Introduction

Did you know that over ₹1.5 lakh crore is traded daily in the Indian stock market? That means around ₹17 lakh is transacted every second! The stock market is like a river of flowing money, and if you learn the right way to navigate it, you can make your share of profits without much difficulty.

However, if you invest blindly with greed and without knowledge, you might end up losing money rather than making it. Hence, understanding how to invest smartly and strategically is crucial to success in the stock market.

In this blog, we will explore different ways to earn money from the stock market, whether you are a beginner or an experienced trader. Let’s get started!

Long-Term Investment: The Buy & Hold Strategy

What is Long-Term Investment?

Long-term investing means buying shares of fundamentally strong companies and holding them for an extended period—ranging from a few years to decades.

Example:

Legendary Indian investor Rakesh Jhunjhunwala invested in Titan Company shares and held them for many years. His investment grew from a few crores to over ₹11,000 crore in value.

Benefits of Long-Term Investment:

✅ Power of Compounding – The longer you hold your investment, the greater the returns due to compounding.

✅ Dividend Income – Some companies share their profits with investors through dividends.

✅ Less Impact of Market Fluctuations – Short-term volatility does not affect long-term investments significantly.

Risk Factor:

🔴 Market crashes can temporarily reduce portfolio value but markets tend to recover in the long run.

If you want to master long-term investing, learning fundamental analysis is essential.

Mutual Funds: Safe & Diversified Investment

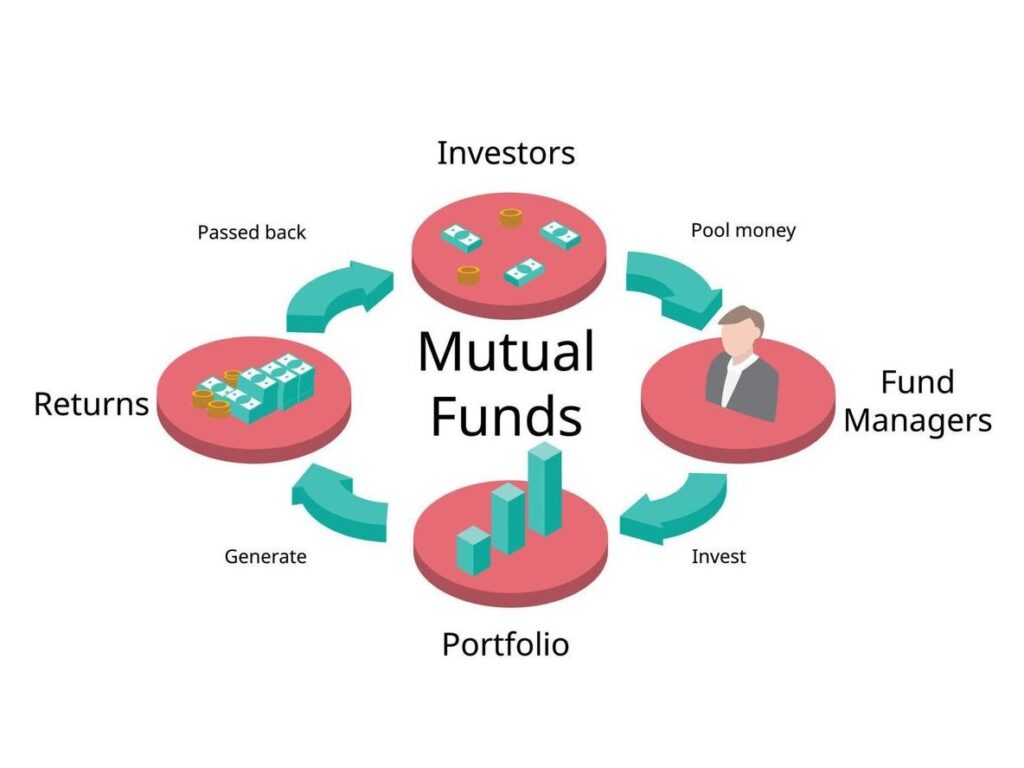

What are Mutual Funds?

Mutual funds are professionally managed investment funds that pool money from multiple investors and invest in a diversified portfolio of stocks and bonds. These funds are managed by expert fund managers.

Advantages:

✅ Diversification – Investment is spread across multiple stocks, reducing risk.

✅ Professional Management – Experts handle stock selection for you.

✅ Systematic Investment Plan (SIP) – You can start investing with as little as ₹500 per month.

Example:

If you invest in a Large Cap Mutual Fund, your money gets invested in India’s top companies like HDFC Bank, Reliance, and TCS.

Risks:

🔴 If the fund manager’s strategy fails, returns may be lower. However, selecting a good mutual fund and investing for the long term can help you earn solid returns.

Index Funds & ETFs: Low-Risk Investment

If you want to invest in the overall market without picking individual stocks, then Index Funds and Exchange-Traded Funds (ETFs) are ideal options.

What is an Index Fund?

An Index Fund is a mutual fund designed to replicate the performance of a specific market index, such as Nifty 50 or Sensex. These funds invest in the same stocks as their benchmark index and maintain the same proportion, making them a passive investment option with lower expense ratios compared to actively managed funds. For example:

Nifty 50 Index Fund – Tracks the top 50 companies listed on the NSE.

Nifty Next 50 Index Fund – Invests in the next 50 large-cap stocks after Nifty 50.

Nifty Small cap 50 Index Fund – Focuses on the top 50 small-cap companies.

Nifty Midcap 150 Index Fund – Covers mid-sized companies with strong growth potential.

Sensex Index Fund – Tracks the 30 largest and most actively traded stocks on the BSE.

What is an ETF (Exchange-Traded Fund)?

An ETF is similar to an index fund but trades like a stock on the stock exchange. This means you can buy or sell an ETF anytime during market hours, just like individual stocks. ETFs offer more flexibility and liquidity compared to index mutual funds while still tracking a market index like Nifty 50, Bank Nifty, IT index, or Gold ETFs.

Both Index Funds and ETFs are excellent choices for passive investors who want broad market exposure with lower risks and minimal active management.

Example:

✅ Nifty 50 Index Fund – If the Nifty 50 index grows by 10%, your investment will also grow by 10%.

✅ Gold ETF – If the price of gold increases, your ETF investment will increase in value.

Risks:

🔴 Market-wide risks apply—if the overall market falls, index funds will also decline.

🔴 Limited flexibility—since the fund tracks an index, it cannot beat market returns significantly.

However, for passive investors, index funds and ETFs are one of the best investment options.

Intraday Trading: Quick Profits with High Risk

If you want to earn daily profits, intraday trading allows you to buy and sell stocks within the same trading day to capitalize on small price movements. Traders use technical analysis, price action patterns, and real-time market data to make quick decisions. Success in intraday trading depends on factors like liquidity, volatility, and timing the market correctly. Since stocks can fluctuate rapidly, risk management strategies like stop-loss orders and position sizing are essential to minimize potential losses.

Example:

If you buy a stock at ₹100 in the morning and sell it at ₹102 by noon, you make a ₹2 per share profit. If you buy 1000 shares, you earn ₹2000 in just a few hours.

Risks:

🔴 High Volatility – Stock prices fluctuate rapidly.

🔴 Margin Trading Risks – You can trade with leverage, but this increases both profit potential and risk.

If you want to succeed in intraday trading, mastering technical analysis is crucial.

Swing Trading: Short-Term Profits

If you want to hold stocks for a few days to weeks, then swing trading is the best approach. Swing trading is a short-term trading strategy where traders buy stocks and hold them for a few days to a few weeks to capitalize on price swings. The goal is to take advantage of upward or downward movements in stock prices during a short time frame.

Example:

You invest in Infosys stocks expecting strong quarterly earnings. After 2-3 weeks, the stock price rises by 5-10%, and you sell to lock in your gains.

Risks:

🔴 Market trends can change quickly, leading to unexpected losses.

🔴 Requires knowledge of technical analysis and risk management strategies.

Swing trading is ideal for traders who want to balance between quick profits and manageable risk without committing to long-term investments.

Futures & Options (F&O): High-Risk, High-Reward Trading

F&O, or Futures and Options, is what we call a zero-sum game. This means that for every profit made, someone else incurs an equal loss. In simple terms, F&O is a high-risk, high-reward arena. If you have a solid understanding of the market and the courage to take risks, this might be for you.

Here, you don’t directly buy or sell stocks. Instead, you trade based on predictions of future price movements.

F&O trading isn’t limited to just stocks or indices. You can also trade commodities like gold, silver, and crude oil, or currencies like the dollar and yen.

How Does It Work?

In Options trading:

- If you believe the market will go up, you buy a Call Option.

- If you think the market will go down, you buy a Put Option.

Now, if your analysis is correct and the market moves in your favor, you can earn massive profits—even in a single day! But beware: if the market moves against you, you can lose your entire capital just as quickly.

Example:

✅ If you believe the Nifty 50 index will rise, you can buy a Call Option.

✅ If the market moves in your favor, you can make lakhs in a single trade.

Risks:

🔴 High risk of capital loss – If the market moves against you, you can lose your entire investment.

🔴 Requires deep market knowledge – Not recommended for beginners.

F&O trading is only for those who can closely monitor every move in the market and have the expertise to analyze trends accurately. It’s not for the faint-hearted or casual investors.

How to Start Investing in the Stock Market?

1. Open a Demat Account:

You need a Demat & Trading account with a trusted broker like Zerodha, Upstox, or Angel One. Opening an account takes 15-20 minutes online.

2. Learn Market Research:

Understanding fundamental and technical analysis is crucial. Use resources like YouTube, financial blogs, and stock market apps to gain knowledge.

3. Start with Small Investments:

Begin with ₹5000-₹10,000, and gradually increase your investment as you gain experience.

4. Stay Updated:

Follow financial news, Telegram stock groups, and expert opinions to stay ahead in the market.

Conclusion

The stock market offers multiple ways to earn money, but each method has its own risk-reward ratio. The key to success is strategy, discipline, and continuous learning.

If you are a beginner, start with mutual funds or long-term investments. If you want to trade actively, master technical analysis and risk management.

With the right approach, the share market can help you achieve financial freedom! 🚀

FAQs

1. Can beginners make money in the stock market?

Yes, beginners can start with mutual funds or index funds and gradually learn stock market investing.

2. Is trading riskier than investing?

Yes, trading is riskier due to market fluctuations, whereas long-term investing is more stable.

3. How much money do I need to start trading?

You can start trading with as little as ₹5000-₹10,000, but higher capital gives more flexibility.

4. What is the best way to invest with low risk?

The safest options are mutual funds, index funds, and blue-chip stocks.

5. How long does it take to become a successful trader?

It depends on learning, practice, and experience—typically 6 months to a few years.

If you have more questions, drop them in the comments! 📩