The Viral ₹1 Crore Formula: The Truth About the 15-15-15 Rule in SIP Investing

The 15-15-15 rule in SIP investing promises a ₹1 crore corpus, but can a one-size-fits-all formula really build real wealth in today’s unpredictable world?

Finance influencers swear by it. Mutual fund ads flaunt it. Even your office colleague might’ve mentioned it during lunch. The now-famous 15-15-15 rule: invest ₹15,000 a month, earn 15% annually, and stay put for 15 years — boom, you’re a crorepati.

It’s simple. Clean. Viral.

But here’s a little reality check: the market doesn’t run on Instagram math.

Markets don’t deliver straight-line returns, life doesn’t follow spreadsheets, and most portfolios don’t grow in peace for 15 years straight. The formula may work on calculators, but does it hold up in the real world?

This blog isn’t here to bash the 15-15-15 rule in SIP investing. It’s here to unpack the reality behind the hype — what works, what doesn’t, and how you can still build wealth without chasing unrealistic expectations.

Because long-term investing isn’t about magic numbers — it’s about staying in the game, even when the game gets tough.

Why the 15% Return Assumption Isn’t as Easy as It Sounds

The core of the 15-15-15 rule in SIP investing hinges on one key number: 15% annual returns. Sounds straightforward. But let’s be honest — how often do mutual funds consistently deliver that over 15 years?

Market Reality vs Calculator Assumptions

Yes, some equity mutual funds have beaten the 15% mark over long stretches. But those are outliers, not the norm. The market doesn’t serve up double-digit returns year after year. It delivers them in bursts — often followed by corrections, sideways years, or even crashes.

Even the best-performing funds go through:

- Bad stock calls

- Changing fund managers

- Global macro shocks

- Sector rotation cycles

Assuming 15% returns every year is like expecting India to win every cricket match with a six on the final ball. Possible? Sure. Predictable? Not really.

The Risk of Going All-In for 15%

To chase 15% returns, many investors end up:

- Overloading on equities

- Ignoring debt completely

- Investing in highly volatile thematic or small-cap funds

While equities are essential for long-term growth, they come with volatility — and without a buffer like debt, that volatility can wreck your peace of mind (and your goals).

So yes, 15% is possible. But it comes with a trade-off in stability — and you need to decide whether you’re okay with that.

The Life Factor: What the 15-15-15 Rule Ignores

The 15-15-15 rule in SIP investing feels neat and predictable. But life? Not so much.

Even if your SIP is perfect on paper — ₹15,000/month, right mutual fund, long time horizon — life doesn’t follow Excel sheets.

Real Life = Real Disruptions

You might:

- Switch jobs or face income uncertainty

- Pause your SIPs during emergencies

- Panic and redeem during a market crash

- Redirect funds to home loans, education, or medical bills

SIP calculators don’t account for fear, doubt, or human emotions. But those are often the biggest reasons investors don’t stay invested. In fact, AMFI data shows that most mutual fund investors exit within two years — far before compounding can work its magic.

The Gap Between Plans and Practice

Let’s say you start your SIP with full enthusiasm. In year three, a bear market slashes your portfolio value. You freeze SIPs “temporarily.” That temporary break turns into years. Suddenly, the whole “15-year” plan is off-track.

The takeaway? Discipline beats ambition. The best investors aren’t the ones chasing 15% returns — they’re the ones who stick around, rain or shine.

Crorepati or Just a Nice Number? Let’s Talk Inflation

The 15-15-15 rule in SIP investing promises ₹1 crore at the end of 15 years. That sounds like a dream — but what does ₹1 crore really mean in 2040?

Inflation Quietly Eats Your Gains

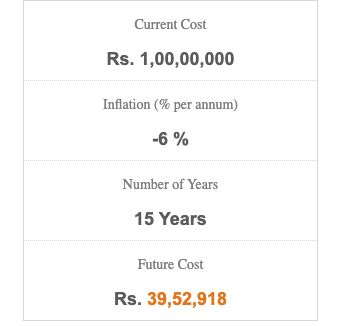

Even a modest 5% inflation rate halves your money’s purchasing power in about 15 years. So:

- ₹1 crore in 2040 = roughly ₹48 lakh in today’s value

- That means your “crorepati” status might feel like a middle-class milestone, not financial freedom

Let’s say today you could buy a premium SUV, a foreign trip, and fund your kid’s education with ₹1 crore. In 2040? That same amount may cover just one of those things.

Real Returns > Round Numbers

Instead of obsessing over the ₹1 crore target, focus on building inflation-beating real returns:

- A balanced portfolio with equity + debt

- Systematic increases in SIPs as your income grows

- Reviewing goals every few years, adjusting for changing needs

Because money doesn’t just need to grow — it needs to outpace inflation to stay meaningful.

The Risky Roads Paved by the 15-15-15 Rule

On paper, the 15-15-15 rule in SIP investing looks like a smart hack. But in real life, it can nudge investors toward dangerous shortcuts in the quest for 15% returns.

When the Need for Speed Backfires

To chase that magic 15% figure, some investors may:

- Go all-in on thematic or sectoral funds — tempting, but highly volatile

- Hop between “hot” funds — chasing past winners rarely ends well

- Fall for unregulated schemes that promise “guaranteed high returns” — often a trap for capital erosion

All of this increases risk without guaranteeing better returns. You might end up with losses instead of gains.

Chasing Numbers vs Managing Risk

Trying to beat the market every year is a stressful, often fruitless exercise. A better approach?

- Focus on risk-adjusted returns, not headline-grabbing percentages

- Build a diversified, long-term portfolio

- Accept that compounding rewards patience, not adrenaline

The market rewards discipline, not desperation. If 15% becomes an obsession, it could cost you your peace — and your capital.

A Better Way to Build Wealth with SIPs

Instead of chasing the picture-perfect 15-15-15 rule in SIP investing, smart investors focus on what they can actually control — strategy, discipline, and time.

Start with Realistic Expectations

- Target returns of 10–12% from equity mutual funds — it’s achievable and historically grounded

- Understand that returns vary across timeframes and funds

- Avoid rigidity — financial goals may evolve, so should your SIP plans

Diversify, Review, Stay Consistent

- Mix equity and debt funds to balance growth and stability

- Review annually — adjust SIP amounts, rebalance, or change funds based on goals and performance

- Automate your SIPs, but stay emotionally invested — know why you’re investing

Play the Long Game

Wealth isn’t built by chasing the perfect formula — it’s built by letting compounding work its magic over time.

Stick to your plan. Ignore the noise. Stay invested even when markets test your patience.

That’s how SIPs work — not with magic numbers, but with real-world consistency.

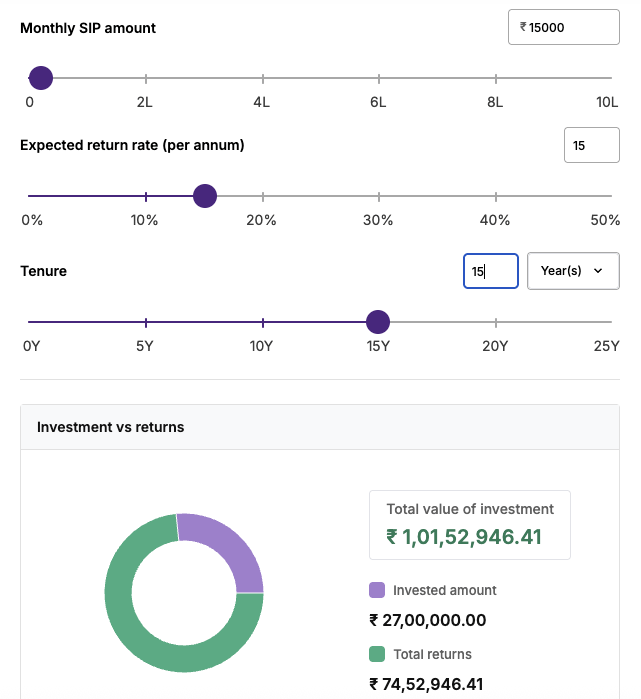

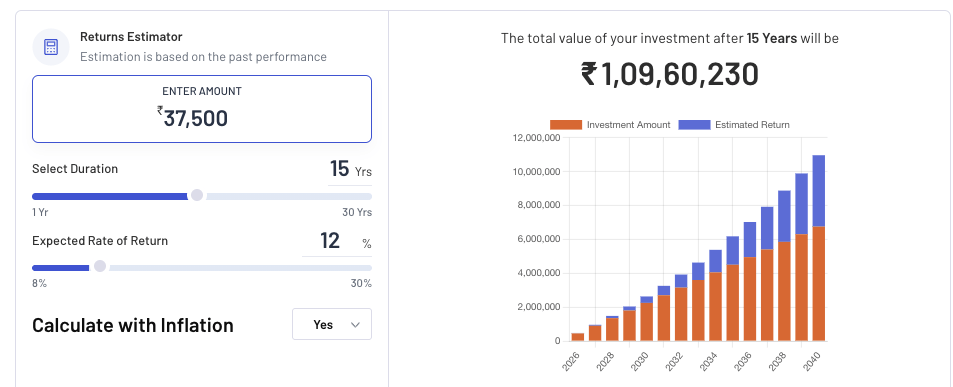

Real Example: Want ₹1 Crore by 2040? Here’s What It Actually Takes

Let’s say you want to have ₹1 crore by 2040, which is 15 years from now.

But here’s the catch:

₹1 crore in 2040 ≠ ₹1 crore today.

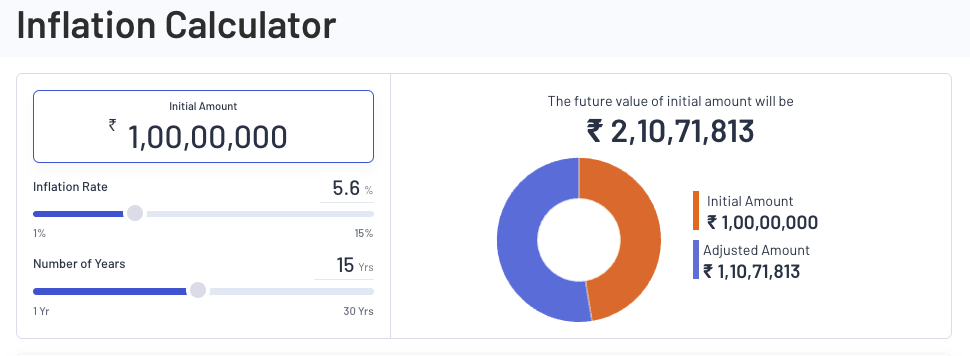

If inflation averages just 5% annually, then ₹1 crore in 2040 will have the purchasing power of only ₹48 lakh in today’s money.

So if your real goal is to retain ₹1 crore worth of today’s value, you actually need a future value target of ~₹2.1 crore by 2040 to beat inflation.

The Inputs:

- Target Amount in 2040 (inflation-adjusted): ₹2.1 crore

- Time Horizon: 15 years

- Assumed Returns: 12% annually (realistic for long-term equity SIPs)

- SIP Frequency: Monthly

The Math:

To reach ₹2.1 crore in 15 years at 12% annual returns, you’ll need to invest:

➡️ ₹37,500/month

That’s over 2.5x the original 15-15-15 rule! But this is the realistic path to becoming a crorepati with meaningful wealth in the future.

Conclusion: The 15-15-15 Rule in SIP Investing — A Great Start, But Not the Full Story

The 15-15-15 rule in SIP investing is catchy, simple, and makes for a great headline. But real-life investing isn’t a viral reel — it’s a marathon with market dips, inflation, life changes, and emotional decisions.

Yes, it’s possible to become a crorepati through SIPs. But don’t anchor your expectations on a fixed number like 15%. Returns fluctuate, inflation erodes value, and human behaviour plays a bigger role than any calculator.

Instead of chasing a perfect formula, focus on:

- Starting early

- Increasing your SIPs as income grows

- Staying consistent through ups and downs

- Balancing equity with debt for stability

- Reviewing and adjusting every year

The magic isn’t in 15-15-15 — it’s in showing up, month after month, for 15 years or more.

Build your own path to wealth — realistic, resilient, and ready for life’s curveballs.

Frequently Asked Questions (FAQs)

What is the 15-15-15 rule in SIP investing?

The 15-15-15 rule in SIP investing refers to investing ₹15,000 per month for 15 years at a 15% annual return to accumulate ₹1 crore.

Is the 15% return guaranteed in the 15-15-15 rule?

No, equity market returns are unpredictable. While some funds may deliver 15% or more, it’s not guaranteed or consistent year to year.

Can I still become a crorepati if I earn less than 15% returns?

Yes. Even with a 10–12% return, you can still reach ₹1 crore by investing slightly more or staying invested longer.

What are the risks of blindly following the 15-15-15 rule?

Overestimating returns may lead you to take unnecessary risks or invest in volatile schemes. It can also cause disappointment if targets aren’t met.

How does inflation impact the ₹1 crore goal?

With 5% inflation, ₹1 crore in 2040 will have the purchasing power of around ₹48 lakh today. So the real value of wealth matters more than the number.

Should I put 100% of my money into equity to chase 15% returns?

Not advisable. A balanced portfolio with equity and debt helps manage risk and provides stability, especially during market downturns.

Is SIP still a good strategy if 15% returns are uncertain?

Absolutely. SIPs help in rupee cost averaging, instill discipline, and build long-term wealth — even with moderate returns.

What should I aim for instead of 15-15-15?

Aim for consistent investing, a realistic return of 10–12%, and increasing your SIP as income grows. Focus on long-term discipline.

What if I can’t invest ₹15,000 per month?

Start with what you can afford — even ₹2,000–₹5,000/month is a great start. Increase contributions as your income rises.

How often should I review my SIP portfolio?

Once or twice a year is ideal. Check if your fund is performing reasonably against benchmarks and if it aligns with your goals.

Does 15-15-15 work with any SIP fund?

Not all SIPs will deliver the same returns. Fund selection based on consistent performance, management, and risk profile is key.

How do I calculate how much SIP I need to invest to reach ₹1 crore?

You can use SIP calculators online. Input expected return, time horizon, and target amount to see the required monthly investment.

Is 15 years the ideal investment horizon?

Not necessarily. Longer durations give compounding more power. If you start early, even 20 or 25 years could be better.

Why do people exit SIPs early despite good returns?

Many investors panic during short-term market drops or need funds urgently. Emotional discipline is often the biggest challenge.

Should I follow the 15-15-15 rule in SIP investing in 2025 and beyond?

Use it as a mental framework, not a strict formula. Adjust for real-world factors like inflation, risk appetite, and changing goals.

Related Articles:

SIP vs Fixed Deposit (FD): Which Investment is Better for You?

SIP vs Lumpsum: Which Investment Strategy is Right for You?

The Power of SIP: Every Investor’s Best Friend

More Articles

DRDO’s Emergency Weapon Orders: Defence Stocks Set to Gain

Discounted Cash Flow (DCF): The King of Stock Valuation Methods

Strategic Shifts to High-Margin Segments: Future Multibagger Stocks to Watch