of the gains.

- Sensex ended at 80,746.74, gaining 179.03 points (0.22%). The index crossed the 81,000 milestone in morning trade but faced resistance at higher levels.

- Nifty Bank settled at 54,101.10, up 33.55 points (0.062%), reflecting subdued movement in banking stocks after an initial rally.

- Nifty IT dropped sharply to 35,118.45, losing 356.50 points (−1.00%). IT remained the biggest drag of the day, reversing the positive market sentiment.

- S&P BSE SmallCap fell to 52,710.91, down 313.69 points (−0.59%), highlighting the sharp sell-off in broader markets where overvalued counters witnessed profit booking.

The contrast was clear: while the Sensex and Nifty managed to cling to minor gains, IT weakness and smallcap correction pulled the market mood down, turning what could have been a strong rally into a flat, cautious close.

Snapshot of Index Performance – Stock Market 4th September

| Index | Closing Level | Change | % Change |

|---|---|---|---|

| Nifty 50 | 24,733.65 | +18.60 | +0.075% |

| Sensex | 80,746.74 | +179.03 | +0.22% |

| Nifty Bank | 54,101.10 | +33.55 | +0.062% |

| Nifty IT | 35,118.45 | −356.50 | −1.00% |

| BSE SmallCap | 52,710.91 | −313.69 | −0.59% |

Top Gainers on Stock Market 4th September

- DOMS Industries (+7.46% at ₹2,690)

- Strong rally after GST cuts boosted outlook for consumer goods.

- High volumes supported the upmove.

- Bata (+6.77% at ₹1,241.10)

- Benefitted from tax rationalization in footwear; surged on heavy buying.

- Mahindra & Mahindra (+5.90% at ₹3,480)

- Auto major hit a 10-year high, cheered by GST relief on SUVs and passenger vehicles.

- Syrma SGS Technology (+4.61% at ₹828)

- Continued its upward streak with strong delivery volumes; touched a 10-year high.

- Netweb Technologies (+4.44% at ₹2,639)

- Rallied after winning fresh orders, keeping the momentum alive.

Top Losers on Stock Market 4th September

- Ola Electric (−6.52% at ₹64.49)

- Sharp correction after recent rally; investors booked profits aggressively.

- Shipping Corporation (−4.82% at ₹211.30)

- Dropped after going ex-dividend, triggering selling pressure.

- TBO Tek (−4.34% at ₹1,522)

- Recent acquisition-driven rally cooled off; high volatility persisted.

- Sarda Energy & Minerals (−4.26% at ₹561.50)

- Weakness in metals and global cues led to a sharp fall.

- JM Financial (−3.86% at ₹182.20)

- Declined on heavy selling and concerns over NBFC exposure.

Summary Table of Top Gainers & Losers – Stock Market 4th September

| Top Gainers | LTP (₹) | Day Change % |

|---|---|---|

| DOMS Industries | 2,690 | +7.46% |

| Bata | 1,241.10 | +6.77% |

| Mahindra & Mahindra | 3,480 | +5.90% |

| Syrma SGS Technology | 828 | +4.61% |

| Netweb Technologies | 2,639 | +4.44% |

| Top Losers | LTP (₹) | Day Change % |

|---|---|---|

| Ola Electric | 64.49 | −6.52% |

| Shipping Corporation | 211.30 | −4.82% |

| TBO Tek | 1,522 | −4.34% |

| Sarda Energy & Minerals | 561.50 | −4.26% |

| JM Financial | 182.20 | −3.86% |

Why Did the Market Nosedive After Opening Higher?

The Stock Market 4th September started with a strong gap-up, but momentum faded quickly. Here’s why:

🔹 GST Optimism Fueled the Opening

- The GST Council’s tax rationalization gave an immediate boost to autos, FMCG, and consumer stocks.

- Buying was broad-based in the first half, pushing Sensex past 81,000 and Nifty above 24,900.

🔹 Profit Booking Triggered Midday Correction

- After scaling new highs, traders locked in profits.

- Banking, cement, and realty sectors faced selling pressure, erasing early gains.

🔹 IT Stocks Dragged Benchmarks

- Nifty IT fell 1%, with stocks like Infosys and TCS under pressure due to global tech demand concerns and rupee fluctuations.

- This sectoral weakness capped overall market momentum.

🔹 Smallcap & Midcap Sell-off

- Smallcap index slipped 314 points, marking a clear reversal from the previous session’s rally.

- Concerns of overvaluation in smaller stocks led to broad-based selling.

🔹 Mixed Global & Macro Cues

- Weak global signals and caution ahead of U.S. data releases contributed to risk-off sentiment.

- Investors trimmed positions in riskier assets, adding to the intraday volatility.

Conclusion: Stock Market 4th September

The Stock Market 4th September was a classic case of “from euphoria to caution.” While GST reforms triggered a powerful opening rally, profit booking, IT weakness, and smallcap pressure wiped out most gains.

Despite closing flat, the market’s ability to hold above key support levels shows underlying strength. However, the late-session sell-off is a reminder that volatility remains high. Investors will now watch for follow-through buying, global cues, and the GST Council’s detailed announcements in the coming days.

For now, Stock Market 4th September serves as a lesson: sharp rallies are often followed by equally sharp corrections, and discipline is key for traders.

Related Articles

Read Our All Newsletter On Pre-Market Analysis

Systematic Withdrawal Plan 2025 – 7 Powerful Benefits

Best IPOs in 2025: Top 10 Stocks That Doubled Investors’ Money