Market Outlook 29 July | A Sluggish Start to the Week

Good morning and welcome to your Market Outlook 29 July edition.

Markets began the week on a soft footing, extending their losing streak for the third consecutive session. The Nifty 50 closed at 24,684.55, down 152.45 points (-0.61%), while the Sensex slipped 592.61 points to end at 80,870.48. Selling pressure persisted across key sectors — Nifty Bank declined by 0.78%, Nifty IT dropped 0.71%, and the SmallCap index underperformed with a sharp 1.35% fall, reflecting continued risk-off sentiment among broader market participants.

In today’s newsletter, we decode the Nifty’s technical outlook, highlight key news impacting stock-specific moves, track the pulse of the IPO market with fresh GMP updates, and present a fundamentally strong smallcap stock on radar.

Let’s dive into your Tuesday trade setup with the complete Market Outlook for 29 July.

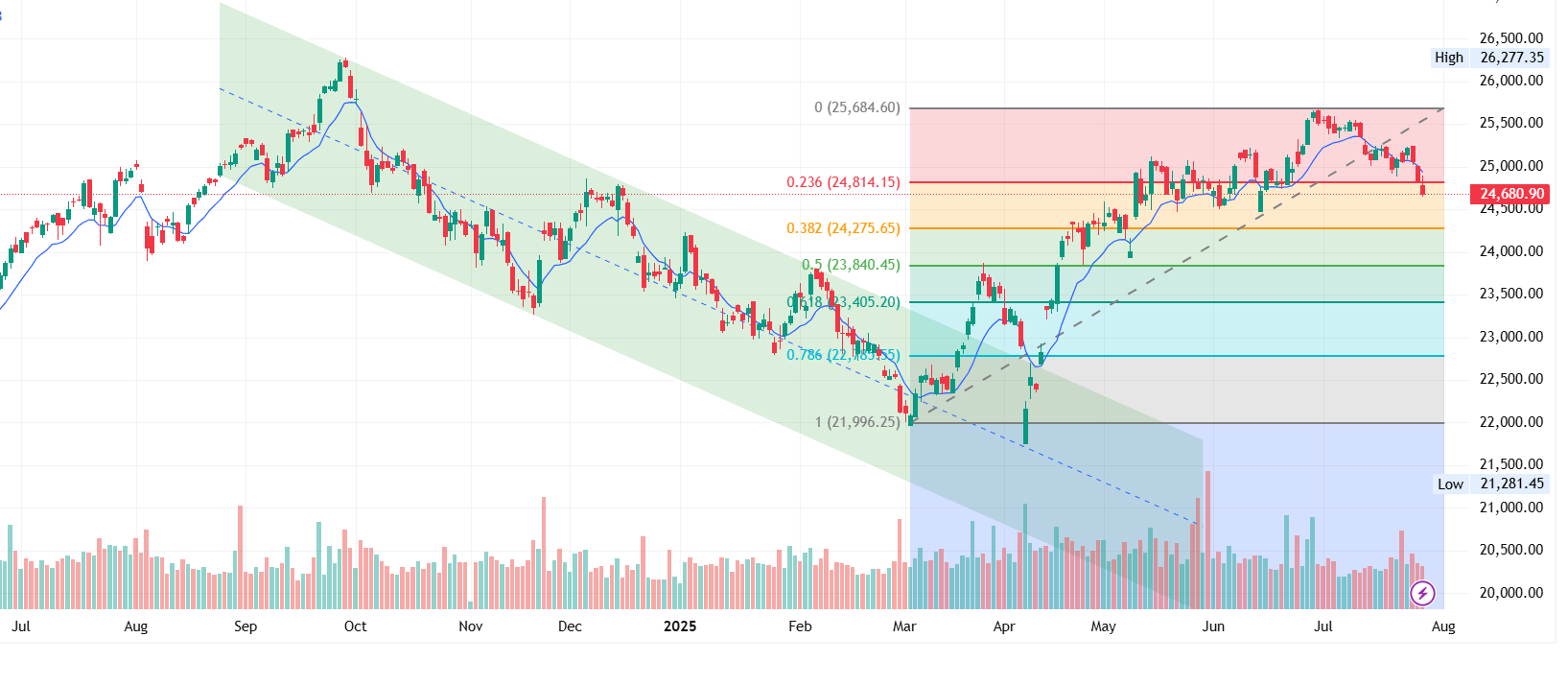

Nifty 50 Technical Analysis | Market Outlook 29 July

Close: ₹24,680.90 (-156 pts / -0.63%)

Key Observations:

Break Below 0.236 Fibonacci Level (₹24,814.15)

Nifty has decisively slipped below the 0.236 Fibonacci retracement level, measured from the swing low of ₹21,996 to the recent high of ₹25,684. This signals short-term weakness and opens the door for deeper retracements. The next important levels to watch are:

- 0.382 Fib at ₹24,275

- 0.5 Fib at ₹23,840

Breakdown Below 9 EMA

The 9-day EMA stands at ₹24,937.43, and Nifty is trading significantly below it, reinforcing short-term bearish momentum.

Bearish Candlestick Structure

The index has formed consecutive red candles with expanding bodies and increasing volume—indicating growing selling pressure rather than simple profit booking.

Trendline Breakdown

The rising trendline that supported the March–June rally has been broken. This breakdown signals a shift in market tone from trending bullish to possible consolidation or correction.

Key Levels to Watch

If Downside Continues:

| Fibonacci Level | Price (₹) | Technical Significance |

|---|---|---|

| 0.382 | 24,275 | Immediate support, possible bounce zone |

| 0.5 | 23,840 | Stronger support, may attract buying interest |

| 0.618 | 23,405 | Breach of this could indicate medium-term trend reversal |

These levels align with historical congestion zones, increasing their technical relevance.

Reversal Watch – Unlikely in Near Term

For the current bearish structure to be reversed, Nifty would need to sustain above ₹25,000–25,100, reclaiming both the 9 EMA and 0.236 Fib. However, this scenario looks unlikely without a strong external trigger or gap-up opening.

Strategy Outlook | Market Outlook 29 July

Short-Term Bias: Bearish to Neutral

Trading Approach:

- Sell on Rise: Pullbacks to ₹24,800–24,900 may offer shorting opportunities with tight stops above the 9 EMA.

- Watch for Support: ₹24,275 is the next key support. Traders can look for quick long trades here only if strong reversal signals emerge.

- Deeper Correction: A break below ₹24,275 opens the path toward ₹23,840.

Invalidation Level:

Any close back above ₹25,000 with rising volume would negate the current bearish setup.

Conclusion:

Nifty has confirmed a short-term breakdown by breaching both its 9 EMA and key Fibonacci support. The technical setup suggests a continued corrective move toward ₹24,275 and ₹23,840, barring any major positive catalyst.

News & Stocks That Might Be Impacted

UltraTech Cement to Invest ₹10,000 Cr in FY26; Capacity Nears 200 MTPA

UltraTech Cement, India’s largest cement manufacturer, has announced plans to invest up to ₹10,000 crore in FY26 for capacity expansion and operational upgrades. The company aims to cross the 200 MTPA mark, with 192.26 MTPA already achieved as of June 30, 2025. Over 42.6 MTPA was added in FY25 alone, through a combination of acquisitions (India Cements, Kesoram Industries) and organic growth.

The expansion also focuses on green energy—UltraTech is adding 107 MW of renewable power at former Kesoram units and planning a capex program for India Cements assets. Despite higher debt from acquisitions (net debt/EBITDA at 1.33x), the company remains bullish on a 6–7% cement demand growth, supported by the government’s massive ₹11.2 lakh crore infrastructure allocation in the Union Budget.

📈 Stock(s) That Might Be Impacted:

- UltraTech Cement (NSE: ULTRACEMCO) – Positive long-term view due to aggressive growth and efficiency focus.

- India Cements (NSE: INDIACEM) – Re-rating possible as integration with UltraTech progresses.

- Kesoram Industries (NSE: KESORAMIND) – May benefit from capacity and efficiency boost.

- Ambuja Cements (NSE: AMBUJACEM) – Faces intensified competition as Adani vs UltraTech rivalry deepens.

Capital India Finance Allots ₹50 Cr in 9.55% NCDs

Capital India Finance Ltd (CIFL) has allotted ₹50 crore worth of secured Non-Convertible Debentures (NCDs) with a fixed 9.55% annual coupon and 3-year maturity. These bonds, backed by receivables, will be listed on BSE and serve to raise non-dilutive capital for business expansion. The secured nature of the instruments, strong coverage ratio, and timely disclosures suggest healthy governance and risk control.

📈 Stock(s) That Might Be Impacted:

- Capital India Finance (NSE: CIFL) – Positive sentiment from debt market participation; stock may gain traction among yield-seeking investors.

- Other NBFCs like Muthoot Finance, Manappuram, or Piramal Capital may face comparison pressure on cost of capital and disclosures.

Crisil Sees Q1 FY26 Revenue Growth Slowing to 4–6%

Crisil Intelligence revised its Q1 FY26 revenue growth forecast for India Inc to 4–6%, down from ~7% in previous quarters. Core sectors such as power, IT services, and steel dragged overall growth. Power revenue is expected to fall 8% YoY due to lower electricity demand from cooler weather. IT revenue remained flat due to global project delays and macro uncertainty. Steel was hit by maintenance shutdowns and soft pricing.

However, pharma (+9–11%), telecom (+12%), organised retail (+15–17%), aluminium (+23%), and airlines (+15%) stood out as growth engines.

📈 Stock(s) That Might Be Impacted:

- Negative:

- NTPC (NSE: NTPC), Tata Power (NSE: TATAPOWER) – Hit by weak summer demand and coal consumption decline.

- TCS (NSE: TCS), Infosys (NSE: INFY) – Cautious near-term outlook on project delays.

- JSW Steel (NSE: JSWSTEEL), Tata Steel (NSE: TATASTEEL) – Softer prices, shutdowns impact earnings.

- Positive:

- Sun Pharma (NSE: SUNPHARMA), Dr. Reddy’s (NSE: DRREDDY) – Strong pharma exports and stable domestic demand.

- Bharti Airtel (NSE: BHARTIARTL), Reliance Jio (via RIL) – Improved ARPUs driving telecom strength.

- Titan (NSE: TITAN), Trent (NSE: TRENT) – Beneficiaries in organised retail surge.

- Hindalco (NSE: HINDALCO) – Riding high on aluminium exports and downstream product demand.

- IndiGo (NSE: INDIGO) – Volume and revenue tailwinds amid fleet expansions.

UPL Finalises ₹180 Call on Partly Paid Shares; Rights Issue Nears Completion

UPL Ltd has approved the second and final call of ₹180 per share (₹1 face + ₹179 premium) on its partly paid-up shares issued under the ₹360 rights issue. This applies to over 9.38 crore shares. The funds raised will strengthen the balance sheet, support liquidity, and fund global expansion.

The company has already reported a 2,140% YoY profit surge in Q4 FY25, improved margins (20.5% EBITDA), and institutional holding rising to 55.9%. The stock trades at a PEG ratio of 0.4, hinting at possible re-rating if the turnaround continues.

📈 Stock(s) That Might Be Impacted:

- UPL Ltd (NSE: UPL) – Positive sentiment from strong earnings momentum and completion of capital raising.

- Investors in Rights Issue – With the final call due, trading activity in partly paid shares may rise until record date (1 Aug).

- Agrochemical Peers like PI Industries, Rallis India, and BASF India may see relative valuation movements.

Authum Investment: Promoter Sells 3.41% Stake, Reinvests ₹1,307 Cr via Debt

Promoter entity Mentor Capital Ltd sold a 3.41% stake in Authum Investment & Infrastructure Ltd (~₹1,307 crore) through the open market. Buyers included Fidelity and Goldman Sachs, underscoring institutional confidence.

Interestingly, the promoter has reinvested the proceeds into Authum via a low-interest non-dilutive debt instrument. The funds aim to strengthen liquidity, support retail lending, and reduce financing costs, with a possible future conversion into preference shares.

📈 Stock(s) That Might Be Impacted:

- Authum Investment (NSE: AIIL) – Short-term dip (~2.4%) due to promoter sale, but strategic reinvestment and institutional interest bode well long-term.

- NBFCs like L&T Finance, Bajaj Finance, and IIFL Finance may be compared for promoter skin-in-the-game and capital infusion quality.

Lenskart Prepares for $1 Billion IPO Filing This Week

Eyewear unicorn Lenskart is reportedly preparing to file its Draft Red Herring Prospectus (DRHP) for a $1 billion IPO this week. The SoftBank-backed startup was last valued at $6.1 billion (as per Fidelity’s April estimate) and raised $200 million from Temasek and others in June 2024.

The IPO comes amid growing investor interest in Indian tech startups opting for domestic listings. Lenskart operates in over 130 cities and has international expansion plans in Southeast Asia and the Middle East.

📈 Stock(s) That Might Be Impacted:

- Lenskart (Unlisted) – Unlisted investors may see rising valuations on private markets and pre-IPO activity.

- IPO-bound Startups like Oyo, FirstCry, and Mobikwik could also attract renewed investor attention.

- Retail & D2C Players – Including Nykaa (NSE: NYKAA) and Titan (via Taneira), may face competitive benchmarking.

Stock in Technical Screener – Market Outlook 29 July

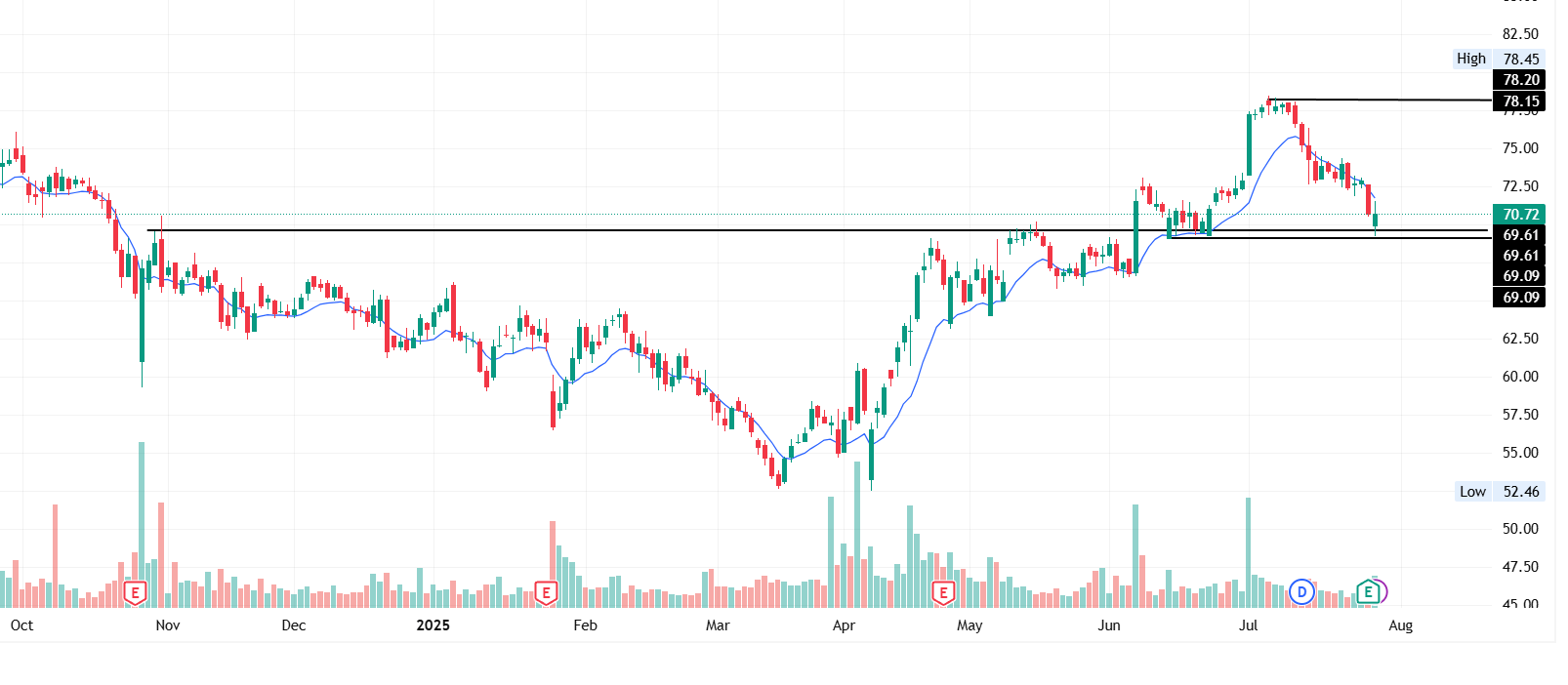

IDFC FIRST BANK – Technical Analysis

Current Price: ₹70.72

Recent Move: Pullback from high of ₹78.45

Volume: 36.3 million (moderate; no heavy panic selling)

Key Technical Observations:

1. Support Re-Test at ₹69–69.60 Zone

The stock has bounced intraday from a critical horizontal support level. This zone acted as strong resistance in May–June and has now flipped into support—often a sign of demand re-emerging.

2. EMA Breakdown (Short-Term Weakness)

The 9-day EMA stands at ₹71.75. With price currently below this level, near-term momentum is mildly bearish. However, today’s flat close signals potential for reversal or consolidation near support.

3. Recent Trend Structure

IDFC First rallied from around ₹60 to ₹78.45 during June and July in a strong uptrend. The current phase appears to be a healthy correction, not a trend reversal. Structure remains bullish unless ₹69 decisively breaks.

Key Technical Levels

| Type | Level (₹) | Remarks |

|---|---|---|

| Support 1 | 69.60 | Critical horizontal support (tested today) |

| Support 2 | 69.09 | Minor support zone from previous dips |

| Resistance 1 | 71.75 | Immediate resistance at 9-EMA |

| Resistance 2 | 73.75–74.00 | Short-term swing resistance |

| Target | 78.15–78.45 | Previous high, potential breakout level |

Trading Plan

Short-Term View (1–5 Days)

- Buy Zone: Look for confirmation if price holds above ₹69.60 with bullish candle

- Target: ₹73.50–74.00

- Stop-loss: ₹69.00 (close basis)

- Note: Avoid fresh shorting unless price breaks ₹69 on strong volume.

Swing View (1–3 Weeks)

- Bias: Bullish as long as ₹69 is defended

- Accumulation Range: ₹69.50–₹70.50

- Targets: ₹74.00 and then ₹78.15

- Stop-loss: ₹68.50 (on daily close)

Risk Factors to Monitor

- A breakdown below ₹69 would invalidate the bullish setup, opening downside to ₹66–67 range.

- Weakness in broader markets, particularly Nifty or financial sector indices, could weigh on performance. Watch sector sentiment closely.

Conclusion:

IDFC First Bank is trading near a technically significant support zone. If ₹69.60 continues to hold, it offers a low-risk opportunity for both short-term traders and swing participants. Confirmation of a bounce could set the stock up for a move back to ₹74–78 levels, aligning with broader technical strength.

IPO Watch – Market Outlook 29 July

🔷 Mainboard IPOs

| IPO Name | Open Date | Close Date | Listing Date | GMP (Est. Gain %) |

|---|---|---|---|---|

| NSDL IPO | 30-Jul | 1-Aug | 6-Aug | ₹135 (16.88%) |

| Aditya Infotech IPO | 29-Jul | 31-Jul | 5-Aug | ₹255 (37.78%) |

| M&B Engineering IPO | 30-Jul | 1-Aug | 6-Aug | ₹34 (8.83%) |

| Sri Lotus Developers IPO | 30-Jul | 1-Aug | 6-Aug | ₹43 (28.67%) |

| Highway Infrastructure IPO | 5-Aug | 7-Aug | 12-Aug | ₹25 (35.71%) |

| GNG Electronics | 23-Jul | 25-Jul | 30-Jul | ₹94 (39.66%) |

| Laxmi India Finance | 29-Jul | 31-Jul | 5-Aug | ₹10 (6.33%) |

| Shanti Gold International | 25-Jul | 29-Jul | 1-Aug | ₹37.5 (18.84%) |

🔶 SME IPOs

| SME IPO Name | Open Date | Close Date | Listing Date | GMP (Est. Gain %) |

|---|---|---|---|---|

| Monarch Surveyors | 22-Jul | 24-Jul | 29-Jul | ₹210 (84.00%) |

| Shree Refrigerations | 25-Jul | 29-Jul | 1-Aug | ₹90 (72.00%) |

| Patel Chem Specialities | 25-Jul | 29-Jul | 1-Aug | ₹40 (47.62%) |

| Flysbs Aviation | 1-Aug | 5-Aug | 8-Aug | ₹150 (66.67%) |

| Sellowrap Industries | 25-Jul | 29-Jul | 1-Aug | ₹18 (21.69%) |

| Repono | 28-Jul | 30-Jul | 4-Aug | ₹21 (21.88%) |

| TSC India | 23-Jul | 25-Jul | 30-Jul | ₹12 (17.14%) |

| Kaytex Fabrics | 29-Jul | 31-Jul | 5-Aug | ₹32 (17.78%) |

| Jyoti Global Plast | 4-Aug | 6-Aug | 11-Aug | ₹10 (15.15%) |

| Cash Ur Drive Marketing | 31-Jul | 4-Aug | 7-Aug | ₹25 (19.23%) |

| Renol Polychem | 31-Jul | 4-Aug | 7-Aug | ₹8 (7.62%) |

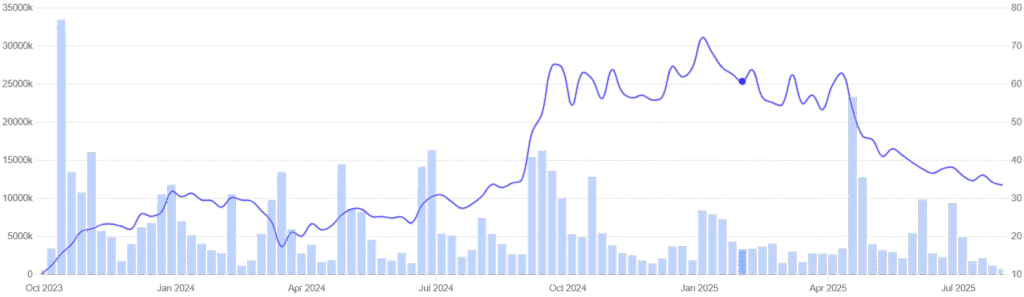

Smallcap Stock of the Day – Cellecor Gadgets Ltd

Overview

- Market Cap: ₹728 Cr

- Current Price: ₹33.4 (28 July Close)

- 52-Week High/Low: ₹81.5 / ₹28.3

- Industry: Consumer Electronics – Trading & Distribution

Business Summary

Cellecor Gadgets Ltd, incorporated in 2020, is engaged in the distribution and trading of consumer electronics including mobile accessories, smart TVs, and gadgets. The company doesn’t manufacture directly, but sources products from third-party manufacturers, rebranding and retailing them under the “Cellecor” brand along with other established labels.

It operates in a high-growth, asset-light model focused on wide reach and brand recall in Tier-2 and Tier-3 cities, with a presence in over 25,000+ retail outlets across India. As consumer electronics demand continues to surge, Cellecor positions itself as a fast-scaling export stock with retail and e-commerce growth potential.

Key Metrics

| Metric | Value |

|---|---|

| Stock P/E | 23.6 |

| Industry P/E | 35.8 |

| Sales Growth (YoY) | 105% |

| Profit Growth (YoY) | 91.9% |

| ROCE | 24.2% |

| ROE | 25.1% |

| Debt-to-Equity | 0.77 |

| Operating Margin (OPM) | 5.29% |

| Promoter Holding | 49.6% |

| Book Value | ₹7.17 |

| EPS (TTM) | ₹1.42 |

| Intrinsic Value (Fair Val Estimate) | ₹95.7 |

Risk–Reward Analysis

Why It’s Interesting:

- 📈 Strong Revenue & Profit Growth in just 3 years of listing

- 💡 Asset-Light Model: High scalability without heavy CapEx

- 🧾 Low Valuation: CMP ₹33.4 vs intrinsic value ₹95.7 (potential undervaluation)

- 🌍 Potential Export Play: Growth in gadget distribution & exports from India

Risks to Note:

- 📉 High volatility due to recent listing and low float

- ⚙️ Margins remain thin at 5.29%, sensitive to supply chain costs

- 🏭 No manufacturing control – relies entirely on third-party vendors

- 🔁 Inventory-driven business: Working capital cycles can stretch in downturns

Disclaimer: High-Risk, High-Reward

Cellecor Gadgets is a high-risk, high-reward smallcap with impressive early growth but low margin stability. It’s suitable only for investors who understand the volatility of SME/Export stocks and can manage short-term fluctuations for long-term gains.

Conclusion

As we head into Tuesday’s trade, global cues remain cautiously optimistic while domestic earnings and macro flows will continue to guide momentum. Nifty and Sensex are near key support levels, with stock-specific moves dominating amid result reactions.

Several key developments—from the Vistara-Air India pilot strike risk to Vedanta’s capex boost—could lead to action in select pockets. Meanwhile, IDFC First Bank shows technical resilience, and smallcap picks like Cellecor Gadgets offer high-risk opportunities for aggressive traders.

Stay alert to newsflow and technical setups. The market remains in a buy-on-dips mode, but selectivity is key in this earnings-heavy week.

Focus for the Day:

- Track earnings-heavy names and post-result reactions

- Watch for technical supports holding on Nifty (22,300–22,500)

- Monitor SME IPO buzz—sentiment remains strong in broader markets

We’ll be back tomorrow morning with fresh insights.

Until then, trade smart and stay informed.

Related Articles

How a Tea Seller Used the Power of Compound Interest to Build ₹45 Lakh

China’s Fertilizer Export Halt to India: Stocks Set to Gain from the Supply Shock

The 15-15-15 Rule: Why the ₹1 Crore SIP Dream Needs a Reality Check