Introduction: A $35 Billion Opportunity in the East

As the global fashion industry shifts gears, India garment exports to Japan are entering a strategic growth phase. With Japan being one of the largest textile importers in the world, India sees a timely opportunity to increase its presence in this high-potential market.

Despite being the world’s fourth-largest importer of textiles and apparel (T&A), Japan accounted for only 1% of India’s total garment exports in 2022. In contrast, China dominates Japan’s T&A market with a 56% share, followed by Vietnam, Bangladesh, and others.

But change is in the air.

With China’s share declining steadily and Japanese buyers looking for cost-effective, flexible, and high-quality alternatives, India is now stepping up its game. The Apparel Export Promotion Council (AEPC) is leading the charge by deepening India-Japan textile trade ties, promoting India’s garment strengths at international fairs, and aligning with the government’s strategic moves.

And the timing couldn’t be better.

From zero-duty access under the India-Japan CEPA agreement to a new PLI scheme focused on man-made fibre (MMF) garments, India is setting the stage to become a preferred apparel supplier to Japan.

The stage is set, the players are ready, and the market is wide open.

Inside Japan’s Textile & Apparel Market: High-Value, High-Potential

Japan may be small in size and population (125+ million), but when it comes to fashion consumption, it punches well above its weight.

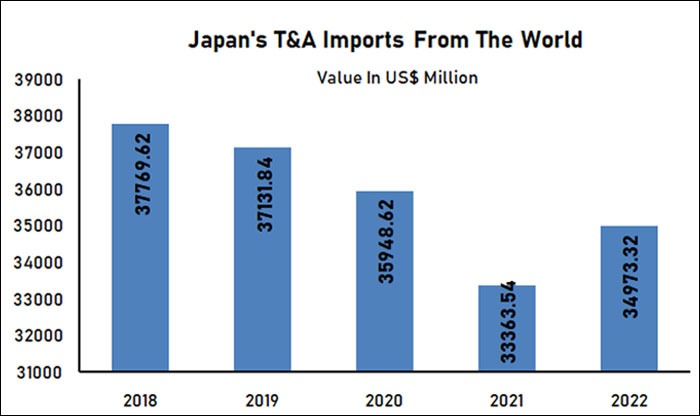

According to UN Comtrade 2022 data, Japan’s textile and apparel (T&A) imports stood at USD 34.97 billion, making it the 4th largest importer globally. The market is not only large, but it’s also stable, sophisticated, and quality-conscious—traits that Indian exporters can now leverage.

Who Supplies Japan?

The Japanese T&A import market is currently dominated by:

| Country | Share in Japan’s T&A Imports | 2022 Import Value (USD) |

|---|---|---|

| China | 56% | $19.46 billion |

| Vietnam | 14% | ~$4.9 billion |

| Bangladesh | 4% | ~$1.4 billion |

| Indonesia | 4% | ~$1.4 billion |

| Cambodia | 3% | ~$1.05 billion |

| India | 1.1% | $386 million |

China’s growth in Japan’s market slowed in 2022 to just +0.41%, while apparel exports declined -0.65%. This opens up a key opportunity for India garment exports to Japan—especially given Japan’s demand for high-quality, flexible sourcing partners.

What Does Japan Import?

Apparel dominates Japan’s T&A basket:

- 👕 Knitted Apparel – $12.96 billion (37% share)

- 👖 Woven Apparel – $12.01 billion (34% share)

- 🧶 Other Made-Ups/Textiles – 14%

- 🧵 Man-Made Fibres (MMF) – 3%

- 🛋 Cotton – 2% (but saw 22% growth YoY)

- 🪄 Carpets, Non-Woven, etc. – Remaining share

Both knitwear and woven segments are growing steadily, presenting a dual-track opportunity for Indian manufacturers.

Why Japan Matters

- Japan’s importers prefer flexible, small-batch orders, aligning well with India’s SME-led garment structure.

- As Japan’s domestic apparel production declines, import reliance is rising.

- Unlike price-driven Western markets, Japan prioritizes design, detail, and agility—traits India can master with better quality control and innovation.

India Garment Exports to Japan: Current Status and Room to Grow

India is currently the 9th largest textile and apparel exporter to Japan, with $386 million in exports in 2022. But with Japan’s total T&A imports nearing $35 billion, that translates to just over 1% market share—leaving plenty of room to grow.

What India Currently Exports to Japan

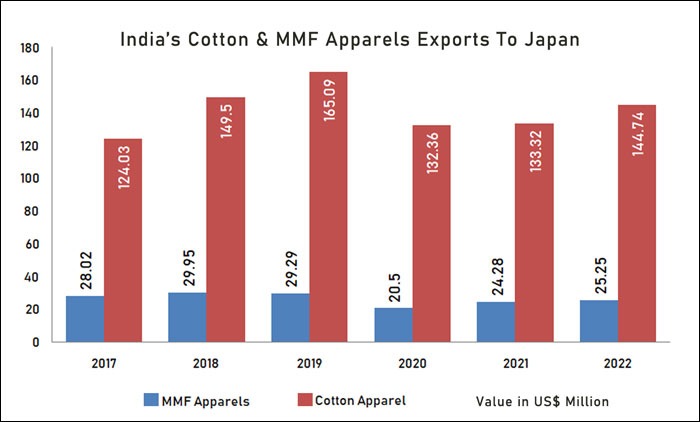

Apparel makes up 51% of India’s T&A exports to Japan, followed by:

- 🪢 Cotton textiles – 17%

- 🧶 Other made-ups – 14%

- 🏠 Home furnishings & carpets – 4%

In terms of products, Indian exporters mostly ship:

- Cotton blouses

- Cotton dresses

- Cotton T-shirts

- Cotton furnishing articles

- Cotton trousers

Clearly, India’s Japan export story is cotton-led. But that’s also where the limitation lies.

The Challenges Holding India Back

While India has mastered cotton-based apparel exports, it struggles in the MMF (man-made fibre) segment—a category that’s critical to meeting modern global demand.

Japanese brands expect:

- Faster lead times

- Fabric innovation (MMF, blended textiles)

- Consistent product quality

- Smaller MOQs (Minimum Order Quantities)

Unfortunately, India’s MMF garment ecosystem is underdeveloped, limiting its reach in synthetic-heavy markets like Japan.

Another challenge: Japanese buyers are highly quality- and culture-driven. Even small design flaws or inconsistencies in sizing and stitching can lead to buyer dropouts. This puts pressure on Indian exporters to move beyond volume and into precision.

But the good news? These challenges are being directly addressed—through policy reforms, trade shows, and incentives. That’s what we’ll cover next.

The Push for MMF: Plugging the Gap with Policy

To truly compete in the Japanese market—and globally—India must shift from being cotton-heavy to fibre-diverse. That’s where the government’s renewed focus on man-made fibre (MMF) comes in.

Why MMF Matters

Globally, MMF-based garments account for over 70% of apparel consumption. Japan, known for its tech-driven, climate-adaptive fashion, has a strong appetite for:

- Polyester and performance fabrics

- Wrinkle-free and easy-care garments

- Weather-sensitive blends (quick-dry, lightweight, heat-retaining)

Yet, Indian manufacturers have limited MMF capacity, and many are not equipped for synthetic fibre processing at scale. This has kept India out of high-demand product segments like outerwear, activewear, and business casuals for the Japanese market.

Enter: The Production Linked Incentive (PLI) Scheme

To address this structural gap, the Indian government has rolled out the PLI scheme for textiles, with a strong focus on:

- Boosting MMF apparel and technical textiles

- Promoting fabric innovation and quality diversification

- Simplifying eligibility norms to include more mid-sized manufacturers

- Facilitating capacity creation and R&D investments

This is expected to upgrade India’s manufacturing base, enabling exporters to take on high-spec orders from countries like Japan.

Quality + Logistics: The Missing Links Being Fixed

The government is also:

- Enforcing BIS (Bureau of Indian Standards) norms to guarantee product consistency and safety—something that Japanese buyers highly value.

- Exploring direct shipping routes to Japan, which would reduce both freight costs and delivery times, giving India a faster supply-chain advantage.

The Strategy in Motion

These efforts aren’t just on paper.

Events like UPNEXT INDIA 2023, a reverse buyer-seller meet organized by AEPC, brought 84 Japanese buyers face-to-face with 112 Indian exporters—showcasing India’s readiness to scale up in both cotton and MMF.

Combined with the India Tex Trend Fair (July 15–17 in Tokyo), these engagements show that India is serious about plugging the MMF gap and becoming Japan-ready.

AEPC’s Big Moves: Connecting India with Japan’s Fashion Chains

To bridge the gap between potential and actual orders, India is doing more than just improving manufacturing. It’s actively bringing Japanese buyers to Indian showrooms—and vice versa.

At the centre of this mission is the Apparel Export Promotion Council (AEPC), which has launched multiple strategic initiatives to put Indian garments in front of Japanese decision-makers.

Reverse Buyer-Seller Meet: UPNEXT INDIA 2023

One of AEPC’s most impactful steps was the UPNEXT INDIA 2023 meet—an exclusive B2B event focused on Japan.

- 84 Japanese buyers attended, including major retail chains and trading houses.

- 112 Indian exporters showcased products tailored to Japanese tastes and quality preferences.

- The event proved that India can deliver customised, small-batch orders—a key demand of Japanese buyers.

AEPC Chairman Naren Goenka said it best:

“We have a strong business opportunity in Japan. China’s dominance is declining, and with CEPA giving India duty-free access, the advantage is shifting in our favour.”

India Tex Trend Fair: Japan Showcase Goes Global

From July 15–17, 2025, Tokyo will host the India Tex Trend Fair, where 150+ Indian exporters will present:

- High-quality cotton garments

- New MMF-based designs

- Apparel tailored to Japanese sizing, weather, and trends

This isn’t just a fashion expo—it’s a diplomatic and business-level push. Union Textiles Minister Giriraj Singh will inaugurate the fair, signalling strong government backing and commitment to deepening textile ties with Japan.

CEPA: India’s Trade Weapon vs. China

One of India’s biggest competitive edges is the India-Japan Comprehensive Economic Partnership Agreement (CEPA).

- Indian Ready-Made Garments (RMG) enter Japan at 0% duty

- China and Turkey, in contrast, face ~9% duties

That’s a massive price advantage—especially when combined with India’s growing ability to fulfil flexible, high-quality orders.

AEPC is making sure that Indian exporters don’t just know this—but use it strategically.

Stocks to Watch: Who Benefits from the Japan Shift?

India’s expanding garment exports to Japan aren’t just good news for trade—but a potential wealth-creation opportunity for investors. As AEPC drives more engagement and the government unlocks PLI benefits, publicly listed companies in apparel and textiles stand to gain.

Below are top listed players with export strength, MMF capabilities, or product-market fit for Japan’s demand profile:

| Company | Why It’s a Japan Play |

|---|---|

| Gokaldas Exports | One of India’s top apparel exporters, catering to global fashion giants. Actively expanding MMF production capacity. Strong execution on small & large batch orders. |

| K.P.R. Mill Ltd | Integrated textile player with strong global exports. Entered MMF segment through expansion and PLI benefits. Focused on automation and ESG-compliant production. |

| Siyaram Silk Mills | Specialist in blended fabrics (poly-viscose, poly-wool, MMF-based), ideal for Japan’s fashion-forward winter and business wear needs. |

| Arvind Ltd | Export-driven textile giant. Manufactures denim, knits, and woven MMF fabrics. Also owns/operates licensed brands like GAP, Arrow, and Tommy Hilfiger. |

| Monte Carlo Fashions | Strong winterwear and outerwear portfolio. High potential for export growth to cold-climate nations like Japan. Focused on brand-driven value. |

| Page Industries | Premium innerwear (Jockey). While domestic-focused, it’s expanding overseas presence in Asia and could benefit from niche demand in Japan’s high-margin market. |

Honorable Mentions (Unlisted but Market Movers)

- Shahi Exports: India’s largest apparel exporter (unlisted). Supplies to brands like H&M, GAP, Uniqlo—already serving Japan indirectly.

- Texport Industries: A high-capacity RMG exporter, focuses on MMF and sustainable production.

What to Watch for as an Investor

- PLI allocation: Which companies secure the next round of MMF-focused incentives

- Export order announcements tied to AEPC trade fairs

- Capacity expansion or partnerships with Japanese firms

- Direct Japan-market entries via e-commerce or offline retail tie-ups

India’s garment sector is now where IT was in the 2000s—globally competitive, policy-backed, and ripe for re-rating.

Conclusion: The Road Ahead for India in Japan’s Apparel Market

Japan’s $35 billion textile and apparel market is opening up like never before—and India is stepping onto the runway at the perfect moment.

With China’s dominance gradually declining and Japanese buyers actively scouting for cost-effective, high-quality, and flexible suppliers, India has a golden chance to reshape its position in the global fashion supply chain.

Backed by:

- Zero-duty access under the India-Japan CEPA

- The PLI scheme focused on MMF innovation

- AEPC-led buyer-seller meets and trade fairs

- Improving logistics and quality standards

…India is building a robust platform to become Japan’s next big sourcing hub.

But to truly seize this opportunity, India must:

- Upgrade its MMF manufacturing ecosystem

- Maintain stringent quality control

- Forge strong long-term relationships with Japanese buyers

- Invest in design, sizing accuracy, and packaging tailored to Japan’s culture

For businesses and investors alike, this isn’t just about exports—it’s about creating long-term value in one of the world’s most stable, high-spending fashion markets.

The needles are threaded. The fabric is ready.

Now, it’s time to stitch success—Japan style.

FAQs on India Garment Exports to Japan

Q1. Why is Japan important for India’s garment exports?

Japan is the 4th largest importer of textiles and apparel. Increasing India garment exports to Japan offers massive growth potential, especially as China’s share declines.

Q2. What products does India currently export to Japan?

India exports cotton garments like T-shirts, blouses, trousers, and furnishing articles. However, there is growing scope for India garment exports to Japan in man-made fibre (MMF) apparel.

Q3. How does the CEPA agreement help Indian exporters?

Under CEPA, India garment exports to Japan enjoy 0% import duty, while other countries like China face ~9%—giving India a strong price advantage.

Q4. What is the role of the PLI scheme in boosting exports?

The Production Linked Incentive (PLI) scheme encourages MMF apparel production, directly supporting India garment exports to Japan with financial and infrastructure incentives.

Q5. Which Indian companies benefit from this export opportunity?

Gokaldas Exports, K.P.R. Mill, Arvind Ltd, and Siyaram Silk Mills are key listed firms positioned to benefit from the rise in India garment exports to Japan.

Related Articles

South India’s Manufacturing Boom: Top Stocks to Watch as Tamil Nadu Becomes the Next China

India’s $100 Billion Silicon Bet: The Semiconductor Investment Opportunity No One Should Ignore

Trump’s Tariff Shockwave: How Indian Stocks & Sectors Will Be Hit or Rise