Market Outlook 4 September

Good morning and welcome to your Market Outlook 4 September Edition.

After two days of volatility, Dalal Street regained stability as investors drew comfort from positive cues emerging out of the GST Council meeting, which sparked hopes of possible tax relief measures. The buying interest was broad-based, led by banking, metals, and pharma, while small- and mid-cap counters witnessed a strong rebound, signaling a return of risk appetite.

At close, the Nifty 50 climbed 131.70 points (0.54%) to 24,711.30, while the Sensex advanced 414.35 points (0.52%) to settle at 80,572.23. The Bank Nifty jumped 0.77%, supported by strong gains in frontline lenders, whereas Nifty IT slipped 0.67% amid sector-specific pressure. On the broader market front, the S&P BSE SmallCap surged 0.99%, highlighting strong participation beyond large caps.

With these developments setting the tone, let’s take a closer look at the technical outlook, key news, IPO activity, and stocks to watch for today’s session.

Index Technical View | Market Outlook 4 September

According to Equitypandit technical analysis, the market outlook remains mixed with index-specific trends offering clear trading ranges.

Sensex Technical View

The Sensex (80,568) remains in a negative trend as per the latest analysis. Traders holding short positions can continue to hold with a daily closing stoploss at 80,684, while fresh long positions should only be considered if the index manages to close above this key level.

- Support Levels: 80,158 • 79,748 • 79,491

- Resistance Levels: 80,824 • 81,081 • 81,491

- Tentative Range: 81,234 – 79,901

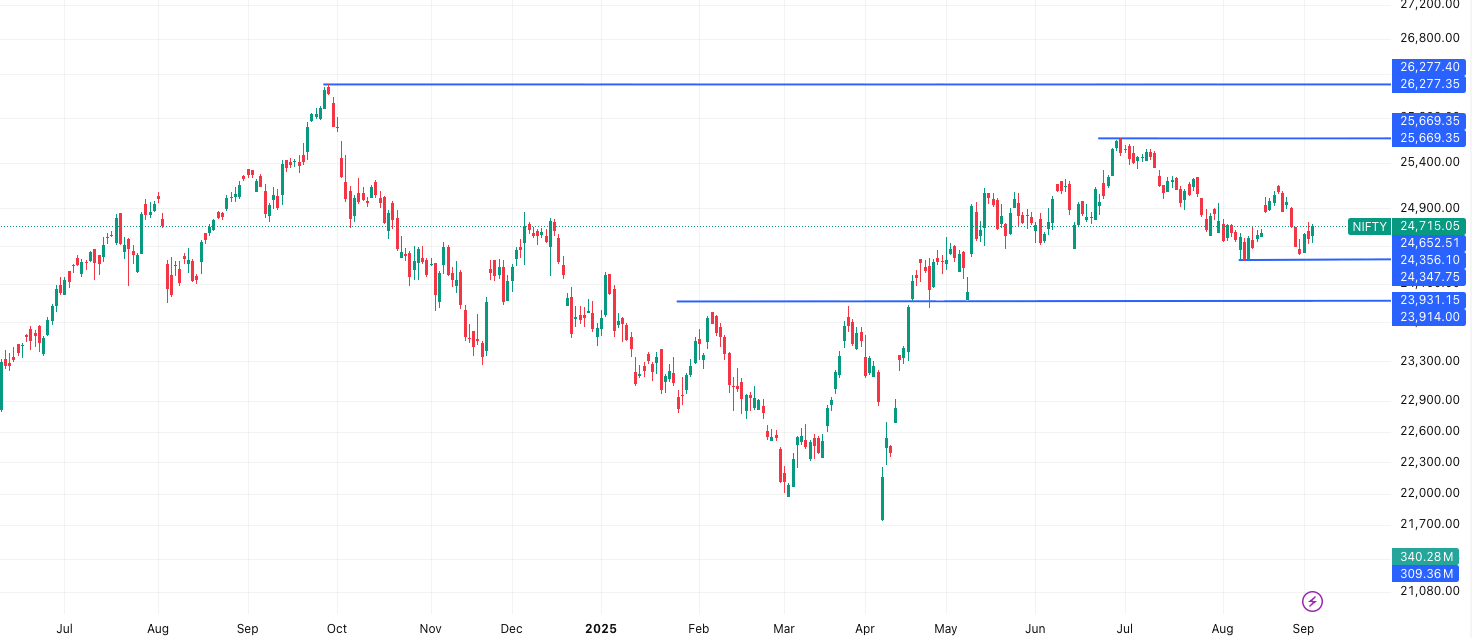

Nifty Technical View

The Nifty 50 (24,715) has entered a positive trend in the last trading session, signaling strength in the broader market. Traders can look for long opportunities with a stoploss at 24,430 on a daily closing basis. The index will remain strong as long as it trades above this level.

- Support Levels: 24,586 • 24,458 • 24,383

- Resistance Levels: 24,790 • 24,866 • 24,994

- Tentative Range: 24,920 – 24,509

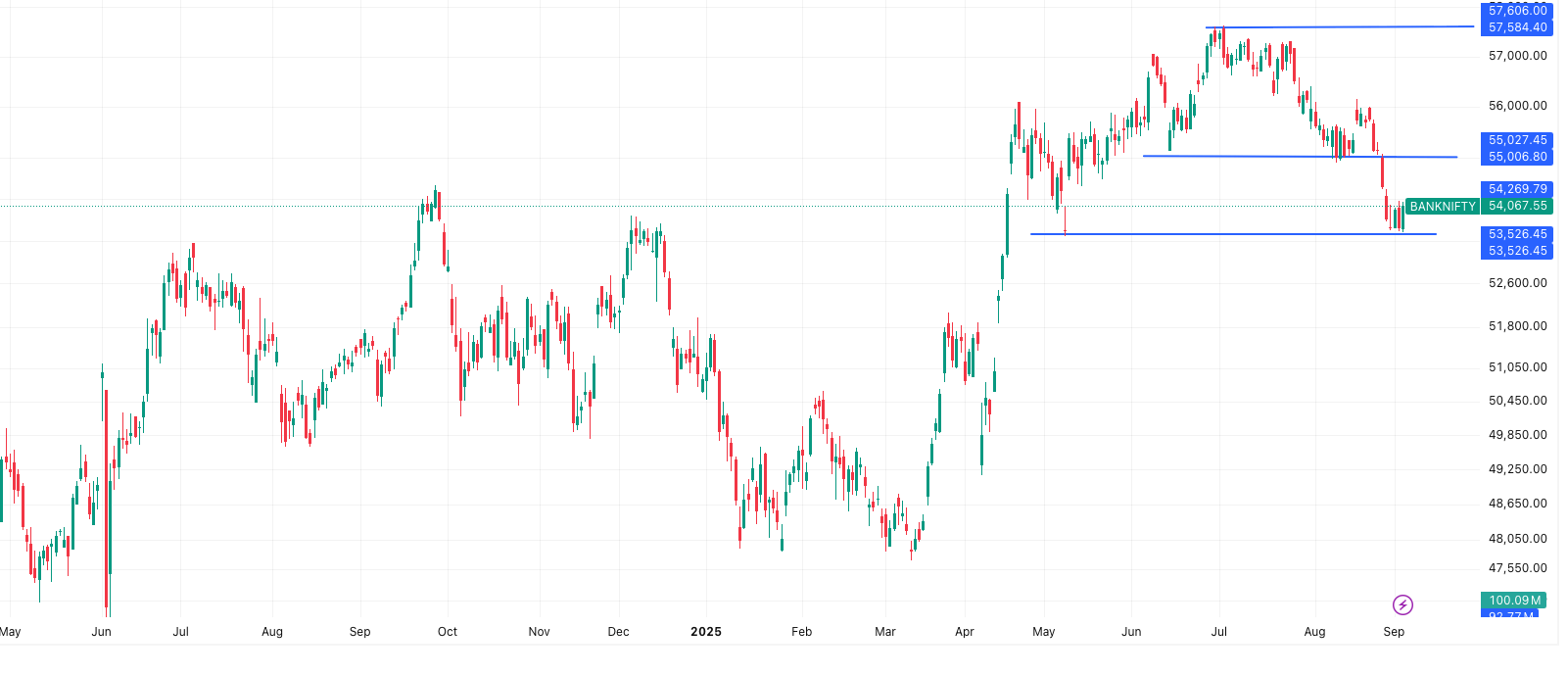

Bank Nifty Technical View

The Bank Nifty (54,068) continues to show a negative trend. Short positions can be held with a stoploss at 54,346, while fresh long positions should only be initiated if the index closes above this threshold.

- Support Levels: 53,707 • 53,347 • 53,133

- Resistance Levels: 54,282 • 54,496 • 54,856

- Tentative Range: 54,582 – 53,552

Overall Market Outlook 4 September: The Nifty is showing resilience with a positive setup, while the Sensex and Bank Nifty still need stronger breakouts above resistance to confirm bullish momentum. Traders should adopt a selective approach, focusing on Nifty-led strength while staying cautious on banking and large-cap benchmarks.

News and Stocks That Might Be Impacted | Market Outlook 4 September

Arkade Developers Buys Mumbai Land for ₹148 Crore

Realty firm Arkade Developers Ltd announced the acquisition of a 14,364 sq. metre land parcel in Bhandup (West), Mumbai Metropolitan Region for ₹148 crore. This move expands its real estate footprint, adding to the 31 projects (5 million sq. ft.) it has already completed and 2 million sq. ft. under construction.

Market Outlook 4 September Impact: Real estate and allied construction stocks may witness positive traction, with investor interest shifting towards companies with strong MMR exposure.

Jane Street vs SEBI: Legal Battle Escalates

US trading giant Jane Street has filed a case against SEBI before the Securities Appellate Tribunal (SAT), seeking access to investigation records related to alleged manipulation in India’s derivatives market. The firm had earlier deposited ₹4,844 crore of alleged unlawful gains in an escrow account.

Market Outlook 4 September Impact: The case may keep derivatives trading under scrutiny, potentially impacting Bank Nifty constituents and F&O activity in the short term. Broader market sentiment may remain cautious as legal tussles unfold.

Kaynes Tech Advances OSAT Facility in Gujarat

Kaynes Technologies Ltd confirmed that its pilot OSAT (Outsourced Semiconductor Assembly & Test) plant in Gujarat is producing samples, with three anchor clients already onboarded. The company expects commercial production in Q4 FY25.

Market Outlook 4 September Impact: Semiconductor theme remains a key growth story. Kaynes Tech, along with CG Power, could attract investor attention as the government’s Semicon India 2025 push gathers momentum.

Franklin Templeton Launches Multi-Factor Equity Fund

Franklin Templeton MF received SEBI approval for its Franklin India Multi-Factor Fund, an open-ended equity scheme based on Quality, Value, Sentiment, and Alternative factors. The NFO opens November 10, 2025.

Market Outlook 4 September Impact: While the launch is months away, this signals growing demand for quant-based mutual funds. AMC stocks and asset management peers may see renewed attention.

Sarveshwar Foods Signs MoU with German Tech Partner

Sarveshwar Foods Ltd, the first listed private food company from J&K, entered into a strategic MoU with a German company to adopt CO₂ rice storage, recyclable cocoons, and smoke-generation technologies. This will improve product quality and global exports.

Market Outlook 4 September Impact: Positive for Sarveshwar Foods (NSE: SARVESHWAR) as the company strengthens its export-driven growth story, particularly in Europe, the Middle East, and North America.

Union Health Ministry Proposes NDCT Rule Amendments

The Health Ministry has proposed amendments to the New Drugs and Clinical Trials (NDCT) Rules, 2019, reducing test licence approval timelines from 90 days to 45 days and allowing certain BA/BE studies to begin post-notification.

Market Outlook 4 September Impact: This could benefit pharma and clinical research companies, improving India’s competitiveness as a global pharma hub. Expect interest in mid-cap pharma and CRO (contract research organizations) stocks.

IPO Update | Market Outlook 4 September

Mainboard IPOs to Watch

| IPO Name | Open | Close | Subscription | Listing Date | GMP (Est. Listing Gain) |

|---|---|---|---|---|---|

| Dev Accelerator IPO | 10-Sep | 12-Sep | – | 17-Sep | ₹– (NA) |

| Urban Co. IPO | 10-Sep | 12-Sep | – | 17-Sep | ₹12 (≈11.65%) |

| Shringar House of Mangalsutra IPO | 10-Sep | 12-Sep | – | 17-Sep | ₹– (0.00%) |

| Amanta Healthcare IPO | 1-Sep | 3-Sep | 82.18x | 9-Sep | ₹8.5 (≈6.75%) |

SME IPOs Gaining Investor Traction

| IPO Name | Open | Close | Subscription | Listing Date | GMP (Est. Listing Gain) |

|---|---|---|---|---|---|

| Sharvaya Metals (BSE SME) | 4-Sep | 9-Sep | – | 12-Sep | ₹22 (≈11.22%) |

| Vigor Plast (NSE SME) | 4-Sep | 9-Sep | – | 12-Sep | ₹– (0.00%) |

| Austere Systems (BSE SME) | 3-Sep | 8-Sep | 6.75x | 11-Sep | ₹17 (≈30.91%) |

| Goel Construction (BSE SME) | 2-Sep | 4-Sep | 10.79x | 10-Sep | ₹57 (≈21.67%) |

| Optivalue Tek Consulting (NSE SME) | 2-Sep | 4-Sep | 4.9x | 10-Sep | ₹13 (≈15.48%) |

Market Outlook 4 September IPO View: Strong demand is visible in select SME IPOs such as Goel Construction and Austere Systems, which are drawing robust subscription and attractive GMPs. On the mainboard side, Amanta Healthcare IPO closed with stellar oversubscription and is set for listing on 9th September, keeping investors’ eyes on listing gains.

Stocks in Radar For Market Outlook 4 September

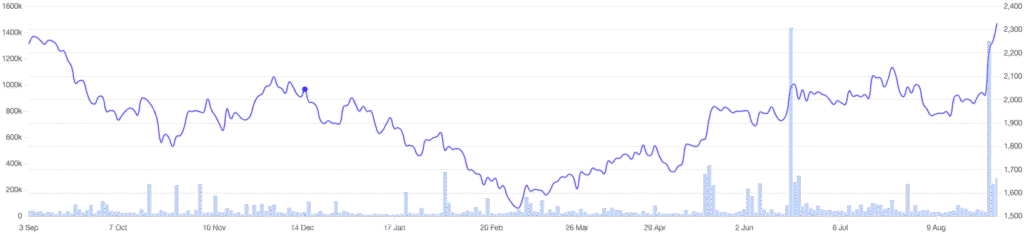

Zydus Wellness (CMP: ₹2,300 | Target: ₹2,995 | Upside: ~28%)

Source: Anand Rathi Research

Business Overview

Zydus Wellness has strengthened its global play by acquiring UK-based Comfort Click, a digital-first health & wellness brand. This move significantly broadens its footprint across the UK, EU, and USA, placing Zydus in the fast-growing global vitamins, minerals & supplements (VMS) space.

Comfort Click Portfolio:

- WeightWorld – Plant-based supplements, collagen, probiotics, sports nutrition

- Maxmedix – Paediatric VMS gummies

- Animigo – Natural pet health supplements

Financial Highlights

- Comfort Click revenue: £134m (~₹16bn, FY25) with >57% 2-/5-year CAGR

- EBITDA: £21m (~₹2.5bn), 16% margin

- Post-acquisition, Zydus revenue expected to cross ₹50bn by FY27 (vs ₹27bn FY25)

- EPS accretive: +1% in FY26e, +20% in FY27e

Drivers

- Expands international revenue contribution from 3% → ~40% by FY27

- Strong cross-selling potential in global VMS market

- Comfort Click’s management retains skin-in-the-game with incentives tied to performance

Valuation & Outlook

- Trades at 34x/24x/21x FY26/27/28e EPS of ₹65.7/₹93.6/₹106.1

- New 12-month target price revised to ₹2,995 (earlier ₹2,570)

- Acquisition accelerates Zydus into the ₹50bn+ revenue orbit, rare among Indian FMCG players with a health & wellness focus

Outlook: Retain BUY. Acquisition is earnings-accretive and strategically positions Zydus Wellness as a serious global player in nutrition & wellness.

Conclusion | Market Outlook 4 September

The Market Outlook 4 September signals cautious optimism as investors start the week on a positive note. Nifty demonstrated resilience, while Sensex and Bank Nifty continue to watch critical resistance levels. Key developments, including the GST Council’s potential relief measures, strong IPO activity, and strategic corporate moves like Zydus Wellness’s Comfort Click acquisition, are likely to keep market sentiment upbeat.

Investors should focus on sectoral leaders in banking, metals, pharma, and select mid- and small-cap stocks, while remaining alert to F&O volatility and legal or regulatory developments that could impact sentiment. The combination of solid fundamentals, promising IPOs, and corporate growth stories sets the stage for a measured but positive trading session.

Overall, the Market Outlook 4 September suggests a selective bullish approach, favoring fundamentally strong companies and sectors showing early signs of momentum.

More Articles

Real Money Gaming Ban India: UPI, Payments & Industry Impact

Amanta Healthcare IPO: 5 Powerful Positives & Risks Investors Must Know

Best IPOs in 2025: Top 10 Stocks That Doubled Investors’ Money