Introduction:

The Travel Food IPO is one of the most anticipated listings of the year. India’s top airport-focused quick service restaurant (QSR) and lounge operator is hitting the public markets with a ₹2,000 crore offer for sale. Promoters include global player SSP Group and the Kapur family.

Travel Food Services Limited operates nearly 400 QSR outlets and lounges across 17 airports in India and Malaysia. The brand portfolio features over 100 in-house and partner names, catering to the unique needs of air travelers. The company has built a strong presence in airports like Delhi, Mumbai, Bengaluru, and Chennai.

Travel Food Services has shown sharp recovery post-COVID and now delivers strong profit margins. With high return ratios and growing revenue, the IPO comes at a time when the travel and hospitality sector is regaining momentum.

Is this IPO a quality play in a niche but growing space? Let’s break it down.

Travel Food IPO – Key Details

| Particulars | Details |

|---|---|

| IPO Type | Book Building (100% Offer for Sale) |

| IPO Open Date | July 3, 2025 (Thursday) |

| IPO Close Date | July 7, 2025 (Monday) |

| Listing Date (Tentative) | July 10, 2025 (Thursday) |

| Face Value | ₹1 per share |

| Price Band | ₹1045 to ₹1100 per share |

| Lot Size | 13 Shares |

| Total Issue Size | Aggregating up to ₹2,000 crore (OFS) |

| Fresh Issue | Nil |

| Offer for Sale | 100% (Shares offered by existing shareholders) |

| Exchange Listing | BSE & NSE |

| Registrar | MUFG Intime India Pvt Ltd (Link Intime) |

| BRLMs (Book Running Lead Managers) | Kotak Mahindra Capital, HSBC Securities, ICICI Securities, Batlivala & Karani Securities |

Travel Food Services IPO – Tentative Timeline

| Event | Date |

|---|---|

| IPO Opens | July 3, 2025 (Thursday) |

| IPO Closes | July 7, 2025 (Monday) |

| Cut-off for UPI Mandate | July 7, 2025 – 5:00 PM |

| Allotment Finalization | July 8, 2025 (Tuesday) |

| Refund Initiation | July 9, 2025 (Wednesday) |

| Shares Credited to Demat | July 9, 2025 (Wednesday) |

| IPO Listing Date | July 10, 2025 (Thursday) |

IPO Objective – Travel Food Services Limited

The Travel Food Services IPO is structured entirely as an Offer for Sale (OFS). As a result, the company will not raise any fresh capital, nor will it receive proceeds from the issue. Instead, the funds raised will go directly to the promoter selling shareholders, including entities under the SSP Group and members of the Kapur family.

The primary objectives of the IPO are as follows:

- Firstly, to offer an exit route for existing shareholders by offloading a portion of their stake.

- Secondly, to achieve the benefits of listing equity shares on BSE and NSE, which will improve brand visibility, enhance public image, and provide liquidity to existing shareholders.

- Moreover, the listing will pave the way for wider investor participation, allowing both retail and institutional investors to invest in one of India’s largest airport-based food and beverage service providers.

- Lastly, it will help unlock shareholder value and establish a market-driven valuation for the company.

Since there is no component of fresh equity, the company will not deploy funds toward operations, expansions, or debt reduction. However, listing benefits and the monetization opportunity for promoters mark key milestones in the company’s corporate journey.

Company Overview- Travel Food IPO

Business Model & Segments

Travel Food Services Limited (TFS), incorporated in 2007, is India’s leading airport-centric food and beverage service provider. The company operates across two primary verticals:

- Travel QSR (Quick Service Restaurants): These include a range of fast food, cafes, bakeries, bars, and food courts within airports and highways, catering to time-sensitive travellers.

- Airport Lounges: Premium lounges designed for first- and business-class flyers, airline loyalty program members, credit/debit card users, and walk-in customers in select locations.

Together, these segments allow TFS to serve a wide range of airport passengers—from value-seeking travellers to premium flyers—at scale.

Scale of Operations

As of June 30, 2024, TFS had built an expansive footprint:

- 397 Travel QSR outlets: 335 in Indian airports, 30 in Malaysian airports, and 32 on Indian highways.

- 31 Lounges: 24 across 8 Indian airports and 7 in Malaysia, with a new lounge launched in Hong Kong in July 2024.

The company is present in 14 airports in India, including 13 of the top 15 airports by passenger traffic. These airports collectively handled 74% of India’s total air traffic in FY24, giving TFS a stronghold in the busiest travel hubs.

Brand Portfolio

TFS manages a portfolio of 117 brands, split across:

- International Brands: KFC, Pizza Hut, Subway, Wagamama, Coffee Bean & Tea Leaf, etc.

- Regional Indian Brands: Hatti Kaapi, Bikanervala, Sangeetha, Adyar Ananda Bhavan, etc.

- In-House Brands: Dilli Streat, JOSHH, Caféccino, Curry Kitchen, among others.

In FY24, in-house brands contributed ~47% to Travel QSR revenues—allowing higher profitability and greater flexibility in pricing and experience design.

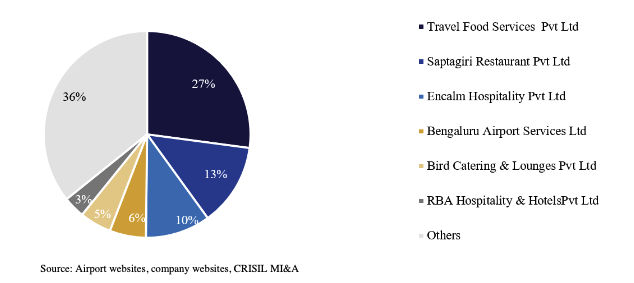

Market Leadership

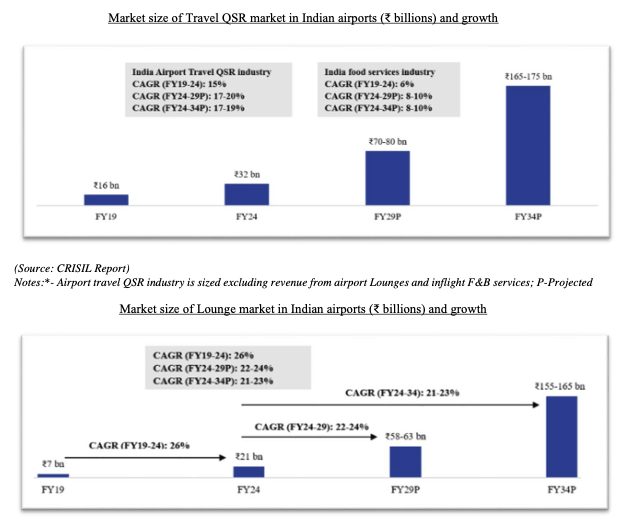

According to the CRISIL Report:

- TFS had a 24% revenue market share in India’s Travel QSR segment in FY24.

- It also held a 45% revenue market share in India’s private airport lounge segment.

- The company operated the largest network of both Travel QSRs and private lounges in Indian airports as of March 2024.

Its high contract retention rate of 92% since inception demonstrates strong operational capabilities and trusted partnerships with airport authorities.

Promoter Support & Global Partnerships

TFS is promoted by two strong entities:

- SSP Group plc (UK) – A FTSE 250-listed global leader in travel F&B services with a presence in over 600 locations across 37 countries. TFS leverages SSP’s international brand network, governance standards, and global best practices.

- K Hospitality (India) – A legacy Indian food services company owned by the Kapur Family Trust with 50+ years of hospitality experience. It operates brands like Copper Chimney and Blue Sea Banquets, and supports TFS in culinary development, procurement, and consumer insights.

Strategic Expansion Plans

TFS plans to expand globally through the ARAYA lounge brand. Under this strategy:

- TFS will manage lounges in India, Southeast Asia, and the Middle East.

- SSP will roll out ARAYA lounges across Europe, North America, and Australasia and pay TFS a franchise fee.

This will allow TFS to participate in global lounge growth without significant capital outlay.

Sector Tailwinds

India’s airport infrastructure is expanding rapidly. The government aims to grow the number of airports from 137 to 300 by 2047. Low-cost carriers (LCCs) are also driving footfall, and the absence of in-flight meals on LCCs pushes food demand inside airports.

The Travel QSR sector is expected to grow at a 17–19% CAGR over the next decade, while the lounge market is projected to grow at 21–23% CAGR—both trends directly benefiting TFS’s core businesses.

Financial Overview of Travel Food IPO

Travel Food Services Limited has demonstrated strong growth across key financial metrics, backed by a post-pandemic rebound in air travel, premiumisation in airport infrastructure, and its expanding footprint across India and Malaysia. Here’s a breakdown of the company’s performance over the past three fiscal years and the latest quarter:

Revenue and Profitability

| Particulars | FY22 | FY23 | FY24 | Q1 FY25 (Apr–Jun 2024) |

|---|---|---|---|---|

| Revenue from Operations (₹ Cr) | 389.61 | 1,067.15 | 1,396.32 | 409.86 |

| EBITDA (₹ Cr) | 140.27 | 458.05 | 549.89 | 132.89 |

| EBITDA Margin (%) | 36.00% | 42.92% | 39.38% | 32.42% |

| Profit After Tax (₹ Cr) | 5.03 | 251.30 | 298.02 | 59.55 |

| PAT Margin (%) | 1.29% | 23.54% | 21.34% | 14.53% |

Key Observations:

- Revenue has grown at a CAGR of ~84% between FY22 and FY24, indicating a strong recovery and expansion post-COVID.

- EBITDA margins remain healthy, consistently above 30%, reflecting operating efficiency in both the Travel QSR and Lounge businesses.

- PAT margin, although slightly lower in Q1 FY25, has been stable above 20% in FY23 and FY24—indicative of strong bottom-line control.

Balance Sheet Strength

| Particulars | FY22 | FY23 | FY24 | Q1 FY25 |

|---|---|---|---|---|

| Net Worth (₹ Cr) | 406.51 | 651.12 | 796.00 | 851.83 |

| Total Assets (₹ Cr) | 1,056.49 | 1,332.32 | 1,623.39 | 1,771.16 |

| Total Borrowing (₹ Cr) | 38.17 | 31.05 | 63.78 | 66.97 |

| Net Asset Value (₹/share) | 30.87 | 49.45 | 60.45 | 64.69 |

Key Takeaways:

- The company has maintained a conservative debt profile, with borrowings making up a small part of the balance sheet.

- Net Worth has more than doubled in just two years, signaling strong internal accruals and reinvestment.

- Net Asset Value per share has increased steadily—an encouraging sign for long-term investors.

Key Ratios

| Metric | FY22 | FY23 | FY24 | Q1 FY25 |

|---|---|---|---|---|

| ROCE (%) | 13.52% | 53.87% | 49.97% | 11.06% |

| ROE / RoNW (%) | 1.24% | 38.60% | 36.14% | 36.57% |

Insight:

- Return ratios are exceptionally high, especially ROCE, which indicates the company’s ability to generate strong returns on capital employed.

- The temporary dip in Q1 FY25 is seasonally aligned but the overall trend remains robust.

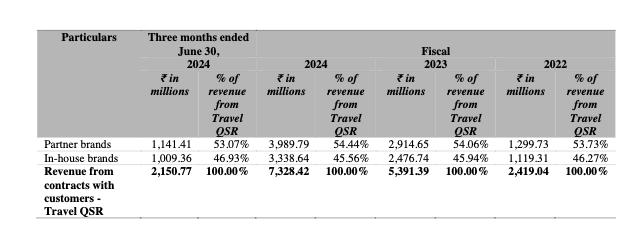

Revenue Mix (FY24)

- Travel QSR Revenue: ₹732.84 Cr

- Partner brands: ~54.4%

- In-house brands: ~45.6%

- Lounge Revenue: A substantial and growing portion of revenue, supported by strong partnerships with airlines, card networks, and loyalty programs.

Summary

Travel Food Services has built a resilient and profitable business model, evident from its rapid revenue growth, strong margins, and high return ratios. As India’s air travel and airport infrastructure scales up, the company appears well-positioned to leverage future growth while maintaining healthy financial discipline.

Valuation & Peer Comparison

Travel Food Services (TFS) operates in a niche, high-growth space—airport-centric QSRs and lounges. While its absolute scale may appear modest next to high-street QSR giants, TFS leads within its category by revenue, footprint, and brand diversity.

High-Street QSR Comparables

| Company | FY24 Revenue (₹ Cr) | Total Stores | Brands | SSSG Growth |

|---|---|---|---|---|

| Devyani Intl. | ~3,364 | 1,782 | KFC, Pizza Hut, Costa | -4.6% to +8.7% |

| Jubilant FoodWorks | ~5,165 | 1,939 | Domino’s, Popeyes, Dunkin’ | NA |

| Sapphire Foods | ~3,305 | 830 | KFC, Pizza Hut | -1.1% to -16% |

| Westlife Foodworld | ~2,130 | NA | McDonald’s | -1.5% |

Takeaway: While these players dominate overall QSR revenue, TFS offers better visibility in the airport segment with less overlap in format and operations.

Travel QSR & Lounge Focused Peers

| Company | FY24 Revenue (₹ Cr) | Airport Stores | No. of Brands | CAGR (FY22–24) |

|---|---|---|---|---|

| TFS | 1,396.3 | 313 | 117 | 89.3% |

| Lite Bite Foods | 651.6 | 37 | NA | 53.9% |

| HMSHost (FY23) | ~431.6 | 49 | NA | NA |

Takeaway: TFS clearly leads the travel F&B space in both size and scale, with significant margin upside due to captive airport traffic and longer dwell times.

Lounge Operators

| Company | FY24 Revenue (₹ Cr) | Lounges | Airports | CAGR (FY22–24) |

|---|---|---|---|---|

| TFS | 1,396.3 | 24 | 8 | 89.3% |

| Encalm Hospitality | 673.9 | 9 | 3 | 1200%+ |

| RBA Hospitality | 39.2 | 6 | 2 | 105.1% |

Takeaway: While newer players like Encalm are scaling fast, TFS offers mature infrastructure, international presence (including Hong Kong), and a first-mover advantage in private airport lounges.

Valuation Insight

With the IPO price band set between ₹1045 and ₹1100 per share, Travel Food Services Limited is seeking a P/E multiple of approximately 39.3x to 41.1x based on its FY24 EPS of ₹27.58.

This valuation appears moderately priced compared to other listed high-street QSR peers, many of which trade at significantly higher earnings multiples despite lower profitability metrics.

Given its dominant position in the niche travel QSR and airport lounge segment, strong brand partnerships, and nearly 90% revenue CAGR (FY22–FY24), the IPO could attract long-term investors seeking differentiated F&B exposure.

However, it’s crucial to consider that the company operates in a specialized environment with dependency on airport footfall and global travel trends.

Travel Food Services IPO Peer Comparison

(As on March 31, 2025)

| Company Name | EPS (Basic) | EPS (Diluted) | NAV/Share (₹) | P/E (x) | RoNW (%) | P/BV Ratio |

|---|---|---|---|---|---|---|

| Travel Food Services Limited | 27.58 | 27.58 | 79.62 | 39.3 – 41.1 | 34.64 | 13.1 – 13.8 |

| Jubilant Foodworks Ltd | 3.41 | 3.41 | 31.87 | 205.81 | 10.02 | 22.61 |

| Devyani International Limited | 0.08 | 0.08 | 9.07 | 2,097.13 | 0.84 | 18.56 |

| Sapphire Foods India Limited | 0.60 | 0.60 | 43.53 | 548.00 | 1.38 | 7.63 |

| Westlife Foodworld Limited | 0.78 | 0.78 | 38.70 | 955.26 | 2.01 | 19.61 |

| Restaurant Brands Asia Limited | -4.33 | -4.33 | 15.61 | — | 23.80 | 5.47 |

Key Takeaway:

Compared to high-street QSR peers, TFS offers stronger earnings, higher RoNW, and a significantly lower valuation multiple — positioning it as a relatively attractive bet among listed food retail names.

Investment Strategy

Short-Term: Listing Pop Possible

TFS has a strong brand, high growth, and a near-monopoly at India’s busiest airports. With 89% revenue CAGR in the last two years and 45% lounge market share, buzz around the IPO is likely. If the IPO is priced well, it could see solid listing gains.

Quick Tip: Watch GMP trends and QIB demand before the final day to decide short-term entry.

Long-Term: Play on Air Travel + Premium F&B

As more Indians fly, and airports add lounges and food zones, TFS is in the right place at the right time. The company’s 117-brand portfolio, backed by global giant SSP and K Hospitality, gives it strong staying power.

Why Hold Long-Term?

- India aims for 300 airports by 2047

- Lounge and airport F&B spending is rising fast

- High returns: 49.97% ROCE and 39% EBITDA margin in FY24

Allotment Strategy

Apply via multiple retail accounts (family/friends) to boost allotment chances. If QIB and HNI interest is high early on, consider small-ticket HNI bids (~₹2–5 lakh).

Conclusion

Travel Food Services is a leader in airport food and lounges, operating at almost all major Indian airports. With strong revenue growth, premium brand tie-ups, and backing from global players, it’s well-positioned to benefit from India’s booming air travel industry.

However, since the IPO is a pure offer-for-sale, there’s no fresh capital going into the business. So, the final pricing and demand trends will play a big role in deciding whether it’s a good bet.

Overall, investors looking for exposure to the growing airport retail and travel experience sector may find TFS an interesting opportunity—especially if valuations are reasonable.

Travel Food Services IPO – FAQs

1. What does Travel Food Services (TFS) do?

TFS runs quick-service restaurants (QSRs) and lounges at airports across India and Malaysia. It operates popular food brands like KFC, Domino’s, Subway, and in-house names like Caféccino and Dilli Streat.

2. When is the IPO open for subscription?

The IPO opens on July 3, 2025, and closes on July 7, 2025.

3. What is the price band and lot size?

The price band and lot size haven’t been announced yet. Stay tuned for updates closer to the opening date.

4. What kind of IPO is this?

It’s a 100% offer-for-sale (OFS). That means existing shareholders are selling their shares, and the company will not receive any new capital.

5. Who are the promoters of TFS?

The promoters include SSP Group (UK) and the Kapur Family Trust, both experienced in global and Indian hospitality sectors.

6. On which stock exchanges will TFS be listed?

Shares will be listed on both BSE and NSE, with a tentative listing date of July 10, 2025.

7. What’s the business strength of TFS?

TFS has a presence in 14 Indian airports, a portfolio of 117 brands, and a 45% market share in airport lounges as of FY24.

8. How has the company performed financially?

TFS posted a revenue of ₹1,396 crore in FY24 with a strong EBITDA margin of over 39% and ROCE of nearly 50%.

9. What are the IPO allotment and refund dates?

Allotment is expected on July 8, refunds and Demat credit on July 9, and listing on July 10, 2025.

10. Is this IPO good for listing gains or long-term?

If priced attractively, it may offer short-term listing gains. Long-term investors can benefit from India’s growing airport and travel food industry.

Related Articles

Why Fundamentals Are Failing—and Market Cycles Are Getting Shorter