Nifty Jumps After Breakout: Bulls Regain Command as Rate Cut Hopes Rise

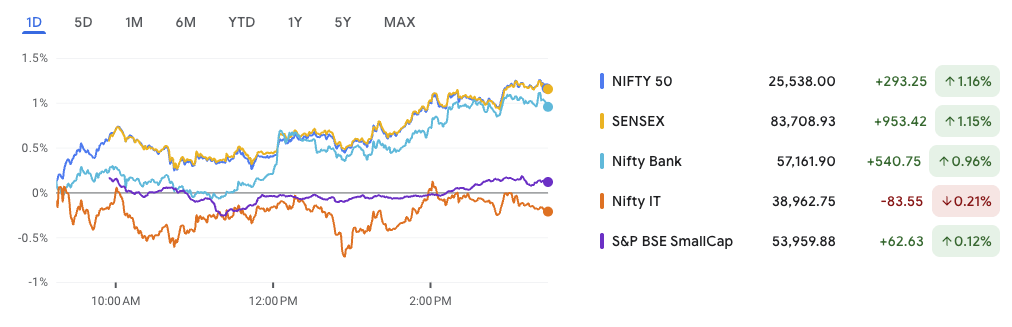

Nifty jumps after breakout, closing at 25,538 with a sharp gain of 293 points (1.16%), marking its highest close in over eight months. The Sensex too rallied nearly 1,000 points, and Nifty Bank posted a robust 0.96% climb, driven by renewed buying across large-cap financials. While IT stocks saw mild profit booking, the overall mood remained decisively positive.

Market sentiment is being buoyed by growing expectations of rate cuts by the RBI, especially as global central banks begin signaling a shift toward easing. This macro backdrop, combined with strong technical signals, is reinforcing the bullish momentum across the board.

But this isn’t just a large-cap story anymore. Small caps are starting to move, IPO interest is resurging, and stock-specific breakouts are showing high risk-reward potential. As Nifty jumps after breakout, investors are watching closely for leadership rotation, breakout confirmations, and fresh opportunities.

In this edition, we cover:

- Technical Radar: Is this a clean breakout or just short-term euphoria?

- Macro Moves: RBI, inflation outlook, and how the global narrative is shifting

- Sector in Focus: Where smart money is rotating — financials, capital goods, or something else?

- Stock(s) to Watch: One high-conviction swing trade setup you can’t ignore

- IPO Watch: Fresh listings and where subscription trends are telling a new story

- Small Cap Radar: A low-debt, high-margin niche financial stock that’s gaining ground

Whether you’re riding the trend or waiting for a dip — this issue is packed with insights to help you stay ahead.

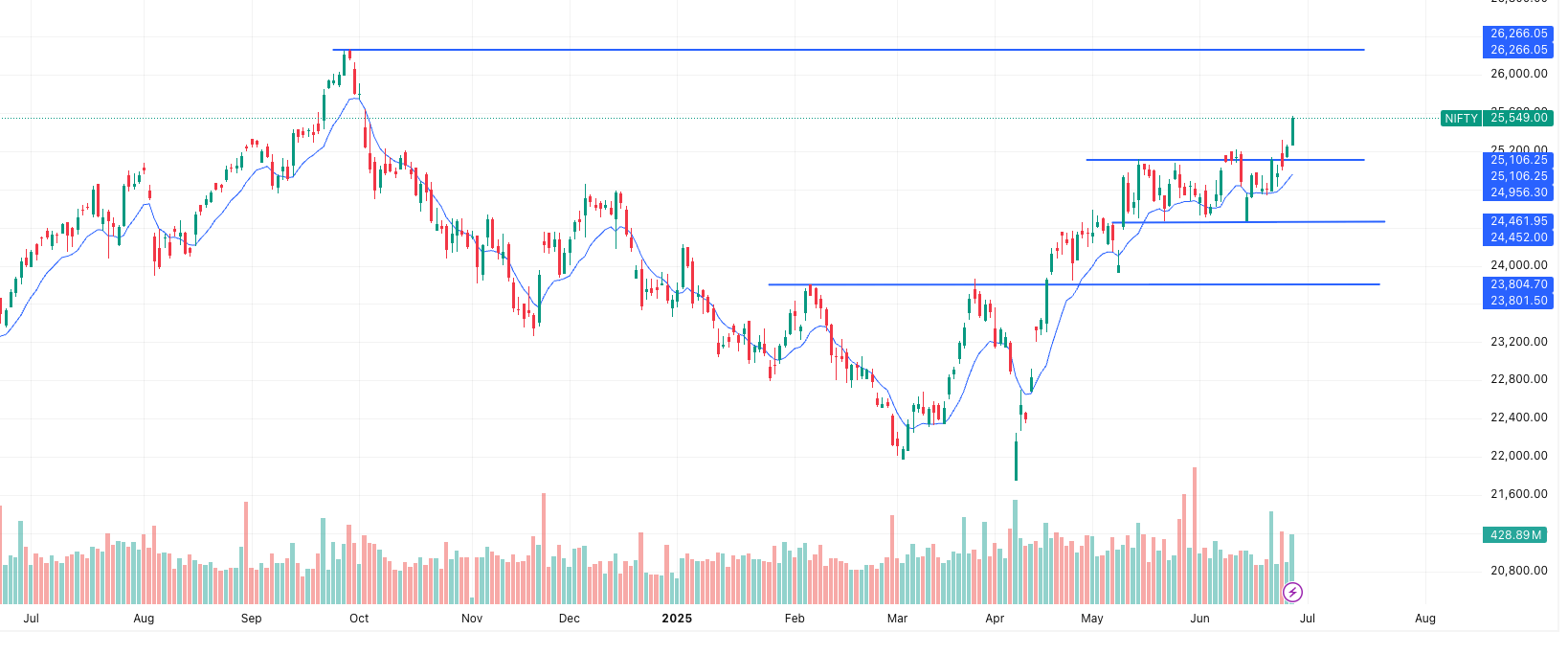

Nifty 50 Technical Analysis – Post-Breakout Setup

Nifty jumps after breakout, closing at ₹25,549 and marking its strongest move in months. This breakout came from a multi-week range between ₹24,950 and ₹25,100, confirmed by a sharp rise in volume. Importantly, the price is now trading well above its 9 EMA of ₹24,956, reinforcing bullish momentum.

Chart Structure and Trend Dynamics

This is a classic rectangle breakout pattern. Since March 2025, Nifty has been forming higher highs and higher lows—a sign of healthy trend continuation. The June consolidation served as a launchpad. As a result, the breakout looks well-supported both technically and psychologically.

The measured target for this breakout, based on the range height of ~₹600, projects a near-term upside to ₹25,700. Furthermore, the round level of ₹26,000 and the all-time high at ₹26,266 could act as future resistance if momentum sustains.

Price Levels to Watch

- Retest Buy Zone: ₹25,100–₹25,150

- Immediate Resistance: ₹25,700

- Major Resistance: ₹26,266

- Key Support: ₹24,950

- Stronger Support Base: ₹24,450–₹24,460

How to Trade It

A low-volume dip to the ₹25,100–₹25,150 zone could offer a solid entry for positional traders, with a stop below ₹24,950. On the other hand, if momentum continues, riding the trend with a trailing stop along the 9 EMA could yield gains up to ₹26,266.

Final Word

To sum up, Nifty jumps after breakout, supported by volume, price action, and structure. Unless the index breaks back below ₹24,950, the path of least resistance remains upward. Traders should stay alert for a follow-through day or any signs of sectoral rotation.

News that fueling momentum as Nifty jumps after breakout

Markets are on a roll. After weeks of consolidation, Nifty jumps after breakout, reclaiming bullish strength above the 25,500 mark. Underneath this technical optimism, several macroeconomic and sector-specific developments are driving sentiment and investor focus. Here’s a closer look at what’s moving the needle—and the stocks to watch:

1. China Restricts Specialty Fertiliser Exports: India’s Farm Sector on Alert

China has quietly imposed stringent control over the export of specialty fertilisers, which account for nearly 80% of India’s imports in this category. The bottleneck comes from delays in CIQ (China Entry-Exit Inspection and Quarantine) certifications—without which exports can’t leave Chinese ports. Unlike past disruptions, this one is more systematic, part of China’s long-term strategy since 2021 to tighten control on critical agri-inputs.

India’s horticulture and precision farming sectors, heavily reliant on these inputs, could face yield and quality issues if supplies stay constrained.

Stocks likely impacted:

- Coromandel International and Gujarat State Fertilizers may face input cost inflation.

- Deepak Fertilisers and Chambal Fertilisers could see tailwinds if domestic production receives policy support or sees rising realisations.

2. Pine Labs Files ₹2,600 Cr IPO: Fintech Story Reinforced

Pine Labs, a digital payments major, has filed for a ₹2,600 crore IPO. Backed by Peak XV, PayPal, and Mastercard, it plans to use the funds to expand overseas, improve tech infrastructure, and pare debt. The IPO reinforces investor appetite in India’s maturing fintech ecosystem, despite volatility around listed peers like Paytm.

Stocks likely impacted:

- Paytm (One 97 Comm) may see competitive pressure resurface.

- Angel One could benefit as investor activity in digital broking and fintech exposure sees renewed buzz.

3. Titan Gains Momentum: Technical Breakout Confirmed

Titan, India’s top luxury and lifestyle player, has jumped 25% from its 52-week low. A breakout from its falling channel pattern has caught the attention of technical analysts, with Axis Securities seeing a near-term upside towards ₹4,000. RSI and volume trends confirm bullish momentum.

Stock to watch:

- Titan Ltd – A classic chart breakout with solid fundamentals in jewellery and wearables, Titan may continue to trend higher as domestic consumption picks up.

4. Voltas & Whirlpool Rally as Panasonic Exits Appliance Market

In a strategic shift, Panasonic is exiting the Indian washing machine and refrigerator space, citing poor market performance. It plans to shut down its Jhajjar plant operations. This opens up market share in mid-premium and entry-level segments.

Stocks to watch:

- Voltas and Whirlpool India jumped nearly 5%, as Panasonic’s exit reduces competition and strengthens their distribution-led advantage.

5. Nestlé Declares 1:1 Bonus Issue: First-Ever in History

Nestlé India has approved a 1:1 bonus share issue—its first in corporate history. Every shareholder will receive one bonus share for every share held. Bonus shares are expected to be credited by August 25, 2025.

Stock to watch:

- Nestlé India – Bonus issuance typically improves liquidity and brings retail interest. While fundamentals remain robust, the stock may see pre-bonus run-up in the short term.

6. NSE Set to Launch Electricity Futures

The NSE is preparing to launch monthly electricity futures contracts. These contracts will track the 30-day weighted average spot price from major power exchanges and help industries hedge power costs. With no transaction charges for the first six months, participation is expected to be strong.

Stocks to watch:

- Indian Energy Exchange (IEX) and HPL Electric may see volumes and visibility rise.

- JSW Energy, Tata Power stand to gain as price discovery improves across contracts.

7. Lupin Secures USFDA Nod for Prucalopride

Lupin has received USFDA approval to market Prucalopride, a treatment for chronic idiopathic constipation. The US market size for the drug is ~$184 million. The tablets will be manufactured at Lupin’s Goa facility.

Stocks to watch:

- Lupin – Already showing earnings momentum, this new launch strengthens its US play and may offer near-term upside if demand traction is seen.

8. Hitachi Energy Delivers Mega Transformers for Power Grid

Hitachi Energy India is delivering ultra-high-voltage transformers (765 kV), aligned with Power Grid’s infrastructure expansion. These transformers will be capable of powering 30 million households and are the first of their kind globally to use biodegradable natural ester oil.

Stocks to watch:

- Hitachi Energy India (POWERINDIA) – A direct play on India’s grid modernization and Make-in-India manufacturing scale-up in the power sector.

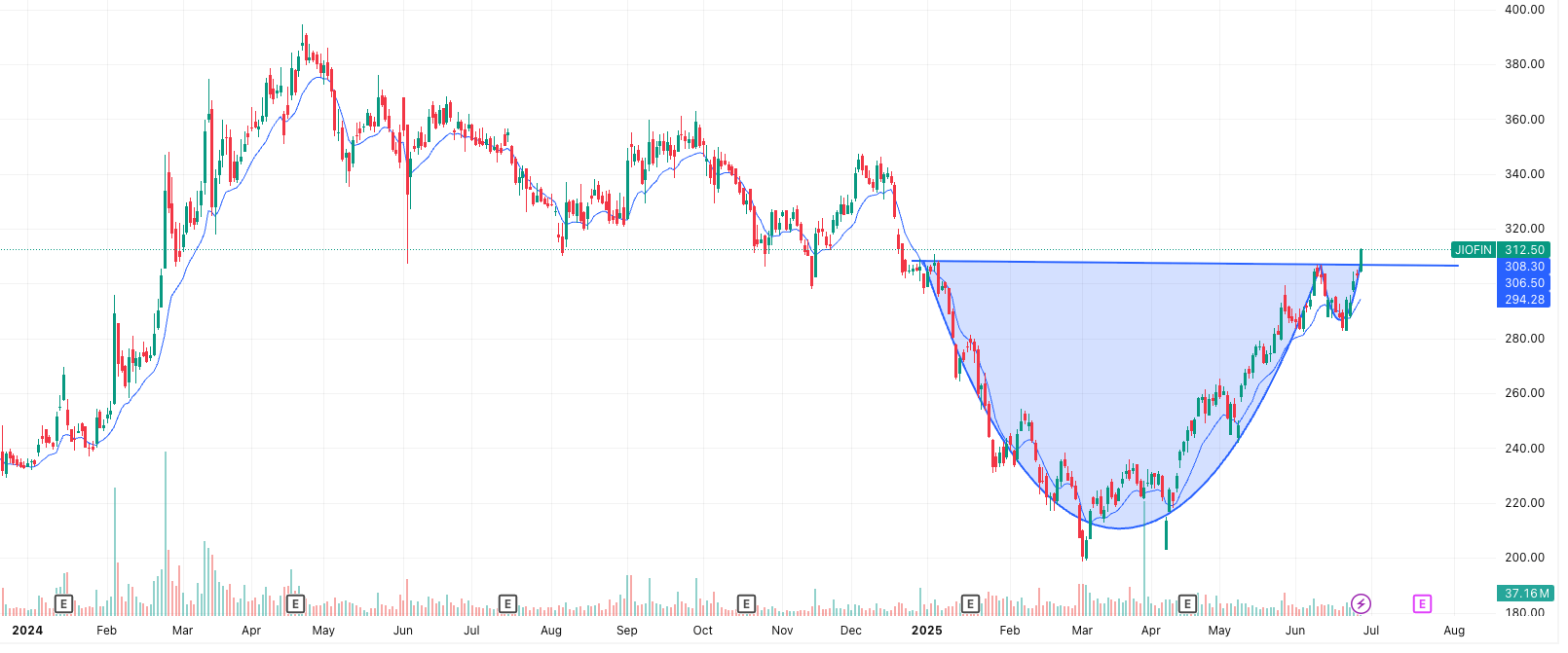

Technical Radar: Jio Financial Services (JIOFIN)

Current Price: ₹312.50

Breakout Pattern: Cup and Handle

Breakout Zone: ₹306–308

Volume: 37.16 million (high conviction breakout)

What’s Happening on the Chart?

JIOFIN has broken out of a classic Cup and Handle pattern, one of the most reliable continuation setups in technical analysis. The cup base formed gradually between January and mid-June 2025, bottoming around ₹210. In late June, the stock formed a handle—a short, healthy dip—and then burst above resistance with a strong bullish candle and high volume. That’s the kind of price-action traders wait for.

The breakout not only clears the ₹308 barrier, but it’s also backed by solid structure—higher lows since March and price holding well above the 9-day EMA (₹294). This confirms both trend strength and momentum.

What Are the Targets?

- Near-term zone: ₹340–₹350

- Swing target: ₹380–₹410 (based on the depth of the cup)

These levels won’t come in a straight line, but they offer a clear roadmap for both short-term trades and positional holds.

Where’s the Risk?

- Retest buy zone: ₹306–308 (ideal if the stock pulls back on low volume)

- Stop-loss: ₹294 (9 EMA)

- Setup invalidation: Below ₹288 (recent swing low)

Final Word

This is a textbook breakout—clean pattern, rising volume, and strong follow-through. If broader markets continue to support financial sector strength, Jio Financial could be setting up for a move toward ₹400+ in the coming weeks. A dip near ₹308 could offer a low-risk entry, but even at current levels, the breakout looks actionable for a disciplined swing setup.

IPO Update – June 27, 2025

With Nifty jumps after breakout dominating market sentiment, investor appetite for new listings remains strong. Here’s a look at the most active IPOs across segments.

🏛️ Mainboard IPOs

| Company | Open – Close | Total Subscription | GMP (Listing Gain) |

|---|---|---|---|

| Indogulf Cropsciences | Jun 26 – Jun 30 | 0.41x | ₹11 (9.91%) |

| Sambhv Steel Tubes | Jun 25 – Jun 27 | 1.16x | ₹10 (12.20%) |

| HDB Financial Services | Jun 25 – Jun 27 | 1.18x | ₹57 (7.70%) |

| Globe Civil Projects | Jun 24 – Jun 26 | 80.66x | ₹12 (16.90%) |

| Ellenbarrie Industrial Gases | Jun 24 – Jun 26 | 17.34x | ₹24 (6.00%) |

| Kalpataru Limited | Jun 24 – Jun 26 | 2.31x | ₹9 (2.17%) |

📈 NSE SME IPOs

| Company | Open – Close | Total Subscription | GMP (Listing Gain) |

|---|---|---|---|

| Moving Media Entertainment | Jun 26 – Jun 30 | 1.07x | ₹13 (18.57%) |

| Valencia India | Jun 26 – Jun 30 | 0.46x | ₹21 (19.09%) |

| Ace Alpha Tech | Jun 26 – Jun 30 | 0.43x | ₹14 (20.29%) |

| PRO FX Tech | Jun 26 – Jun 30 | 1.29x | ₹– (0%) |

| Suntech Infra Solutions | Jun 25 – Jun 27 | 18.15x | ₹25 (29.07%) |

| Rama Telecom | Jun 25 – Jun 27 | 0.97x | ₹3 (4.41%) |

| Supertech EV | Jun 25 – Jun 27 | 1.41x | ₹– (0%) |

| Abram Food | Jun 24 – Jun 26 | 28.25x | ₹8 (8.16%) |

| Icon Facilitators | Jun 24 – Jun 26 | 4.06x | ₹10 (10.99%) |

| AJC Jewel Manufacturers | Jun 23 – Jun 26 | 2.82x | ₹9 (9.47%) |

| Shri Hare-Krishna Sponge Iron | Jun 24 – Jun 26 | 6.81x | ₹– (0%) |

Insight: The strong overall IPO response — particularly for Globe Civil Projects and Suntech Infra — aligns with the optimistic market tone after Nifty jumps after breakout, encouraging broader risk appetite among retail and HNI investors.

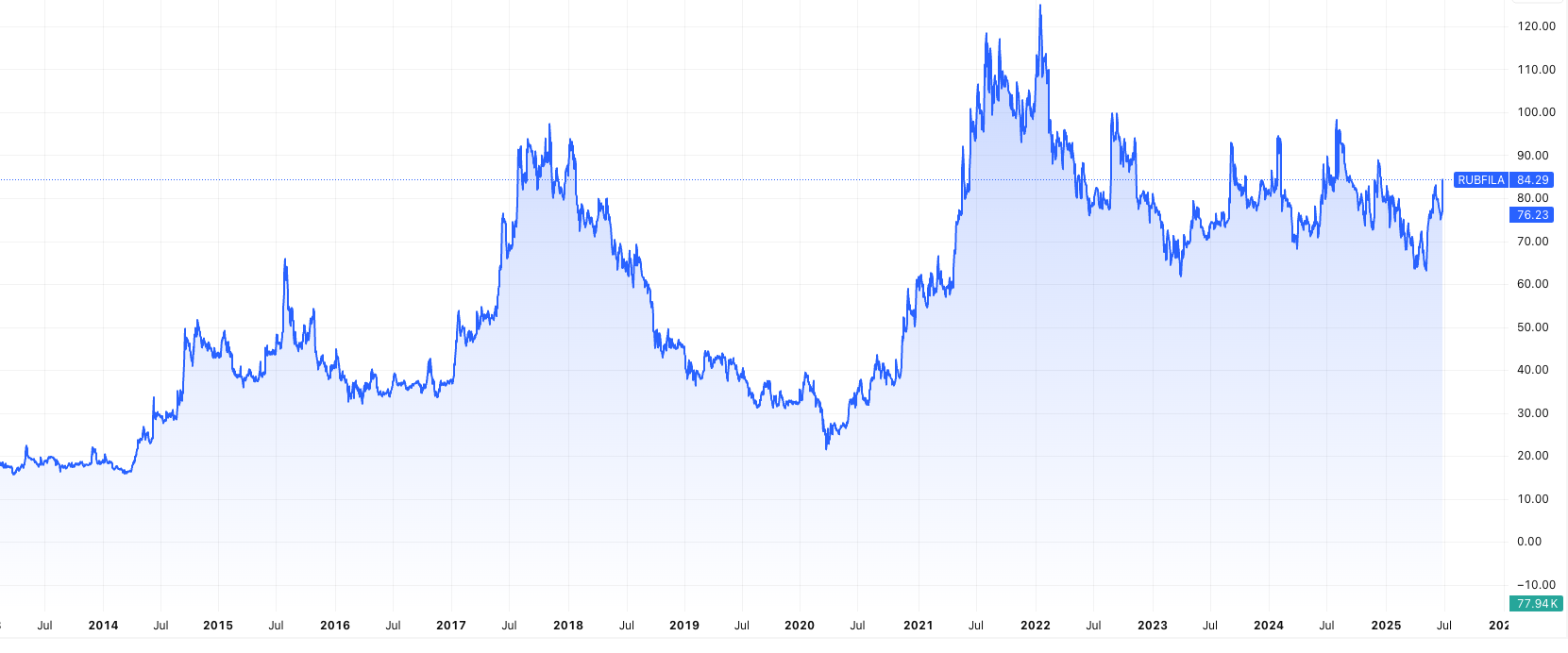

Small Cap of the Day: Rubfila International Ltd

Market Cap: ₹458 Cr | CMP: ₹84.3

As Nifty jumps after breakout, attention is shifting to select small caps with strong fundamentals and niche market positions. One such name quietly gaining traction is Rubfila International Ltd (RIL) — India’s largest manufacturer of heat-resistant latex rubber thread.

What Does Rubfila Do?

Established in 1993, Rubfila operates under the Finquest Group umbrella, which also owns Reid & Taylor and Digjam. Rubfila manufactures a wide range of latex rubber threads used in everything from innerwear and sportswear to catheter production and toys.

With ISO and OEKO Tex certifications, Rubfila caters to clients in over 30 countries and is recognised as an Export House by the Ministry of Commerce. Its products include talc- and silicon-coated rubber threads, furniture-grade and food-grade threads, and rubber threads for medical applications.

Production & Expansion

The company runs two large facilities in Kerala and Tamil Nadu. With the commissioning of a new line in FY23, total capacity has expanded to 27,500 MT per annum. To boost vertical integration, Rubfila also started manufacturing carton boxes in 2023 for in-house use.

- Revenue mix: 81% from latex rubber thread, 19% from tissue paper

- Geography: 78% domestic, 22% export

- Key end-users: Innerwear, diapers, furniture, medical devices, toys

Why It Stands Out

Despite modest topline growth, Rubfila maintains zero debt, offers a 1.43% dividend yield, and boasts solid capital efficiency:

| Key Metric | Value |

|---|---|

| ROCE | 12.6% |

| ROE | 9.3% |

| OPM | 8.03% |

| PE Ratio | 18.6x (vs industry PE of 29.7x) |

| Price to Book | 1.66x |

| Intrinsic Value | ₹118 (vs CMP ₹84.3) |

Investment Outlook

Rubfila may not offer aggressive growth, but for conservative investors seeking small-cap exposure with:

- Low debt

- Stable cash flows

- Global customer base

…it can serve as a value pick in a post-breakout bullish market environment. Investors should monitor margin recovery and volume growth, especially in exports, to validate upside potential.

Conclusion: Market Momentum Picks Up Speed

As Nifty jumps after breakout, the overall sentiment in Indian equities has turned decisively bullish. The index breaking past the 25,100 zone with strong volume confirms a continuation of the uptrend, and investor appetite appears broad-based—from frontline stocks to SME IPOs and select small caps.

On the IPO front, demand remains robust across both mainboard and SME segments, signaling strong retail and institutional interest. Corporate developments like the Pine Labs IPO, Titan’s breakout rally, and Nestlé’s bonus issue are keeping large-cap investors engaged, while small caps like Rubfila International offer quietly compelling long-term narratives.

Policy news—whether China’s fertiliser export controls or NSE’s electricity futures launch—suggests deeper structural shifts across sectors like agri-inputs, power, and digital finance.

In this environment, it’s not just the Nifty that’s breaking out—India’s growth narrative is expanding across sectors, across caps, and across borders. The opportunity lies in spotting it early.

Related Articles:

Insider Buying in Indian Stocks: Hidden Signals You Shouldn’t Ignore

India’s $40 Billion Spending Wave: What’s Powering the Next Consumption Boom?

Electric Plane Take Off: How Beta’s ₹700 Flight Could Disrupt Aviation Stocks

More Articles

India’s Obesity Crisis Fuels a Billion-Dollar Boom: Top Pharma Stocks to Watch

Rare Earth Magnet Manufacturing Stocks: Catch These Before India’s ₹1,000 Cr Push Lifts Off

Ready-to-Drink (RTD) Cocktails: The Fastest-Growing Segment in the Liquor Market