Introduction: Strategic Shifts Behind Future Multibagger Stocks

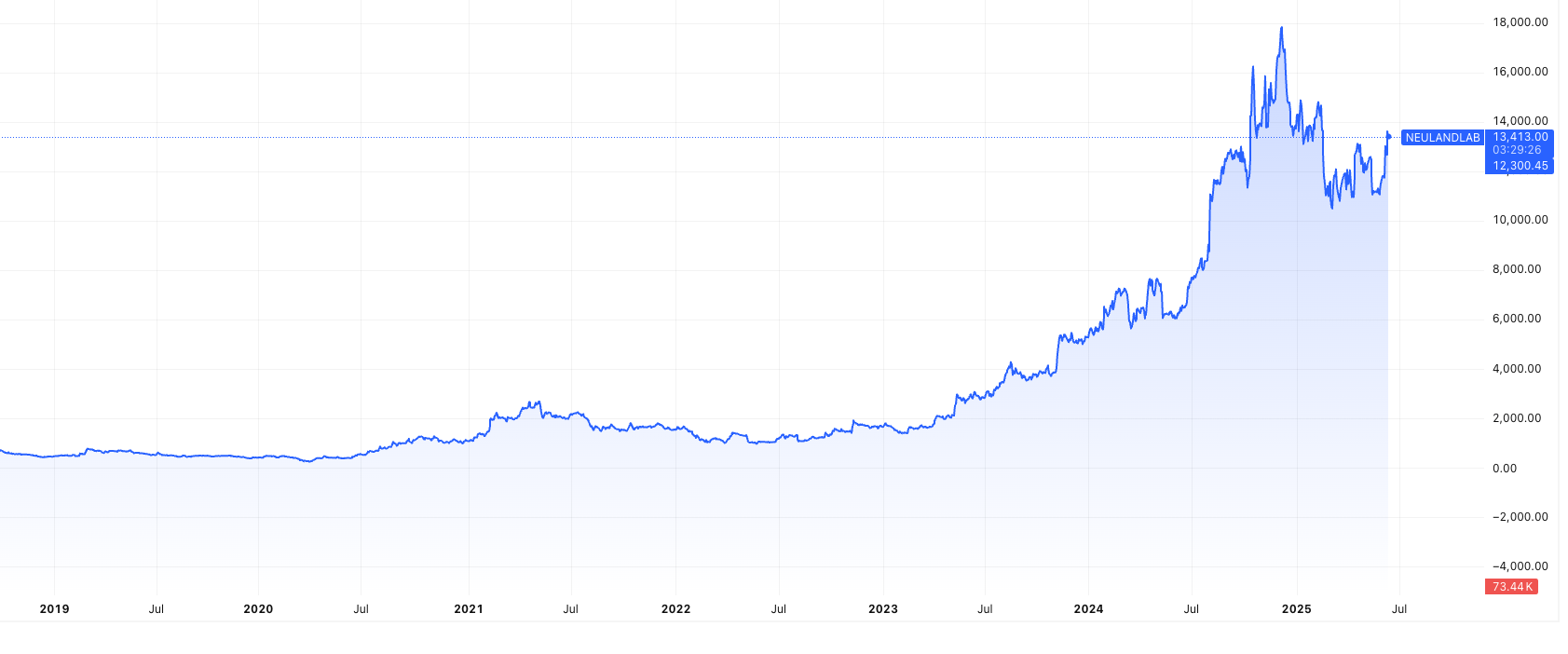

In the Indian stock market, some of the biggest wealth creators didn’t start as stars. Instead, they quietly reinvented themselves. A prime example is Neuland Laboratories.

A decade ago, Neuland was a standard API manufacturer. But over time, it made a bold strategic shift toward Contract Manufacturing Services (CMS). This is a high-margin, sticky business. As a result, CMS now contributes 49% of its revenue in FY24, up from just 11% in FY14. The company expects this to rise to 55–60% in the next 3–4 years.

This shift changed everything. Neuland’s stock jumped from ₹500 to over ₹18,000. It became a classic case of a future multibagger stock, powered not by hype—but by margin expansion and business evolution.

So, who’s next?

In this blog, we explore companies that are now making similar moves. They are entering high-margin categories, revamping their product mix, or tapping new premium segments. While they may not be widely talked about yet, their strategic shifts could make them the future multibagger stocks of tomorrow.

Let’s break down the sectors and names you should be watching.

What Is a High-Margin Shift — and What Can Go Wrong?

A high-margin shift is when a company moves from low-profit, commoditized products to premium or specialized offerings that deliver better returns per unit sold. It’s a strategic realignment — often involving innovation, acquisitions, or entry into new verticals — with the goal of expanding margins and long-term earnings.

Many of India’s future multibagger stocks have made such a pivot. These companies exit or de-prioritize legacy segments and focus on differentiated, often tech- or brand-led businesses. It’s not just about growth — it’s about profitable, sustainable growth.

However, not every shift works out.

The Flip Side: When the Shift Fails

A high-margin strategy often involves upfront investment, longer gestation periods, or entering unfamiliar markets. If not executed well, it can backfire — leading to lost capital, shrinking market share, and investor disappointment.

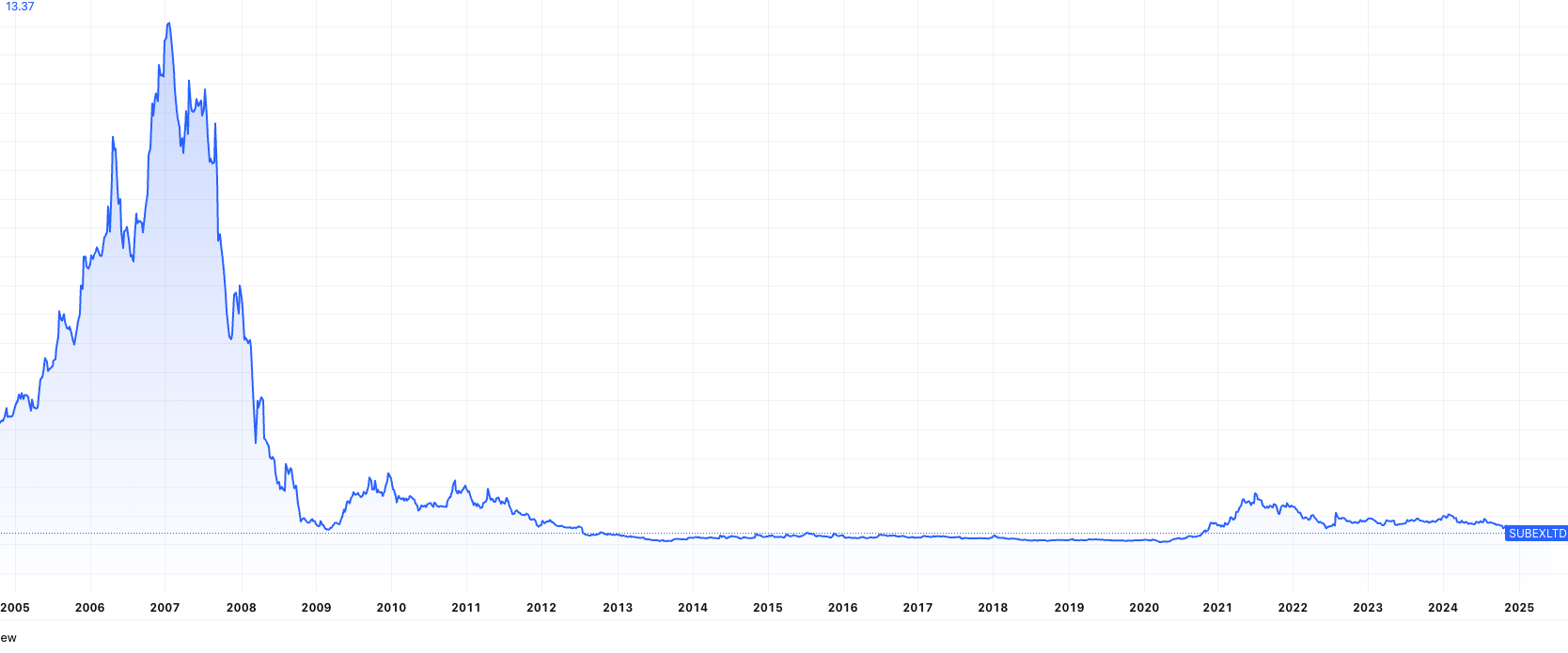

Example: Subex Ltd.

Subex, once a market favorite in the telecom software space, tried to pivot toward next-gen offerings like AI-based analytics and IoT platforms. It positioned itself as a tech transformation story. However, the execution lagged. Revenues declined, customer stickiness didn’t improve, and competition intensified. Despite bold announcements and rebranding efforts, Subex failed to translate its strategic shift into profits.

Its stock, which surged in anticipation, eventually crashed — turning a potential “future multibagger stock” into a cautionary tale for retail investors.

The Takeaway

Strategic shifts can unlock massive value — but only when backed by strong execution, capable management, and demand visibility. Investors should look not just at what a company plans, but how it’s implementing the shift.

In the next sections, we’ll explore companies currently undergoing promising transformations — the kind that could potentially turn them into future multibagger stocks.

Renewable Energy: Future Multibagger Stocks

As the world pivots toward sustainability, renewable energy has emerged not only as an ethical imperative but also as a high-margin business opportunity. India’s ambitious target of achieving 500 GW of non-fossil fuel capacity by 2030 is accelerating this shift — and some players are already ahead in the race. These companies are not only contributing to clean energy goals but also reshaping their business models for higher profitability, making them contenders for future multibagger stocks.

Adani Green Energy: Wind & Solar Leadership in Action

Adani Green Energy Limited (AGEL) is among the most aggressive players in the renewable space. The company has built a strong portfolio of solar, wind, and hybrid energy projects.

Recent Strategic Moves:

- In February 2025, AGEL surpassed 12,000 MW of renewable capacity, showcasing rapid execution.

- By April 2025, it started wind energy generation at the Khavda plant with an initial 250 MW, pushing operational capacity to 2,250 MW (including solar).

AGEL’s integrated model and long-term PPAs help maintain high EBITDA margins. With more capacity under development, this renewable shift strengthens its case as a future multibagger stock, backed by real assets and demand visibility.

Tata Power: From Coal to Clean

Tata Power, once heavily reliant on coal-based generation, is undergoing a strategic transformation. It is steadily reducing thermal dependence and expanding its green portfolio — primarily in wind and solar.

While it hasn’t made major standalone announcements in 2025, Tata Power’s past initiatives and sector-wide investments put it in a favorable position. Its asset-light solar rooftop business and utility-scale projects offer scalable margins.

JSW Energy: Betting Big on Wind & Hydro

JSW Energy is focusing on higher-margin renewable segments such as wind and hydro power. It is building new generation capacity and has already commissioned a number of wind projects under its green arm, JSW Neo Energy.

The company’s disciplined capital allocation and lean operations make it a steady candidate for future multibagger stock status — particularly as clean energy gains pricing power.

ReNew Power: B2B Clean Energy at Scale

ReNew Power, under ReNew Energy Global PLC, is targeting institutional clients with solar and wind solutions. Its focus on long-term contracts and expanding asset base in India positions it well for margin accretion.

Although there were no specific project updates in 2025, the company continues to build capacity and pursue large-scale contracts — aligning with the broader high-margin shift narrative.

Consumer Goods: Premium Is Profitable

India’s fast-moving consumer goods (FMCG) sector is undergoing a noticeable shift—from mass-market staples to high-margin premium offerings. With evolving consumer preferences and rising disposable income, companies are aggressively entering value-accretive segments such as gourmet food, health and wellness, and organic products. For investors, this transformation signals more than just better branding—it hints at operating leverage, pricing power, and the potential to identify future multibagger stocks early in their evolution.

Tata Consumer Products: Spicing Up Margins

In 2025, Tata Consumer Products made two bold moves to expand its portfolio:

- Acquisition of Capital Foods (Ching’s Secret & Smith & Jones) for ₹5,100 crore.

- Acquisition of Organic India for ₹1,900 crore.

These strategic buys gave Tata Consumer access to:

- High-growth categories like instant noodles, Chinese sauces, and health-oriented products.

- Established brands with deep consumer recall.

- A quick path to margin expansion by leveraging Tata’s extensive distribution.

By April 2025, Tata had completed integration of these brands, unlocking synergies and operational efficiencies. This kind of margin-accretive expansion through acquisition shows the company’s clear intention to become a diversified, premium FMCG powerhouse—making it a strong contender for future multibagger stock status.

The Organic Play: Wellness as a Growth Lever

Organic India’s inclusion in Tata Consumer’s portfolio signals a deep commitment to wellness, an emerging high-margin vertical. As health-conscious consumers grow in number, premium-priced organic goods can offer sustainable profit expansion—especially through online and premium retail channels.

These moves echo a familiar pattern: strong parent, focused acquisitions, and targeted distribution—one that has historically created multibagger stories in the FMCG space.

Travel and Hospitality: Margin-Rich Verticals in Focus

The travel and hospitality sector is seeing a strategic pivot. Companies are now concentrating less on commoditized services like basic flight booking and more on curated, high-margin verticals—such as corporate travel, MICE (Meetings, Incentives, Conferences, and Exhibitions), and premium packages. This evolution, spurred by post-pandemic recovery and digitization, offers an exciting landscape for spotting future multibagger stocks.

Yatra Online: From Volume to Value

Yatra Online, a major Indian travel services company, is an early example of this margin shift. In its Q4 FY2025 results, it outlined strong momentum in high-margin segments:

- MICE Business: Boosted by the acquisition of Globe Travels in September 2024. This business alone added INR 1,430 million (USD 16.7 million) in new annual billing potential in Q4 FY25.

- Hotels & Holiday Packages: Adjusted margin rose 23.3% YoY to INR 357.8 million for Q4, and 29.2% YoY to INR 1,473.1 million for FY2025.

These high-margin segments now form the company’s core growth engine, as opposed to the low-margin ticketing business.

Yatra’s transformation isn’t just operational—it’s strategic. With 35 new corporate clients onboarded in just one quarter and a tech-forward approach, Yatra is quietly laying the groundwork to be a future multibagger stock in the travel-tech domain.

Why This Matters

Travel platforms that scale B2B verticals—especially ones with contractual, recurring revenues—have the potential to unlock sticky customer relationships and improved cash flows. Yatra’s execution here shows how even service-sector players can reinvent themselves around high-margin profit pools.

Streamlined for Digital Profits: Future Multibagger Stocks

The media and entertainment industry is undergoing one of its most transformative shifts in decades. As traditional TV viewership declines, companies are now banking on digital platforms and OTT streaming to unlock high-margin growth. With rising subscription revenues and targeted digital advertising, this shift is reshaping the valuation models—and may create future multibagger stocks in the process.

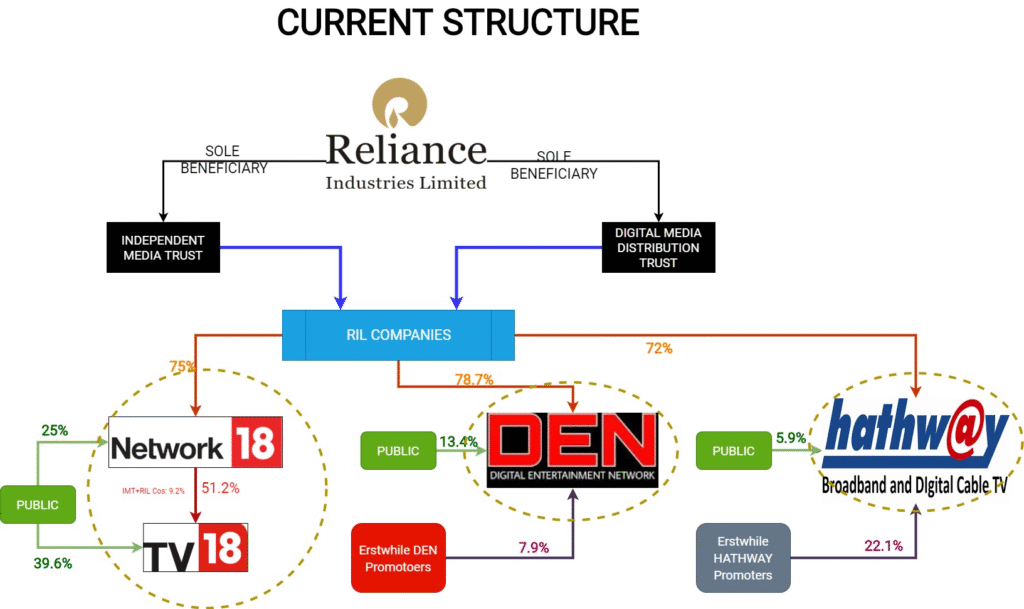

Reliance Industries: Building a Digital Empire

One of the most significant moves came from Reliance Industries, which completed its $8.5 billion merger with Walt Disney’s Indian media assets in November 2024. This merger created a formidable joint venture combining:

- Disney’s Star India,

- Viacom18,

- JioCinema, and

- Hotstar.

Now in 2025, the integration is in full swing under the leadership of Nita M. Ambani as Chairperson.

Why it’s a high-margin bet:

Digital streaming platforms scale faster than traditional TV and come with better ad-targeting capabilities and recurring subscription revenues. This pivot enables Reliance’s media arm to shift focus from legacy cost-heavy models to leaner, tech-driven operations.

Ownership Breakdown:

- Reliance: 16.34%

- Viacom18: 46.82%

- Disney: 36.84%

With one of the strongest content portfolios and distribution reach, this integrated play positions Reliance at the forefront of India’s digital content monetization wave. And for investors, it represents a long-term, platform-driven high-margin story—one that could be a future multibagger stock in the streaming-led entertainment space.

Key Takeaway

As consumer attention shifts from cable to smartphones, traditional media houses that successfully ride the digital wave could unlock outsized value. The Reliance-Disney integration stands as a landmark example of how legacy businesses can future-proof themselves—and possibly their investors’ portfolios.

New-Age Industrial Bets: Future Multibagger Stocks

As commoditized industries face margin pressure, a new breed of companies is carving out lucrative niches by moving up the value chain. These companies are strategically shifting from volume-led models to high-margin segments through innovation, premiumisation, and diversification. Such transformations—when successful—can deliver operational leverage and rerating potential, turning them into future multibagger stocks.

Garware Hi-Tech Films: From Commodities to Consumer Tech

Once known for basic polyester films, Garware Hi-Tech Films Ltd. is now aggressively transitioning toward high-value, application-specific products:

- High-margin verticals: Sun Control Films (SCF), Paint Protection Films (PPF), shrink films, and specialty low-oligomer films.

- Result: Revenue CAGR of 17% and Net Profit CAGR of 29% over the past 3 years.

- Operating Margins: Now guided at 22–25%, up from traditional single-digit margins.

- Upcoming trigger: TPU extrusion line starting October 2026, likely to boost margins further by 1.5–2%.

This margin-accretive transition has already been rewarded by the market and may have more room to run. If executed well, the consumer-tech positioning could help Garware emerge as a future multibagger stock in India’s industrial innovation space.

CCL Products: Brewing a Premium Coffee Play

Traditionally a B2B instant coffee exporter, CCL Products (India) Ltd. is now brewing a direct-to-consumer transformation.

- Strategic Shift: From wholesale exports to premium branded coffee under the UK-origin Percol brand.

- Launched in India recently, targeting health-conscious millennials with high-quality, sustainably sourced coffee.

- Pricing power: Positioned well above mass-market players, enabling margin expansion.

- Go-to-market: Experience-led marketing (tastings, influencer tie-ups) and selective offline availability.

Early feedback suggests strong urban traction. With India’s coffee consumption still nascent, CCL’s strategic premiumisation may unlock brand-led valuation rerating—earning it a spot among future multibagger stocks.

Camlin Fine Sciences: A Chemistry-Driven Value Shift

Camlin Fine Sciences Ltd. is betting big on higher-value segments within the specialty chemicals landscape:

- Focus: Blends, aroma ingredients (like Vanillin), antioxidants for food, animal feed, and nutraceuticals.

- Margin Profile: Blends business already earns EBITDA margins in the high teens, moving toward 20%.

- Growth Catalyst: Potential acquisition of French company Vinpai to expand high-margin categories using differentiated tech.

- Vision: Greater global reach + product innovation = sustained valuation upside.

While still in a transition phase, Camlin’s blend of margin expansion and global playbook makes it an underrated candidate for future multibagger stock status.

Key Insight: These industrial companies aren’t chasing top-line at the cost of margins. Instead, they’re redesigning their business models for sustainable, higher-margin revenue streams—often with less competition and better pricing power. For long-term investors, these strategic pivots can be potent multibagger catalysts.

Conclusion: High-Margin Shifts as the Launchpad for Future Multibagger Stocks

Strategic shifts toward high-margin segments are no longer just a trend—they’re fast becoming a blueprint for wealth creation. Whether it’s a chemical company transitioning into specialty blends, a B2B exporter going premium D2C, or an industrial player reinventing itself with consumer tech flair, these businesses are rewriting the growth playbook.

Yet, as seen in past examples, not every shift guarantees success. Execution, capital discipline, and timing remain critical. That’s why spotting future multibagger stocks early requires both research and the right platform to act.

👉 Start your multibagger hunt today with Angel One—where smart investing meets smarter insights.

FAQs:

▸ What are future multibagger stocks?

Future multibagger stocks are shares of companies expected to multiply in value due to strong business shifts, financial growth, or sectoral tailwinds.

▸ Why do companies shift to high-margin segments?

To improve profitability, reduce volatility, and increase long-term shareholder value.

▸ Can strategic shifts guarantee multibagger returns?

Not always. Execution risk and market dynamics can affect outcomes even with good strategy.

▸ Which sectors are leading in high-margin transitions?

Renewables, FMCG premiumization, specialty chemicals, travel-tech, and consumer brands.

▸ What is a recent example of a successful high-margin shift?

Neuland Labs transitioned to CMS and grew its share price from ₹500 to over ₹18,000 in a decade.

▸ Are all high-margin strategies safe for investors?

No. Some fail due to poor execution—like certain real estate and agri-tech pivots in the past.

▸ What should investors look for in such companies?

Scalability, management credibility, capital discipline, and timing of the shift.

▸ Is 2025 a good year for spotting future multibaggers?

Yes. Several Indian companies have recently announced high-margin strategic pivots.

▸ How does Angel One help in tracking such stocks?

With real-time alerts, research reports, and curated watchlists for emerging opportunities.

▸ How can I start investing in these future multibaggers?

Sign up on Angel One, research the companies listed in this blog, and invest smartly with strategy.

Related Articles

India Becomes the Cheapest Manufacturing Hub: Stocks Set to Win Big