What is DDPI in Demat Account?

Have you ever felt uneasy about giving brokers too much power over your investments? That’s exactly why DDPI was introduced.

DDPI stands for Demat Debit and Pledge Instruction. It is a permission granted via your demat account. With DDPI, brokers can only sell or pledge your shares. They cannot access your account for any other purpose.

Previously, brokers often required a full Power of Attorney (POA). POA allowed them broader control. This sometimes led to misuse, leaving investors at risk. DDPI removes that risk by limiting the broker’s authority.

In short, DDPI in demat account offers a safer, more streamlined way for brokers to perform specific functions. It enhances security and transparency. With DDPI, you maintain more control over your investments.

Ready to discover why DDPI matters? Next, we’ll explain why regulators replaced POA with DDPI, and how this change protects you as an investor.

Why Was DDPI Introduced?

Ever wondered why SEBI suddenly shifted from POA to DDPI? It wasn’t just a minor update—it was a move sparked by growing concerns over investor safety.

For years, brokers relied on Power of Attorney (POA) to sell shares, pledge holdings, and even move securities. While convenient, POAs granted broad powers. In some unfortunate cases, this led to unauthorized transactions, misuses, and even legal battles.

To fix this, SEBI stepped in.

In 2022, SEBI introduced DDPI in demat account setups as a cleaner and safer alternative. The goal? To reduce misuse of investor assets while still allowing brokers to carry out essential functions like selling or pledging shares.

Unlike POA, DDPI is limited in scope. It only permits your broker to debit securities for delivery or margin pledging. Nothing more. No fund transfers. No sweeping access.

This move marked a turning point in how retail investors interact with brokers. It ensures that you remain in control, and that your demat account is used strictly with your consent.

DDPI vs POA: What’s the Difference?

At first glance, POA and DDPI may seem similar. After all, both let your broker act on your behalf. But when you look closer, the differences are significant—and worth understanding.

Key Differences Between POA and DDPI

| Feature | POA (Power of Attorney) | DDPI (Demat Debit & Pledge Instruction) |

|---|---|---|

| Scope | Covers fund transfers, IPOs, F&O | Only allows selling or pledging shares |

| Control | Broker holds broad powers | Investor stays in charge |

| Risk | High risk of misuse | Low risk due to limited access |

| SEBI Status | Phased out for new accounts | Mandatory for new accounts since 2022 |

| Flexibility | Difficult to revoke | Easy to activate or cancel |

| Who Should Use | Existing users (not recommended) | All new investors and those switching |

Why Choose DDPI Over POA?

Earlier, brokers often used POA to access your demat account. Many investors didn’t realize how much power they were handing over. In some cases, this led to unauthorized activity or misuse of holdings.

To solve this, SEBI introduced a safer option—DDPI in demat account arrangements. It gives your broker only the access they need to complete a trade or pledge securities. Nothing more.

As a result, you stay in control of your demat account at all times. You know exactly what your broker can and cannot do.

So, if you care about safety and transparency, switching to DDPI is a smart move. Not only does it protect your assets, but it also aligns with SEBI’s investor-first regulations.

How Does DDPI Work for You?

Now that you understand what DDPI is, let’s see how it works in everyday trading. This SEBI-approved feature simplifies transactions while keeping your demat account secure.

When You Sell Shares

Let’s say you log into your trading app and place a sell order.

Without DDPI, you would have to manually authorize your broker to debit those shares. That’s where delays can happen.

However, with DDPI in demat account, this step becomes seamless. Your broker receives limited permission to debit the specific shares only after you confirm the sale. As a result, your order is processed faster and without extra approvals.

When You Pledge Shares for Margin

In case you’re involved in F&O trading or need margin funding, pledging shares becomes necessary.

With DDPI in place, your broker can initiate a pledge request on your behalf. You still need to verify the pledge through OTP or e-sign, but the initiation becomes faster.

Moreover, this saves time during high-volatility sessions when every second matters.

Where DDPI Doesn’t Apply

Despite its convenience, DDPI has clear limitations—and that’s a good thing.

It does not allow:

- Fund transfers from your bank account

- Purchase of shares without your instruction

- Profile changes or account closure

- Access beyond selling or pledging securities

Because of these strict boundaries, DDPI offers more protection compared to traditional POA.

In Summary

Thanks to DDPI, investors no longer need to worry about misuse of demat holdings.

It ensures that trades and pledges go through smoothly, without giving away full control.

By setting up DDPI in demat account, you get both speed and safety.

How to Activate DDPI Step-by-Step

Activating DDPI in your demat account is easy and fully online. Brokers like Upstox, Zerodha, Groww, and Angel One offer a similar flow. Let’s walk through the exact process, using Upstox as an example.

Below is the exact step-by-step guide:

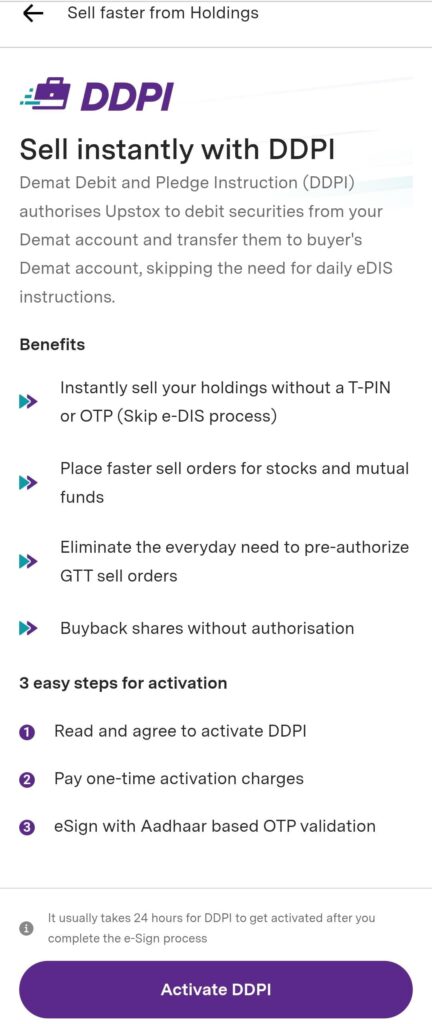

How to Activate DDPI in Upstox

Step 1: Launch Your Broker App and Navigate to DDPI

Begin by logging into your broker’s mobile app.

On the home screen, look for a banner or a pop-up that says “Activate DDPI”.

If you don’t see it, go to your Profile or Account Settings section and find the DDPI option under “Security” or “Account Actions”.

Tapping this will take you to the DDPI activation page.

Step 2: Review and Agree to DDPI Terms

Once you land on the activation screen, you’ll see details about what DDPI does.

Take a moment to read the explanation carefully. It typically mentions that DDPI allows your broker to debit securities only when you sell or pledge shares.

Next, check the box that says:

“I have read and agree to the DDPI document terms.”

After confirming, select “Continue” to move forward.

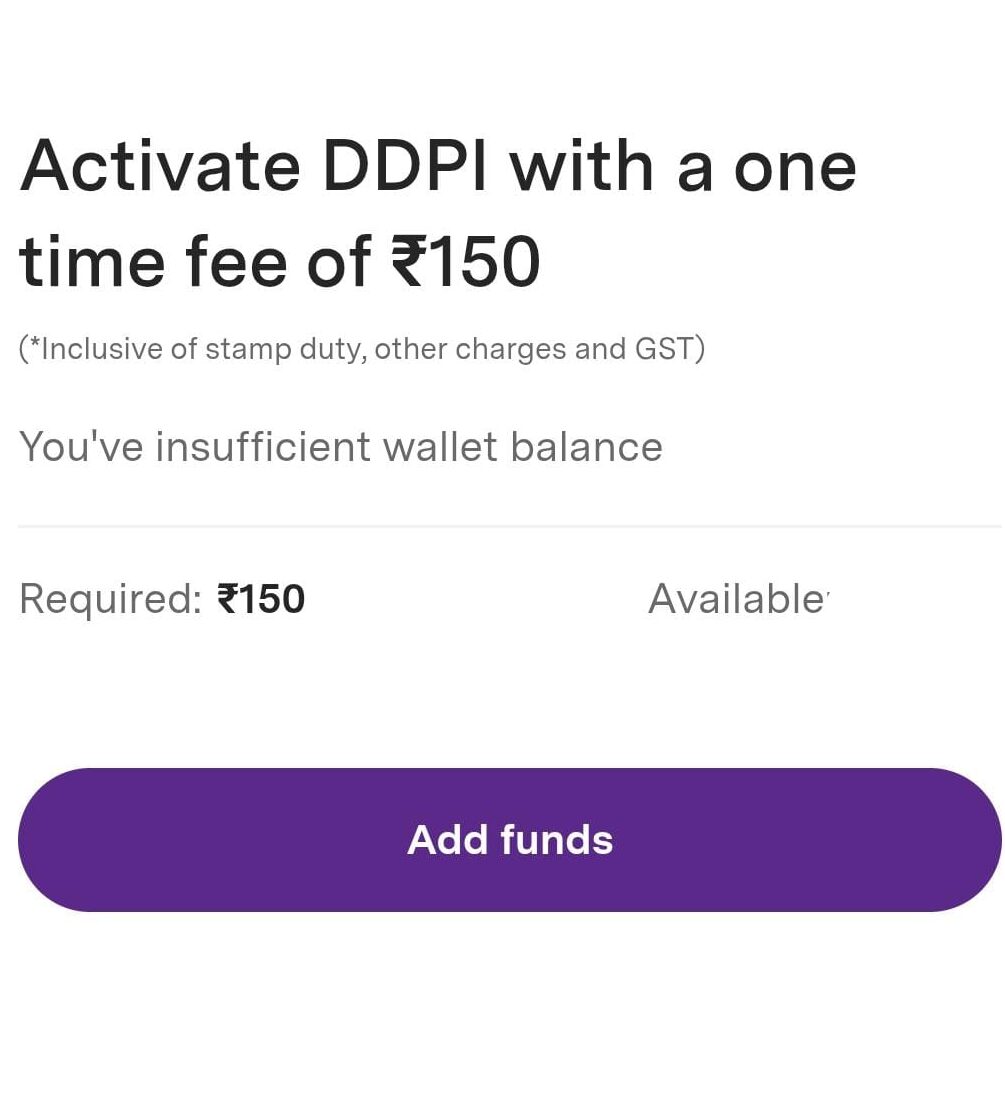

Step 3: Make a One-Time Payment

- Before proceeding to e-sign, your broker will ask for a small activation fee.

- For instance, Upstox charges ₹150 (including stamp duty and GST).

- Upstox: ₹150 (includes stamp duty + GST)

- Angel One / Zerodha / Groww: ₹100 + GST

- If your wallet has enough balance, the app will auto-deduct the amount.

- Otherwise, choose “Add Funds” and top up using UPI, net banking, or other available options.

- Once the amount is available, tap “Pay & Proceed” .

Step 4: Complete eSign Using Aadhaar

After payment, the app redirects you to the NSDL eSign portal.

Enter your 12-digit Aadhaar number, then tap “Send OTP”.

Once the OTP arrives on your Aadhaar-linked mobile number, enter it and click “Verify & Sign”.

This step legally confirms your consent to DDPI.

Step 5: Wait for Confirmation

Right after eSign, a confirmation screen appears. It will say your DDPI request has been submitted successfully.

Usually, DDPI is activated within 24 hours. However, some brokers may take 1–2 business days.

You’ll receive a notification or email once it’s active.

💡 After Activation: What Changes?

With DDPI in your demat account, you no longer need to approve every sell order using T-PIN or eDIS.

This unlocks features like:

- GTT (Good Till Triggered) orders

- Faster stock sell execution

- Margin pledging with minimal delays

- Seamless participation in buybacks and offers

You still remain in full control, as DDPI only authorizes limited, SEBI-approved actions.

Conclusion

In today’s digital-first investing world, security matters more than ever. That’s exactly why DDPI in demat account setups have become the new standard. They give brokers just enough access to execute your sell or pledge orders—without giving away full control of your holdings.

By replacing the old Power of Attorney system, DDPI has introduced greater transparency, reduced risk, and improved investor confidence. Whether you’re new to the stock market or an experienced trader, activating DDPI ensures a smoother and safer trading experience.

As SEBI pushes for tighter investor protections in 2025 and beyond, moving to DDPI isn’t just a compliance step—it’s a smart choice.

So, if you haven’t activated it yet, now’s the perfect time. Take control. Trade smarter. Stay secure.

Frequently Asked Questions (FAQs)

1. What is DDPI in a demat account?

DDPI stands for Demat Debit and Pledge Instruction. It allows your broker to debit securities from your demat account only when you sell or pledge them—nothing more. It’s a secure alternative to the older Power of Attorney (POA).

2. Is DDPI mandatory for trading in 2025?

Yes. As per SEBI’s circular, DDPI is mandatory for all new demat accounts opened after September 2022. If you don’t activate it, you’ll have to manually authorize every sale through T-PIN or eDIS.

3. Can I trade without activating DDPI?

You can, but it’s less convenient. Without DDPI, every sell or pledge order will require manual authorization via OTP or T-PIN. That may cause delays, especially during volatile market conditions

4. How is DDPI safer than POA?

Unlike POA, which gave brokers wide access to your account, DDPI only permits limited, SEBI-approved actions—like selling shares or pledging them. Brokers cannot misuse it for fund transfers or profile changes.

5. Do I need to pay to activate DDPI?

Yes. Most brokers charge a one-time fee between ₹100 to ₹150, including stamp duty and GST. This is a small cost for the convenience and security it offers.

6. Can I cancel or revoke DDPI after activation?

Absolutely. You can request your broker to revoke DDPI at any time. However, after cancellation, you’ll need to approve all sell or pledge orders manually.

7. How long does it take for DDPI to get activated?

In most cases, DDPI is activated within 24 to 48 hours after successful e-signing via Aadhaar. You’ll receive a confirmation once it goes live.

8. Is DDPI applicable across all brokers?

Yes. All SEBI-registered brokers are required to adopt DDPI in demat account processes. Whether you use Zerodha, Groww, Upstox, or Angel One—DDPI is the new standard.

Related Articles:

Best Stock Broker in India: How to Choose Best Broker in 2025

The 15-15-15 Rule: Why the ₹1 Crore SIP Dream Needs a Reality Check

Gold vs Silver vs Sensex: Who Made You Richer?

More Articles

How to Transfer Shares to Family from One Demat to Another (2025 Guide)

The Ugly Truth: Emotions and Investing Mistakes That Cost You Big

Groww vs Angel One: Which Broker Is Truly Built for You?