Introduction: Decoding India’s Derivatives Boom and SEBI’s Wake-Up Call

India’s stock market has witnessed a massive surge in derivatives trading over the last few years, especially in index options. While these instruments offer flexibility and high potential returns, they’ve also become a double-edged sword for many retail investors. Recognizing this growing imbalance, the Securities and Exchange Board of India (SEBI) released a detailed analysis titled the SEBI equity derivatives study 2025, shedding light on how trading behavior, volumes, and investor profitability have evolved — and where concerns lie.

The report covers trading trends post major regulatory changes between December 2024 and May 2025, revealing surprising insights about who’s profiting (or losing) and how SEBI is working to protect individual investors. With nearly 91% of retail traders incurring losses and the notional volume of index options still skyrocketing, SEBI’s findings paint a stark picture of risk, speculation, and the need for structural reform.

In this blog, we’ll break down the study’s key takeaways in a simple, digestible format — looking at trading patterns, the impact of regulatory measures, and the big picture lessons for Indian investors and market watchers.

SEBI’s Game-Changing Moves: What Really Changed and Why It Matters

Until late 2024, weekly index options had turned into a gambler’s paradise.

Traders—many of them new to the market—were betting on Thursday expiries like it was a T20 match. Small amounts. Big risks. Quick results. Most didn’t understand the odds.

SEBI saw the red flags. In response, it hit the brakes.

The SEBI equity derivatives study 2025 outlines seven major measures rolled out between November 2024 and April 2025. Here’s what changed:

- Weekly options trimmed down: Instead of having multiple expiry days across exchanges, SEBI limited them—NSE to Thursday, BSE to Tuesday. That means fewer opportunities for reckless weekly bets.

- Minimum lot sizes increased: Earlier, a trader could enter index options with as little as ₹10,000. Now, you need around ₹50,000 or more—making it harder for casual punters to jump in.

- Premiums must be paid upfront: No more buy-now-pay-later. Traders must now deposit full option premiums before executing a trade. This directly discourages overleveraged positions.

- No tax loopholes on expiry days: SEBI removed favourable calendar spread treatments that traders exploited to save on taxes or reduce risk unfairly.

- Live position checks introduced: Exchanges must now monitor large positions intraday. If you breach your limit, the system knows—reducing manipulation risks in volatile markets.

These steps didn’t kill the party—but they definitely slowed down the wildest moves on the dance floor.

And the effect? Trading volumes dipped. The number of active traders dropped. But importantly, losses among individuals—while still high—started to moderate in early 2025.

This wasn’t just about rules. It was about protecting everyday investors from blowing up their capital in minutes.

Derivatives vs Cash Market: A Tale of Two Growth Stories

For years, India’s stock market had a clear crowd favorite — index options trading.

Why? Because it looked easy. Small entry capital. High returns (if lucky). And a new expiry every week meant traders could bet again and again.

But here’s the catch: most were losing money. A lot of it.

According to the SEBI equity derivatives study 2025, over 91% of individual traders in the derivatives segment made net losses in FY25. And the losses weren’t minor — they grew 41% year-on-year, totaling a staggering ₹1.05 lakh crore!

Now let’s contrast that with the cash market, where investors buy and sell actual stocks (not just contracts). From FY20 to FY25, the cash market grew at a CAGR of 25%, even outperforming derivatives growth in certain years.

Real Example 📉 vs 📈:

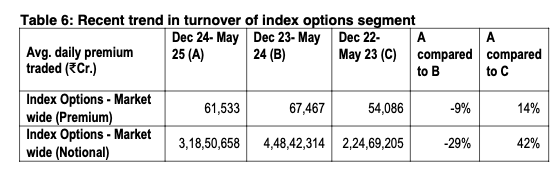

- In FY25, index options saw a massive 29% drop in notional turnover compared to the previous year.

- On the other hand, the cash market’s average daily traded value grew 91% compared to two years ago.

Here’s what that tells us:

💡 Derivatives trading became riskier, more regulated, and less attractive for casual investors.

💡 The cash market, meanwhile, became the safer haven—more transparent and steadily growing.

And SEBI’s measures are clearly nudging traders in that direction—from speculative trades to serious investing.

The Rise and Fall of Individual Traders: Who’s Still in the Game?

The Indian derivatives market was once buzzing with newcomers. College grads. Side hustlers. Influencers selling “sure-shot expiry tips.” Everyone wanted a piece of the options jackpot.

But after SEBI’s new rules?

Over 16 lakh traders vanished.

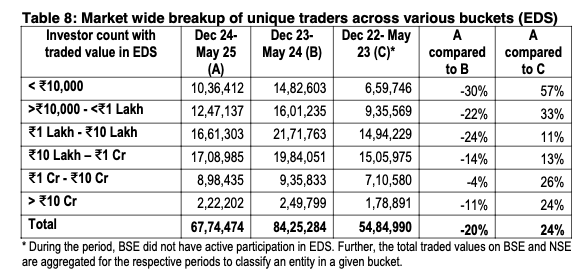

According to the SEBI equity derivatives study 2025, the number of unique individual traders in the equity derivatives segment dropped by a sharp 20% between December 2023 and May 2025.

What changed?

- Small-ticket traders—those with turnover below ₹1 lakh—fled the market fastest.

In fact, traders in the < ₹10,000 bucket dropped by a staggering 30% year-on-year. - On the flip side, individuals with deeper pockets (turning over more than ₹10 lakh) showed only a 4–14% drop, or even minor growth compared to 2 years ago. These were the experienced players who could adapt to stricter rules.

📉 For example, if someone used to make 20 trades a week with ₹5,000 capital each, they suddenly needed ₹25,000–₹50,000 to do the same thing post-Jan 2025. Many simply opted out.

But here’s the kicker: even with fewer traders, total losses didn’t improve much.

The average loss per person in FY25? Still a brutal ₹1.1 lakh.

So, what’s the takeaway?

SEBI didn’t stop trading. It filtered it. The system now favors better-capitalized, more informed traders—and pushes out high-risk speculation.

Are SEBI’s Measures Actually Working? The Q4 Twist You Didn’t Expect

By early 2025, things looked bleak. SEBI’s crackdown had shrunk the derivatives playground. Participation dipped. Losses climbed. Many called it “the end of retail in options.”

But then came Q4 of FY25, and the numbers told a different story.

📊 Losses actually fell for the first time since the new rules kicked in.

| Quarter | Net Loss by Individual Traders | No. of Traders | Avg. Loss Per Person |

|---|---|---|---|

| Q1 | ₹21,255 Cr | 61.4 lakh | ₹34,606 |

| Q2 | ₹25,942 Cr | 59.2 lakh | ₹43,847 |

| Q3 | ₹33,661 Cr | 53.5 lakh | ₹62,975 |

| ✅Q4 | ₹24,745 Cr | 42.7 lakh | ₹57,920 |

Yes, the average person still lost money, but:

- Losses dropped by 26% quarter-on-quarter.

- Average loss per trader declined by over ₹5,000.

- The number of loss-makers dropped for the first time in a year.

What changed?

This wasn’t magic—it was adaptation.

Traders started adjusting to:

- Higher capital requirements

- Upfront premium payments

- Tighter position limits

- No more calendar spread tricks on expiry day

Think of it like this: When speed bumps were installed on a busy road, the reckless drivers disappeared. The careful ones slowed down—but kept moving.

So yes, SEBI’s reforms stung initially. But the Q4 turnaround shows that smart, risk-aware trading is rising, while speculative gambling is falling.

Why 91% of Traders Still Lost Money in FY25 (And What It Says About India’s F&O Craze)

Even after SEBI’s tough love and a Q4 improvement, one brutal fact didn’t change:

💥 91% of individual traders still made net losses in FY25.

That’s not a typo. It’s the same figure as FY24. Despite fewer trades, tighter rules, and better risk disclosure—most individuals in the equity derivatives segment continued to bleed money.

Let’s put that into perspective:

| Year | No. of Traders | Total Net Loss (₹ Cr) | Avg. Loss per Trader |

|---|---|---|---|

| FY22 | 42.7 lakh | ₹40,824 | ₹95,517 |

| FY23 | 58.4 lakh | ₹65,747 | ₹1,12,677 |

| FY24 | 86.3 lakh | ₹74,812 | ₹86,728 |

| ❗ FY25 | 96.1 lakh | ₹1,05,603 | ₹1,10,069 |

Despite all the changes, the total loss ballooned by 41% in FY25. More people joined, and more money was lost.

What’s going wrong?

The problem lies not in trading itself, but in how retail investors approach it:

Lack of risk management: Many retail traders still go all-in on index options with little understanding of volatility or capital preservation.

Chasing expiry-day thrill: India’s obsession with weekly expiries turned trading into a high-stakes casino, especially on Thursdays.

Short-termism over strategy: Most traders focus on intraday gains, not compounding. That’s like trying to win cricket by hitting sixes every ball.

So even though SEBI’s equity derivatives reforms in 2025 tightened the rules and nudged the market toward healthier practices, the data makes one thing clear: regulations can only do so much. The mindset of the trader matters more.

What the SEBI Equity Derivatives Study 2025 Means for Retail Investors

The SEBI equity derivatives study 2025 isn’t just a set of boring charts and compliance updates — it’s a mirror held up to the Indian retail investor.

It shows us two contrasting realities:

1. India is obsessed with index options.

Despite the decline in volumes post-reform, India still leads globally in the number of contracts traded. The average Indian trader now treats expiry Thursdays like game day. But SEBI’s report asks: At what cost?

2. The system is evolving — and so must the trader.

SEBI’s reforms — from bigger lot sizes to upfront premium payments and stricter position limits — are pushing the market towards more responsible participation. And it’s working. In Q4 of FY25, losses dipped, and volatility-driven churn reduced.

But regulation alone can’t save traders from themselves.

The big lesson? If you trade without understanding risk, you’re not investing. You’re donating.

Final Takeaway

The SEBI equity derivatives study 2025 makes one thing clear: The derivatives market is not a playground — it’s a battlefield. And SEBI is tightening the rules to ensure only those with discipline and strategy survive.

So whether you’re a new-age trader or a seasoned investor, take this as your cue to:

- Educate yourself.

- Use risk management tools.

- Trade with purpose — not adrenaline.

Because in the long run, knowledge — not luck — is the best derivative you can hold.

FAQs on SEBI Equity Derivatives Study 2025

Q1. What is the SEBI equity derivatives study 2025?

The SEBI equity derivatives study 2025 is a detailed report analyzing trading trends, reforms, and the impact of recent measures on India’s derivatives market.

Q2. Why did SEBI introduce new measures in 2025?

SEBI introduced reforms to curb excessive speculation, reduce losses among retail traders, and improve overall market stability.

Q3. What changes were made in the equity derivatives market?

Key changes include increased lot sizes, rationalization of expiry dates, stricter position monitoring, and upfront option premium collection.

Q4. How have these reforms impacted retail traders?

Retail participation dropped by 20% year-on-year, but average losses also reduced in Q4 FY25, indicating better risk awareness.

Q5. Does the SEBI study suggest trading derivatives is risky?

Yes. The study found 91% of retail traders lost money in FY25, reinforcing the need for education, strategy, and risk management.

Related Articles

China’s Fertilizer Export Halt to India: Stocks Set to Gain from the Supply Shock

India’s Manufacturing PMI Hits 14-Month High: Stocks That Could Benefit From the Surge

How to Transfer Shares from Groww to Zerodha – Full Guide (2025)