M&B Engineering IPO: Precision Engineering Player Gears Up for Market Debut

The M&B Engineering IPO is all set to hit the primary markets, offering investors a chance to participate in one of India’s trusted names in precision manufacturing and engineering services. Known for its specialized expertise in material handling and heavy fabrication, M&B Engineering has built a strong reputation across sectors like steel, power, and infrastructure.

This IPO not only signals the company’s next phase of growth but also opens the door for retail and institutional investors to get a piece of a niche player with a robust track record. But does it offer value? In this blog, we’ll break down everything — from IPO dates and pricing to financials, GMP trends, and allotment strategies — to help you decide if the M&B Engineering IPO is worth your investment.

M&B Engineering IPO Details

The M&B Engineering IPO is one of the most anticipated public issues in 2025, aiming to raise a whopping ₹650 crore through a mix of fresh issue and offer for sale. The company, known for its precision engineering services, is opening its IPO for subscription from July 30 to August 1, 2025, with a listing planned on both NSE and BSE.

Let’s break down the core details of this IPO:

Key IPO Highlights

| Particulars | Details |

|---|---|

| IPO Opening Date | July 30, 2025 (Wednesday) |

| IPO Closing Date | August 1, 2025 (Friday) |

| Listing Date (Tentative) | August 6, 2025 (Wednesday) |

| Face Value | ₹10 per share |

| Price Band | ₹366 to ₹385 per share |

| Lot Size | 38 shares |

| Total Issue Size | 1,68,83,116 shares (₹650.00 Cr) |

| Fresh Issue | 71,42,857 shares (₹275.00 Cr) |

| Offer for Sale (OFS) | 97,40,259 shares (₹375.00 Cr) |

| Issue Type | Book Building IPO |

| Employee Discount | ₹36 per share |

| Listing Exchange | BSE, NSE |

| Pre-Issue Share Capital | 5,00,00,000 shares |

| Post-Issue Share Capital | 5,71,42,857 shares |

M&B Engineering IPO Reservation

| Investor Category | Shares Offered |

|---|---|

| QIB | Not less than 75% of the Net Offer |

| NII | Not more than 15% of the Net Offer |

| Retail | Not more than 10% of the Net Offer |

M&B Engineering IPO Timeline

| Event | Date |

|---|---|

| IPO Opens | July 30, 2025 (Wed) |

| IPO Closes | August 1, 2025 (Fri) |

| Allotment | August 4, 2025 (Mon) |

| Refunds Initiated | August 5, 2025 (Tue) |

| Shares Credited to Demat | August 5, 2025 (Tue) |

| Listing Date | August 6, 2025 (Wed) |

| UPI Mandate Cut-off | 5 PM on August 1, 2025 |

Promoter Details

The promoters of M&B Engineering include prominent names from the Patel family:

Girishbhai Manibhai Patel, Chirag Hasmukhbhai Patel, Malav Girishbhai Patel, Birva Chirag Patel, Vipinbhai Kantilal Patel, and associated family trusts.

Objects of the Issue – Why Is M&B Engineering IPO Raising Funds?

The M&B Engineering IPO aims to raise ₹275 crore through a fresh issue, which will be strategically deployed to strengthen the company’s operational capabilities and reduce financial liabilities. Here’s a breakdown of how the funds are planned to be utilized:

| S.No. | Purpose | Amount (₹ in crores) |

|---|---|---|

| 1 | Capital expenditure: Purchase of equipment, machinery, solar grid, vehicles | ₹130.58 |

| 2 | Investment in IT software upgradation | ₹5.20 |

| 3 | Repayment/pre-payment of existing loans | ₹58.75 |

| 4 | General corporate purposes | Balance from net proceeds |

Strategic Takeaway

The M&B Engineering IPO is designed not just to expand production capacity but also to modernize operations with tech upgrades and reduce interest burdens. This forward-looking capital deployment suggests a clear intent to scale efficiently while improving margins.

M&B Engineering IPO: Company Overview – Building Steel Dreams Since 1981

Founded in 1981, M&B Engineering Limited is a pioneering name in India’s pre-engineered buildings (PEB) and self-supported roofing solutions space. The M&B Engineering IPO brings to investors a company with deep industry experience, world-class infrastructure, and a strong portfolio of marquee clients.

What Does the Company Do?

The company specializes in design-led manufacturing solutions — from concept to commissioning. Its services span design, engineering, fabrication, testing, and installation of high-performance PEB structures and roofing systems through two core divisions:

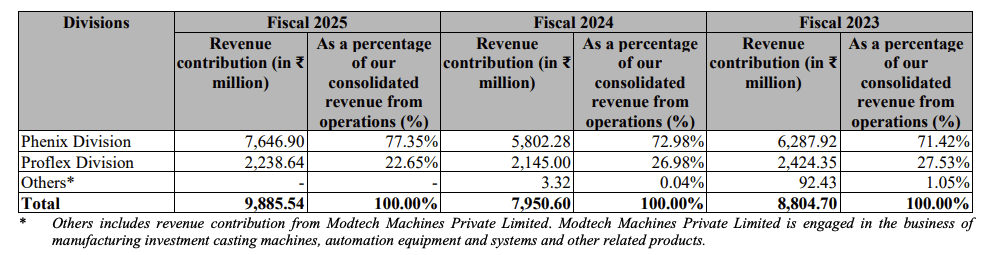

- Phenix Division: Focused on manufacturing PEBs including structural steel frames, columns, purlins, girts, claddings, and standing seam roofs using advanced tech and software.

- Proflex Division: Delivers mobile onsite roofing solutions, manufacturing and installing self-supported steel roofs after civil structure completion.

Together, these divisions have executed 9,500+ projects as of Fiscal 2025.

Revenue Breakdown by Division (₹ in million)

Manufacturing Powerhouses

M&B Engineering operates two state-of-the-art plants:

- Sanand, Gujarat (since 2008)

- Cheyyar, Tamil Nadu (since 2024)

With a combined production capacity of 103,800 MTPA, they cater to a wide array of industrial segments.

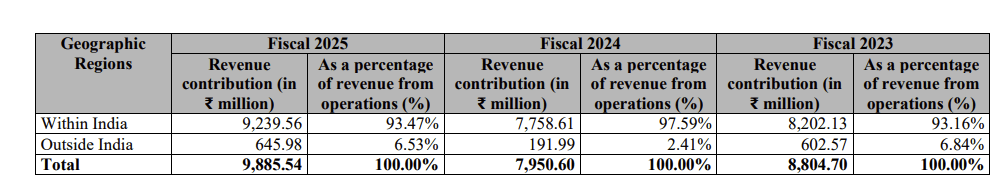

Global Reach

Since 2010, the company has exported PEBs and structural steel components to 22 countries, including:

- USA, Brazil, South Africa, Qatar, Sri Lanka, Morocco, Nigeria, Kenya, and Seychelles.

Export contributed up to 6.53% of revenues in FY25, reflecting a growing international presence.

Trusted by Industry Giants

The M&B Engineering IPO is backed by a customer base that includes:

- Adani Group (Green Energy, Ports, Logistics)

- Tata Advanced Systems, Alembic Pharma, Intas, Arvind, Haldiram’s, Lubi, and many more.

Repeat customers generated over 57% of total revenue in FY25, showcasing trust and satisfaction.

Financial Performance – M&B Engineering IPO

M&B Engineering has shown consistent and improving financial performance over the past three years, supported by growth in exports, domestic demand, and operational efficiency. Here’s a summary of key financials:

Income Statement Summary

| Metric | FY 2025 | FY 2024 | FY 2023 |

|---|---|---|---|

| Revenue from Operations | ₹988.55 Cr | ₹795.06 Cr | ₹880.47 Cr |

| EBITDA | ₹126.38 Cr | ₹79.62 Cr | ₹66.43 Cr |

| EBITDA Margin | 12.78% | 10.01% | 7.54% |

| Net Profit (PAT) | ₹77.05 Cr | ₹45.63 Cr | ₹32.89 Cr |

| PAT Margin | 7.73% | 5.65% | 3.70% |

Key Financial Ratios

| Ratio | FY 2025 | FY 2024 | FY 2023 |

|---|---|---|---|

| Return on Equity (ROE) | 25.13% | 19.68% | 18.89% |

| Return on Capital Employed (ROCE) | 24.80% | 19.17% | 19.70% |

| Net Debt | ₹101.32 Cr | ₹105.61 Cr | ₹23.14 Cr |

| Net Debt to EBITDA | 0.80x | 1.33x | 0.35x |

| Net Debt to Equity | 0.33x | 0.45x | 0.13x |

Operational Metrics

| Metric | FY 2025 | FY 2024 | FY 2023 |

|---|---|---|---|

| Net Working Capital | ₹288.09 Cr | ₹241.45 Cr | ₹159.73 Cr |

| Net Working Capital Days | 106 Days | 111 Days | 66 Days |

| Installed PEB Capacity (MTPA) | 1,03,800 | 72,000 | 72,000 |

| Roofing Systems Capacity (sq. m.) | 18,00,000 | 16,50,000 | 16,50,000 |

| No. of Manufacturing Plants | 2 | 1 | 1 |

💡 Verdict:

M&B Engineering has witnessed strong top-line and bottom-line growth, with consistent improvement in margins, high ROE, and prudent debt levels. Their expansion in capacity and global presence strengthens the long-term outlook.

Valuation and Peer Comparison – M&B Engineering IPO

M&B Engineering’s IPO valuation reflects its strong financial standing, growing profitability, and sector potential. Here’s a breakdown of its pricing multiples and how it stacks up against listed peers in the pre-engineered buildings (PEB) and roofing industry.

Valuation Multiples

| Metric | Pre-IPO | Post-IPO |

|---|---|---|

| EPS (₹) | 15.41 | 13.48 |

| Price-to-Earnings (P/E) | 24.98x | 28.55x |

| Price-to-Book Value (P/BV) | 6.28x | – |

At a post-issue P/E of 28.55x, the IPO appears moderately priced when compared with other established players in the space.

Peer Comparison Table (As of FY25)

| Company | EPS (₹) | NAV (₹) | P/E (x) | RoNW (%) |

|---|---|---|---|---|

| M&B Engineering | 15.41 | 61.31 | 25.14 | 25.13% |

| Pennar Industries | 8.84 | 73.99 | 25.23 | 11.96% |

| Bansal Roofing Products | 4.20 | 25.13 | 28.39 | 16.71% |

| BirlaNU | -43.63 | 1,606.51 | N/A | -2.72% |

| Everest Industries | -2.28 | 377.13 | N/A | -0.60% |

| Interarch Building Products | 68.51 | 451.56 | 33.69 | 14.35% |

💡 Analysis:

- M&B Engineering boasts the highest RoNW (25.13%) among peers, indicating strong capital efficiency.

- Its valuation is comparable to Pennar Industries and Bansal Roofing, but its higher earnings and better return metrics justify the premium.

- Peers like Interarch command a higher P/E due to brand positioning, but M&B’s growth momentum and expansion give it an attractive proposition in the mid-cap PEB space.

M&B Engineering IPO Day-wise GMP Trend

The M&B Engineering IPO is showing promising traction in the grey market, with investor sentiment leaning positive. Here’s the latest day-wise GMP update:

| GMP Date | IPO Price (₹) | GMP (₹) | Estimated Listing Price (₹) | Estimated Profit (₹) | Today’s Movement |

|---|---|---|---|---|---|

| 25-07-2025 | 385.00 | ₹40 | ₹425 (↑10.39%) | ₹1520 | GMP Up today |

What Does This Mean?

- The current GMP of ₹40 suggests a listing gain of 10.39%, which is a positive signal for short-term investors.

- The upward movement in GMP indicates strong demand and healthy subscription interest in the unlisted market.

📌 Note: GMP is unofficial and speculative. It should not be the sole basis for your investment decision.

Conclusion: Should You Apply for the M&B Engineering IPO?

The M&B Engineering IPO combines a solid financial foundation with visible investor interest, especially in the short term. Let’s break down what that means for different investment strategies.

Short-Term Strategy – Likely Listing Gains

Firstly, the grey market premium (GMP) is showing positive momentum. With a GMP of ₹40, the estimated listing price stands at ₹425, reflecting a potential gain of over 10%. Moreover, recent movement in GMP suggests increasing demand. Therefore, for those aiming for quick listing gains, this IPO appears promising.

Long-Term Strategy – Growth with Caution

From a long-term perspective, the company’s consistent growth in revenue and profitability is a strong plus. For instance, the PAT has grown from ₹32.89 crore in FY23 to ₹77.04 crore in FY25. Additionally, margins have improved year-on-year, and return on equity has touched 25.13%, showcasing efficient management.

However, compared to its listed peers, the valuation seems slightly stretched. The post-IPO P/E stands at 28.5x, which is higher than Pennar Industries (25.2x) and similar to Bansal Roofing (28.3x). Hence, while the fundamentals are strong, future upside will depend on consistent execution and sector tailwinds.

Allotment Strategy – Maximise Your Chances

Furthermore, only 10% of the net issue is reserved for retail investors, meaning competition for allotment could be high. To improve your chances, consider applying through multiple family accounts. Also, if you’re eligible for the employee category (with a ₹36 discount), your entry price lowers significantly—making the IPO even more attractive.

Final Thought:

Whether you’re in it for a quick flip or a long-term ride, the M&B Engineering IPO seems to offer something for everyone—just make sure your strategy matches your risk profile.

FAQs – M&B Engineering IPO

Q1. What is the M&B Engineering IPO price band?

The price band for M&B Engineering IPO is ₹360 to ₹385 per share.

Q2. What are the IPO opening and closing dates?

The IPO opens on July 26, 2025, and closes on July 30, 2025.

Q3. What is the lot size for M&B Engineering IPO?

Investors can apply for a minimum of 1 lot (39 shares). The total minimum investment is ₹15,015.

Q4. Is there any discount for employees in this IPO?

Yes, eligible employees will get a ₹36 per share discount.

Q5. What is the grey market premium (GMP) for M&B Engineering IPO?

As of July 25, 2025, the GMP is ₹40, indicating an estimated listing price of ₹425.

Q6. What is the expected listing date of M&B Engineering shares?

The shares are expected to list on August 5, 2025, on NSE and BSE.

Q7. How is M&B Engineering’s financial performance?

The company reported revenue of ₹988.55 crore and a profit of ₹77.04 crore in FY25, with a PAT margin of 7.73%.

Q8. Who are the peers of M&B Engineering in the listed market?

Key listed peers include Pennar Industries, Bansal Roofing, and Everest Industries.

Related Articles

How to Analyze an IPO Before Investing: A Step-by-Step Guide

One Demat vs Multiple Demat – Which is Better for IPO Allotment?