Introduction: Amazon Enters India’s Home Diagnostics Space

Amazon home diagnostics India is now a reality. On June 20, 2025, Amazon India launched its at-home lab testing service across six major cities. These include Bengaluru, Delhi, Gurgaon, Noida, Mumbai, and Hyderabad. The service is in partnership with Orange Health Labs.

Amazon Diagnostics offers doorstep sample collection, digital booking, and access to reports—all through the Amazon app. It is now part of the Amazon Medical ecosystem, which already includes Amazon Pharmacy and Amazon Clinic.

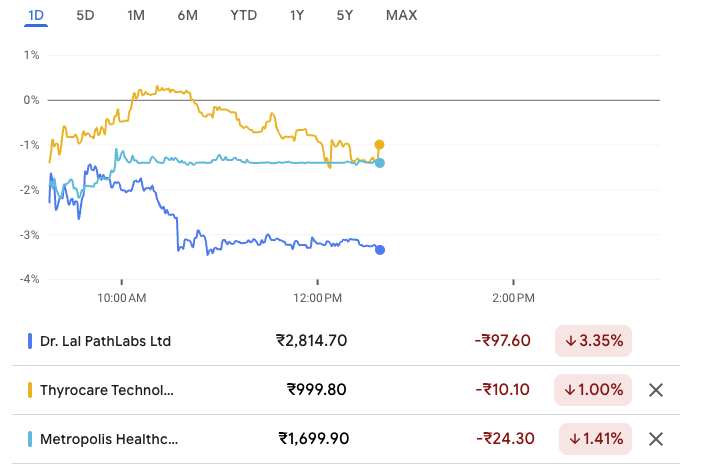

The market responded quickly. Shares of diagnostic companies like Dr Lal PathLabs and Metropolis fell by up to 3%. Investors are concerned about the rising competition. Amazon’s entry adds pressure to an already competitive industry.

Unlike earlier startups, Amazon is not chasing customers with discounts. Instead, it focuses on market-price services and promises a superior user experience. In healthcare, trust and reliability often matter more than price.

With over 800 tests, rapid collection in under 60 minutes, and Amazon’s scale, this move could reshape how Indians access diagnostics. But can Amazon disrupt this space fully? Or will trusted players continue to dominate?

This blog explores Amazon’s strategy, the shift toward doorstep healthcare, and what it means for India’s fast-growing diagnostics sector.

Amazon’s Healthcare Ecosystem: Now Complete

The launch of Amazon home diagnostics India completes the company’s full-stack healthcare offering. With this move, Amazon now offers Pharmacy, Clinic, and Diagnostics under a single umbrella—Amazon Medical.

Amazon Pharmacy delivers prescription medicines and health essentials. It also includes teleconsultations and home delivery, available to both Prime and non-Prime users. Amazon Clinic enables users to consult licensed doctors digitally for common medical concerns.

Now, Amazon Diagnostics adds a powerful new layer. Customers can book lab tests, schedule sample collection, and view reports—all within the Amazon app. Sample collection happens within 60 minutes of booking in most serviceable PIN codes.

The service, in collaboration with Orange Health Labs, will initially operate in six cities. These cover over 450 PIN codes across Bengaluru, Delhi, Gurgaon, Noida, Mumbai, and Hyderabad.

Importantly, Amazon is not relying on deep discounts. “We are not following a price-led strategy,” a spokesperson said. “In healthcare, people value trust and reliability. We’re focused on offering a great customer experience at market prices.”

This positions Amazon as a serious, long-term player in diagnostics—not just another discount-driven startup.

Immediate Impact on Listed Diagnostics Players

The launch of Amazon home diagnostics India shook investor confidence in traditional diagnostic companies. On Monday, shares of major players like Dr Lal PathLabs and Metropolis Healthcare dropped by up to 3%.

Investors fear that Amazon’s scale and tech-enabled services will intensify competition. These legacy companies have strong networks and brand trust. But Amazon brings speed, digital convenience, and a massive customer base.

The fear is not just about price cuts. Although Amazon isn’t offering discounts, it can still disrupt the market with better logistics and user experience. Its ability to collect samples within 60 minutes is unmatched by most incumbents.

For now, listed diagnostic players retain an advantage in chronic care and illness-driven testing. These account for nearly 85% of India’s diagnostics market. Their experience, clinical accuracy, and brand trust are hard to replicate overnight.

Still, the entry of a tech giant signals a shift. Investors will likely re-evaluate growth and margin expectations for traditional players in the quarters ahead.

Market Context: A Booming but Fragmented Industry

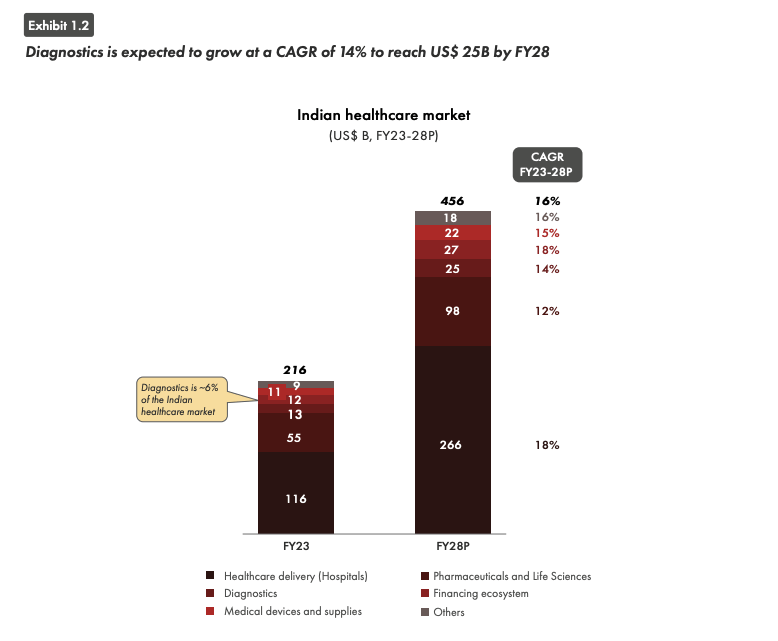

India’s diagnostics market has grown rapidly over the last five years. It reached $12 billion in FY24, with an annual growth rate of 8%. However, the market is still highly fragmented.

Only about 15% of the sector is organized. This segment has grown faster, at 12% CAGR. Analysts now expect the entire diagnostics industry to grow at 14% CAGR in the coming years.

Preventive testing is also rising. At present, it forms just 12% of the total market. But with the growing burden of non-communicable diseases like diabetes, heart, and kidney ailments, demand for routine testing is set to surge.

Rural India presents an even bigger opportunity. Over 65% of India’s population lives in rural areas, but diagnostic services there remain limited. Logistics, lack of labs, and poor infrastructure continue to hold back access.

That’s where doorstep diagnostics can make a real difference. Companies that combine technology, fast logistics, and clinical accuracy can expand access—and gain significant market share in the process.

Home Diagnostics Is Already a Crowd: Meet the Pioneers

While Amazon home diagnostics India is making headlines, it’s not the first to explore this space. Several health-tech startups and home-care providers have already built strong customer bases with similar offerings.

Here are four key players already reshaping the home diagnostics space:

1. Portea

Portea delivers diagnostic services directly to homes. These include blood tests, full-body checkups, and chronic condition tracking. The company also offers elderly care and nursing services. Its easy-to-use booking system and wide service range make it a preferred choice in urban areas.

2. MedRabbits Healthcare

MedRabbits combines home diagnostics with end-to-end healthcare. Services range from lab tests and physiotherapy to mental health and chronic care. The platform uses tech to simplify bookings and personalize care, especially for long-term patients.

3. Emoha

Emoha focuses on elder care. It offers 24/7 emergency support, health tracking, and senior-specific wellness services. Its tech-enabled system allows families to monitor their loved ones remotely while ensuring timely diagnostics and assistance.

4. Kyno Health

Kyno Health promotes preventive healthcare. It offers wellness plans, lifestyle coaching, and diagnostics through an app-first approach. Its platform uses health data to deliver customized care, aiming to reduce long-term health risks.

These players already serve thousands of users and have built strong operational models. Amazon’s entry adds pressure—but also brings more visibility to the value of doorstep healthcare.

Can Amazon Win the Home Diagnostics Race?

Amazon home diagnostics India brings strong advantages—technology, logistics, trust, and scale. But this doesn’t guarantee it will dominate the market.

What Works in Amazon’s Favor:

- Fast logistics: Amazon promises sample collection within 60 minutes. This is faster than most competitors.

- App integration: Booking, tracking, and reports all happen inside the familiar Amazon app.

- Brand trust: Amazon already has millions of loyal users in India who trust its delivery timelines and digital interface.

What Might Hold It Back:

- Healthcare is personal: In diagnostics, trust is built over time through clinical quality and consistency—not just speed.

- Regulatory hurdles: Medical services require strict compliance and continuous quality assurance.

- Market complexity: Illness-driven testing still makes up 85% of the market. Established players like Dr Lal PathLabs have deep hospital networks and doctor referrals.

Past Lessons from Amazon India:

Amazon has experimented—and exited—other verticals before. In 2022, it shut down both its food delivery and ed-tech ventures in India. These exits show that scale alone doesn’t guarantee success in complex markets.

So, while Amazon’s entry is significant, it’s not a knockout blow to existing players. The winners will be those who balance speed, quality, and trust—and adapt fast to changing consumer expectations.

Conclusion: A New Era of At-Home Healthcare Begins

The launch of Amazon home diagnostics India marks a pivotal moment for the country’s healthcare sector. With its tech strength and customer reach, Amazon has signaled that home healthcare is no longer niche—it’s the future.

Traditional diagnostic companies still hold key advantages. Their clinical networks, established credibility, and strong offline presence give them staying power. But competition is heating up. Amazon’s entry raises the bar on convenience and user experience.

Meanwhile, startups like Portea, MedRabbits, Emoha, and Kyno Health continue to push innovation. They show that home diagnostics isn’t just about testing—it’s about delivering care where people live.

The bottom line? Doorstep diagnostics is no longer optional. Whether it’s a tech giant or a focused startup, the goal is the same: to make healthcare more accessible, faster, and user-friendly.

For investors, healthcare providers, and patients alike, this shift deserves close attention. A new race has begun—and the winners will be those who deliver care that’s trusted, tech-enabled, and truly patient-first.

Thinking of betting on the next healthcare disruptor? Open a free Demat account with Angel One and start investing smarter.

FAQs – Amazon Home Diagnostics India

Q1. What is Amazon Diagnostics?

Amazon Diagnostics is an at-home lab testing service launched by Amazon India in partnership with Orange Health Labs. It offers 800+ tests with doorstep sample collection and digital results.

Q2. Where is Amazon home diagnostics India currently available?

It’s available in six cities: Bengaluru, Delhi, Gurgaon, Noida, Mumbai, and Hyderabad, covering over 450 PIN codes.

Q3. How does Amazon’s entry affect companies like Dr Lal PathLabs and Metropolis?

Amazon’s launch adds competition, causing shares of traditional diagnostic companies to fall. Investors fear pricing pressure and loss of market share.

Q4. Is Amazon offering discounted health tests?

No. Amazon is not using deep discounts. It’s focusing on market price parity and superior customer experience to build trust.

Q5. Will Amazon dominate the home diagnostics market?

It’s too early to say. Amazon has scale and logistics, but incumbents still hold strong positions in illness-led diagnostics and doctor referrals.

Related Articles

India’s Yoga Economy: How Baba Ramdev Bent the Wellness Industry into a Business Empire

From Flop to Fragrance King: The FOGG Deodorant Success Story