Introduction: Rare Earth Magnet Manufacturing Stocks Are About to Get Hot

Imagine an electric car silently cruising through city traffic. Its motor spins with incredible efficiency—not because of fuel or a lithium battery alone, but thanks to rare earth magnets embedded deep inside the motor.

These powerful magnets are also what guide missiles, make fighter jets maneuverable, and help wind turbines generate clean energy. And right now, India is taking its first serious step to build them at scale.

The government is preparing a ₹1,000 crore scheme to boost domestic magnet production. This move could quietly rerate a handful of rare earth magnet manufacturing stocks—but only if you catch them early.

Most investors are still focused on batteries or semiconductors. But magnets are what make movement possible in all things electric.

And this time, smart money will move before the headlines do.

Why Rare Earth Magnets Are a Strategic Priority

Rare earth magnets—especially those made from neodymium—are small but incredibly powerful. They’re the hidden force behind electric vehicle motors, missile guidance systems, drones, smartphones, and wind turbines.

What silicon is to semiconductors, neodymium magnets are to electric motion.

But there’s a problem: China controls around 85% of the global rare earth magnet supply. That includes mining, refining, and manufacturing. For India, which is pushing hard for electric mobility, clean energy, and defense indigenisation, that’s a strategic vulnerability.

That’s why rare earth magnet manufacturing has become a national priority. It fits squarely into India’s push for:

- EV adoption (electric motors can’t run without these magnets)

- Defense indigenisation (missile and radar systems need them)

- Clean energy (wind turbines and energy-efficient motors rely on them)

- Tech supply chain security (so we’re not dependent on China)

As the world races toward electrification, magnets are no longer niche. They’re core.

And India wants to build them—not import them.

Inside the ₹1,000 Crore Scheme: What’s Coming

The Indian government is about to launch a ₹1,000 crore scheme to jumpstart rare earth magnet manufacturing. This move, led by the Ministry of Heavy Industries (MHI) in collaboration with the Department of Atomic Energy (DAE), is aimed at building strategic capacity fast—and locally.

Key elements of the scheme:

- Total outlay: ₹1,000 crore

- Production target: 1,500 tonnes of rare earth magnets per year

- Raw material source: India Rare Earths Limited (IREL) to supply 500 tonnes

- PLI tweak likely: Officials may adjust the Domestic Value Addition (DVA) criteria under the PLI scheme to ensure OEMs manufacture magnets locally, not import them

- Early interest: 5–6 companies have already shown willingness to enter the space

This is not just policy—it’s a signal to Indian companies and investors:

👉 Start building now, and the government will support you.

It also marks the beginning of a rare opportunity for listed players to lock in long-term strategic value—before magnet demand explodes across EVs, defence, and electronics.

Rare Earth Magnet Manufacturing Stocks to Watch Before the Rally

The ₹1,000 crore rare earth magnet scheme isn’t just about industrial policy—it’s a market signal. When governments create supply chains from scratch in critical sectors like magnets, the early beneficiaries are often listed companies already positioned—either through mining access, magnet manufacturing, or R&D partnerships.

But here’s the catch: most of these rare earth magnet manufacturing stocks are still under the radar. Why?

Because the market hasn’t fully priced in this future demand.

Magnets may not grab headlines like EV batteries or solar panels, but they’re just as essential. And with India aiming to build domestic capacity, a few players across metals, mining, and motor tech could see real momentum—especially as IREL starts supplying raw material and PLI rules are tweaked.

In the sections below, we’ll break down the companies worth watching now—before the crowd notices.

Vedanta Ltd. (VEDL)

Diversified metals major tapping into India’s rare earth future

Vedanta is steadily emerging as a strategic player in India’s critical minerals roadmap. The company has partnered with CSIR laboratories to extract rare earth oxides—such as scandium—from bauxite residue, a process that could place it in a favorable position as India pushes for self-reliance in rare earth magnet manufacturing. While this segment is not yet generating revenue, Vedanta’s early R&D work and access to mineral waste streams position it for long-term participation in the domestic supply chain.

Its broader portfolio—spanning aluminum, zinc, and energy—naturally aligns with national objectives around EVs, clean energy, and advanced materials.

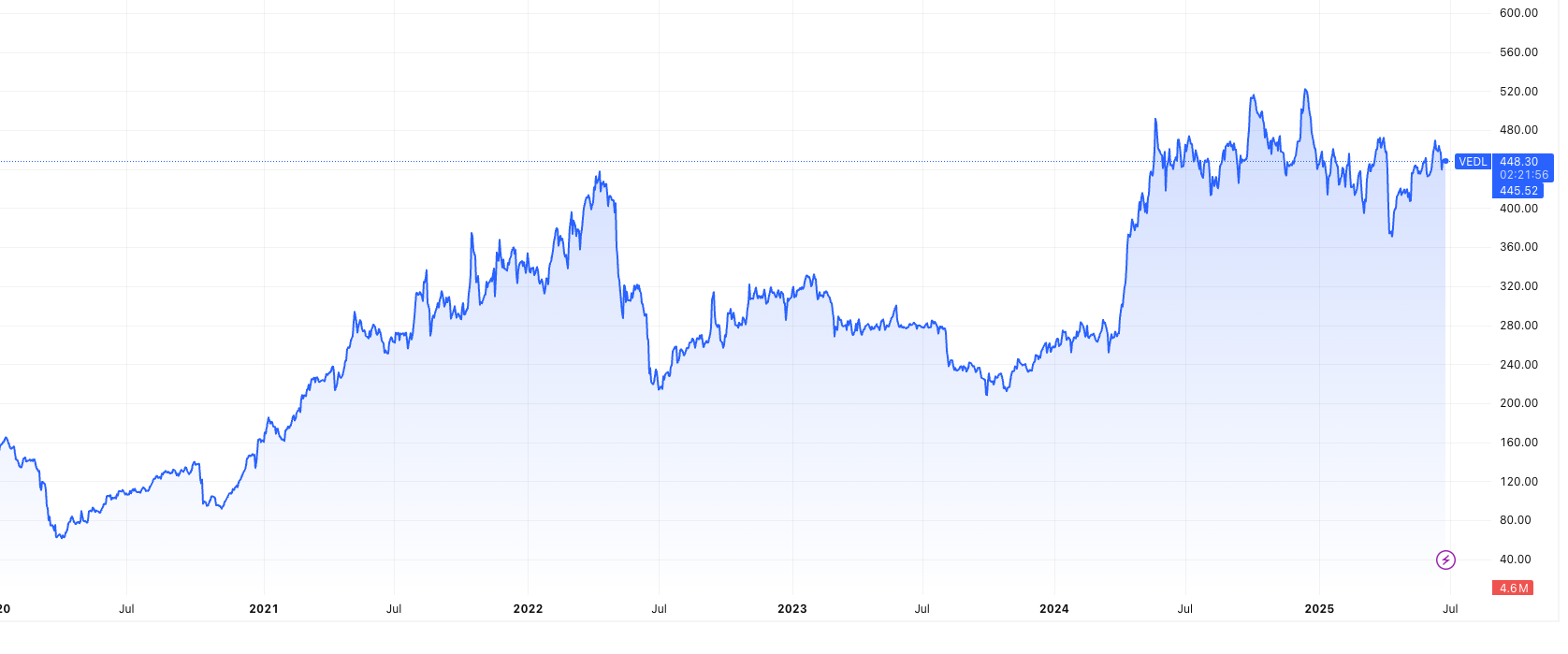

Financial Performance and Momentum

Vedanta’s performance in the short term has been muted, with returns of –5.2% over 6 months and –4.6% over 1 year. However, long-term numbers remain strong: over 104% gains in 3 years and 308% over 5 years, significantly outperforming benchmark indices.

In FY25, the company reported $18.2 billion in revenue and $5.5 billion in EBITDA. After losses in the previous year, Vedanta posted a net profit of $1.6 billion. A ₹7 per share dividend was also declared in June 2025, underlining healthy cash flows and shareholder reward.

Valuation, Structure, and Risks

Vedanta currently trades at a PE multiple of ~11.7x—slightly above the industry average—but offers an attractive dividend yield of nearly 9.7%. It is also undergoing a shareholder-approved demerger into multiple focused entities, a move that could unlock vertical-specific valuation, especially in segments linked to clean energy and critical minerals.

Risks remain. Nearly 100% of promoter shares are pledged—a key concern—and foreign institutional holding has declined slightly. That said, domestic institutional investors, including mutual funds, have increased their positions in recent quarters.

Conclusion:

While Vedanta is not a pure-play magnet manufacturer, its mineral access, processing capabilities, and government-aligned R&D efforts make it a strong candidate for indirect participation in India’s ₹1,000 crore rare earth magnet scheme. It’s a stock to watch for investors seeking long-term, diversified exposure with rare earth potential baked in.

Hindustan Zinc Ltd. (HINDZINC)

Strategic miner quietly entering rare earth territory

Hindustan Zinc, a Vedanta Group company and one of the world’s largest zinc producers, has recently begun making strategic moves into rare earths. The company was declared the preferred bidder for a rare earth block in Uttar Pradesh under the government’s National Critical Mineral Mission (NCMM)—a key signal of future diversification beyond zinc and silver.

While the company has no current production in rare earths, its mining expertise, regulatory alignment, and long-term expansion plans position it as a watchlist candidate in the rare earth magnet manufacturing story.

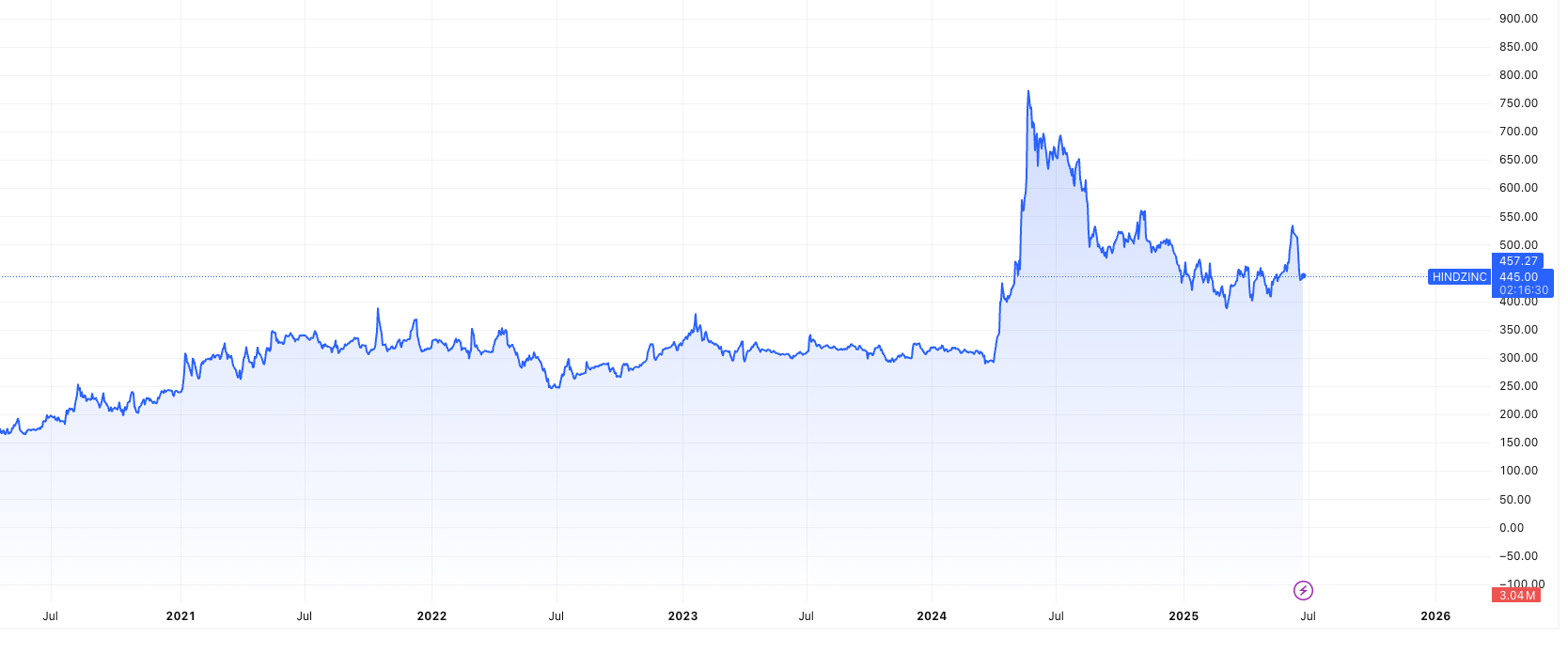

Market Performance and Volatility

The stock has shown a mixed performance. It rallied nearly 28% ahead of mid-June 2025, but quickly corrected by 17.8% over seven sessions following a stake sale by promoter Vedanta. Year-to-date, it remains up 18%, yet trails significantly over a 12-month view, with a ~30% decline compared to broader indices.

Notably, HZL is trading below all major moving averages (5D to 200D), signaling a technically bearish phase—though analysts see upside potential tied to expansion milestones.

Ownership, Expansion, and Strategic Moves

Promoter holding stands at 63.42% post a recent 1.6% stake sale by Vedanta for ₹3,028 crore. The Government of India retains a 27.92% stake. Despite the selloff, institutional appetite appears strong, with domestic investors reportedly putting in over ₹8,200 crore across two days.

The company has also approved a ₹12,000 crore capex to expand its zinc smelting and mining capacity, with a long-term goal to double metal production by FY31. Financial performance remains robust, with Q4 FY25 net profit rising 47.3% year-on-year to ₹3,003 crore and revenue up 20%.

The high dividend yield (4.2%) and large dividend payouts—such as the ₹10/share interim dividend announced in June 2025—make it attractive for income-seeking investors.

Conclusion:

Hindustan Zinc’s recent rare earth block win may mark the beginning of a deeper role in India’s critical minerals space. Though its rare earth exposure is still at the exploration stage, its operational strength, mining infrastructure, and government alignment give it the tools to scale quickly once commercial production is viable. For investors betting on early rare earth movers with financial muscle, HZL offers quiet but credible upside potential.

NMDC Ltd.

From iron ore giant to critical minerals explorer

NMDC, India’s largest iron ore producer, is gradually expanding into the critical minerals space—including rare earths, lithium, and copper. The company’s move to participate in auctions under the National Critical Mineral Mission and explore overseas assets in Australia and Indonesia signals an ambitious diversification beyond bulk commodities.

While rare earth production hasn’t yet started, NMDC’s vast mining experience, strong financials, and government backing give it a solid platform to scale quickly once exploration yields results.

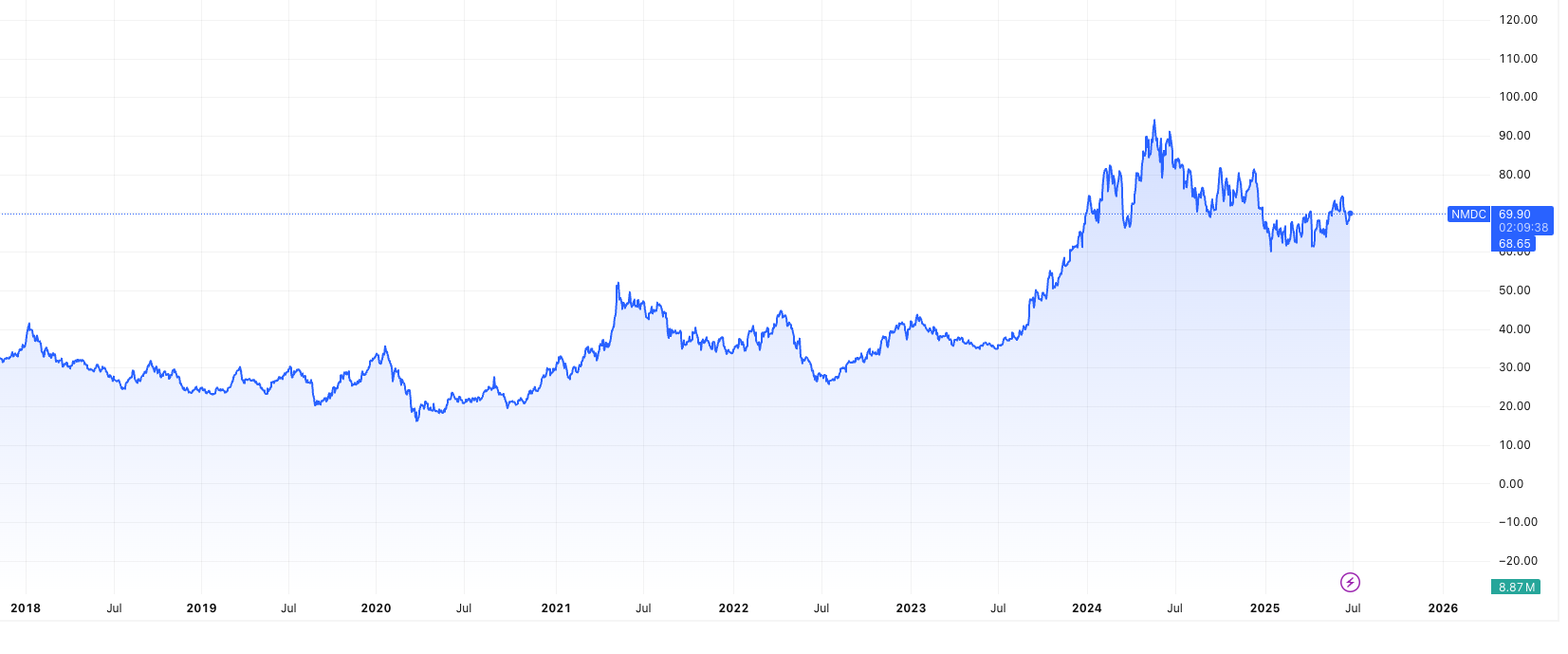

Market Trends and Valuation Insights

Despite a long-term expansion story, the stock has struggled recently—falling 6% year-to-date and 23% over the past year. The Karnataka minerals tax bill has added pressure, along with softer global iron ore prices. However, a 3:1 stock split in late 2024 boosted liquidity, and institutional buying (mainly by DIIs) picked up in June 2025.

With a trailing PE of ~6.5x, NMDC trades at a discount to sector peers, despite offering a healthy ~4.3% dividend yield. The enterprise value is at 5.9x FY26E EBITDA, slightly above its 5-year average—reflecting long-term confidence.

Expansion, Earnings & Rare Earth Ambitions

The company posted a net profit of ₹1,483 crore in Q4 FY25 (up 5% YoY), though EBITDA dropped 13.5%. It declared a final dividend of ₹1/share and outlined plans to hit 100 MTPA iron ore output by 2030 with ₹70,000 crore in capex.

Importantly, NMDC is eyeing strategic acquisitions in lithium and rare earths abroad—particularly in Australia and Indonesia. Domestically, its participation in the government’s rare earth policy push could position it as a dark horse in the coming years.

Conclusion:

NMDC is not yet a direct beneficiary of India’s ₹1,000 crore rare earth magnet scheme, but its first-mover advantage in critical minerals exploration makes it a stock worth tracking. For investors looking to get early exposure to a PSU miner pivoting beyond iron ore, NMDC presents both value and strategic optionality.

NALCO (National Aluminium Company Ltd.)

Bauxite today, rare earths tomorrow?

NALCO, a leading PSU in bauxite mining and alumina refining, is emerging as a quiet contender in India’s rare earth strategy. With access to bauxite-rich reserves that often contain rare earth elements (REEs), the company is now exploring rare earth extraction from bauxite residue—a significant shift from its traditional business model.

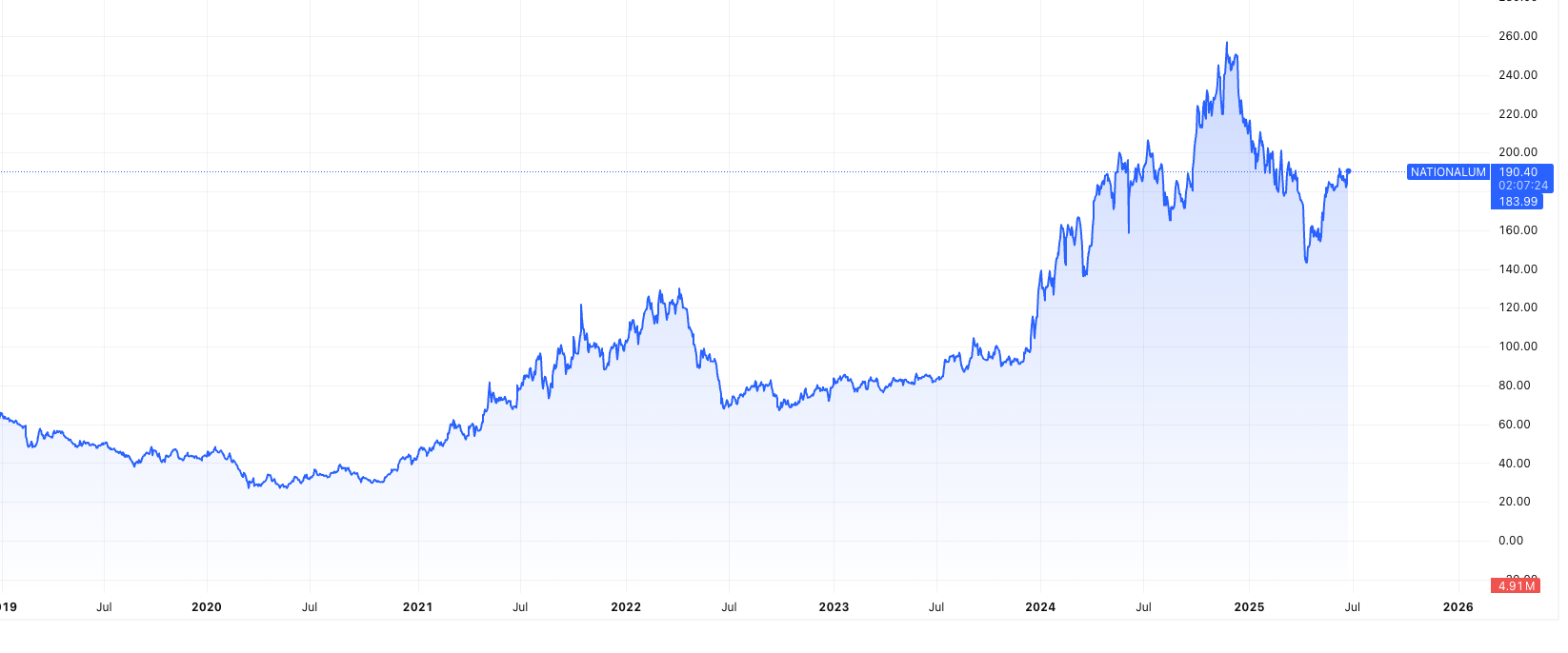

Performance Snapshot & Valuation

- Stock performance: Up ~35% YTD (June 2025); up 90% in 1 year.

- 52-week range: ₹88.21 – ₹209.60; current pullback ~10% from peak.

- Valuation: PE ~12.5x (above sector average); dividend yield ~3.8%; ROCE ~23%.

Despite being slightly overvalued (by ~11%), strong institutional buying in Q1 FY26 shows market confidence in NALCO’s growth runway.

Rare Earth Angle & Growth Outlook

NALCO is planning to add 1 MTPA alumina capacity by FY28 and is one of the few Indian firms actively researching REE recovery from red mud (a bauxite by-product). This positions it well to leverage the ₹1,000 crore rare earth magnet scheme—especially if R&D leads to scalable REE production.

Q4 FY25 saw a 16.6% YoY profit jump, supported by robust alumina pricing and improved cash flow (CFO/PAT ratio: 1.19).

Conclusion:

NALCO offers a compelling mix of traditional stability and rare earth optionality. If its R&D into REE extraction pays off, it could be one of the few aluminium players to ride India’s magnet manufacturing wave—making it an under-the-radar pick in this emerging theme.

Coal India Ltd. (COALINDIA)

From coal powerhouse to rare earth partner

Coal India, the world’s largest coal producer, is now pivoting toward critical minerals. In June 2025, it signed an MoU with IREL to collaborate on rare earth element development—a bold step in diversifying beyond fossil fuels.

Stock Momentum & Valuation

- 6-Month Return: +12% YTD as of June 2025.

- 1-Year Return: +25%, Outperforming Nifty and delivering steady gains.

- Valuation: PE ~8.2x (below sector avg), dividend yield ~5.1%, market cap ~₹3.1 lakh crore.

Strong cash reserves (₹35,000 crore) and stable dividends make Coal India a defensive play with rare earth upside.

Why It’s on the Magnet Map

While coal remains its core, CIL is actively exploring lithium in Argentina and Chile and working with IREL on rare earths. This gives the company potential indirect exposure to India’s ₹1,000 crore magnet scheme. Q4 FY25 net profit grew 10% YoY to ₹8,682 crore, and it declared a ₹5/share dividend, reaffirming financial strength.

Conclusion:

Coal India isn’t a direct rare earth producer—yet. But its partnerships and diversification into critical minerals make it a strategic player to watch. For investors seeking a low-risk, high-dividend stock that could ride India’s rare earth tailwind, Coal India is a solid candidate.

Permanent Magnets Ltd. (PML)

India’s direct play on rare earth magnet manufacturing

PML is one of the few pure-play listed magnet manufacturers in India. It produces magnets for EVs, industrial automation, and renewable energy—sectors that stand to benefit directly from the government’s ₹1,000 crore rare earth magnet manufacturing scheme.

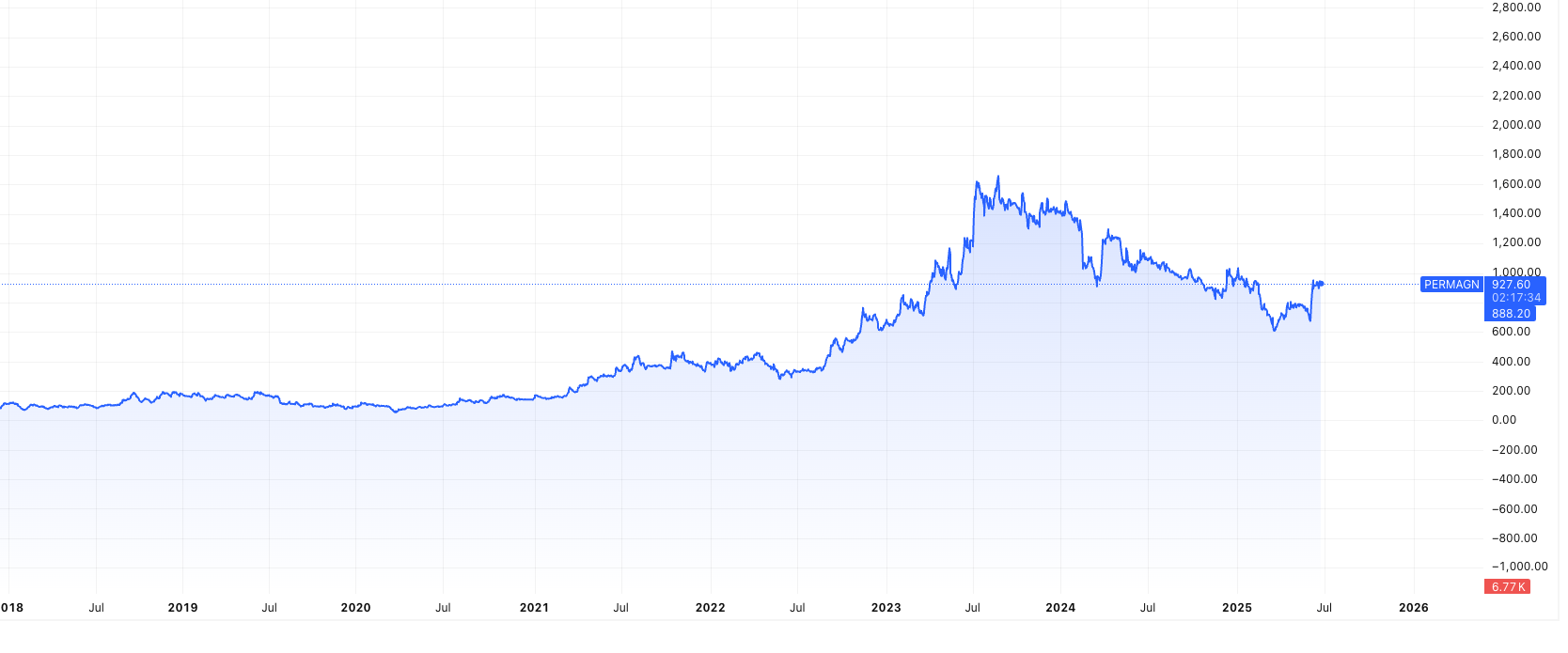

Stock & Valuation Snapshot

- 6-Month Return: Down ~8% YTD as of June 2025.

- 1-Year Return: Flat (~0%), underperforming small-cap peers.

- Valuation: PE ~30x (vs. sector ~20x), trades at 5.54x book value.

- Market Cap: ~₹900 crore.

Despite premium valuation, its first-mover advantage in magnet manufacturing keeps it on radar, especially as demand grows for domestic sources.

Magnet Business and Growth Prospects

Q4 FY25 revenue rose 10% YoY to ₹200 crore, though margins contracted due to input costs. The company is now expanding capacity to serve EV and renewable sectors, which could surge if OEMs localize sourcing under the new scheme.

PML’s small size brings scalability risk, but also high upside potential if it secures incentives or bulk supply contracts via IREL or the PLI scheme.

Conclusion:

PML offers direct exposure to India’s rare earth magnet push—unlike larger players with indirect links. It’s high risk due to size and valuation, but also high reward if the policy tailwind converts into orders. For early movers, this is the stock to keep a close watch on.

Sterling Tools Ltd. (with Sterling Gtake E-Mobility)

Betting on the future—without rare earths

Sterling Tools is traditionally known for automotive fasteners, but its EV arm, Sterling Gtake E-Mobility (SGEM), is now grabbing attention. Why? It’s developing magnet-free electric motors—a smart hedge as rare earth prices stay volatile and supply remains China-dependent.

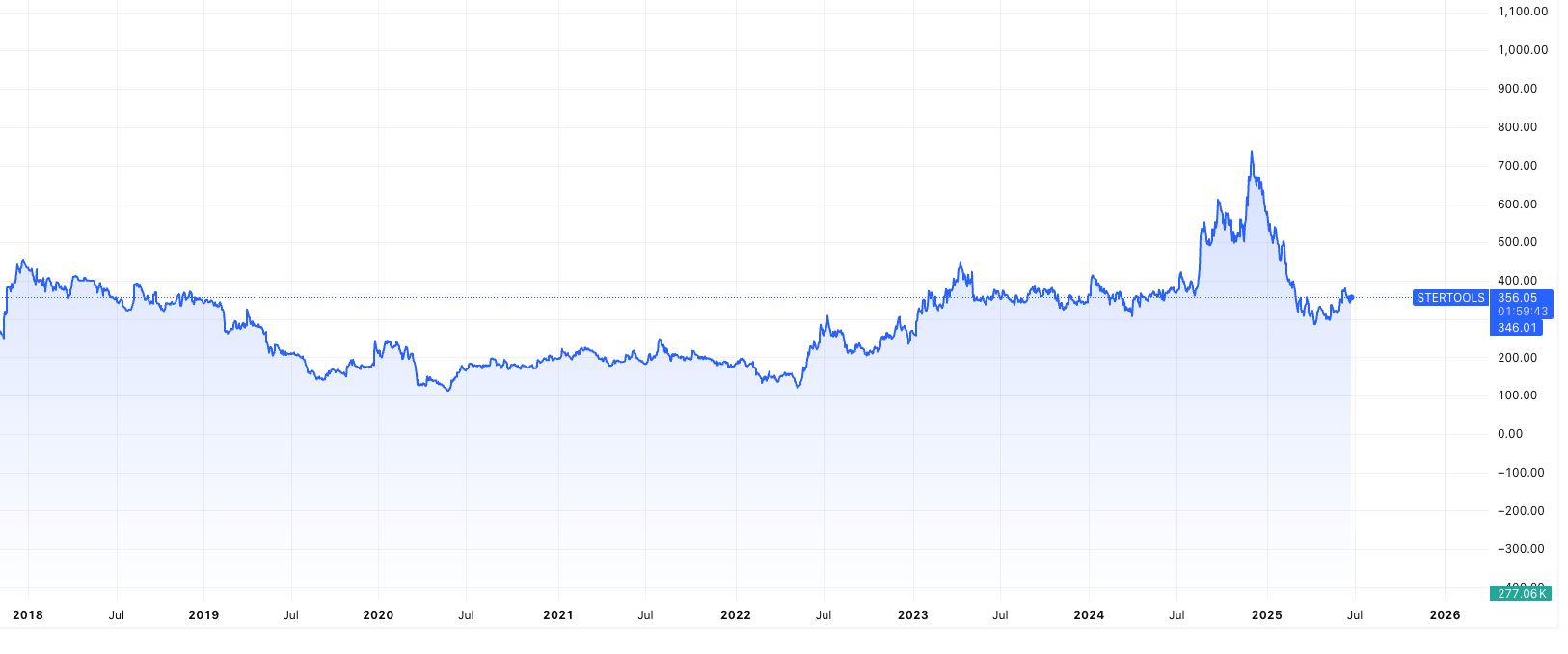

Performance & Valuation Snapshot

- 6-Month Return: +25% YTD (June 2025); +60% from 52-week low.

- 1-Year Return: +0%, Underperforming small-cap benchmarks.

- Valuation: PE ~28x (vs. sector ~22x), market cap ~₹1,800 crore, 3.8x book value.

Promoters hold 65.77%, with rising FII interest (~3.2%) thanks to its EV bets.

Why It Matters in the Rare Earth Narrative

Sterling’s partnership with UK-based AEM to build traction motors without rare earth magnets is a game-changer. If magnet-free EV tech scales, the company could attract OEMs keen to reduce China reliance—and become a parallel play to India’s rare earth push.

Q4 FY25 results showed a 15% YoY revenue jump and 8% profit growth, with ₹100 crore capex planned to expand EV components by FY27.

Conclusion:

Sterling Tools isn’t making rare earth magnets—it’s trying to make them obsolete. That makes it an interesting contrarian bet as India backs both domestic magnet manufacturing and alternatives to rare earth dependency.

Investor Strategy: Enter Quietly, Exit Smart

India’s ₹1,000 crore magnet mission is still under the radar—which gives savvy investors a narrow window. Here’s how to make the most of it:

What to Watch:

- Confirmed PLI or government sourcing announcements (especially tied to IREL’s 500-tonne supply commitment).

- Mentions of rare earth magnets or critical minerals in investor presentations or conference calls (Q1/Q2 FY26).

- Defense or EV capex updates from companies like Vedanta, Hindustan Zinc, or NMDC.

- Tech partnerships (like Sterling-AEM’s magnet-free motors) that align with self-reliance or China-alternative narratives.

Key Strategy Tips:

- Don’t chase short-term rallies—enter when news is early and sentiment is quiet.

- Mix your exposure across direct players (Permanent Magnets), diversifiers (Coal India, NMDC), and innovators (Sterling Tools).

- Keep an eye on policy rollout timelines—initial approvals or tender wins can trigger sharp upside.

Conclusion: Rare Earth Magnet Manufacturing Stocks – A Rare Window

India’s upcoming scheme isn’t just a subsidy—it’s a signal. From EVs to defense and clean energy, rare earth magnets are becoming strategic assets.

A few stocks are already positioned—but the market hasn’t priced in the full impact. You don’t need to guess the next Vedanta or NALCO breakout—you just need to position before the rest of the market connects the dots.

This rare earth story is just beginning. And those who spot structural shifts early, often exit rich.

Want to ride India’s rare earth revolution early? Track top magnet stocks now on Angel One before the rally begins.

FAQs: Rare Earth Magnet Manufacturing Stocks

What are rare earth magnets used for?

They power EV motors, drones, missiles, wind turbines, and even your smartphone speakers.

Why is India investing ₹1,000 crore in this sector?

To reduce dependence on China and build local capabilities in EVs, defense, and electronics.

Which listed companies benefit directly from this push?

Permanent Magnets Ltd is the closest pure play. Others like Vedanta, NALCO, NMDC, and Hindustan Zinc offer indirect exposure.

What is the role of IREL in this scheme?

IREL will supply 500 tonnes of rare earth raw material to support magnet manufacturing.

Is IREL listed on the stock market?

No. It’s a government-owned unlisted PSU. Investors must track listed ecosystem partners instead.

What makes Permanent Magnets Ltd special?

It manufactures magnets in India, giving it a direct edge if demand for locally sourced magnets rises.

Why watch Sterling Tools if they don’t use magnets?

They’re innovating with magnet-free EV motors—offering a smart alternative if rare earths remain expensive or restricted.

How can investors time their entry into these stocks?

Look for official announcements on PLI approvals, sourcing contracts, or magnet capacity expansions.

Are these stocks high-risk?

Some, like small caps (PML, Sterling), carry volatility. Large PSUs offer more stability but slower moves.

Where can I monitor these stocks and sector updates easily?

You can use Angel One’s tracking tools, watchlists, and news feeds to stay ahead of the market.

Related Articles

Electric Plane Take Off: How Beta’s ₹700 Flight Could Disrupt Aviation Stocks

Jio BlackRock and Aladdin: Is This the Jio Moment for Mutual Funds in India?