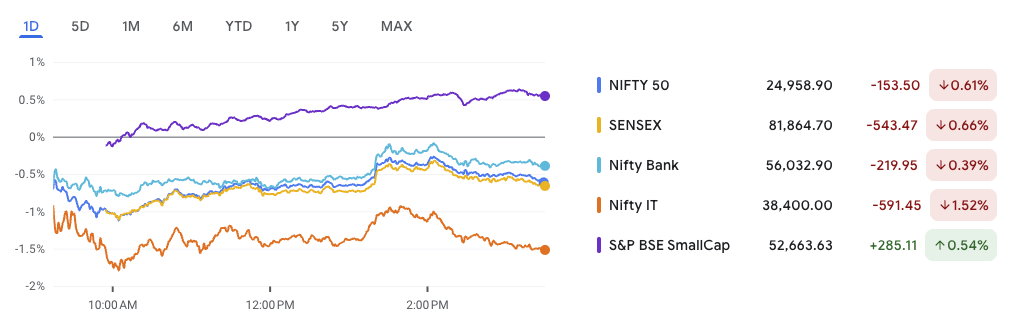

Nifty falls on Iran tensions as global sentiment turns risk-off

Nifty falls on Iran tensions, dragging Indian equities lower as geopolitical risk escalated. After the U.S. reportedly bombed Iran, market participants rushed to safety, triggering a broad sell-off across global markets. The Nifty 50 dropped 153.50 points to close at 24,958.90, while the Sensex fell 543 points.

IT stocks led the fall, with the Nifty IT index down 1.52%, as investors feared that rising global volatility could dent technology demand. Financials followed, with Nifty Bank slipping 0.39%.

Interestingly, smallcap stocks remained resilient. The S&P BSE SmallCap index rose 0.54%, signaling selective risk-on appetite even as the broader market slipped.

With the Nifty falling on Iran tensions and global sentiment uncertain, market participants must now watch key levels closely. Will the index hold 24,900 support? Or are we heading for a deeper correction?

In this newsletter, we decode it all:

- 📉 Nifty Outlook: Key levels and breakout scenarios

- 🗞️ News & Stock Impact: IPO surprises, sector trends, and government moves

- 📈 Technical Radar: Breakout watch on Birlasoft

- 💎 Smallcap Pick of the Day: Can Platinum Industries sparkle through volatility?

Stay with us for expert-level clarity and tactical insights.

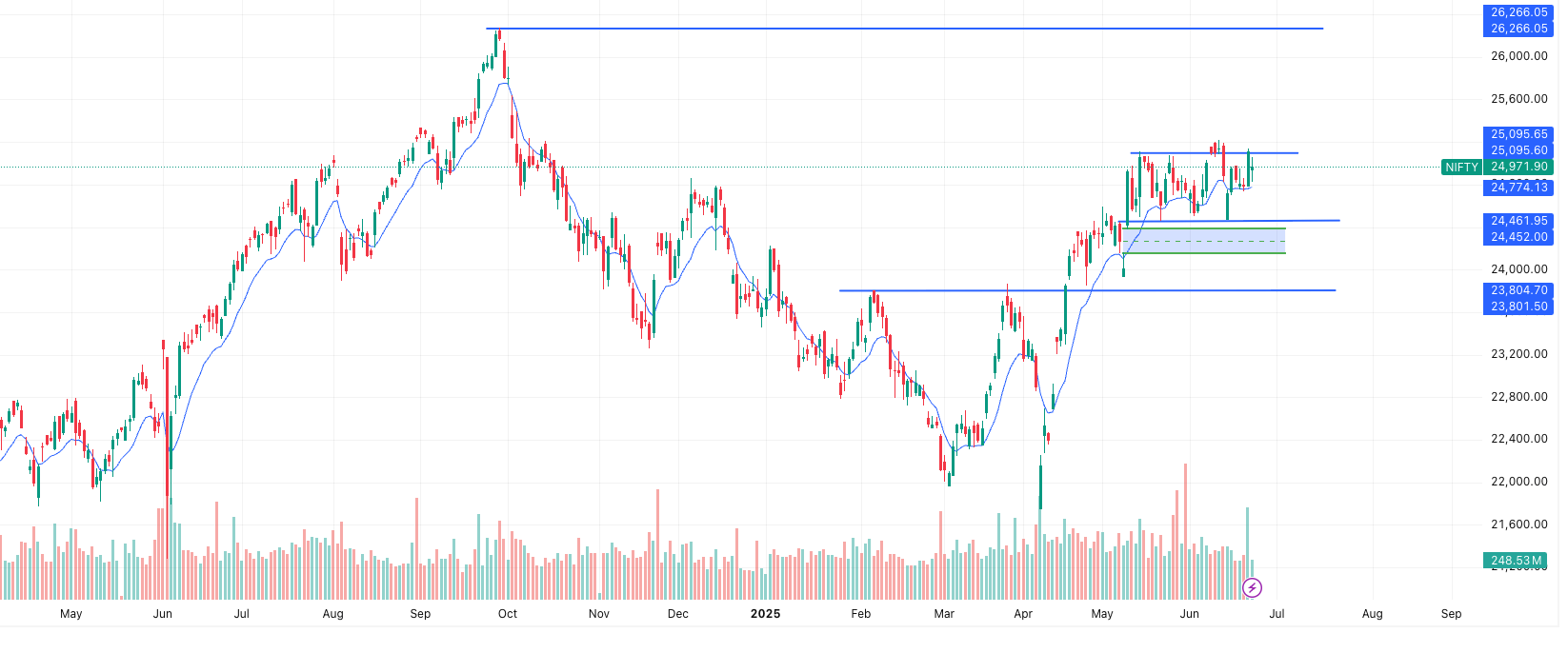

Nifty Outlook: Market at Crossroads as Iran Tensions Weigh

Nifty falls on Iran tensions, dropping 153 points to close at 24,971.90. This decline follows reports of a U.S. strike on Iran, which has rattled global sentiment. As a result, traders turned cautious, prompting a risk-off move across markets. However, the broader technical structure still suggests consolidation rather than breakdown.

1. Where Are We in the Market Cycle?

We appear to be in the late phase of a strong bull leg, following a powerful recovery from the March 2025 lows. Although the recent weeks show waning momentum, this isn’t a trend reversal yet.

- Rather than falling sharply, prices are moving sideways, which indicates digestion of prior gains.

- So far, buyers have shown strength on dips, keeping the larger structure constructive.

Therefore, while caution is warranted, there’s no need to panic yet.

2. Technical Structure: Price Action Speaks

Let’s decode what the chart is really telling us:

- 25,100–25,150: This is a stiff resistance zone. Notably, Nifty has tested it six times recently — without success.

- 24,450–24,460: A demand zone that has held firm. Every dip into this level has been bought.

In addition, the 9-EMA has consistently supported the price. This suggests the short-term trend is still intact.

Meanwhile, although volume is rising, there is no rush to exit. This implies smart money is positioning — not fleeing.

3. Macro View: Nifty Falls on Iran Tensions, But Is It Serious?

Yes, Nifty falls on Iran tensions, but let’s add some context.

“Geopolitical events often cause sharp reactions. But they rarely derail bull markets — unless macro fundamentals also deteriorate.”

So far:

- India’s macro remains stable

- Oil prices have not surged excessively

- Volatility Index (VIX) has risen, but remains below panic levels

Therefore, this dip seems more like a tactical reset than a fundamental shift. Moreover, past reactions to such news have often been short-lived.

4. What Smart Money Is Doing Right Now

Here’s how seasoned traders are reacting:

- Booked some profits near 25,000

- Not adding aggressively until Nifty clears 25,100

- Watching the 24,450 support zone closely for fresh entry signals

In short, they’re staying prepared — not reactive.

5. What Could Happen Next?

Let’s explore three possible scenarios:

Scenario A: Breakout

If Nifty closes above 25,150 with rising volumes, expect a breakout.

This could drive the index towards 25,600–26,200.

In this case, traders should consider trailing long positions.

Scenario B: Breakdown

If Nifty closes below 24,450, bearish pressure could intensify.

The likely downside would be towards 23,800.

Here, defensive positioning or tactical shorts may be warranted.

Scenario C: Time Correction

If Nifty continues oscillating between 24,450–25,100, the index will consolidate further.

During this phase, it’s best to accumulate leaders and avoid leverage.

6. Conclusion: A Veteran’s Final Word

Although Nifty falls on Iran tensions, this looks like a reaction — not a reversal. The market remains in a coiled consolidation phase, setting up for the next directional move.

So what should smart traders do?

- Wait for confirmation before acting

- Don’t let headlines drive impulsive trades

- Keep an eye on Bank Nifty and Reliance for leadership clues

“The market doesn’t reward urgency. It rewards discipline.”

As long as support holds, the long-term trend stays bullish — and this dip could be an opportunity, not a threat.

News And Stock Impact

Kamath Brothers Invest ₹250 Cr in InCred Ahead of IPO

The Kamath brothers, well-known for their role in building Zerodha, have invested ₹250 crore in InCred Holdings Ltd. This strategic move comes ahead of InCred’s IPO plans, signaling growing interest in tech-driven NBFCs.

Impacted Stock: InCred (Unlisted)

Although InCred is currently unlisted, this funding round could set the stage for robust demand when the IPO hits the market. Moreover, this reflects rising investor appetite for fintech-lending platforms, despite near-term uncertainty as Nifty falls on Iran tensions.

BSE & IndiGo May Join Nifty 50; IndusInd, Hero MotoCorp Likely to Exit

According to reports, BSE Ltd and InterGlobe Aviation (IndiGo) could replace IndusInd Bank and Hero MotoCorp in the upcoming Nifty 50 reshuffle, expected in September.

Impacted Stocks:

- BSE Ltd: This inclusion buzz has already supported the stock’s momentum. With consistent fundamentals and a tech-savvy product suite, it is likely to see continued accumulation.

- IndiGo: Institutional interest could rise as index funds realign portfolios.

- IndusInd Bank & Hero MotoCorp: May face outflows in the short term due to passive fund exits.

This comes at a time when Nifty falls on Iran tensions, making strong fundamentals and index relevance even more crucial for resilience.

Adani New Industries Commissions 5 MW Green Hydrogen Plant

Adani New Industries Ltd (ANIL) launched India’s first off-grid 5 MW green hydrogen plant in Gujarat. The plant is a pilot for a much larger green hydrogen hub in Mundra.

Impacted Stock: Adani Enterprises (Parent of ANIL)

This development positions Adani as a frontrunner in India’s green energy transition. While the broader market faces geopolitical risks — especially as Nifty falls on Iran tensions — such sustainability-linked growth stories can attract long-term ESG-focused investors.

PhonePe Eyes $1.5 Billion IPO

Walmart-backed PhonePe is reportedly planning to raise $1.5 billion in a blockbuster IPO, valuing the fintech giant at nearly $15 billion. Filing may begin as early as August.

Impacted Stock: Flipkart/ Walmart (Parent Entity)

Although PhonePe is not listed independently, the IPO will unlock value for Walmart and possibly reignite IPO interest in India’s fintech space. In the near term, this adds a bright spot to an otherwise cautious sentiment, especially today as Nifty falls on Iran tensions.

Amazon’s Entry into Diagnostics Spooks Traditional Players

Amazon India, in partnership with Orange Health Labs, has launched a home diagnostics service offering 800+ tests. The service will be available in six major cities, with a focus on digital integration and doorstep collection.

Impacted Stocks:

- Dr Lal PathLabs: Down ~2–3% intraday

- Metropolis Healthcare: Also saw declines due to increased competitive pressure

This move has triggered a selloff in diagnostic stocks, as investors re-evaluate margin and volume assumptions. Competitive disruption adds downside risk — even more so in an environment where Nifty falls on Iran tensions, amplifying sector-specific corrections.

Read Full Blog here: Amazon Diagnostics Goes Live: Impact on India’s Lab Testing IndustryRice Exporters Face Heat Amid Iran-Israel Escalation

The escalation in Iran-Israel tensions is beginning to impact trade. Haryana’s rice exporters, who account for 30% of India’s basmati exports to Iran, are facing ship delays and payment disruptions. Areas like Karnal, Kaithal, and Sonipat are most affected.

Impacted Stocks: KRBL, LT Foods, Chaman Lal Setia

These companies have direct or indirect exposure to Iran. As tensions mount and Nifty falls on Iran tensions, the outlook for export-led agri stocks weakens. Watch for any updates in trade corridor restoration or payment normalisation.

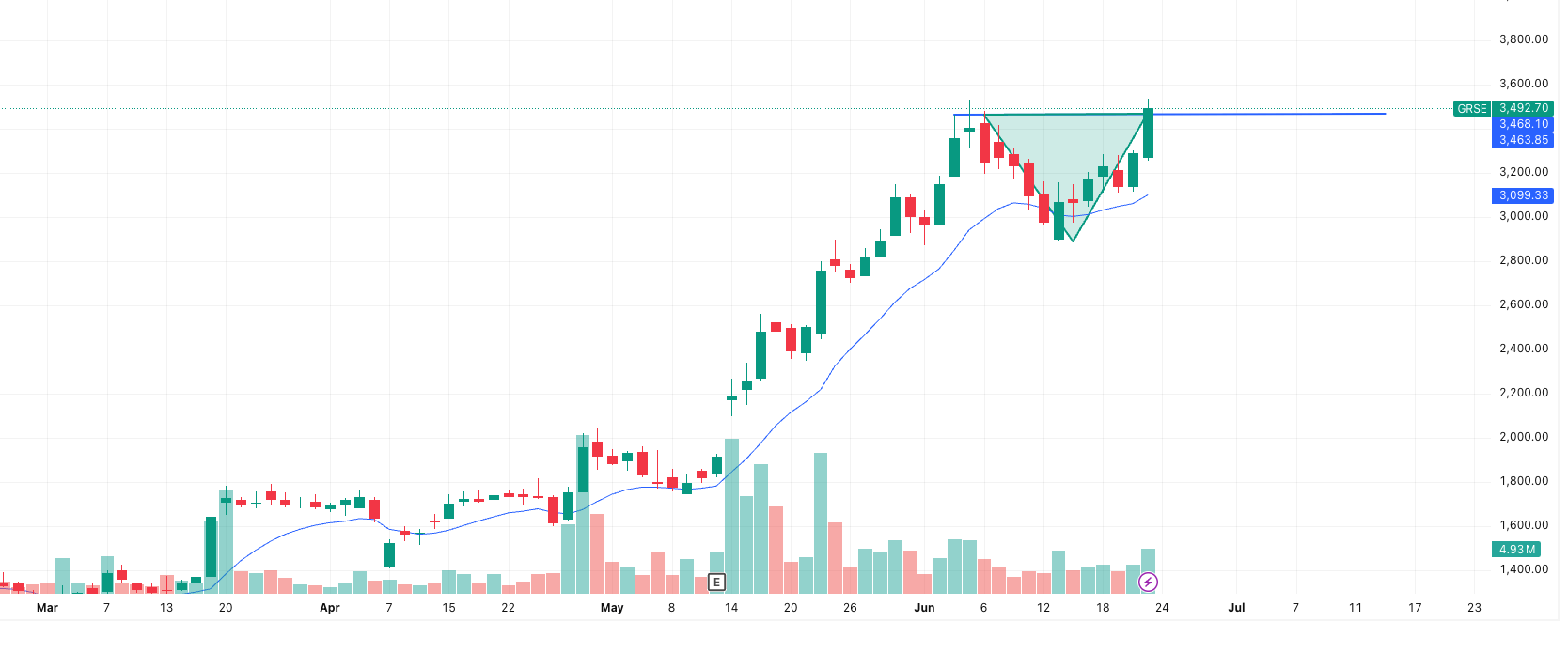

Stock on Technical Radder– GRSE

GRSE – Breakout Amid Global Jitters

Closing Price: ₹3,492.70

Volume: 4.93M shares (above 10-day average)

1️⃣ Structure & Breakout Context

Despite the cautious sentiment as Nifty falls on Iran tensions, GRSE has delivered a decisive breakout from a well-formed descending triangle pattern — a classic bullish continuation structure in trending stocks.

- The horizontal resistance at ₹3,470 was tested multiple times.

- Meanwhile, lower highs shaped the descending trendline — forming volatility compression.

- On June 23, price exploded past ₹3,470 with strong momentum and volume, triggering a confirmed breakout near the triangle’s apex.

🔍 This pattern signals that the market is ready to resume the prior uptrend after a period of consolidation.

2️⃣ Volume Confirmation & EMA Alignment

Moreover, what strengthens the setup is the sharp surge in volume, which significantly exceeded the 10-day average.

- This implies that institutional buyers are stepping in — not just retail enthusiasm.

- Additionally, the stock remains well above the 9-EMA (₹3,099), which typically serves as dynamic support in trending phases.

📌 Volume with breakout is not just a detail — it’s a verdict. This breakout is real.

3️⃣ Target Projections Using Measured Move

To estimate near-term upside, the triangle height is applied to the breakout point:

- Triangle Depth = ₹3,470 − ₹3,100 = ₹370

- Target = ₹3,470 + ₹370 = ₹3,840

Realistically, intermediate resistance may appear around ₹3,750–₹3,840, followed by psychological resistance at ₹4,000.

💡 In high-momentum breakouts, traders often book partial profits before round-number zones.

4️⃣ Risk Management Strategy

Given that price has already broken out, traders may:

- Enter on retest: ₹3,450–₹3,470 (ideal for fresh entry)

- Stop-loss:

- Conservative: Below triangle base (₹3,280)

- Aggressive: Below EMA9 or minor support (₹3,300)

- Risk–Reward Estimate:

- Risk = ₹170

- Reward = ₹350–₹370

- R:R ≈ 1:2.5, well-aligned with swing trading principles.

📍 Always let the market confirm — but when it does, act decisively.

5️⃣ Broader Context & Geopolitical Overlay

Importantly, this breakout has come despite macro uncertainty, as Nifty falls on Iran tensions and investors remain risk-averse. However, defense and shipbuilding stocks like GRSE are showing relative strength, often becoming safe-haven plays in such geopolitical climates.

A veteran trader would interpret this as:

“Money is rotating into sectors with strategic tailwinds. The chart reflects conviction, not confusion.”

Summary Table

| Parameter | Value/Observation |

|---|---|

| Pattern | Descending Triangle (Bullish Continuation) |

| Breakout Level | ₹3,470 |

| Volume | Strong, confirming institutional activity |

| Target Zone | ₹3,750–₹3,840 |

| Stop-Loss Range | ₹3,280–₹3,300 |

| Bias | Short-Term Bullish |

| Risk–Reward | ~1:2.5 |

💬 Final Note:

In times when Nifty falls on Iran tensions, setups like GRSE — backed by structure, volume, and sector tailwinds — stand out as tactical opportunities in an otherwise jittery market.

IPO Updates – As of June 23, 2025

The IPO market continues to stay hot with multiple listings queued up in both Mainboard and SME segments. Here’s a snapshot with key details — GMP, open-close-listing dates, and segment classification.

Mainboard IPOs

| Company Name | GMP (Gain %) | Price Band (₹) | Open | Close | Allotment | Listing |

|---|---|---|---|---|---|---|

| Indogulf Cropsciences | ₹11 (9.91%) | 111 – 122 | 26-Jun | 30-Jun | 1-Jul | 3-Jul |

| HDB Financial | ₹69 (9.32%) | 740 – 809 | 25-Jun | 27-Jun | 30-Jun | 2-Jul |

| Sambhv Steel Tubes | ₹8 (9.76%) | 82 – 90 | 25-Jun | 27-Jun | 30-Jun | 2-Jul |

| Kalpataru Projects | ₹9 (2.17%) | 414 – 423 | 24-Jun | 26-Jun | 27-Jun | 1-Jul |

| Ellenbarrie Industrial Gases | ₹10 (2.50%) | 400 – 410 | 24-Jun | 26-Jun | 27-Jun | 1-Jul |

| Globe Civil Projects | ₹15 (21.13%) | 71 – 86 | 24-Jun | 26-Jun | 27-Jun | 1-Jul |

SME IPOs

| Company Name | GMP (Gain %) | Price Band (₹) | Open | Close | Allotment | Listing |

|---|---|---|---|---|---|---|

| Moving Media Entertainment | ₹5 (7.14%) | 70 – 75 | 26-Jun | 30-Jun | 1-Jul | 3-Jul |

| Valencia India | ₹– (0%) | 110 – 110 | 26-Jun | 30-Jun | 1-Jul | 3-Jul |

| PRO FX Tech | ₹– (0%) | 87 – 87 | 26-Jun | 30-Jun | 1-Jul | 3-Jul |

| Ace Alpha Tech | ₹– (0%) | 69 – 69 | 26-Jun | 30-Jun | 1-Jul | 3-Jul |

| Rama Telecom | ₹4 (5.88%) | 68 – 72 | 25-Jun | 27-Jun | 30-Jun | 2-Jul |

| Supertech EV | ₹5 (5.43%) | 92 – 97 | 25-Jun | 27-Jun | 30-Jun | 2-Jul |

| Suntech Infra Solutions | ₹23 (26.74%) | 86 – 109 | 25-Jun | 27-Jun | 30-Jun | 2-Jul |

| Abram Food | ₹9 (9.18%) | 98 – 107 | 24-Jun | 26-Jun | 27-Jun | 1-Jul |

| Icon Facilitators | ₹10 (10.99%) | 91 – 101 | 24-Jun | 26-Jun | 27-Jun | 1-Jul |

| Shri Hare-Krishna Sponge Iron | ₹– (0%) | 59 – 59 | 24-Jun | 26-Jun | 27-Jun | 1-Jul |

| AJC Jewel | ₹9 (9.47%) | 95 – 104 | 23-Jun | 26-Jun | 27-Jun | 1-Jul |

| Mayasheel Ventures | ₹5 (10.64%) | 47 – 52 | 20-Jun | 24-Jun | 25-Jun | 27-Jun |

| Aakaar Medical Technologies | ₹– (0%) | 72 – 72 | 20-Jun | 24-Jun | 25-Jun | 27-Jun |

| Safe Enterprises Retail Fixtures | ₹10 (7.25%) | 138 – 148 | 20-Jun | 24-Jun | 25-Jun | 27-Jun |

Smallcap of the Day – High Risk, High Reward

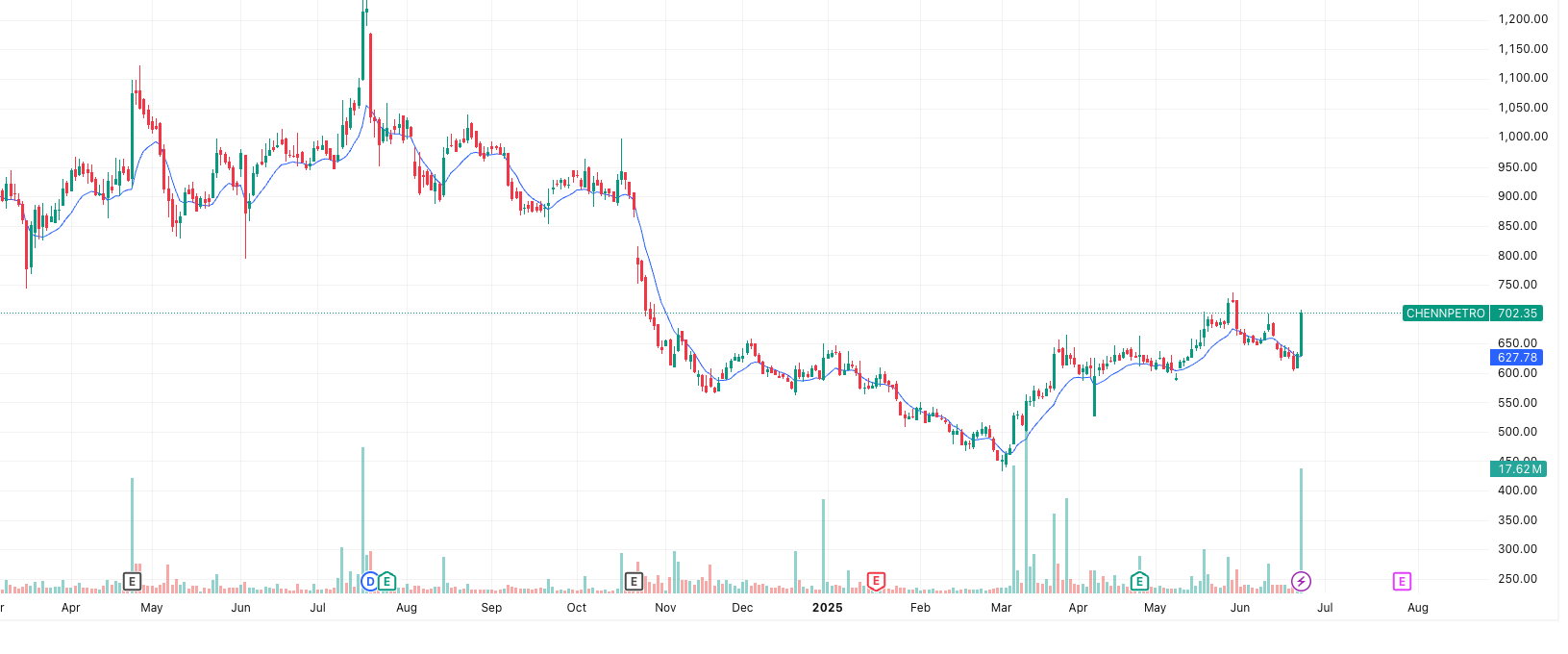

Chennai Petroleum Corporation Ltd (CPCL)

Current Price: ₹702 | Market Cap: ₹10,464 Cr | Dividend Yield: 7.83%

About the Company

Chennai Petroleum Corporation Ltd, a subsidiary of Indian Oil Corporation (IOCL), operates in refining and the manufacturing of lubricating oil additives. Its product basket includes LPG, diesel, aviation turbine fuel, paraffin wax, petrochemical feedstocks, petroleum coke, and more.

Its refining output is largely marketed by IOCL, while specialty products are distributed independently, giving CPCL strong integration within India’s petroleum value chain.

Why CPCL, Why Now?

As Nifty falls on Iran tensions, investors are once again reminded of how geopolitical risks in the Middle East ripple across global oil markets.

Following the US airstrikes on Iran’s nuclear sites and the Iranian Parliament’s signal to potentially close the Strait of Hormuz, oil supply fears have resurfaced. While most oil marketing companies (OMCs) like HPCL and BPCL remain preferred by brokerages, CPCL offers a contrarian high-risk bet amid oil market volatility.

Although it trails in profitability (ROCE: 4.3%, ROE: 2.5%), its strategic position in the downstream segment, along with a 7.83% dividend yield, makes it a compelling play for risk-tolerant investors betting on GRM (Gross Refining Margin) improvement.

Key Metrics Snapshot

| Metric | Value |

|---|---|

| Stock P/E | 48.9 |

| Book Value | ₹551 |

| Debt to Equity | 0.38 |

| Intrinsic Value | ₹436 |

| Price to Book | 1.27x |

| EV/EBITDA | 12.0 |

| OPM | 1.71% |

| Sales (FY25) | ₹59,356 Cr |

| Inventory | ₹6,493 Cr |

| Cash & Equivalents | ₹375 Cr |

Macro Risk Context – Strait of Hormuz Tensions

While India is now importing more crude from Russia and the Americas, any extended disruption in the Strait of Hormuz — which still handles 35%+ of India’s crude inflow — could spike freight costs and distort CPCL’s input sourcing.

Yet, India’s record crude imports in May and stable domestic demand may offer a floor to CPCL’s operational outlook. However, margin pressure and high volatility remain key risks.

⚠️ Risk-Reward Outlook

✅ Positives

- Strategic role within IOCL network

- High dividend yield

- Undervalued on price-to-book terms

- Proxy to oil price movements with optionality upside

🚫 Risks

- Weak earnings growth (EPS 3Y CAGR: –45.9%)

- Low return ratios

- Highly sensitive to geopolitical shocks and GRM changes

Veteran Take

“When the world’s oil artery feels the strain, downstream bets like CPCL get caught between margin risk and opportunity. Smart capital watches volume, not noise.”

Conclusion: Navigating Volatility with Clarity

As Nifty falls on Iran tensions, it’s a reminder that markets don’t move on headlines alone—but on how they digest them. Despite weakness, the broader uptrend remains intact, with bulls defending key levels. While geopolitical shocks can rattle sentiment short-term, India’s resilient macro fundamentals, sectoral strength in defense, and strategic oil diversification offer key buffers.

From GRSE’s breakout on the technical radar to Chennai Petroleum’s contrarian appeal amid energy uncertainty, opportunities are still present—but demand a sharp focus on risk management and disciplined execution.

Meanwhile, IPO activity stays red-hot across mainboard and SME segments, reflecting sustained investor appetite. Keep an eye on price action, not just price moves.

“In volatile times, preparation outperforms prediction.”

Stay agile, stay informed—and above all, stay patient.

Open your Angel One Demat account today and ride every breakout with confidence!

Related Articles

Why the Iran Israel Conflict Hasn’t Hit Indian Markets

Ambani and Trump: A High-Stakes Real Estate Alliance Redrawing Global Business Ties